Homeownership

Builds Wealth

Introduction

Homeownership can be a catalyst to wealth building,

especially among households with low incomes who hold

most of their wealth in their homes. Homeownership creates

wealth in two ways:

1. Appreciation in the home’s value.

2. Equity accumulated as homeowners pay down their

mortgages (also known as “forced savings”).

Home value appreciation helps homeowners build wealth

by enabling them to realize greater proceeds if they sell

the home or borrow against the additional equity. Housing

stability is particularly important for wealth accumulation,

and the length of homeownership is significantly and

positively associated with household net wealth.

1

In addition,

owning a home promotes intergenerational homeownership

and wealth building. See the full evidence brief on how

homeownership contributes to wealth building here.

A study of Habitat for Humanity

homeowners in Ohio

1 HABITAT FOR HUMANITY INTERNATIONAL A STUDY OF HABITAT FOR HUMANITY HOMEOWNERS IN OHIO

Barriers to wealth building

through homeownership

Gender, racial and ethnic gaps persist in wealth building

in the U.S., including wealth built through homeownership.

Because of market forces and negotiating power, single

men earn 7.9% more annually on their housing investment

than single women. Single women typically pay 1-2% more

for homes, on average, and then sell for 2-3% less than

single men, leading to an approximate loss of $1,800 (in

2022 dollars) annually for single women compared with

single men.

2

Black and Hispanic/Latino households accumulate

less wealth and equity in their homes, on average, than

white households. Barriers contributing to this include:

• Having higher mortgage rates.

• Purchasing lower-valued and slowly appreciating

homes.

• Having higher property taxes.

3

Based on these factors, Black and Hispanic/Latino

households are also less likely to sustain homeownership

over time. One analysis of households between 1976 and

1993 found that less than half of homeowners of color

with low incomes remained homeowners within four years

of purchasing their homes, compared with 60% of white

homeowners with low incomes, 65% of white households

with middle incomes, and 85% of white households with

high incomes.

4

How Habitat helps households

with lower incomes

In the U.S., Habitat for Humanity focuses its services

on homebuyers and homeowners who earn between

30% and 80% of the area median income, or AMI. The

U.S. Department of Housing and Urban Development

calculates AMI for each geographic area annually based

on the midpoint of a region’s (e.g., metropolitan area and

non-metropolitan counties) family income distribution

with adjustments based on family size. For a family of

four living in the Cincinnati, Ohio, area, for instance, this

translates to gross annual incomes ranging from $28,650

to $76,400 in 2022.

5

Habitat oers financial and educational assistance

to homebuyers to ensure that they pay an aordable

mortgage and can thus more easily build wealth. This

assistance typically includes:

• A primary zero- or low-interest loan equivalent to no

more than 30% of the homebuyer’s income.

• Repayable or forgivable secondary loans that may be

contingent on the homebuyer remaining in the home

for a specified period.

• Pre-purchase homeownership classes to prepare

buyers for a successful homeownership journey.

Appreciation

Year A Year C Year B

($)

Down payment

Payment

Debt forgiven

Debt

Housing equity was calculated at 10 and 30 years for this

study. The Habitat aliates included in the study’s sample

oered zero-interest loans with terms no longer than 30

years. The study calculates housing appreciation from the

dierence between the purchase price and the current

value of the home. The study estimates the current value

of the home by inflating the purchase price of the home to

2021 dollars using the Midwest consumer price index and

then projecting the purchase price at 10 and 30 years using

county-level averages of the Federal Housing Finance

Agency House Price Index, or FHFA HPI.

6

Why Ohio?

Ohio is the seventh most populous state in the U.S., with

11.8 million residents.

7

Approximately 80% of the population

resides in urban areas, with the remaining 20% residing in

rural areas. According to the U.S. Census Bureau, in 2020,

approximately 75.9% of the state’s population was white

only, 12.3% was Black only, 2.5% was Asian only, and the

remaining 4.8% were American Indian/Alaska Native, Native

Hawaiian/other Pacific Islander, other, or a combination of

dierent races. Approximately 4% of the state’s population

were of Hispanic/Latino origin.

8

As of 2020, approximately

66.3% of Ohioans owned their home. The homeownership

rate has yet to recover from the eects of the Great

Recession, having peaked at 73.3% in 2005.

9

Ohio can be

characterized as a unique state where some cities have

experienced economic and housing booms while “Rust

Belt” cities that historically relied on U.S. steel production

and other heavy industries, with Cleveland and Dayton

fueling much of the growth.

10

Most recently, Intel announced

the building of a chip plant near Columbus, further

contributing to the economic development in this area.

11

Habitat for Humanity in Ohio

• Forty-three Habitat aliates operate within Ohio,

and all oer zero-interest-rate loans to homebuyers

with low incomes. Aliates seek households earning

between 30% and 80% of AMI and having front-end

and back-end debt-to-income, or DTI, ratios

12

of 30%

and 43%, respectively.

In 2021, Habitat for Humanity International conducted

a pilot study in Ohio to understand the extent to which

Habitat helps homeowners build wealth and how wealth

building varies by homeowner, aliate and market

characteristics. This study addresses two questions:

1. To what extent do Habitat homeowners build wealth?

2. To what extent does accumulated wealth vary by

homeowner, aliate and market characteristics?

Lessons learned from this pilot study are being used to

inform a national impact study.

How wealth is calculated

This study defines wealth accumulated as the sum of

mortgage payments, home value appreciation and any

housing debt forgiven. Figure 1 depicts a typical debt

structure from the time of home purchase (Year A) to

the time the home is paid o (Year B). The homeowner

leverages debt and contributes a down payment to

purchase the home at Year A. As the homeowner makes

mortgage payments and debt is forgiven, starting in

Year C, the homeowner begins to increase the equity in

the home. Depending on market trends and the home’s

location, the home’s value rises over time, also known as

appreciation. The combination of debt reduction, mortgage

payments, amount of the down payment, and home value

appreciation constitutes a homeowner’s equity or wealth

by Year B.

HABITAT FOR HUMANITY INTERNATIONAL A STUDY OF HABITAT FOR HUMANITY HOMEOWNERS IN OHIO 2

The Ohio wealth building study

Figure 1: Wealth accumulation model

HOW DOES HOMEOWNERSHIP CONTRIBUTE TO SOCIAL AND

CIVIC ENGAGEMENT?

• Ohio aliates vary in stang capacity. Based on the

survey responses from aliates, almost one-third of

aliates are run entirely by volunteers. The average

aliate, however, is staed by five full-time employees

and 1.4 part-time employees.

• Over 70% of aliates oer pre- and/or post-purchase

support to homebuyers. The most prevalent forms

of homebuyer support include financial education,

lending practices and homeownership classes.

Study approach

Data sources used to understand homebuyer, aliate,

and market characteristics

In order to understand homebuyer and aliate

characteristics, a combination of data sources were used.

HFHI’s Aliate Statistical Report, or ASR, was used

to determine the number of mortgages held by each

aliate and the delinquency rate. Aliates were asked

to review their Housing Production Report, or HPR,

address portfolio to validate their data, correct incomplete

addresses, and provide updated homeowner names and

demographics. Mortgage data was purchased from Black

Knight Inc., an integrated technology, data and analytics

firm, and validated by Ohio aliates. Participating aliates

also completed an aliate programs and practices

survey to understand intake, homebuyer support,

construction and financing processes. In addition, data

from the FHFA HPI and the consumer price index were

used to calculate wealth at 10 and 30 years, and data

related to poverty rates, changes in population, income

and housing occupancy from the American Community

Survey, or ACS, were used to understand characteristics

of the local housing market.

3 HABITAT FOR HUMANITY INTERNATIONAL A STUDY OF HABITAT FOR HUMANITY HOMEOWNERS IN OHIO

Sample

The study’s sample consists of all homeowners who

purchased a home from an Ohio-based Habitat aliate

between 2010 and 2021, and the sample period extends

over the same time frame. This means that the longest

follow-up period for a homeowner is almost 11 years,

and the shortest period is less than a year. Because

of the relatively short follow-up period of this study,

homeowners are assumed to have remained in their

homes throughout the lifetime of the mortgage with no

delinquencies or foreclosures.

Of the 43 Habitat aliates in Ohio, over half (23 aliates)

participated in the pilot study, providing data on 818 (68%)

of all Habitat properties sold in Ohio over the sample

period. These aliates are nearly equally divided between

rural and urban areas; 48% of the participating aliates

are in rural areas and the remaining 52% are in urban

areas. Five aliates also participated in a focus group to

validate assumptions of the analysis, such as length of

Habitat homeownership. A full list of aliate participants

and a description of their geographic service areas can be

found in Appendix A.

Aliates were categorized into four clusters based

on characteristics that would be associated with

homeowners’ wealth accumulation. The study includes

this grouping in more rigorous statistical analyses

to understand the independent relationships across

homeowner, aliate and market characteristics and

wealth building.

Cluster A:

Small aliates located

in rural areas and with

limited capacity to

support homeowners

(e.g., decline in number of

mortgages held, limited

oerings of homeowner

education programs).

Cluster C:

Aliates located in urban

areas and having the

capacity to originate large

volumes of loans.

Cluster B:

Large aliate located in

a rapidly growing urban

area and with varying

homeowner support (e.g.,

types of homeowner

education oered,

capacity to provide in-

house financial services).

This cluster contains only

one aliate.

Cluster D:

Large aliate located in a

stable housing market in

an urban area and having

high delinquency rates.

This cluster contains only

one aliate.

HABITAT FOR HUMANITY INTERNATIONAL A STUDY OF HABITAT FOR HUMANITY HOMEOWNERS IN OHIO 4

Findings

Homeowner characteristics and wealth building

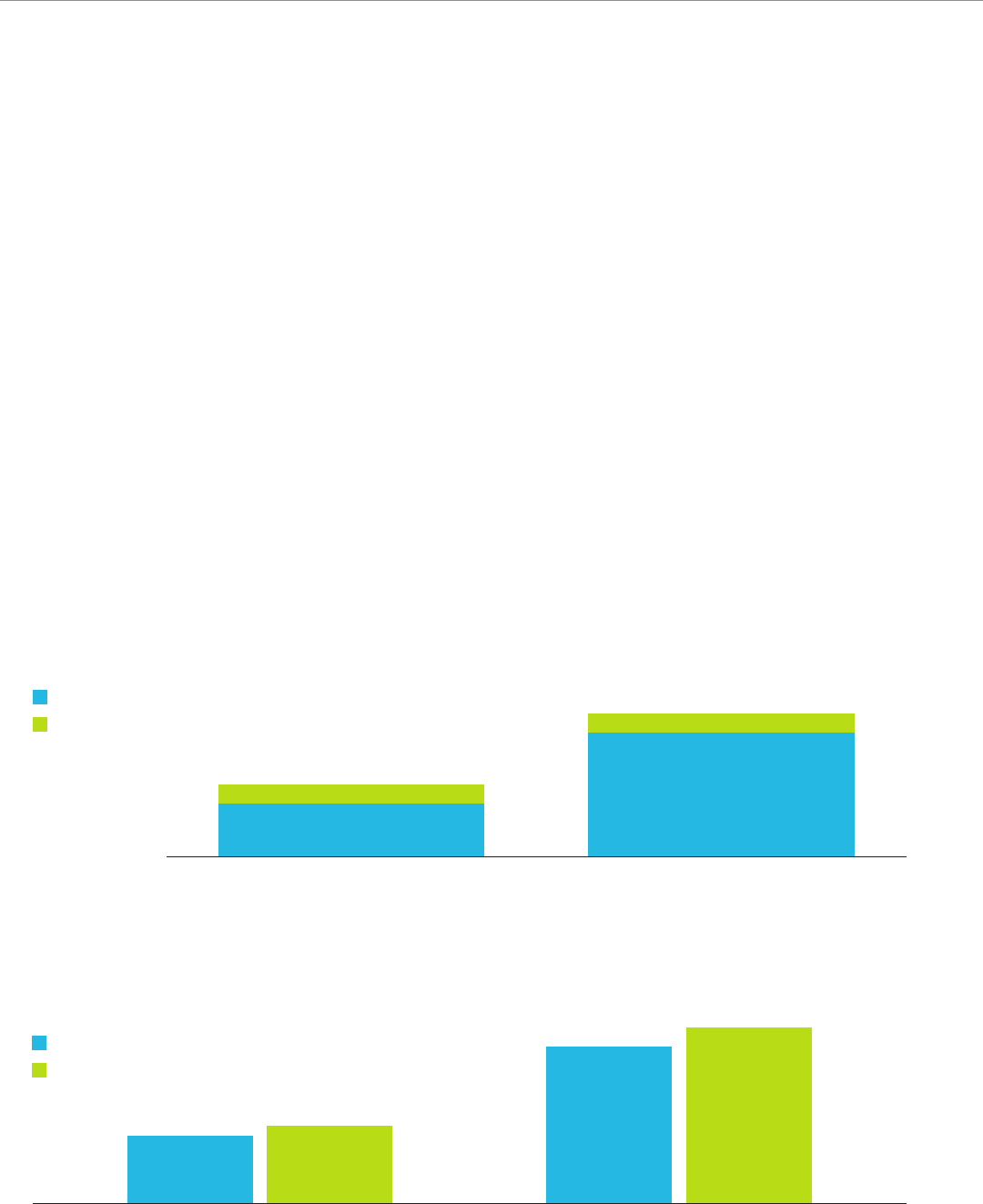

Overall, this pilot study found that the average Habitat

homeowner in Ohio was estimated to accumulate $45,923

in home equity wealth after 10 years and $106,410 after 30

years. Forced saving comprised the largest share of home

equity wealth, and housing appreciation contributed more

to wealth accumulation in the short term (35%) than in the

long term (16%) (Figure 2).

These findings suggest that housing market volatility is

more likely to influence total wealth in the short term,

while programs or policies to sustain homeownership are

more likely to aect wealth accumulation in the long term,

especially in low-growth or stagnant housing markets.

On average, female-headed households gained less wealth

over time than non-female-headed households. At 10

years, female-headed households were estimated to gain

$45,684 from home equity, compared with $52,425 for

non-female-headed households (Figure 3). Female-headed

households similarly were estimated to gain less wealth

($105,246) at 30 years compared with non-female-headed

households ($118,068). Despite this, when controlling

for aliate and market characteristics, gender was not a

significant indicator of wealth accumulation over time.

Racial dierences in housing wealth accumulation

were investigated, leading to the finding that racial

dierences had a significant but small association

with housing wealth. Black-headed households were

estimated to accumulate approximately $700 (or 1.5%)

less than non-Black-headed households after 10 years

of homeownership and $2,800 (or 2.5%) less after 30

years of homeownership. The study further explores

this relationship with more rigorous statistical analysis

to understand if this finding remains once aliate and

market characteristics are included.

Figure 2: Average home equity accumulation at 10 and 30 years, based on data from 818 homeowners.

Figure 3: Average home equity accumulation at 10 and 30 years, by gender of title holders.

$45,923

$29,931

$15,992

$106,410

$89,794

10 years 30 years

$16,616

Forced savings

Appreciation

Female-headed households

Non-female-headed households

10 years 30 years

$45,684 $52,425 $105,246 $118,068

5 HABITAT FOR HUMANITY INTERNATIONAL A STUDY OF HABITAT FOR HUMANITY HOMEOWNERS IN OHIO

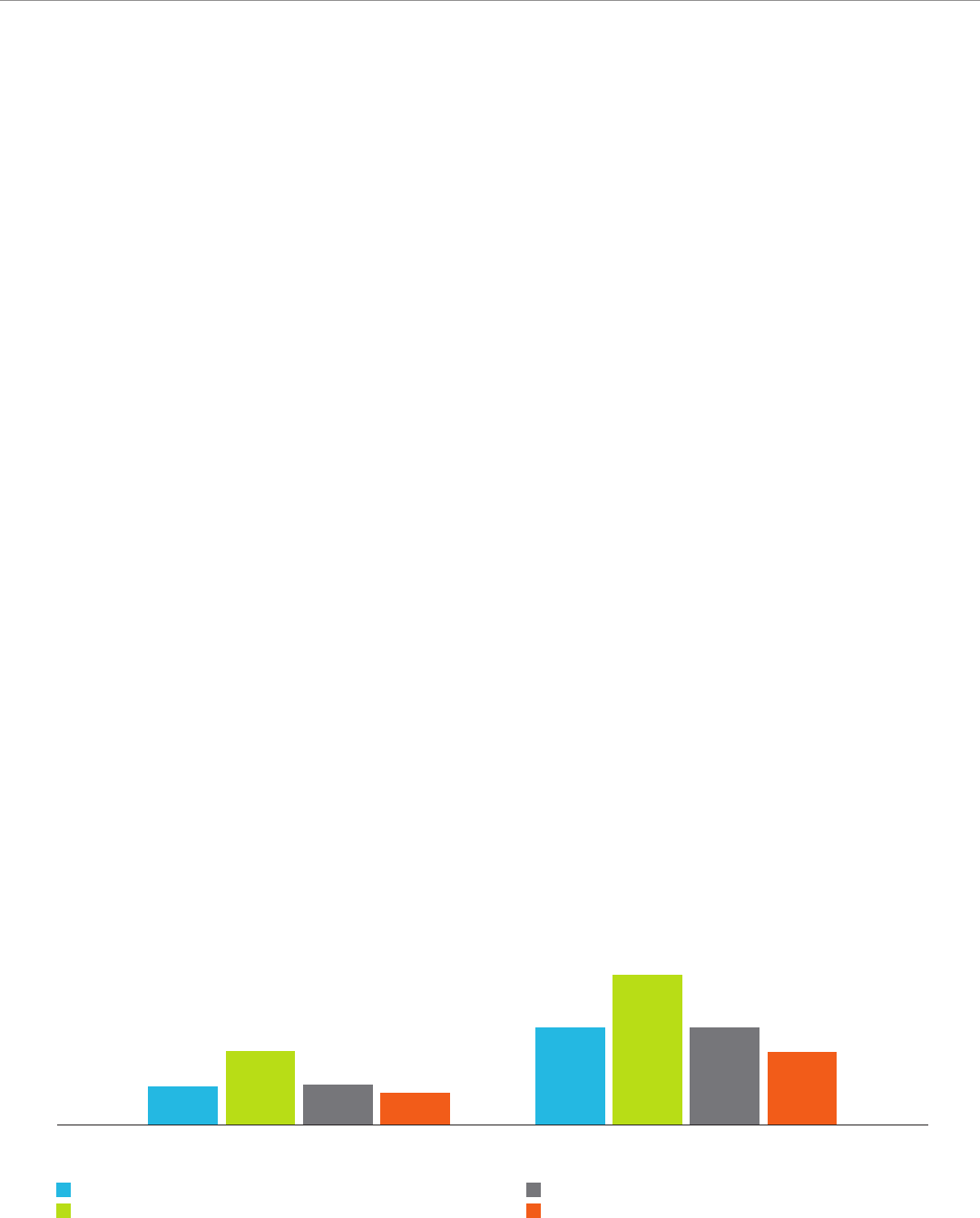

Aliate characteristics and wealth building

Wealth accumulation varied by aliate characteristics.

After 10 years, homeowners in Cluster B (large aliate

in a rapidly growing urban area with varying homeowner

supports) gained the most wealth on average — almost

twice that of the other clusters (Figure 4). Homeowners

accumulated similar amounts of wealth across the three

remaining clusters of aliates, ranging from $33,121 in Cluster

D (large aliate in an urban area and with high delinquency

rates) to $41,221 in Cluster C (aliates in urban areas with

capacity to originate large volumes of loans). After 30 years

of homeownership, homeowners in Cluster B continued

to accumulate the most wealth ($153,702) compared with

homeowners in other clusters, and the dierences in wealth

between Cluster D and the other clusters widened.

Homeowner, aliate and market characteristics

and wealth building

This study then examines the relationship between

wealth building and homeowner, aliate and market

characteristics. Local market factors such as increases

in population, median household income and number of

owner-occupied units are associated with greater growth

in housing wealth. Increases in the Black population,

poverty rate and baseline home values are associated

with diminished gains in housing wealth for homeowners.

For example, when a county’s population increases

by 10%, it is expected to result in additional wealth

accumulation of approximately $2,000 (4%) after 10

years of homeownership and $6,000 (or 6%) after 30

years of homeownership.

Figure 4: Average home equity accumulation at 10 and 30 years, by aliate cluster

Inclusion of aliate and market characteristics, however,

did not modify the relationship between homeowner

demographics and wealth accumulation. Race remains

significantly correlated with home equity accumulation,

with Black-headed households associated with a

negligible decrease in wealth accumulation. Figure

5 shows the comparison between Black-headed

households and non-Black-headed households by aliate

cluster at year 30. After 30 years of homeownership,

Black-headed households are associated with housing

wealth accumulation that is 2.5% ($2,800) less than

non-Black-headed households. Small but significant

racial disparities in wealth exist across all clusters

except Cluster D (urban aliate with a high mortgage

delinquency rate). One point to note is that after 30 years

of homeownership, homeowners who purchased homes

from the aliate in Cluster D were associated with less

wealth accumulation than those homeowners in Cluster

A (smaller rural aliates). The results were similar at 10

years (results not depicted).

Further research is recommended to understand the

factors that contribute to racial disparities in wealth

accumulation among Habitat homeowners, especially

those served in rural areas. Findings from this pilot study

will inform a future study on wealth building across the

Habitat network, and the authors hope to disentangle and

expound on these results.

Cluster A: Small rural aliates

Cluster B: Urban aliate with varying homeowner supports

Cluster C: Large urban aliates

Cluster D: Large urban aliate with high delinquency rate

10 years 30 years

$39,727 $41,221

$33,121

$75,125

$99,534 $99,091

$74,124

$153,702

HABITAT FOR HUMANITY INTERNATIONAL A STUDY OF HABITAT FOR HUMANITY HOMEOWNERS IN OHIO 6

Figure 5: Average home equity accumulation at year 30, by aliate cluster and race of homeowner.

After exploring some of the known barriers to wealth

building associated with race and gender, this study

found that aliate and market characteristics may be

more important contributors to wealth accumulation than

homeowner demographics. The overall results suggest

that homeowners purchasing homes from smaller rural

aliates accumulate less estimated wealth than those

homeowners purchasing from more urban aliates.

Homeowners who purchased homes in counties with a

strong local economy and housing market, as indicated

by increases in population, median household income and

the number of owner-occupied units, were associated

with larger increases in housing wealth accumulation.

Furthermore, homeowners who purchased homes from

aliates in urban areas (clusters B and C) tended to have

Conclusion

higher wealth accumulation than those who purchased

from aliates in rural areas (Cluster A). This result stems

largely from the lower appreciation rates of homes in rural

areas. Black homeowners of these smaller rural aliates,

however, fared worse than non-Black homeowners from

the rural aliates and their more urban counterparts.

Moreover, Black-headed households in a rapidly growing

urban area also accumulated less wealth than non-

Black homeowners. This pilot study is a first step in

understanding the extent to which Habitat builds wealth

for its homeowners. The next phase of this research is to

use the lessons learned from conducting the pilot study

to implement a more rigorous national evaluation that will

help to unpack wealth building and financial health among

Habitat homeowners.

Cluster A

Small rural aliates

Cluster B

Urban aliate with varying

homeowner supports

Cluster C

Large urban aliates

Cluster D

Large urban aliate with

high delinquency rate

$101,246

$106,410

$108,135

$111,621

$115,383

$110,546

$104,936

$104,936

Black-headed

households

Non-Black-headed

households

Habitat for Humanity International’s U.S. Research and Measurement team thanks Ryan Miller and all the Ohio-based

aliates who graciously provided their data, participated in our focus groups, and answered our myriad questions.

Without them, this report and what was learned for a national scale-up of this project would not be possible. We also

thank Guardians of Honor (gohnow.com) for assisting with the preliminary analysis.

23-88321/PDF/RD/10-2023/JN

A Habitat for Humanity U.S. Research and Measurement Team report

285 Peachtree Center Ave. NE, Suite 2700, Atlanta, GA 30303-1220 USA

322 W. Lamar St., Americus, GA 31709-3543 USA

(800) 422-4828 fax (229) 928-8811 publicinf[email protected] habitat.org

Appendix A: Ohio aliate participants

Aliate name Aliate name Aliate geographic service area Aliate geographic service area

Alliance Area Alliance Area City of Alliance, villages of Beloit and City of Alliance, villages of Beloit and

Sebring. Sebring.

Buckeye Ridge Buckeye Ridge Marion, Morrow and Wyandot counties Marion, Morrow and Wyandot counties

Greater Cincinnati Greater Cincinnati Butler, Warren, Clermont and Hamilton Butler, Warren, Clermont and Hamilton

counties. Also serves counties in Kentucky counties. Also serves counties in Kentucky

and Indiana, but they were not included in and Indiana, but they were not included in

this study. this study.

Greater Cleveland Greater Cleveland Cuyahoga County Cuyahoga County

Greater Dayton Greater Dayton Clark, Greene and Montgomery counties Clark, Greene and Montgomery counties

Delaware & Union Delaware & Union

CountiesCounties

Delaware and Union counties Delaware and Union counties

East Central Ohio East Central Ohio Carroll, Harrison, Jeerson, Tuscarawas Carroll, Harrison, Jeerson, Tuscarawas

and Stark counties (excluding the City of and Stark counties (excluding the City of

Alliance) Alliance)

Findlay/Hancock CountyFindlay/Hancock County Hancock County Hancock County

Firelands Firelands Erie and Huron counties and city of Bellevue Erie and Huron counties and city of Bellevue

Fulton County Fulton County Fulton County Fulton County

Holmes County Holmes County Holmes County Holmes County

Knox County Knox County Knox County Knox County

1. Di, Z.; Belsky, E.; and Liu, X. “Do Homeowners Achieve More Household Wealth in the Long Run?” Journal of Housing Economics,

16(3-4), 274-290

2. Goldsmith-Pinkham, P.S., and Shue, K. “The Gender Gap in Housing Returns.” Published online March 23, 2020.

http://dx.doi.org/10.2139/ssrn.3559892

3. Habitat for Humanity International. “How Does Homeownership Contribute to Wealth Building?” Retrieved from

https://www.habitat.org/our-work/impact/research-series-how-does-homeownership-contribute-to-wealth-building.

4. Reid, C. Achieving the American Dream? A Longitudinal Analysis of the Homeownership Experiences of Low-Income Households.

Center for Social Development at University of Washington; 2005. https://openscholarship.wustl.edu/cgi/viewcontent.

cgi?article=1074&context=csd_research

5. https://www.huduser.gov/portal/datasets/il/il22/Section8-IncomeLimits-FY22.pdf

6. Current housing value = Purchase price*(1 + HPI/100)time, where units of HPI and time are percentage and year, respectively.

7. U.S. Census Bureau (n.d.). “Ohio QuickFacts.” Retrieved from https://www.census.gov/quickfacts/OH.

8. Census Bureau (n.d). Ohio 2020 Census. Retrieved from https://www.census.gov/library/stories/state-by-state/ohio-population-

change-between-census-decade.html.

9. U.S. Census Bureau, Homeownership Rate for Ohio (OHHOWN), retrieved from FRED, Federal Reserve Bank of St. Louis;

https://fred.stlouisfed.org/series/OHHOWN, April 25, 2022.

10. U.S. Bureau of Economic Analysis. Gross Domestic Product by County, 2020. Retrieved from https://www.bea.gov/sites/default/

files/2021-12/lagdp1221.pdf, Dec. 8, 2021.

11. “Intel Announces Next US Site with Landmark Investment in Ohio.” Retrieved from https://www.intel.com/content/www/us/en/

newsroom/news/intel-announces-next-us-site-landmark-investment-ohio.html#gs.yqn2k9, Jan. 21, 2022.

12. Front-end DTI ratio is a ratio between a monthly mortgage payment and household’s monthly gross income. Back-end DTI ratio is a

ratio between all monthly debt payment and household monthly gross income.

Aliate name Aliate name Aliate geographic service area Aliate geographic service area

Lake-Geauga Geauga and Lake counties

Lima Area The portion of Allen County south of U.S.

Highway 30 and west of Napolean Road.

Also includes the portion of the city of

Delphos within Van Wert County.

Lorain County Lorain County

Maumee Valley Lucas County

Medina County Medina County

MidOhio Franklin and Licking counties

Putnam County Putnam County

Sandusky County Sandusky County

Seneca ZIP code 44883

Southeast Ohio Athens, Fairfield, Hocking, Meigs, Morgan,

Noble and Perry counties and Muskingum

County ZIP codes 43701, 43734, 43771 and

43720

Summit County Summit County