Draft Program Year 2021 Ohio

Consolidated Plan

Annual Action Plan HOME-

American Rescue Plan Act (ARPA)

Allocation Plan Amendment

April 2022

Prepared By:

Ohio Department of Development

Community Services Division

Office of Community Development

Mike DeWine, Governor of Ohio

Jon Husted, Lt. Governor of Ohio

Lydia Mihalik, Director

Ohio Department of Development

Table of Contents:

Background 1

Consultation 1

Public Participation 4

Needs Assessment and Gap Analysis 5

HOME-ARPA Activities 10

Development of Affordable Rental Housing 10

Acquisition and Development of Non-Congregate Shelters 16

Administration 16

HOME-ARPA Production Goals 16

Preferences 16

HOME-ARPA Refinancing Guidelines 16

Appendix 17

1

Background

On March 11, 2021, President Biden signed the American Rescue Plan Act (ARPA) of 2021 in to law to

address the continued impact of the COVID-19 pandemic on the economy, public health, state and local

governments, individuals, and businesses. On April 8, 2021, HUD announced that the state of Ohio was

allocated $90,557,128 as part of the HOME-American Rescue Plan Act (HOME-ARPA) for homelessness

assistance and assistance to other vulnerable populations to:

• Provide capital investment for permanent rental housing

• Upgrade available stock of shelter to include non-congregate shelter

• Provide tenant-based rental assistance and supportive services

Consultation

HUD Notice CPD-21-10 issued on September 13, 2021, provided the list of HOME ARPA Allocation Plan

requirements including the citizen participation and consultation processes for public engagement. On

November 22, 2021, the Office of Community Development held the HOME-ARPA Allocation Stakeholder

Group Meeting via Webex to discuss the various eligible activities and funds available to begin the

process of planning the allocation plan. The HOME-ARPA Stakeholder Group was comprised of persons

representing statewide homeless organizations, local government, veterans, mental health and addiction

services providers, housing developers, fair housing groups along with various non-profit organizations

and state agencies that deal specifically with support services and housing as noted in the table below.

The Ohio Domestic Violence Network was consulted separately.

Based on the Stakeholder Group meeting, consensus was reached with regards to identifying priorities

for the use of HOME-ARPA funds throughout the state, with permanent supportive housing type projects

discussed as one of the top priorities.

The Stakeholder Group meeting identified possible partners for collaboration with the Ohio Housing

Finance Agency (OHFA) a key partner as part of the development of affordable housing through the

Housing Development Assistance Program (HDAP). Following the Stakeholder Group meeting

participants were asked to provide the OCD with comments in order to help development the HOME-

ARPA Allocation Plan. Additional feedback was received through direct consultation from a number of

organizations that have been summarized in the following table.

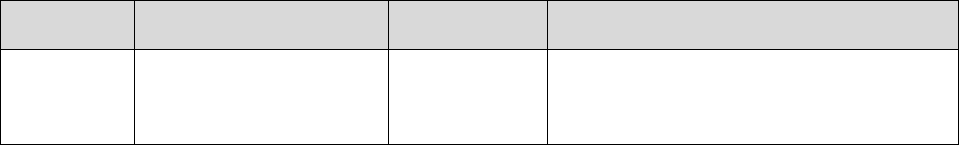

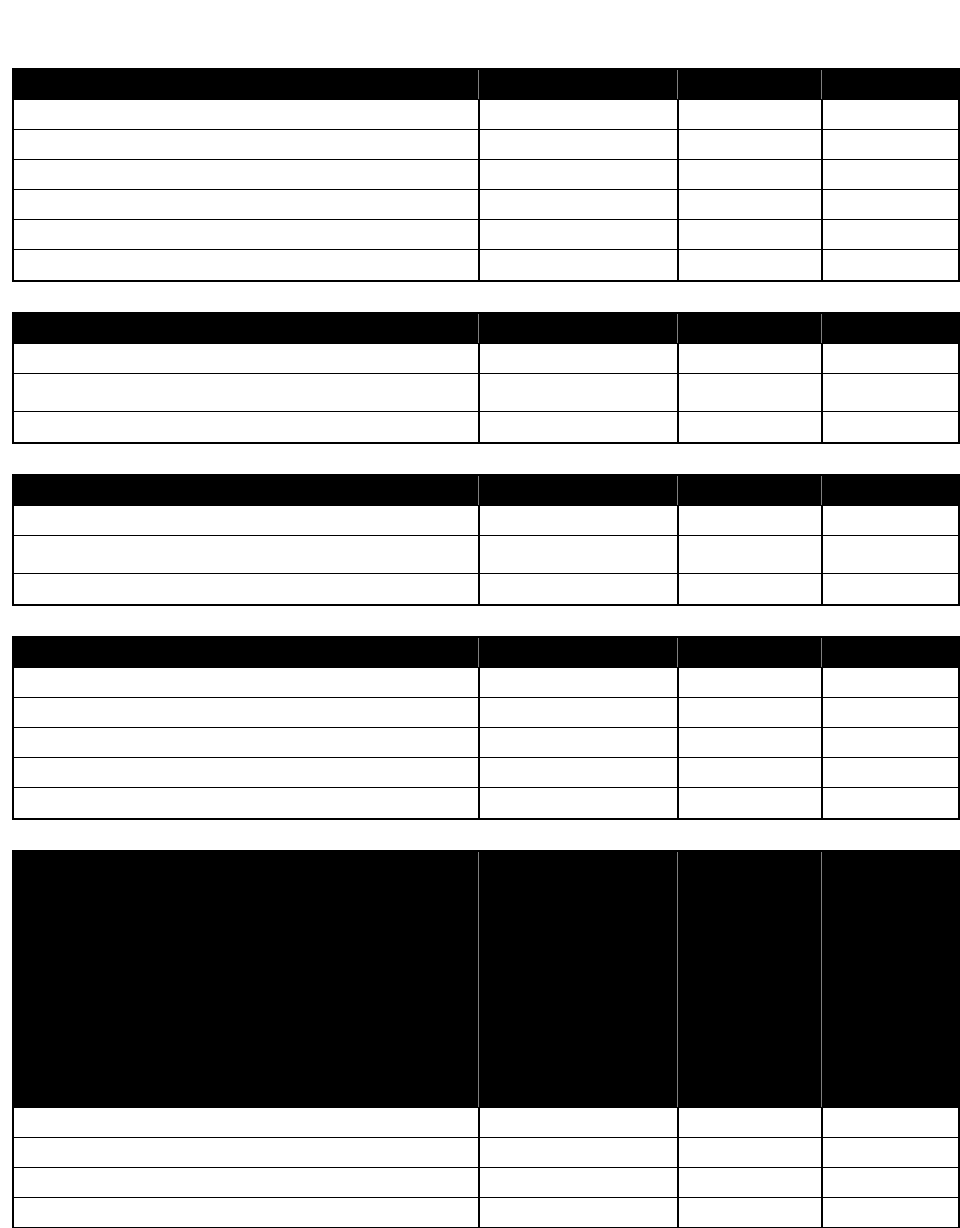

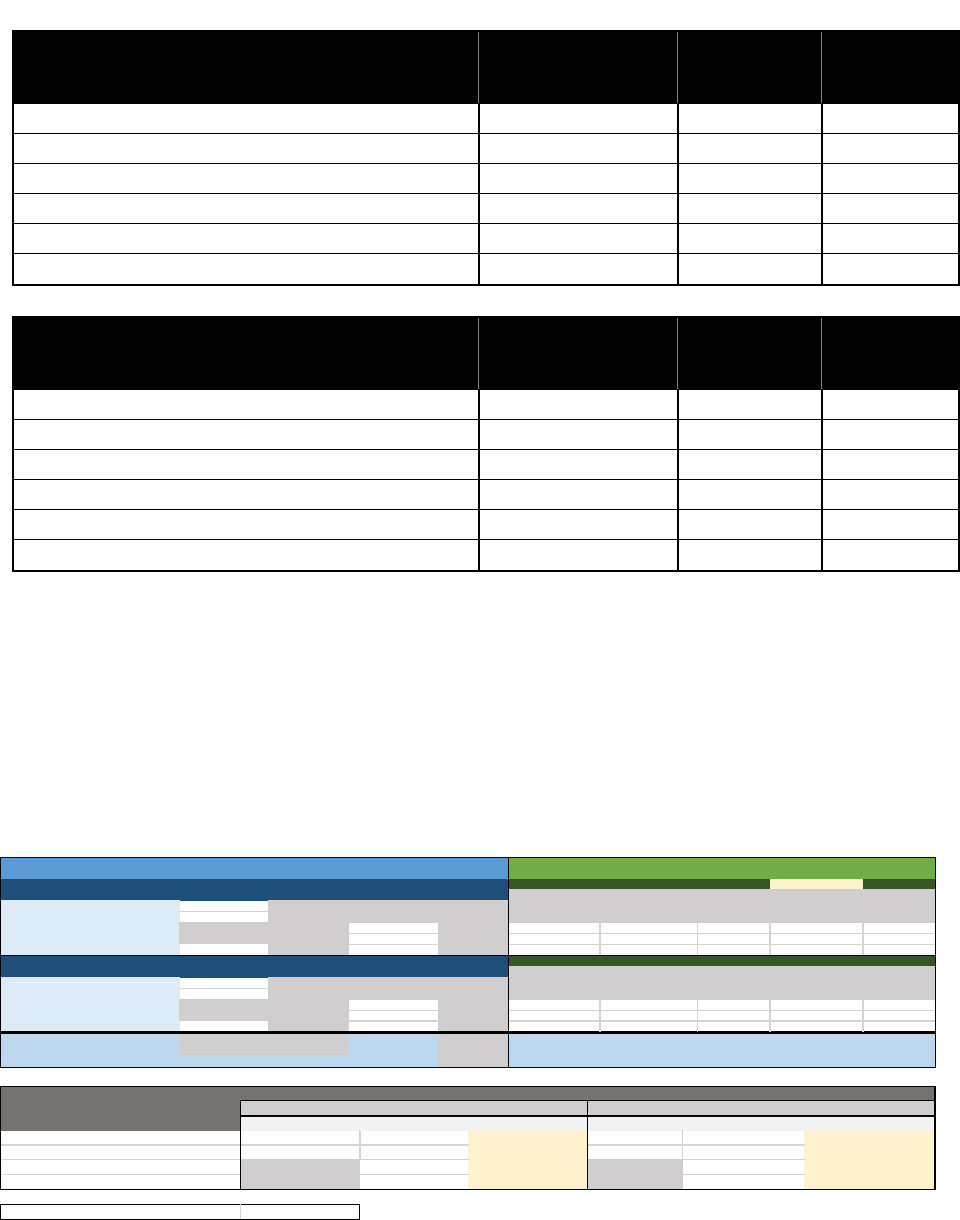

Table 1: HOME ARPA Consultation Table

Agency/Org

Consulted

Type of Agency/Org

Method of

Consultation

Feedback

Ohio

Municipal

League

Local Government

Representative

Virtual

stakeholder

meeting

The OHAC participated in the virtual stakeholder

meeting on 11/21/21. No feedback was received

during or following the meeting. The draft plan was

distributed to them for review.

2

Coalition on

Homelessness

and Housing in

Ohio

(COHHIO)

Homeless Service Providers.

Balance of State Continuum of

Care

Virtual

stakeholder

meeting, direct

phone calls, email

Bill Faith and Douglas Argue from the Coalition on

Homelessness and Housing in Ohio representing

homeless groups throughout the state indicated at the

virtual stakeholder meeting held on 11/21/21 that

there is a need to focus on the development of

affordable housing as opposed to TBRA. COHHIO

was also consulted on 4/7/22 to discuss the proposed

activities and budget included in the plan. They were

in agreement that less funds be directed towards non-

congregate shelter activity from the initial amount of

$30 million. If a significant amount of funds were to

be directed towards non-congregate language in the

plan should be added that allows for unspent funds to

be directed towards the development of rental

housing. In addition, they added that support services

is an important component as part of the development

of affordable rental housing that should be included

as a stand-alone activity in the plan.

Ohio Housing

Finance

Agency

(OHFA)

Public agencies that address the

needs of the qualifying

populations including

mainstream benefit systems

Virtual

stakeholder

meeting, direct

phone calls, email

Karen Banyai from OHFA indicated at the virtual

stakeholder meeting held on 11/21/21 that there is

strong need for permanent supportive housing

projects. They added that funding for support services

as part of the permanent supportive housing projects

is needed. OHFA was integral in the development of

the affordable rental housing development activity,

through consultation efforts between the initial

stakeholder meeting and final draft of the document.

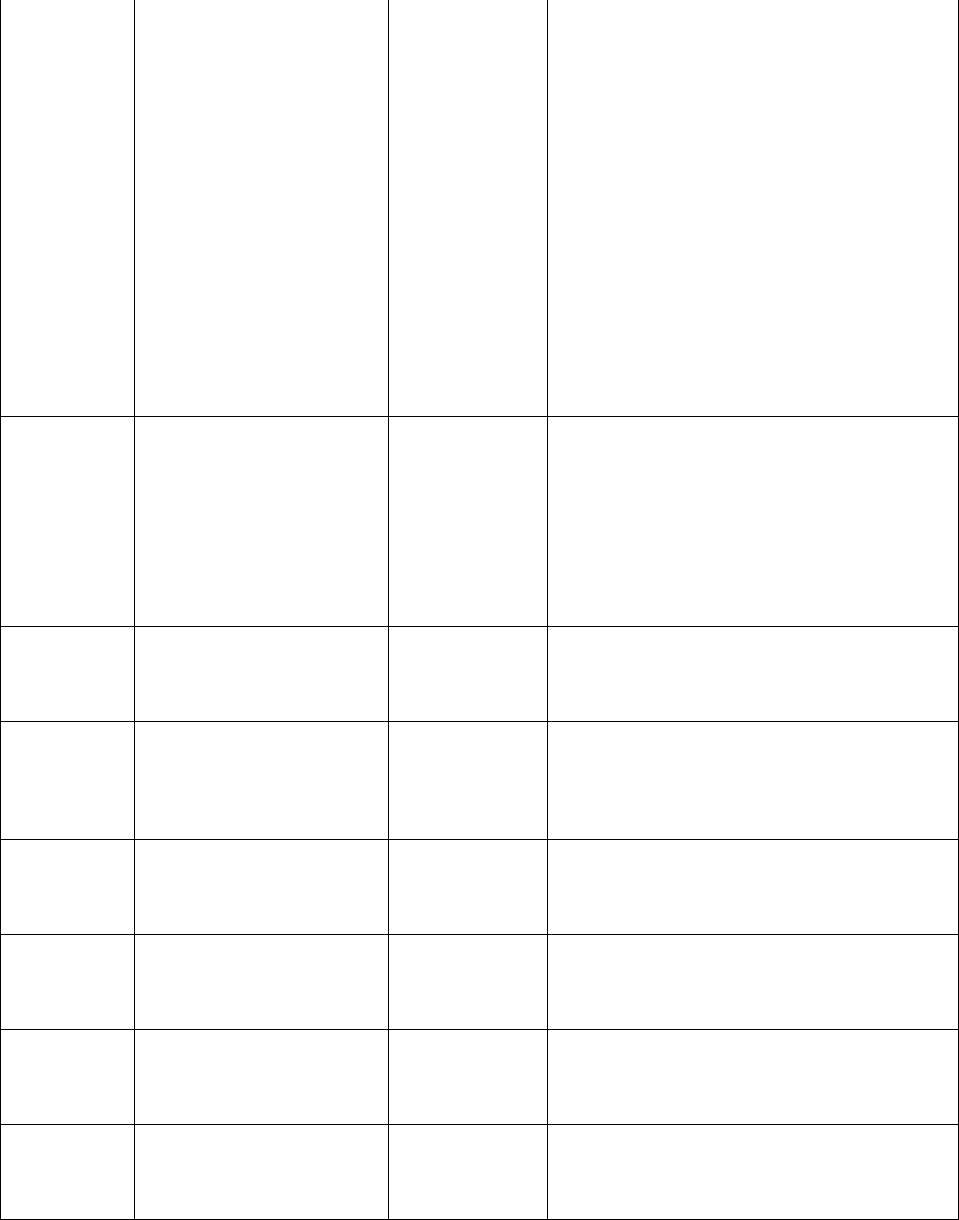

Ohio

Department of

Health

Public agencies that address the

needs of the qualifying

populations including

mainstream benefit systems

Virtual

stakeholder

meeting

The OHAC participated in the virtual stakeholder

meeting on 11/21/21. No feedback was received

during or following the meeting. The draft plan was

distributed to them for review.

Community

Housing

Network

Rural affordable housing

developer

Virtual

stakeholder

meeting, email

Ryan Cessell from CHN agreed at the 11/21/21

stakeholder meeting that there is a strong need for

permanent supportive housing projects. They added

that funding for support services as part of the

permanent supportive housing projects is needed.

Ohio Housing

Authorities

Conference

Public Housing Agencies

(PHAs)

Virtual

stakeholder

meeting

The OHAC participated in the virtual stakeholder

meeting on 11/21/21. No feedback was received

during or following the meeting. The draft plan was

distributed to them for review.

CAA of

Columbiana

County

Homeless Service Providers,

Vertans's Groups, Balance of

State Continuum of Care

representative (Region 6 Lead)

Virtual

stakeholder

meeting

The HfH participated in the virtual stakeholder

meeting on 11/21/21. No feedback was received

during or following the meeting. The draft plan was

distributed to them for review.

Buckeye Hills

Regional

Council

Housing services provider,

Balance of State Continuum of

Care representative (Region 2

Lead)

Virtual

stakeholder

meeting

The HfH participated in the virtual stakeholder

meeting on 11/21/21. No feedback was received

during or following the meeting. The draft plan was

distributed to them for review.

Great Lakes

Community

Action

Partnership

Housing services provider

Virtual

stakeholder

meeting

The HfH participated in the virtual stakeholder

meeting on 11/21/21. No feedback was received

during or following the meeting. The draft plan was

distributed to them for review.

3

U.S.

Department of

Veteran

Services

Veterans’ Groups

Virtual

stakeholder

meeting

The HfH participated in the virtual stakeholder

meeting on 11/21/21. No feedback was received

during or following the meeting. The draft plan was

distributed to them for review.

Corporation

for Supportive

Housing

Advocacy organization,

supportive housing provider

Virtual

stakeholder

meeting

Based on one-on-one consultation on 3/31/22, as well

as feedback provided as part of the comment period

CSH has voiced support for the development of

affordable rental housing for all qualifying

populations throughout the state. They have indicated

that as part of these projects there is also a need for

support services such as housing clinical staff and

peer supporters. They also indicated that funding for

non-profit capacity building would be very valuable

for long-term sustainability.

Ohio

Department of

Veterans

Affairs

Veterans’ Groups

Virtual

stakeholder

meeting

The ODVA participated in the virtual stakeholder

meeting on 11/21/21. No feedback was received

during or following the meeting. The draft plan was

distributed to them for review.

Habitat for

Humanity

Rural affordable housing

developer

Virtual

stakeholder

meeting

The HfH participated in the virtual stakeholder

meeting on 11/21/21. No feedback was received

during or following the meeting. The draft plan was

distributed to them for review.

County

Commissioners

Association

Local Government

Representative

Virtual

stakeholder

meeting

The CCA participated in the virtual stakeholder

meeting on 11/21/21. No feedback was received

during or following the meeting. The draft plan was

distributed to them for review.

Ohio

Department of

Mental Health

and Addiction

Services

Public agencies that address the

needs of the qualifying

populations including

mainstream benefit systems

Virtual

stakeholder

meeting, direct

phone calls, email

Based on one-on-one consultation on 3/31/22, phone

calls/emails, as well as feedback provided as part of

the 11/21/21 stakeholder group meeting, OHMAS has

voiced support for the development of affordable

rental housing for all qualifying populations

throughout the state. They have indicated that as part

of these projects there is also a need for support

services such as housing clinical staff and peer

supporters, but understand that the timing of the grant

could make this difficult as part of program

implementation.

Ohio Civil

Rights

Commission

Organizations that address civil

rights, fair housing, and needs

of people with disabilities

Virtual

stakeholder

meeting

The Ohio Civil Rights Commission participated in

the virtual stakeholder meeting on 11/21/21. No

feedback was received during or following the

meeting. The draft plan was distributed to them for

review.

ODJFS, Office

of Workforce

and

Development

Public agencies that address the

needs of the qualifying

populations including

mainstream benefit systems

Virtual

stakeholder

meeting

The ODJFS participated in the virtual stakeholder

meeting on 11/21/21. No feedback was received

during or following the meeting. The draft plan was

distributed to them for review.

4

Ohio Domestic

Violence

Network

Victim Services Providers

Direct phone calls

and email

The Ohio Domestic Violence Network (ODVN), a

statewide organization that provides services for

domestic violence services was consulted 3/23/22

outside of the stakeholder group meeting. The ODVN

discussed the projects that are eligible, specifically

why Development’s initial HOME-ARPA proposal

included significant funds for non-congregate

shelters, not enough funding for housing development

for survivors and why funding was not dedicated for

TBRA and supportive services. It was brought to

ODVN’s attention that no preferences will be placed

on any of the eligible projects as outlined in the

HOME-ARPA Allocation Plan, so there are funding

options for independent housing developments for

survivors of domestic violence. Development

suggested that ODVN discuss these proposals with

OHFA to understand the process.

Sunday Creek

Horizons

Rural affordable housing

developer

Direct phone calls

and email

The Sunday Creek Development, a rural development

group located in Appalachian Ohio was consulted

3/11/22 outside of the stakeholder group meeting.

They expressed support for the development of

affordable rental housing, but indicated that a local

match commitment of the HOME-APRA funds

should be required for the development of affordable

housing projects. They also added that as there are

few non-profit developers in rural Ohio, particularly

Appalachian Ohio, both non-profit and private

developers should be eligible to develop affordable

housing projects. In addition, they expressed a

preference for HOME-ARPA to be utilized for 4%

gap new construction development as opposed to 9%

credits.

Findlay Hope

House

Homeless Service Provider,

Victim Service Provider,

Balance of State Continuum of

Care representative (Region 11

Lead)

Focus Group

Hope House participated in a focus group on 4/7/22

to learn more about the specific needs of homeless

persons, victims of domestic violence and qualifying

populations. The participants expressed support for

utilizing HOME-ARPA resources for the

development of additional affordable rental housing

units as well as providing support services that can

include transportation and financial management

training.

Public Participation

Following the HOME-ARPA Stakeholder Group Meeting the draft HOME-ARPA Allocation Plan was

prepared for public comment beginning on March 1, 2022. The draft HOME-ARPA Allocation Plan was

posted online along with the memo announcing the HOME-ARPA Allocation Plan public comment

process at https://development.ohio.gov/wps/portal/gov/development/community/community-

resources/ohio-consolidated-plan for the 15-day public comment period. A direct email was sent to over

600 communities and organizations throughout the state along with notification made available at

https://development.ohio.gov/home/news-and-events/all-events/2022-0302-public-hearing-home-arpa .

As indicated in the HOME-ARPA memo, the public hearing for the draft HOME-ARPA Allocation Plan took

place on March 2, 2022 at the

Vern Riffe Center 19th Floor, Room 1932, 77 South High Street Columbus,

Ohio 43215. As indicated on Development’s website, “the State of Ohio is an Equal Opportunity Employer

and Provider of ADA services” along with the following information regarding website accessibility “the

Department of Administrative Services has taken steps to ensure that sites on the InnovateOhio Platform

5

are at least minimally accessible to people with disabilities who use assistive technology to access the

Internet. A total of thirty-three individuals attended the public hearing virtually with two individuals

attending the public hearing. A total of three comments were received at the public hearing with ten

written comments received during the public comment period, which are included in the appendix of the

plan. A summary of the comments with responses are included below.

Based on feedback received during the draft HOME-ARPA Allocation Plan public comment period that

took place from March 1, 2022 – March 16, 2022, the plan was amended and posted for an additional 15-

day public comment period and public hearing to broaden public participation efforts. The 2

nd

public

comment period will take place from April 18, 2022 – May 3, 2022, with the Public Hearing taking place

@10:30am April 20, 2022 at the Vern Riffe Center 19th Floor, Room 1932, 77 South High Street

Columbus, Ohio 43215.

In addition to the public participation efforts outlined above the HOME-ARPA funds along with an

overview of the eligible activities and program requirements were discussed as part of the Community

Housing Impact and Preservation Program (CHIP) Advisory Group and Housing Development Assistance

Program Advisory Group meetings that were held virtually on November 2, 2021 and December 2, 2021.

The minutes of the CHIP meeting minutes can be found at

https://development.ohio.gov/wps/portal/gov/development/community/community-resources/ohio-

consolidated-plan

.

Needs Assessment and Gap Analysis

The state of Ohio reviewed the existing PY2020 – 2024 Consolidated Plan, Ohio Housing Finance

Agency’s (OHFA) Housing Needs Assessment, the OHFA Confronting Homelessness Report-

Homelessness in Ohio 2012- 2018, 2014-2018 Comprehensive Housing Affordable Strategy (CHAS)

Ohio’s 2020 Point-in-Time Report, the Corporation for Supportive Housing (CSH) State Investment

Response Estimator Tool Data, and the National Low-Income Housing Coalition (NHILC) Shortage of

Affordable Rental Homes to help determine the needs that exist for the following qualifying populations:

• Homeless, as defined in 24 CFR 91.5

• At risk of Homelessness, as defined in 24 CFR 91.5

• Fleeing, or Attempting to Flee, Domestic Violence, Dating Violence, Sexual Assault, Stalking or

Human Trafficking

• Other Populations:

o Other families requiring services or housing assistance to prevent homelessness

o At greatest risk of housing instability

o Veterans and families that include a veteran family member

Upon examination of the data and plans discussed previously, Development was able to determine the

gaps that exist for persons that fall under one of the qualifying population criteria as will be discussed

later. The following provides an overview of how the information contained within the plans and data

aligns with the mission of the HOME-ARPA.

Describe the size and demographic populations within the Participating Jurisdiction’s (PJ)

boundaries as well as the unmet housing and service needs of qualifying populations:

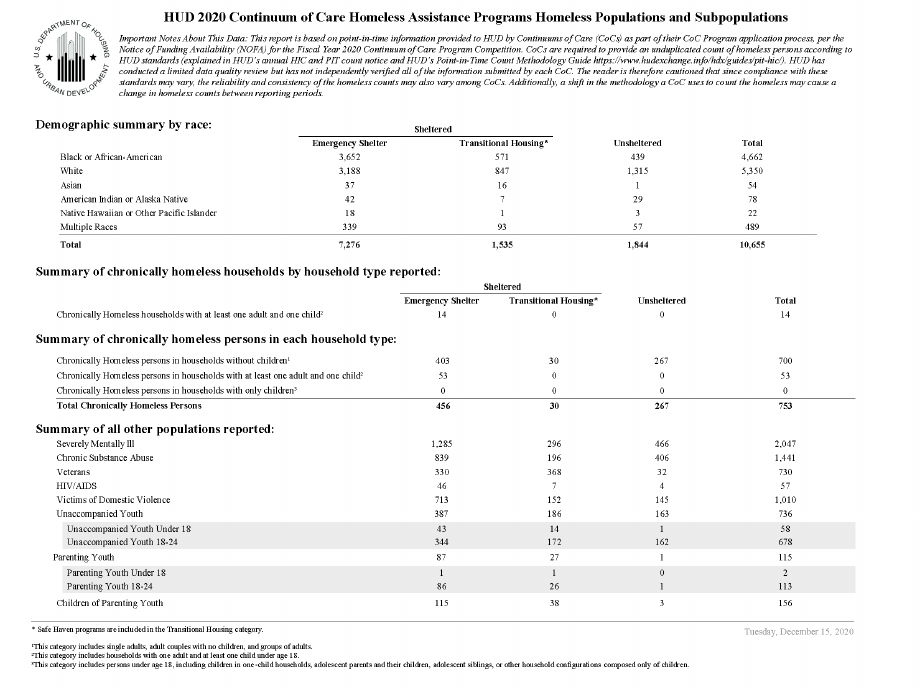

As reported in the 2020 point-in-time data presented to HUD, there was a total of 10,655 homeless

individuals and 8,343 homeless households in the state of Ohio on a single night, with just over 20%

percent of all households unsheltered. A total of 963 households, or 11.5%, were homeless with children.

The following table provides an assessment of persons that are covered by the qualifying population

categories as reported in the 2020 Point-in-Time Report. In 2020, there were 730 homeless veterans,

2,047 persons with severe mental illness and over 1,000 victims of domestic violence reported.

Table 2: 2020 CoC Point-in-Time Data

6

The OHFA Needs Assessment provides a comprehensive understanding of the critical housing trends

and needs facing Ohioans. The updated 2021 report “uses a wide range of state data to identify the scale

and scope of the state’s housing challenges. The Assessment evaluates Ohio’s current housing

landscape to gauge housing needs, identify gaps, and highlight key trends. Beyond its role in the Annual

Plan, findings from the Housing Needs Assessment inform OHFA’s programmatic and policy decisions

throughout the year, such as the Qualified Allocation Plan (QAP), to ensure that every Ohioan has access

to safe, affordable housing.” The Housing Insecurity section of the report specifically looks at the

population at risk for losing their home or experiencing homelessness. The findings reported in the OHFA

Needs Assessment help to understand what the housing conditions are like throughout the state, both in

rural and urban areas:

• Ohio's foreclosure rate (0.6%), 90-day delinquency rate (2%) and negative equity share (4%) in

December 2019 were all at record low levels, having fallen precipitously from the height of the Great

Recession.

• In 2018 there were 105,265 eviction filings statewide, representing 6.6% of all renter households.

Although consistently higher than the national rate, Ohio's eviction filing rate has fallen to the lowest

level in decades, having peaked in 2005 at 8.6%.

• Ohio's public and community schools reported that 35,214 students (2% of enrollment) lacked a fixed,

regular and adequate nighttime residence during the 2018–19 school year.

• In 2019 there were 32,362 beds in Ohio for homeless persons, including 9,231 in temporary housing

and 23,131 in permanent housing.

• 76,000 Ohioans accessed homelessness services in 2018 from one of the state's Continuums of

Care. This represents a 30% increase from 2012.

7

As indicated in the 2021 report dealing specifically with housing for homeowners, “More than 40% of

mortgage holders aged 65 or over are housing cost-burdened. Out of this age group, one-in-six mortgage

holders (17%) are severely cost-burdened. Black homeowners are twice as likely to be severely cost

burdened as white homeowners (14% compared to 7%), meaning they spend at least half their income on

housing.”

The housing affordability crisis is not limited to

homeowners. As reported in OHFA’s 2021

Needs Assessment, renters in Ohio also face

a tight market. “For every 100 extremely low-

income renters in Ohio, there were only 44

rental units affordable and available to them in

2018. Ohio's affordable housing gap has been

gradually shrinking, but at the current net

annual rate of around 5,000 units built or

made available for the lowest-income renters, it will take almost 50 years to close that gap. One-in-three

Black renters in Ohio (33%) were severely rent burdened in 2018, compared to one-in-five white renters

(22%).” The issue of housing being overcrowded, and housing cost burden significantly impacts rental

housing with “One in four renters in Ohio (25%) experienced severe housing problems, as defined by

HUD, including incomplete kitchen and plumbing facilities, severe overcrowding and severe housing cost

burden.” In terms of housing availability, the following table shows how the vacancy rate has changed

from 2010 – 2019 accordingly to the ACS 5-year estimates. The rental vacancy rate has decreased

during that period from 9.5% to 5.3%, which provides another sign that the housing market in Ohio,

particularly rental housing, has been significantly impacted since the 2008-2009 housing recession.

Additional information regarding the total number of renter and owner households throughout the state

experiencing housing problems, as well as housing cost burden can be found in the appendix. The

Comprehensive Housing Affordability Strategy (CHAS) data included in the appendix provides a summary

of the ACS data for the 2014-2018 period released on September 29, 2021, by Housing and Urban

Development (HUD). It should be noted that nearly 43% of all renter households reported at least one of

four housing problems, and 18.4% of owner households reported one of four housing problems.

Challenges to secure and maintain affordable housing are particularly difficult for Ohio's children and

aging adults. Both children and older adults are more likely to live in cost burdened households and thus

face potential housing insecurity. As Ohio's population continues to age, a growing number of older adults

are also vulnerable to high housing costs. One of every nine households have a single adult aged 65 and

over, making regular home maintenance challenging. Older Ohioans also have higher rates of disabilities:

nearly two-thirds of homes in Ohio are inaccessible to someone in a wheelchair.”

The following excerpt from the Confronting Homelessness report prepared by OHFA sheds some light

with regards to the unmet housing and service needs of qualifying populations:

“The recent COVID-19 crisis has highlighted the importance of a safe, stable, and affordable

home in maintaining a healthy community. The health crisis and related economic crisis have

exacerbated the deep racial and economic inequalities that were already present in Ohio. In the

wake of this economic and health crisis, Ohio is facing increasing challenges to keeping people in

their homes. As hundreds of thousands of Ohioans have filed for unemployment

and experienced disruptions in their income, we expect many of these households will be

unable to pay rent or their mortgage and may face housing instability in the coming year.

Prior to COVID-19, a lack of affordable housing already existed in Ohio; in 2018, the shortage

was more than 256,000 housing units for extremely low-income renters. For every 100 extremely

low-income renters there were only 44 available and affordable units. This affordability crisis will

likely be exacerbated in the coming year.

2019

2010

Total housing units

5,202,304

5,107,273

Occupied housing units 4,676,358 4,552,270

Vacant housing units 525,946

555,003

Homeowner vacancy rate

1.4%

2.6%

Rental vacancy rate 5.3%

9.5%

Source:: 2015-2019 and 2006-2010 ACS 5-Year Estimates DP-04 Data

8

As we begin to understand the changes to homelessness in Ohio, it is critical to understand

the patterns of homelessness that pre-existed COVID-19. Available data presents a somewhat

mixed picture. The 2018 Point-In-Time (PIT) count identified 10,249 homeless individuals in the

state

on a single night in January, a decline of about 200 individuals from 2016. By contrast, in

the same year, Ohio Department of Education data showed that 23,398 Ohio public school

students lacked stable housing at some point during the 2018-2019 school year, an increase of

nearly 5,000 from just two years prior. However, both the PIT count and ODE data only capture

a small portion of those who experience homelessness each year.”

The OHFA report also includes data indicating where people went after exiting the homeless system,

which highlights the lack of housing and services necessary to help extremely low-income Ohioans

achieve housing stability.

• Only 21% of people exiting the homeless system entered a subsidized rental unit, while 45% moved

into an unsubsidized unit;

• 27% moved in with family or friends, which often leads to future bouts of homelessness;

• 9% went to another emergency shelter;

• 7% exited shelter to a place not fit for human habitation.

The following data reported in the OHFA Homelessness Report discusses veterans and victims of

domestic violence, which are classified as high-risk populations with regards to homelessness.

Veterans

Of clients entering programs in 2018, 7.4% were military veterans, with veteran status not reported for

1,046 people. During the study period:

• The average age for veterans entering the CoC system during the study period was 52.

• More than 330 veteran households included children at entry.

• The largest prior residence for veterans included temporary shelter (33%) and a place not fit for

habitation (24%).

• The most common exit destinations were an unsubsidized home (35%), a subsidized home (21%), or

moving with friends or family (18%).

Victims of Domestic Violence

Of all clients, 20.3% reported surviving domestic violence at some point in their lives, including 33% of

women and 9.7% of men. Survivor status was not disclosed for 160 entrants. During the study period:

• The average age for domestic violence survivors at first recorded entry was 35; about 1,680 survivors

who accessed services were children under the age 18 (11% of all domestic survivors who accessed

services in 2018).

• Of all domestic violence survivors, 74% were women.

• Prior to accessing services, 42% were in another shelter, 21% were staying with family or friends, and

19% were literally homeless or living in a place not meant for human habitation.

• The most common exit destinations were an unsubsidized home (38%), moving with friends or family

(30%), or a subsidized home (15%).

• Just over a third of the survivors accessing services (35%) entered with children.

Estimating the number of domestic violence survivors experiencing homelessness exclusively through

HMIS records, however, is challenging.

Identify and consider the current resources available to assist qualifying populations, including

congregate and non-congregate shelter units, supportive services, Tenant-Based Rental

Assistance, and affordable and permanent supportive rental housing

9

In Ohio, there are several programs funded with both federal and state resources that can assist

qualifying populations with supportive services, along with affordable and permanent supportive rental

housing. An overview of the housing programs offered by Development and OHFA are located on

Development’s website. These programs utilize Ohio Housing Trust Fund (OHTF), Community

Development Block Grant (CDBG), CARES-Act, HOME Investment Partnership, Emergency Solutions

Grant (ESG), Housing Opportunities for Persons with AIDS (HOPWA) and National Housing Trust Fund

dollars to help conserve and expand the affordable housing stock; address the issue of homelessness in

Ohio; and provide short-term, emergency assistance and other public services for low-income Ohioans

and qualifying populations. In addition to the state and federal funds offered by Development and OHFA,

Congress has recently approved a total of nearly $1.5 billion of Emergency Rental Assistance (ERA)

allocated to the State of Ohio, to pay up to 12 months of arrears and up to three months prospective rent

for people experiencing housing instability. The statute allows housing providers to initiate ERA

applications with cooperation from their tenants.

Identify the gaps within the current shelter and housing inventory as well as the service delivery

system. Explain how the level of need and gaps in the shelter and housing inventory and service

delivery systems based on the data presented in the plan were determined:

The Low-Income Housing Coalition’s most recent Gap Report indicates that there were only 184,584

rental units in 2019 that were affordable and available to Ohio’s 436,611 extremely low-income

households. With national median rent prices increasing nearly 18% last year (Apartment List), we can

assume that gap has grown much larger over the past two years. Another statewide dataset to

understanding what housing gaps exist within the current shelter and housing inventory is the Corporation

for Supportive Housing’s (CSH) State Investment Response Estimator Tool (S-IRET) (see appendix). The

CSH S-IRET tool annualizes Ohio’s PIT and HIC to determine the level of need for three evidence-based

interventions that end or prevent homelessness. The following is a summary of the housing gap for

individuals and families:

• 1,885 gap in permanent supportive housing units for individuals

• 23,390 gap in rapid rehousing units for individuals and 2,068 for families

• 3,376 gap in units for homeless prevention for individuals and 1,331 for families.

Identify the characteristics of housing associated with instability and an increased risk of

homelessness if the PJ will include such conditions in its definition of “other populations” as

established in the HOME-ARP notice:

HUD’s Comprehensive Housing Affordability Strategy (CHAS) data

(

https://www.huduser.gov/portal/datasets/cp.html), which has been summarized in the appendix,

reports that 381,540 Ohio renter households have at least 1 of 4 severe housing problems, which

represents 24.1 percent of all renter households. The four severe housing problems are: incomplete

kitchen facilities; incomplete plumbing facilities; more than 1 person per room; and cost burden greater

than 50%, which can all lead to greater risk of housing instability and homelessness. The definition of

substandard housing is defined at 24 CFR § 5.425.

Identify priority needs for qualifying populations:

Based on the data that has been discussed previously along with the conversations that took place as

part of the consultation process, the need for permanent supportive housing is the greatest priority for

qualifying populations. The Stakeholder Group indicated that there was a lack of other resources

available for permanent supportive housing projects and that the HOME-ARPA funding is a critical

resource in filling the gap. In addition to the need for permanent supportive housing there also exists a

need to fill the gap that wasn’t fully covered by the ESG-CV and CDBG-CV CARES Act funds by

establishing or enhancing non-congregate housing opportunities in the state. Development has been

10

approached by organizations identifying the need for capital improvements or acquisition and

development of non-congregate shelters.

Based on the needs mentioned and excluding administration and planning funds, Development will

allocate the majority of its allocation (60%) to developing affordable and permanent supportive housing.

The remainder will be made available to organizations for the conversion, renovation, or new

development of non-congregate shelters.

HOME-ARPA Activities

Describe the method for soliciting applications for funding and/or selecting developers, service

providers, subrecipients and/or contractors and whether the PJ will administer eligible activities

directly:

The activities associated with HOME-ARPA are included in this section. The following provides an

overview of the method distribution along with associated program requirements. It should be noted that

there will be no preference given beyond the qualifying populations included in HUD Notice: CPD-21-10.

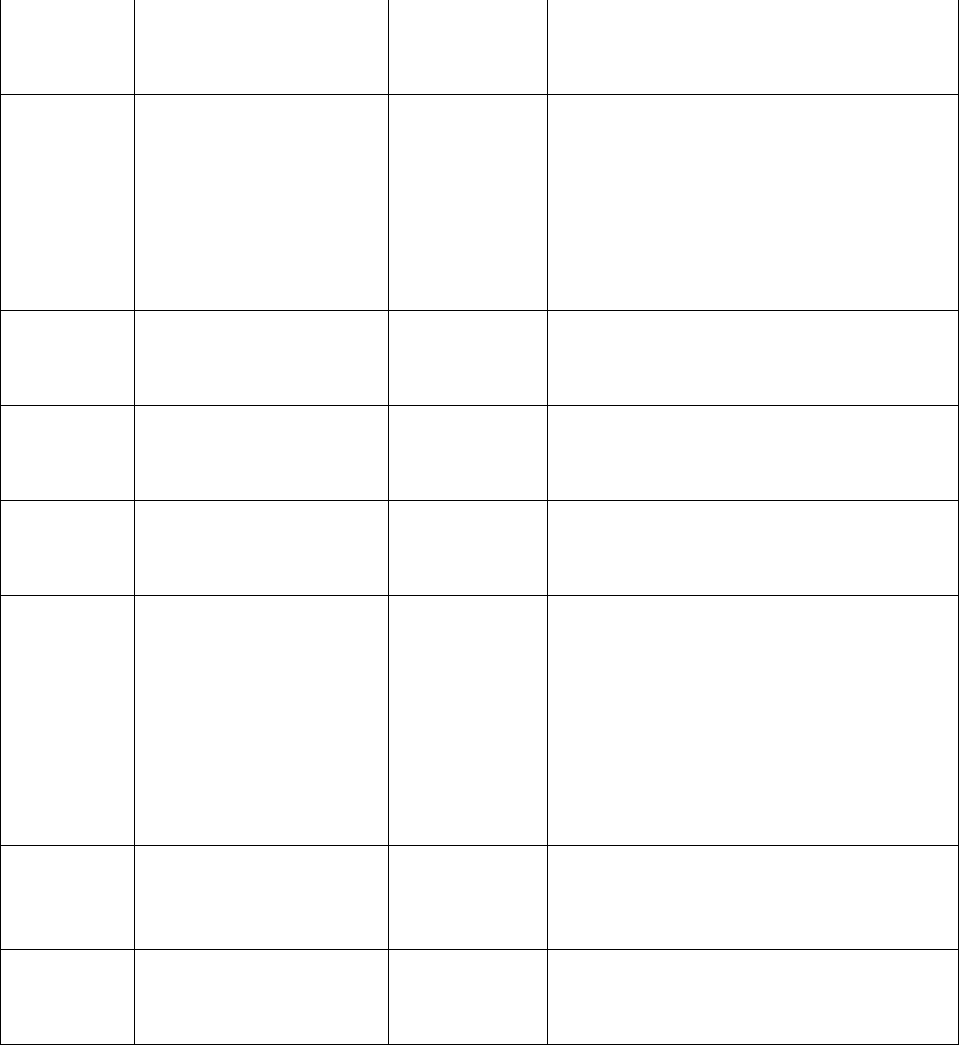

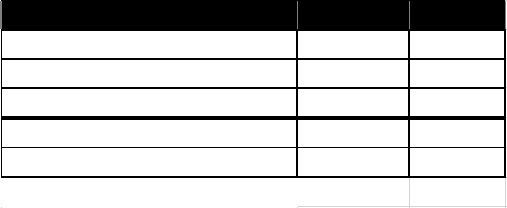

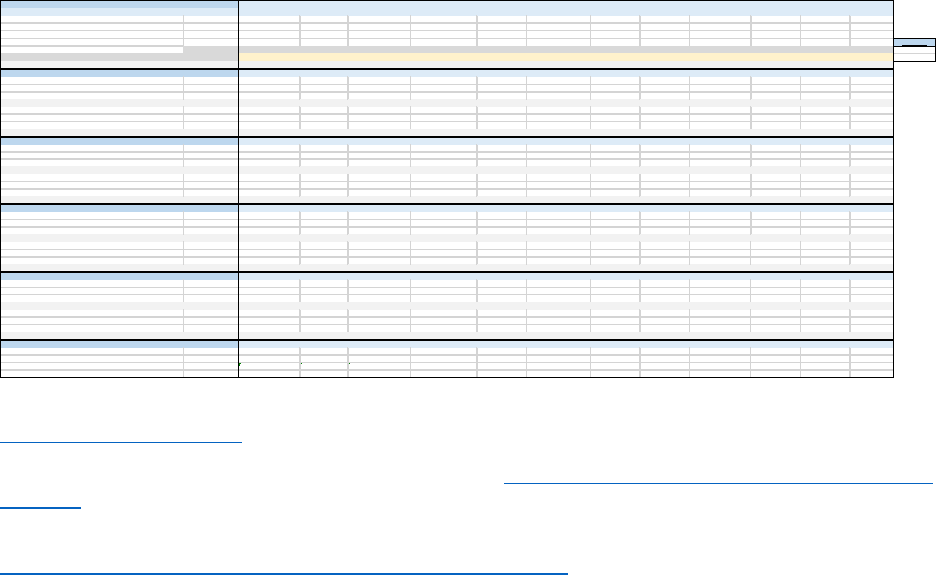

Use of HOME-ARPA Funding Table

Development of Affordable Rental Housing – Housing Development Assistance Program

(Housing Credit Gap Financing (HCGF) and and Bond Gap Financing (BGF), and

Housing Development Gap Funding (HDGF)) Activity for Rental Housing Development

HUD Notice: CPD2021-10 requires the following targeting requirements for Rental Housing:

a. Not less than 70 percent of the total number of rental units assisted with HOME- ARP

funds by the PJ must be restricted for occupancy by households that are qualifying households

at the time of the household’s initial occupancy; and,

b. Not more than 30 percent of the total number of rental units assisted with HOME- ARP

funds by the PJ may be restricted to low-income households. These rental units do not have to be

restricted for occupancy by qualifying households, however rental units restricted to low-income

households are only permitted in projects that include HOME-ARP units for qualifying

households.

Housing Development Assistance Program (Housing Credit Gap Financing and Bond Gap

Financing Activity) Funding Amount: Approximately $67.5 million in HOME-ARPA. The HOME-ARPA

dollars, will be awarded through the Ohio Housing Finance Agencies (OHFA) HDAP to provide gap

financing to developments serving low-income and extremely low-income households serving a

population at risk of homelessness or experiencing homelessness. Funds may be used to preserve or

develop housing serving target populations. Federal regulations may be waived as outlined in HUD

Notice: CPD-21-10.

Funding Amount Percent of the Grant Statutory Limit

Supportive Services

Acquisition and Development of Non-Congregate

Shelters

10,000,000.00

TBRA

Development of Affordable Rental Housing 67,500,000.00

Non-Profit Operating 5%

Non-Profit Capacity Building 5%

Administration and Planning 13,057,128.00 14.4% 15%

Total HOME ARP Allocation

90,557,128.00

11

The HCGF program utilizes HOME-ARPA funding to provide gap financing assistance to developments

using competitive (9%) LIHTCs to renovate or construct service enriched affordable housing serving low-

and moderate- income households, and HOME-ARP Qualified Populations.

Up to $2.5 million will be provided for enhanced HCGF to developers of proposed permanent supportive

housing projects that submitted applications for 2022 competitive (9%) Low- Income Housing Tax Credits

(LIHTC) on February 10, 2022 and meet all criteria to compete in the Service Enriched Housing Pool as

defined in the 2022-23 Qualified Allocation Plan. In exchange for an enhanced HCGF-HOME-ARP award,

developers must agree to set-aside 100 percent of the total units for HOME-ARP Qualified Populations.

The amount of funding per project will equal the original HCGF requested plus an amount of funds equal

to 25% of the deferred developer’s fee listed in the application in order to strengthen the financial

sustainability of the project. The maximum award per project is $750,000.

The BGF program utilizes HOME-ARPA funding to provide gap financing assistance to developments

using multifamily bonds with non-competitive (4%) LIHTCs to renovate or construct affordable housing

serving low- and moderate-income households, and HOME-ARP Qualified Populations the HOME-ARP

funds will be allocated for BGF as follows:

• Up to $17 million will be reserved for sponsors of proposed permanent supportive housing

projects that submitted an application for competitive (9%) LIHTC in 2021 but did not receive an

allocation of credits and agreed to restructure the project financing using multifamily bonds and

4% LIHTC by submitting a revised application in January 2022. Developers must agree to set

aside 100% of the units for HOME-ARP Qualified Populations and the amount of funding per

project based on need defined as compensation for the reduction of credits from 9% to 4% plus

funds to cover additional bond costs and the original HDAP requested plus funds needed for a

capitalized operating reserve for the QP units.

• A minimum of $31.5 million will be reserved for sponsors of proposed integrated permanent

supportive housing multifamily bond projects that submit an application in the 2022 competitive

BGF Program funding round in summer 2022. Developers of New Construction projects will

have a 20% set-aside for HOME-ARP Qualified Households. Preservation projects will have a

30% set-aside for HOME-ARP Qualified Households. All projects will be capped at $2.5 million

per project in HOME-ARP. Developers of new construction or preservation projects that agree

to set-aside 70% or more of the total units for Qualified Populations may receive up to $4.25

million in HOME-ARP funding. If funds are available, projects may be awarded additional gap

financing using OHTF to ensure the financial feasibility of the project. Additional funding may be

allocated if the project has a demonstrated need and is granted an exception request.

Any unused and uncommitted funds will be reserved to 2023 BGF and 2023 HDGF.

The HDGF program utilizes HOME-ARPA funding to provide gap financing assistance to small

permanent supportive housing projects consisting of 25 units or less using other private and public

resources to renovate or construct service enriched affordable housing serving low- and moderate-

income households, and HOME-ARP Qualified Populations. All remaining uncommitted HOME-ARP

funds remaining after all HOME-ARP HCGF and BGF awards have been made will be distributed through

the 2022 HDGF funding round in fall 2022. All projects will be required to set aside 100% of the total units

for HOME-ARP Qualified Persons. The amount of HOME-ARP HDGF will equal the total project cost

less all committed sources. All projects will be capped at $1 million per project in HOME-ARP. If funds are

available, projects may receive an additional award of OHTF to cover any remaining financing gaps. The

OHTF plus HOME-ARP may not exceed 50% of the total project cost.

OHFA reserves the right to exceed or reduce the above award amounts based on the location and needs

of the project. Award amounts for the BGF program will be based on funding availability and the needs of

the project.

12

As noted in the Waivers and Alternative Requirements for Implementation of the HOME American

Rescue Plan Act (HOME-ARPA) Program, the requirements of 24 CFR 92.218 through 24 CFR 92.222

and any other requirements for matching contributions in 24 CFR part 92 shall not apply to HOME-ARPA

funds, as subsection (c)(1) of ARPA states that the underlying statutory requirement at section 220 of

NAHA (42 U.S.C. 12750) does not apply to HOME-ARPA funds.

If utilizing bonds, the development cannot have closed on the bonds prior to application for HDAP funds.

Closing "in Escrow" will be considered by OHFA to be closed.

Eligible Activities: HDAP funds may be applied in the development budget toward non-related party

acquisition, hard costs associated with new construction or rehabilitation, and developer fees associated

with the project.

Funding Requirements

1) Reporting and Record Keeping: The applicant will be responsible for compliance with

applicable implementation, reporting and record keeping requirements associated with HOME-

ARPA, OHFA, and state regulations.

2) Environmental Review Requirements: OHFA will conduct a supplemental environmental

review for all projects receiving HDAP funds. The environmental review will be completed in

accordance with the relevant state or federal requirements as specified below.

Environmental reviews are conducted in accordance with 24 CFR. Part 58. Development serves

as the Responsible Entity.

3) Determination and Requirements for Assisted Units: Assisted units must meet all

requirements as stated in HUD Notice: CPD-21-10.

4) Rehabilitation Standards: Developments that involve rehabilitating structures must adhere to

OCD Residential Rehabilitation Standards (RRS). Refer to OCD’s RRS Handbook, or other

standards agreed on by OHFA and OCD.

5) Lead-Based Paint Standards: All housing developments designed to rehabilitate pre-1978

structures must adhere to the Development's Lead-Based Paint Guidelines.

6) Relocation Standards: All developments, regardless of funding source, that involve

rehabilitating existing occupied units must submit a Relocation Plan or rehabilitation strategy that

outlines the plan to work with the tenants in place. If the development receives federal funds, the

plan must meet the requirements set forth in the Uniform Relocation Assistance and Real

Property Acquisition Policies Act of 1970, as amended. If the development involves acquisition,

the applicant must supply the Real Property Acquisition and Relocation Certifications and

Voluntary Acquisition Forms for the project.

7) Timeline: The HDAP recipient will confirm that all financing is committed and submit a request to

close on HDAP funding to OHFA which must be received at the OHFA offices at 57 East Main

Street, Columbus, OH 43215, by the date(s) set forth in the recipients Funding Agreement.

8) Changes to Approved Applications: The HDAP recipient must notify OHFA, in writing, of all

changes, financial or otherwise, relating to an application for financial assistance of an approved

development. Failure to notify OHFA may jeopardize the applicant's ability to receive assistance

in the future. If there are any substantive changes to the development prior to executing the

Funding Agreement, OHFA may require the applicant to resubmit the application.

9) Eligible/Ineligible Applicants: Applicants can be private for-profit, not-for-profit

developers/owners, or public housing authorities. For developments owned by partnerships

13

(limited liability corporations, etc.), to qualify for financing terms available to not-for-profit

organizations, the majority/controlling general partner interest must be held by a not-for-profit (for-

profit affiliates of not-for-profit parent corporations qualify as a not-for-profit in a partnership

situation). To request financing terms available to not-for-profit organizations, the applicant must

provide evidence of IRS 501(c)(3) or 501(c)(4) status. To be eligible for funding, religious

organizations must meet the provisions in 24 CFR § 92.257.

OHFA reserves the right to evaluate developments, including those that have previously received

an award of HDAP, and that have received other forms of federal subsidy to determine what

amount, if any, the development needs to be financially feasible. OHFA reserves the right to

evaluate such developments to determine the facts and circumstances that necessitate the need

for additional funds and to ensure projects are not over subsidized.

OHFA would prefer that HDAP resources be used to provide new opportunities for affordable

housing or to preserve existing, currently subsidized or rent-restricted affordable housing for the

residents of Ohio. Therefore, OHFA reserves the right to determine if rehabilitating existing

affordable renter-occupied housing without project-based subsidy is eligible.

10) Projects per Developer: Developers may submit more than one proposed development per year

based on the organization’s capacity to implement multiple and/or simultaneous projects. OHFA

reserves the right to require further information and to decide on an organization’s capacity to

carry out multiple developments, which will include status and progress on projects using any

resources provided by OHFA. OHFA may also limit the amount of HDAP awarded to any single

developer.

OHFA reserves the right to combine the costs for developments that are located near each other

and share similar attributes such as project type, construction style, and development team.

11) Cost Certification: After construction is completed, each development may be required to obtain

and submit a cost certification prepared by an independent certified public accountant or other

comparable documentation approved by OHFA.

12) Fee Limits: Developer's fee for applications submitted for HDAP funding must be consistent with

the limits established in the Qualified Allocation Plan (QAP), BGF Guidelines, or other funding

guidelines.

13) Public Notification: Applicants intending to develop rental housing (including lease-purchase)

must comply with the Ohio Revised Code §175.07 pertaining to public notification.

14) Loans:

• 2% interest will be charged unless otherwise agreed to by OHFA;

• Loan will mature at the end of the affordability period. The affordability period is defined as

the minimum term required in 24 CFR 92 and any extended affordability period imposed by

OHFA;

• Collateral will be a subordinate mortgage. OHFA must be in second or shared-second lien

position unless otherwise agreed to by OHFA based on good cause and sufficient supporting

documentation;

• Payments will be based on a percentage of the available cash flow as defined by OHFA. If

loan payments flow from a third party to the recipient, they will be excluded from cash flow

analysis provided they are transferred to OHFA in full. Any remaining balance on the loan is

due as a balloon payment at the end of the term or sale, whichever is first. On a case-by-

case basis, OHFA may agree to subordinate to other government investors and accept

payments consistent with their terms;

• Loan interest will accrue, and repayment obligations will start following the closeout of the

project, regardless of the Placed-in-Service date. Closeout means the HDAP recipient

leased the “Assisted” units, provided the appropriate documentation to OHFA, and OHFA

14

approved the documentation as evidenced by a closeout letter from Analyst; and

• Funds cannot be lent to the project at a rate higher than OHFAs rate without the approval of

OHFA. OHFA reserves the right to designate which general partner/managing

member/owner, if more than one (1), will be the recipient.

15) Grants:

Grants must be requested and are available only when all the following conditions are met:

• The eligible applicant is the controlling general partner and is a 501(c)(3) or 501(c)(4) not-

for-profit (for-profit affiliates of not-for-profit parent corporations qualify as a not-for-profit in a

partnership situation);

• At least 20% of the units in the development will be occupied by and affordable to

households at or below 35% of the area median income;

• The recipient treats the funds as a grant for tax purposes. If the recipient is the project, it will

receive an IRS Form 1099; and

• The recipient does not loan the funds to the development but treats it as a grant or capital

contribution.

Developments that meet both the requirements established by OHFA for Permanent Supportive

Housing and the above-noted conditions are also eligible to request a grant.

For low-income housing tax credit (LIHTC) developments that request a direct grant, the HDAP funds

may be included in eligible tax credit basis if the funds are a general partner's capital contribution and

provided that the development can provide a tax opinion certifying the funds as part of eligible basis.

The development must still meet all the above-noted requirements to be eligible for a grant. However,

when considering grant eligibility, OHFA will apply the regulations governing the funds awarded when

considering how the recipient passes the award on to the development.

16) Fees:

Application Fee: OHFA may elect to impose application, document correction and/or funding fees

as it determines necessary. Fees may be based on threshold deficiencies and designed to

encourage complete and accurate application submissions with a likelihood of success.

Amendment/Extension or Reinstatement to Funding Agreements: OHFA may elect to impose a

$100 fee for each amendment or extension made to the funding agreement. OHFA may also

elect to impose a $1,000 fee to reinstate an expired funding agreement. These fees are

implemented to encourage applicants to complete developments in a timely manner and as

proposed in the application.

17) Waivers:

OHFA reserves the right to waive State-imposed requirements if the applicant demonstrates a

compelling reason. OHFA will review such requests on a case-by-case basis.

18) Application Review Criteria and Review Process:

All programs under the HDAP will include a review of the application and all required supporting

documentation to ensure that the development is financially feasible and meets all HOME-ARPA

and/or OHFA program requirements. OHFA reserves the right to determine cost reasonableness

and fees associated with the development.

The application will be assigned to a Housing Grant Analyst (HGA) who will be responsible for the

application review, funding agreement processing and resolving post-award implementation

issues.

Threshold Review - The threshold criteria assure that all selected developments comply with

program requirements. Applications that do not meet the threshold requirements will not be

considered for funding. The only exception to this will be the HCGF developments, which will

follow the Threshold Review process established in the OHFA QAP.

15

Competitive Review - Applications submitted for the HCGF program will follow the allocation

system established in the OHFA QAP.

Applications submitted for the HDGF program will be evaluated based on the following criteria: 1)

experience and capacity of the applicant and development team; 2) financial feasibility of the

development; 3) site selection; 4) development design; 5) demonstrated market for the

development; and 6) policies as stated in the program guidelines.

Applications submitted for the BGF program will be evaluated based on the following criteria: 1)

experience and capacity of the applicant and development team; 2) financial feasibility of the

development; 3) site selection; 4) development design; 5) demonstrated market for the

development; and 6) policies as stated in the program guidelines. OHFA reserves the right to

prioritize projects located in Ohio’s Appalachian counties (excluding HUD Entitlement

Communities and Non-entitlement Participating Jurisdictions); HUD Non-entitlement Communities

and Non-Participating Jurisdictions, projects preserving existing affordable housing, or projects

undergoing a RAD conversion.

Pro Forma or Affordability Analysis - A financial review will include an evaluation to determine the

amount of funds necessary to complete the actual development of the development, considering

all other committed sources.

The financial review for rental housing developments includes the analysis of a 15- and/or a 30-

year pro forma, assuming a 2% annual revenue increase, a 3% annual operating expense

increase, and a 7% stabilized vacancy rate. If the pro forma forecasts different assumptions,

justification must be provided. The affordability analysis for rental developments requires the

resident's rent and utility payments not to exceed 30% of an income-qualified household's income

at the projected affordability level. Utility allowance information must be obtained from the local

public housing authority, local utility provider, or other approved source (e.g. actual usage history

on rehabilitation developments).

Capitalized Operating Reserves – OHFA will modify program guidelines to include capitalized

operating reserves for projects that do not provide project-based rental subsidy for the QP units.

that meet the requirements of HUD CPD Notice 21-10 and related HUD guidance as an eligible

use of HOME-ARP funds. OHFA will administer the reserves and comply with the requirements

for management and oversight outlined in HUD CPD Notice 21-10.

Pre-Award Site Visit - OHFA may conduct a site visit prior to submitting a funding

recommendation. The purpose of the visit is 1) to evaluate the proposed development site for

suitability and impact on the surrounding community; 2) to confirm the status of previously funded

developments; and 3) to develop the relationship between the applicant and OHFA. Both parties

can discuss any issues or concerns regarding the proposed development and the organization

has an opportunity to familiarize OHFA staff with their overall programs and operations.

Formal Recommendation for Funding - OHFA will present the development and submit a funding

recommendation, either for approval or rejection, to the OHFA Board's Multifamily Committee.

This Committee will submit a formal recommendation to the OHFA's Board for consideration and

approval.

Units Restricted for Occupancy by Qualifying Households: The HOME-ARP rent must comply

with HUD Notice: CPD 2021-10 and may not exceed 30 percent of the adjusted income of a

household whose annual income is equal to or less than 50 percent of the median income for the

area, as determined by HUD (i.e., Low HOME Rents).If a household receives federal or state

tenant-based rental assistance, the rent is the rent permissible under the applicable rental

assistance program (i.e., the tenant rental contribution plus the rental subsidy allowable under

that rental assistance program).

16

19) Application Submission:

Applications must be submitted on a compact disc, or electronically via OHFA’s ftp site, with all

required documents clearly labeled as detailed in the respective program’s guidelines.

Applications must be submitted to the Office of Multifamily Housing, Ohio Housing Finance

Agency, 57 East Main Street, Columbus, Ohio 43215-5135.

Incomplete Applications: OHFA will perform a preliminary review of all submissions to determine

whether a complete application has been submitted. If it is determined that OHFA cannot

evaluate the proposal based on the information provided, the application will be returned to the

applicant along with a written listing of the application’s deficiencies.

Acquisition and Development of Non-Congregate Shelters

Development will reserve the remaining $10 million of its allocation for acquiring and developing NCS for

qualifying individuals and families. This activity may include but is not limited to the acquisition of land and

construction of NCS or acquisition and/or rehabilitation of existing structures such as motels, hotels, or

other facilities to be used for NCS. Organizations interested in the HOME-ARP NCS activity will be

required to provide their own operating expenses.

Development reserves the right to prioritize projects located in Ohio’s Appalachian counties (excluding

HUD Entitlement Communities and Non-entitlement Participating Jurisdictions) and in HUD Non-

entitlement Communities and Non-Participating Jurisdictions

If the need for the NCS activity is less than expected, the balance of uncommitted funds will be

transferred to develop more permanent supportive housing units under the OHFA structure above.

Administration

A total of just over $13 million has been budgeted to cover the implementation of the projects as well as

the long-term compliance requirements for the affordability period. In addition, administration funds will

be used for the training of compliance staff to implement HOME-ARPA, as well as monitoring for

compliance.

HOME-ARPA Production Goals

The activities included in the HOME-ARPA align with the priority needs identified in the PY 2020-2024

Ohio Consolidated Plan section SP-25 that places high priority to homelessness and rapid rehousing as

well as affordable housing production. In addition, the activities align with the goals stated in section SP-

45 of the PY 2020-2024 Ohio Consolidated Plan that deal specifically with housing preservation and

accessibility, affordable housing as well as supportive housing.

There will be approximately 100 rental units rehabilitated along with approximately 700 new rental units

constructed as part of the HDAP Housing Credit Gap Financing (HCGF) and Bond Gap Financing (BGF)

project.

Preferences

There will be no preference given beyond the qualifying populations included in HUD Notice: CPD-21-10.

HOME-ARPA Refinancing Guidelines

HOME-ARPA will not be used to refinance existing debt secured by multifamily rental housing.

17

Appendix

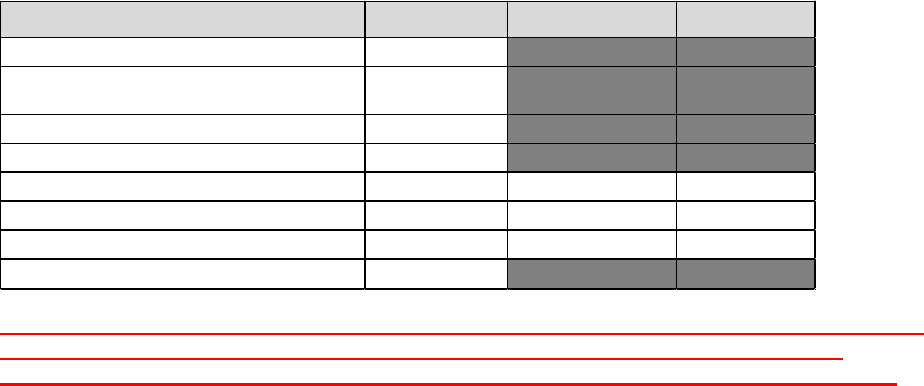

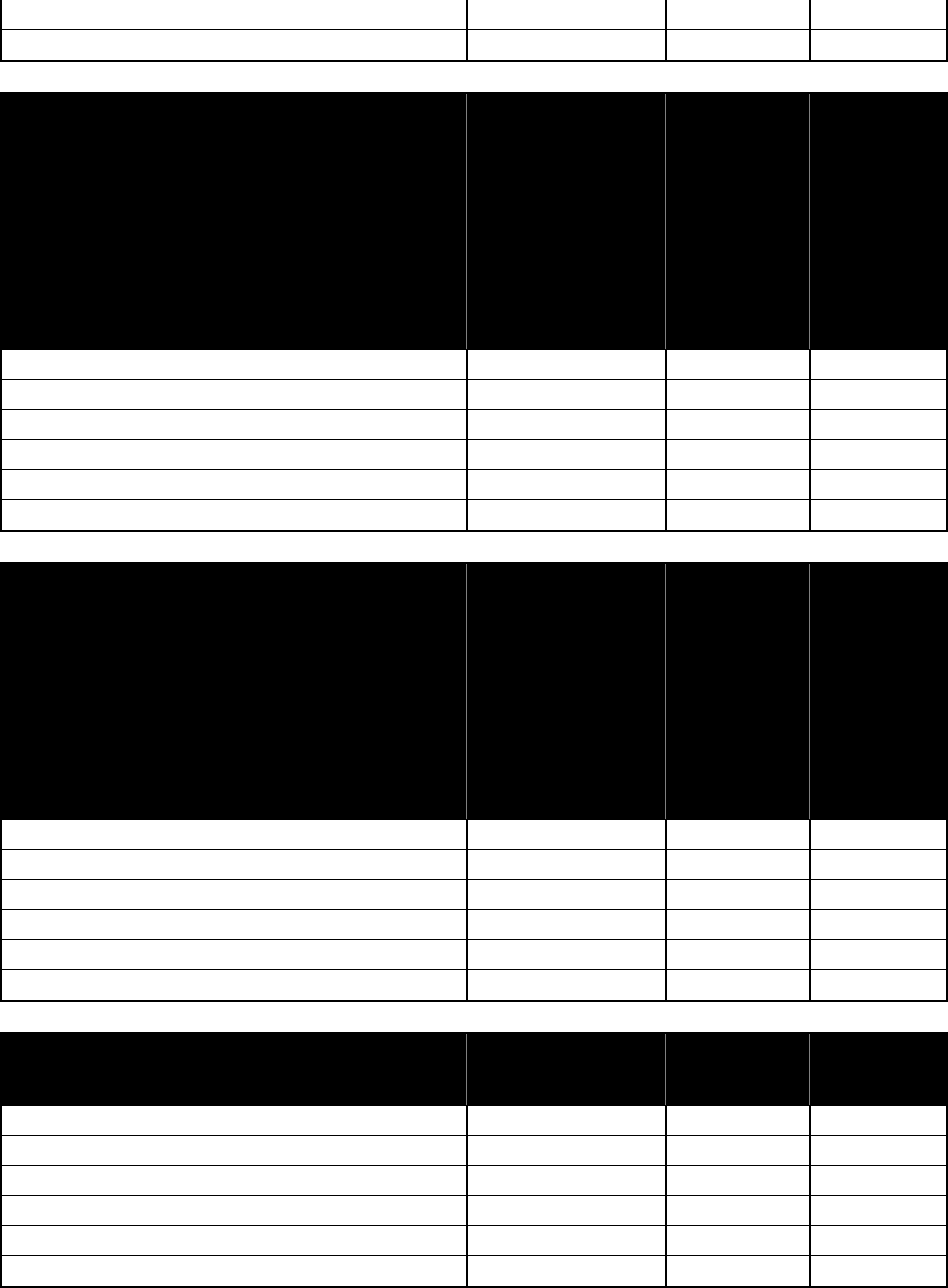

State of Ohio 2006 – 2017 CHAS Dataset issued on September 29, 2021 HUD released updated

CHAS data for the 2014-2018 period

Income Distribution Overview

Owner

Renter

Total

Household Income <= 30% HAMFI

179,020

407,470

586,490

Household Income >30% to <=50% HAMFI

236,735

282,945

519,680

Household Income >50% to <=80% HAMFI

445,620

331,205

776,825

Household Income >80% to <=100% HAMFI

316,740

157,750

474,490

Household Income >100% HAMFI

1,893,115

403,480

2,296,595

Total

3,071,225

1,582,850

4,654,075

Housing Problems Overview 1

Owner

Renter

Total

Household has at least 1 of 4 Housing Problems

567,435

680,610

1,248,045

Household has none of 4 Housing Problems OR cost burden

not available no other problems

2,503,795

902,240

3,406,035

Total

3,071,225

1,582,850

4,654,075

Severe Housing Problems Overview 2

Owner

Renter

Total

Household has at least 1 of 4 Severe Housing Problems

242,895

381,540

624,435

Household has none of 4 Severe Housing Problems OR cost

burden not available no other problems

2,828,330

1,201,310

4,029,640

Total

3,071,225

1,582,850

4,654,075

Housing Cost Burden Overview 3

Owner

Renter

Total

Cost Burden <=30%

2,513,875

899,010

3,412,885

Cost Burden >30% to <=50%

329,445

312,610

642,055

Cost Burden >50%

207,730

328,380

536,110

Cost Burden not available

20,180

42,850

63,030

Total

3,071,225

1,582,850

4,654,075

Income by Housing Problems (Owners and

Renters)

Household has at

least 1 of 4 Housing

Problems

Household

has none of 4

Housing

Problems OR

cost burden

not available

no other

problems

Total

Household Income <= 30% HAMFI

440,585

145,910

586,490

Household Income >30% to <=50% HAMFI

347,255

172,425

519,680

Household Income >50% to <=80% HAMFI

273,400

503,415

776,825

Household Income >80% to <=100% HAMFI

77,975

396,515

474,490

18

Household Income >100% HAMFI

108,830

2,187,765

2,296,595

Total

1,248,045

3,406,035

4,654,075

Income by Housing Problems (Renters only)

Household has at

least 1 of 4 Housing

Problems

Household

has none of 4

Housing

Problems OR

cost burden

not available

no other

problems

Total

Household Income <= 30% HAMFI

302,870

104,605

407,470

Household Income >30% to <=50% HAMFI

215,470

67,475

282,945

Household Income >50% to <=80% HAMFI

123,400

207,800

331,205

Household Income >80% to <=100% HAMFI

19,290

138,460

157,750

Household Income >100% HAMFI

19,580

383,900

403,480

Total

680,610

902,240

1,582,850

Income by Housing Problems (Owners only)

Household has at

least 1 of 4 Housing

Problems

Household

has none of 4

Housing

Problems OR

cost burden

not available

no other

problems

Total

Household Income <= 30% HAMFI

137,715

41,305

179,020

Household Income >30% to <=50% HAMFI

131,785

104,950

236,735

Household Income >50% to <=80% HAMFI

150,000

295,615

445,620

Household Income >80% to <=100% HAMFI

58,685

258,055

316,740

Household Income >100% HAMFI

89,250

1,803,865

1,893,115

Total

567,435

2,503,795

3,071,225

Income by Cost Burden (Owners and Renters)

Cost burden > 30%

Cost burden >

50%

Total

Household Income <= 30% HAMFI

432,885

351,600

586,490

Household Income >30% to <=50% HAMFI

339,080

123,960

519,680

Household Income >50% to <=80% HAMFI

255,195

44,165

776,825

Household Income >80% to <=100% HAMFI

68,670

7,930

474,490

Household Income >100% HAMFI

82,335

8,460

2,296,595

Total

1,178,165

536,110

4,654,075

19

Income by Cost Burden (Renters only)

Cost burden > 30%

Cost burden >

50%

Total

Household Income <= 30% HAMFI

297,090

247,245

407,470

Household Income >30% to <=50% HAMFI

210,160

67,360

282,945

Household Income >50% to <=80% HAMFI

111,510

11,095

331,205

Household Income >80% to <=100% HAMFI

14,100

1,360

157,750

Household Income >100% HAMFI

8,130

1,320

403,480

Total

640,990

328,380

1,582,850

Income by Cost Burden (Owners only)

Cost burden > 30%

Cost burden >

50%

Total

Household Income <= 30% HAMFI

135,795

104,350

179,020

Household Income >30% to <=50% HAMFI

128,915

56,600

236,735

Household Income >50% to <=80% HAMFI

143,690

33,070

445,620

Household Income >80% to <=100% HAMFI

54,570

6,570

316,740

Household Income >100% HAMFI

74,205

7,140

1,893,115

Total

537,175

207,730

3,071,225

Year Selected: 2014-2018 ACS

1. The four housing problems are: incomplete kitchen facilities; incomplete plumbing facilities more than 1 person per room; and cost burden greater than 30%.

2. The four severe housing problems are: incomplete kitchen facilities; incomplete plumbing facilities; more than 1 person per room; and cost burden greater than 50%.

3. Cost burden is the ratio of housing costs to household income. For renters- housing cost is gross rent (contract rent plus utilities)

For owners- housing cost is "select monthly owner costs" which includes mortgage payment; utilities; association fees; insurance; and real estate taxes.

The Corporation for Supportive Housing (CSH) State Investment Response Estimator Tool Data

Population Summary Point in Time Total

State-wide

Annualization Rate

Annualized Total Shift to NCS

Individuals PSH RRH Prevention User Defined Self-Resolve

Sheltered 5,826 3.7

Unsheltered 1,810

Newly Homeless Households 0 0 0 0 0 0

Non-Congregate Shelter (NCS) 0 0 0 0 0 0

Total 7,636 33,756 2,998 24,007 3,376 0 3,376

Families PSH RRH Prevention User Defined Self-Resolve

Sheltered 2,985

Unsheltered 34

Newly Homeless Households 10 0 0 0 0 0 0

Non-Congregate Shelter (NCS) 0 0 0 0 0 0

Total 3,019 6,654 665 3,327 1,331 665 665

Newly Homeless Households 0 0 0 0 0 0

Non-Congregate Shelter (NCS) 0 0 0 0 0 0

Grand Total Households 10,655 40,410 3,663 27,334 4,706 665 4,041

Resource Need

Resource Turnover

HIC Bed Count Estimated Turnover Manual Adjust HIC Bed Count Estimated Turnover Manual Adjust

PSH 11,125

1,113 1,113

7,203 720 720

RRH 1,871 617 4,198 1,259

Prevention (No default estimate) 0 0

User Defined (No default estimate) 0 0

Total PH Placements (SPM Measure 7) 18,701

Families

Individuals

20

National Low-Income Housing Coalition Shortage of Affordable Rental Homes

https://reports.nlihc.org/gap

Ohio Housing Finance Agency 2021 Needs Assessment https://ohiohome.org/hna-20/executivesummary-

hna.aspx

Ohio Housing Finance Agency CONFRONTING HOMELESSNESS - Homelessness in Ohio 2012 – 2018

https://ohiohome.org/news/documents/HomelessnessReport.pdf

Year Need Total Month-by-Month Need

Base Popula tion June July August September October November December January February March Ap ril May

33,756 2,813 2,813 2,813 2,813 2,813 2,813 2,813 2,813 2,813 2,813 2,813 2,813

0 0 0 0 0 0 0 0 0 0 0 0 0

6,654 555 555 555 555 555 555 555 555 555 555 555 555

0 0 0 0 0 0 0 0 0 0 0 0 0 Validation

0 0 0 0 0 0 0 0 0 0 0 0 0

3,368 3,368 3,368 3,368 3,368 3,368 3,368 3,368 3,368 3,368 3,368 3,368

June July August September October November December January February March Ap ril May

0 0 0 0 0 0 0 0 0 0 0 0 0

2,998 250 250 250 250 250 250 250 250 250 250 250 250

1,113 93 93 93 93 93 93 93 93 93 93 93 93

1,885 157 157 157 157 157 157 157 157 157 157 157 157

0 0 0 0 0 0 0 0 0 0 0 0 0

665 55 55 55 55 55 55 55 55 55 55 55 55

720 60 60 60 60 60 60 60 60 60 60 60 60

-55 -5 -5 -5 -5 -5 -5 -5 -5 -5 -5 -5 -5

June July August September October November December January February March Ap ril May

0 0 0 0 0 0 0 0 0 0 0 0 0

24,007 2,001 2,001 2,001 2,001 2,001 2,001 2,001 2,001 2,001 2,001 2,001 2,001

617 51 51 51 51 51 51 51 51 51 51 51 51

23,390 1,949 1,949 1,949 1,949 1,949 1,949 1,949 1,949 1,949 1,949 1,949 1,949

0 0 0 0 0 0 0 0 0 0 0 0 0

3,327 277 277 277 277 277 277 277 277 277 277 277 277

1,259 105 105 105 105 105 105 105 105 105 105 105 105

2,068 172 172 172 172 172 172 172 172 172 172 172 172

June July August September October November December January February March Ap ril May

0 0 0 0 0 0 0 0 0 0 0 0 0

3,376 281 281 281 281 281 281 281 281 281 281 281 281

0 0 0 0 0 0 0 0 0 0 0 0 0

3,376 281 281 281 281 281 281 281 281 281 281 281 281

0 0 0 0 0 0 0 0 0 0 0 0 0

1,331 111 111 111 111 111 111 111 111 111 111 111 111

0 0 0 0 0 0 0 0 0 0 0 0 0

1,331 111 111 111 111 111 111 111 111 111 111 111 111

June July August September October November December January February March Ap ril May

0 0 0 0 0 0 0 0 0 0 0 0 0

0 0

0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0 0 0 0 0 0

665 55 55 55 55 55 55 55 55 55 55 55 55

0 0 0 0 0 0 0 0 0 0 0 0 0

665 55 55 55 55 55 55 55 55 55 55 55 55

June June June June June June June June June June June June

0 0 0 0 0 0 0 0 0 0 0 0 0

3,376 281 281 281 281 281 281 281 281 281 281 281 281

0 0 0 0 0 0 0 0 0 0 0 0 0

665 55 55 55 55 55 55 55 55 55 55 55 55

Total Newly Homeless Households

Total Base P opulation

Individuals

Newly Homeless Ind.

Families

Newly Homeless Families

Indicate Predicted Surge %

Total Need (IND)

System PH Pla cements (IND)

Gap in Resource Need (IND)

Total Need (FAM)

System PH Pla cements (IND)

Total Need Newly Homeless Households (FAM)

Gap in Resource Need (IND)

Total Need Newly Homeless Households (FAM)

Total Need (FAM)

System PH Pla cements (FAM)

Gap in Resource Need (FAM)

Rapid Re-Housing

Total Need Newly Homeless Households (IND)

Total Need (IND)

Gap in Resource Need (FAM)

User Defined

Total Need Newly Homeless Households (IND)

Total Need (IND)

System PH Pla cements (IND)

Gap in Resource Need (IND)

Total Need Newly Homeless Households (FAM)

Total Need (FAM)

System PH Pla cements (FAM)

System PH Pla cements (FAM)

Gap in Resource Need (FAM)

Prevention

Total Need Newly Homeless Households (IND)

Total Need (IND)

Self-Resolve Pr ediction by Month

Total Self-Resolved (IND)

Total Self-Resolved (FAM)

System PH Pla cements (IND)

Gap in Resource Need (IND)

Total Need Newly Homeless Households (FAM)

Total Need (FAM)

Total Self-Resolved Newly Homeless Households (IND)

Total Self-Resolved Newly Homeless Households (FAM)

Gap in Resource Need (FAM)

System PH Pla cements (FAM)

Total Need Newly Homeless Households (IND)

Permanent Supportive Housing