Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 1 Commonwealth of Virginia

Table of Contents

Table of Contents .........................................................................................................................1

Policy ...........................................................................................................................................4

Applicability ............................................................................................................................4

Expenses Must be Reasonable and Necessary .........................................................................4

Cardinal Processing .................................................................................................................5

Cardinal Transparency .............................................................................................................5

Definitions....................................................................................................................................5

Agency .....................................................................................................................................5

Agency Head or Designee .......................................................................................................5

Base Point ................................................................................................................................6

Cardinal ....................................................................................................................................6

Commuting Mileage ................................................................................................................6

Exempt Agency ........................................................................................................................6

Expense Report ........................................................................................................................6

International Travel ..................................................................................................................6

Non-State Employee ................................................................................................................6

Official Station .........................................................................................................................6

Sponsored Programs ................................................................................................................7

State Employee ........................................................................................................................7

Travel Status ............................................................................................................................7

Trip ...........................................................................................................................................7

Travel Reimbursement Requirements..........................................................................................8

Travel Reimbursement Requirements......................................................................................8

Cardinal Certification Statement..............................................................................................9

Travel Planning ..........................................................................................................................10

Introduction ............................................................................................................................10

Contractual Business ..............................................................................................................10

Internet Usage ........................................................................................................................10

Travel Involving Multiple Employees ...................................................................................11

Conference Procurement ........................................................................................................12

Approval and Exceptions ...........................................................................................................13

Lodging Exceptions ...............................................................................................................13

Business Meal Exceptions......................................................................................................13

Designee Documentation .......................................................................................................13

Sponsored Program Funds Exception ....................................................................................14

Travel Involving the Governor ..............................................................................................14

Approving Authority and Exceptions for Cabinet Members and Agency Heads ..................14

Reimbursement by Exempt

Organizations ............................................................................15

L

odging ......................................................................................................................................16

Introdu

ction ............................................................................................................................16

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 2 Commonwealth of Virginia

Lodging Rates ........................................................................................................................16

Alternative Lodging Authorization ........................................................................................17

Non-Canceled Hotel Reservations .........................................................................................17

Number of Persons in a Hotel Room .....................................................................................17

Advance Payments .................................................................................................................18

Hotel Bills ..............................................................................................................................18

Meals and Incidental Travel Expenses (M&IE) ........................................................................19

Introduction ............................................................................................................................19

M&IE Per Diem Allowance...................................................................................................19

M&IE Rates ...........................................................................................................................19

Prorations and Reductions .....................................................................................................20

Allowed Expenses ..................................................................................................................22

Disallowed Expenses .............................................................................................................22

Travel Credits.........................................................................................................................22

Non-Travel Related Meals .........................................................................................................23

Business Meals.......................................................................................................................23

IRS Reporting Requirements for Business Meals .................................................................24

Overtime Meal Allowance .....................................................................................................24

Overtime Meal Rates .............................................................................................................25

Law Enforcement Personnel Meals .......................................................................................26

Transportation ............................................................................................................................27

State-Owned Automobile .......................................................................................................27

State-Owned Automobile Permanent Basis ...........................................................................27

State-Owned Aircraft .............................................................................................................27

Personally-Owned Automobile ..............................................................................................28

Current Mileage Rates ...........................................................................................................28

Short Term Trip Vehicle—Enterprise Rental Car .................................................................29

Cost Benefit Analysis ............................................................................................................30

Mileage Versus Air Costs ......................................................................................................31

Commuting Mileage ..............................................................................................................31

Travel Routing .......................................................................................................................31

Base Point ..............................................................................................................................31

Weekend and Holiday Mileage ..............................................................................................32

Out of Country Mileage .........................................................................................................32

Parking & Toll Expenses .......................................................................................................32

Public Transportation .............................................................................................................33

Air & Rail Tickets ..................................................................................................................34

Air & Rail Tickets – Purchase Options..................................................................................35

Additional Airline Fees ..........................................................................................................35

Chartered Aircraft Travel .......................................................................................................36

Personal Use Aircraft Travel .................................................................................................36

Bus Travel ..............................................................................................................................36

Car Rental ..............................................................................................................................37

Car Rental Insurance ..............................................................................................................37

Car Rental Refueling..............................................................................................................39

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 3 Commonwealth of Virginia

International Travel ....................................................................................................................40

Approval Authority ................................................................................................................40

Air Travel Emphasized ..........................................................................................................40

Per Diem Rates ......................................................................................................................41

DOA Contacts ............................................................................................................................41

Contacts..................................................................................................................................41

Subject Cross References ...........................................................................................................42

References ..............................................................................................................................42

Suggested Job Aids and Forms ..............................................................................................43

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 4 Commonwealth of Virginia

Policy

Applicability

These policies apply to Executive Branch agencies. Executive Branch agencies are

authorized to adopt more restrictive policies and procedures as approved by the

Agency Head. Agencies must retain a written copy of these more restrictive policies

and procedures signed by the Agency Head. All cabinet members and their staff,

Agency Heads, and Executive Branch boards and commissions must comply with the

State Travel Regulations, the same regulations to which all other Executive Branch

employees are held accountable.

Legislative, Judicial, and Independent agencies may establish their own travel

policies, subject to the relevant laws and written authorization by the appropriate

governing body. Non-Executive Branch agencies and Tier 3 Higher Education

Institutions that have adopted travel regulations, which exceed the limits contained in

this topic, must submit copies of their travel policies and procedures to the

Department of Accounts.

Expenses Must

be Reasonable

and Necessary

The Commonwealth of Virginia will reimburse individuals traveling on official State

business for reasonable and necessary expenses incurred. Travel expense accounts

are open to the public and must be able to sustain the test of public review. When

planning and paying for travel there are several factors of primary concern: economy,

prudence and necessity. The use of State funds to accommodate personal comfort,

convenience, and taste is not permitted.

It is the policy of the Commonwealth of Virginia to limit travel costs to only those

expenses that are necessary for providing essential services to the Commonwealth’s

citizens. Further, travelers and travel planners must seek ways to reduce the cost of

travel.

Agencies must communicate State travel policies, regulations and procedures to all

employees who travel on State business. Additionally, agencies must ensure that all

employee travel expenses conform to the State Travel Regulations.

____________________________________________________________________

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 5 Commonwealth of Virginia

Policy, Continued

Cardinal

Processing

State employees will be reimbursed for travel related expenses using the Travel and

Expenses module in Cardinal. Petty cash and the Accounts Payable module may not

be used for these types of reimbursements.

Non-state employees will be set up as vendors in Cardinal. Their travel related

expenses will be processed through the Accounts Payable module.

____________________________________________________________________

Cardinal

Transparency

In order to provide an increased level of transparency in the recording of travel

reimbursements and to take advantage of Cardinal functionality where approved

lodging, meal and incidental rate limits are already loaded in the system, Cardinal

requires that each individual travel day’s reimbursement items be entered separately.

For example, if an individual traveled for 3 days which included 2 nights lodging,

each night of lodging would be entered as a separate line item. Additionally, meals

for each day are entered separately, whether as “all meals-travel day” or split out

between breakfast, lunch, and/or dinner if one meal was provided. The flat $5 per

diem for incidentals will always be split out as a separate line item each day of travel.

Definitions

Agency

Any commission, department, division, institution, board, council or other

organization of the Commonwealth of Virginia operating from State funds.

Agency Head

or Designee

An Agency Head is an officially appointed, elected or designated individual who

directs, and is ultimately responsible for, the overall operations of an agency or

institution.

A designee is any other person appropriately designated to act on behalf of the

Agency Head. Such designation must be approved by the Agency Head in writing

and retained on file within the agency. These listings should adhere to the record

retention policy in order to provide adequate evidentiary support of appropriate

approvals for audit/review purposes. Copies of written designee listings must be

provided to the Department of Accounts and appropriate auditors upon request.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 6 Commonwealth of Virginia

Definitions, Continued

________________________________________________________________

Base Point

The primary place, office, or building where the traveler performs his/her duties on a

routine basis. Multiple base points are not allowed.

Cardinal

This is the accounting and reporting system of the Commonwealth of Virginia.

Commuting

Mileage

Round-trip mileage traveled routinely by the employee between his residence and

base point. Mileage and other commuting costs incurred during commuting status

are considered a personal expense and are not reimbursable.

____________________________________________________________________

Exempt Agency

A State agency that does not fall under the Executive Branch of State government or

whose enabling legislation establishes the organization as a separate political

subdivision of the Commonwealth.

Expense Report

Original authorized documentation for requesting reimbursement of expenses

incurred by an individual while traveling on official State business. This

documentation, including itemized, original hotel bills and receipts as required,

provides support for reimbursement of travel expenses. While the use of the

Employee Travel Authorization and Expense Report on the Cardinal website

indicates adherence to Statewide requirements, its use is optional and substitute

forms and procedures by individual agencies are allowed. The substitute form must

include the Certification Statements from the Cardinal Expense Report for the

Traveler and Approver.

____________________________________________________________________

International

Travel

All travel to areas outside of the 48 contiguous United States.

Non-State

Employee

Any individual who is not employed by the State, but who is conducting State

business. This includes the members of boards, authorities, or commissions.

Official Station

The area within a 25-mile radius of an employee’s designated base point.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 7 Commonwealth of Virginia

Definitions, Continued

Sponsored

Programs

Programs funded by revenue derived from grants and contracts.

State

Employee

Any elected, appointed, classified, or non-classified employee of the Commonwealth.

Travel Status

Travel outside of an employee’s official station.

Trip

Any period of continuous travel between when the traveler leaves his residence or

base point and returns to his residence or base point.

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 8 Commonwealth of Virginia

Travel Reimbursement Requirements

Travel

Reimbursement

Requirements

Although not all-inclusive, the following information is required for expense

reimbursement and must be submitted with the Employee Travel Authorization and

Expense Report (Expense Report).

Authorization and Exception approvals (See Approval and Exceptions section)

Approval for mileage reimbursement at IRS mileage rate (See Current Mileage

Rates)

Reason for travel and any unusual fees such as charges for changing a

reservation/ticket

Hard-copy confirmations of expenses if online methods were used to procure

services (to confirm cost)

Reason for business phone calls, internet service, or fax services

Documentation to support foreign currency conversion calculations related to

international travel

Itemized receipt for lodging or comparative statement if alternative lodging is used

(example: apartment lease)

Receipt for each meal expenditure of $75 or more (IRS requirement)

Receipt for registration fees

Reason for reserved “for hire transportation” (example: chartered transportation)

Receipts required if claim is more than $75 per instance

Work hours and overtime hours for overtime meals

Approval for use of private or chartered airlines or State-owned aircraft

Travelers must keep receipts and accurate records of all expenses to ensure correct

reporting and submission of travel reimbursements. Travel reimbursements will not be

made from travel charge card statements or tissue receipts. Each day’s expenses must be

shown separately on the Expense Report.

The Commonwealth uses GSA rates for Lodging and M&IE expenses, therefore, the

correct rates must be researched and documented clearly on the Expense Report by the

traveler (see Lodging and M&IE sections for further information). The approver of the

Expense Report is responsible for ensuring the correct rates are stated for reimbursement,

based on actual travel dates. (Please note that the GSA rates are generally published for

the Federal fiscal year, which runs from October 1 – September 30 annually.)

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 9 Commonwealth of Virginia

Travel Reimbursement Requirements, Continued

Travelers must submit the Expense Report to their supervisor within 30 working days

after completion of the trip (See CAPP – Cardinal Topic No. 20336, Agency Travel

Processing). In the case of continuous travel, the traveler must submit the Expense

Report to the supervisor within 30 working days of the last day of travel for which

reimbursement is requested. However, employees on continuous travel should

request reimbursement at least monthly. Agency procedures must be designed to

process reimbursements in a timely manner to allow travel charge card payments to

be made by the specified due date.

By signing the Expense Report, the traveler is certifying the accuracy of all

information, the legitimacy of the travel, and the appropriateness of the expenses.

The signature of the traveler’s supervisor certifies that he/she agrees that the travel

was necessary and the requested reimbursements are proper. It is the responsibility of

the Fiscal Office at each agency to ensure that any type of reimbursement (Travel,

Vendor Payment, Petty Cash, etc.) is not paid more than once.

____________________________________________________________________

Cardinal

Certification

Statement

By approving an Expense Report in Cardinal, the agency, department or institution

and its employees and agents agree to the following:

Final agency approval for expenditure transactions rests with the person granted

approval authority in Cardinal. The act of approving a transaction in Cardinal

means the agency certifies to the Comptroller that the request for disbursement of

State funds specified in the approved transaction has been reviewed by appropriate

agency staff and is accurate to the best of their knowledge and belief. The amounts

itemized are considered to be legitimate and proper charges to the appropriations

indicated therein, and are approved for payment. The payment has not been previously

authorized.

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 10 Commonwealth of Virginia

Travel Planning

Introduction

Contractual

Business

Travelers must prepare an estimate of the total cost of any proposed overnight travel

expected to exceed $500.* An appropriate member of management must authorize

planned travel, including cost estimates, prior to travel, on a form acceptable to the

agency. The agency may determine the appropriate member of management at its

discretion. To ensure adequate planning (identification of costs and exceptions), the

requirement to prepare a cost estimate for overnight travel expected to exceed $500

also applies to Agency Heads and cabinet members. However, the requirement to

obtain prior authorization for Agency Head and cabinet member travel applies only

to cases in which exceptions must be obtained or for international travel.

Total cost includes lodging, transportation, meals, conference registration, and any

other travel costs or course fees must be included in the estimate. Costs of the trip

that may be direct billed, such as lodging or conference registration, must also be

included in the cost estimate. The estimate must accompany both the Expense

Report and any applicable direct-billed Vendor Payment vouchers. For planned

travel, the traveler must document that a reasonable effort was made to obtain

efficient, effective, and cost beneficial means of travel for the Commonwealth.

*An employee in a position that requires frequent, similar travel to perform their job

duties is exempt from this requirement. A written approval from the Agency Head

stating that an estimate is unnecessary for a particular employee should be kept on

file at the agency, for documentation purposes.

____________________________________________________________________

If an agency has any agreements with individuals under contract to conduct business

with the Commonwealth, these expenses should be paid with an Accounting

Voucher. When entering into such contracts, agencies should adhere to the dollar

limitations outlined in this section or clearly document the business case for any

deviations. If there is no contractual agreement specific to travel and travel expenses

(hotel, air fare, meals, mileage, etc.) and such expenses are incurred, the dollar

limitations and documentation requirements outlined in this section are applicable.

Internet Usage

In addition to all other policies set forth in this travel policy, the following policies

must be complied with when using the Internet to purchase travel services.

Usage of the Internet to procure travel services is allowed. Use caution and prudent

judgment when choosing an Internet travel service site. Hidden fees, significant pre-

payments, or nonrefundable advances can apply that may not be reimbursable.

The traveler must comply with procurement guidelines.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 11 Commonwealth of Virginia

Travel Planning, Continued

When paying for services via the Internet, the following methods may be used:

Bank of America Visa Individual Liability Travel Card—may be used for all

types of purchases (examples: hotel, transportation tickets)

Bank of America Visa Agency Airline Travel Card (ATC)—may only be used for

AIRLINE tickets

Bank of America Visa Agency Purchase Charge Card (SPCC or Gold)—may

only be used for transportation tickets (examples: rail, air, bus)

Personal Credit Card

In addition to other documents required by policy, the following supplementary

documents must be submitted with the Expense Report when procuring services via

the Internet:

A hardcopy of the final page from the Internet site showing the total cost and

confirmed service.

Airline confirmation (ticket stub) of the type of ticket purchased (coach, business,

etc.).

Travel

Involving

Multiple

Employees

To ensure all travel meets the test of necessity, travel involving more than three

employees from a single agency to a single travel destination (domestic or

international) must be approved in advance by the Agency Head or designee. This

includes travel of presenters as well as attendees. These provisions apply to daily

and overnight travel.

Where it is determined that a seminar, workshop or training program is essential to

staff development for five or more employees, the agency shall investigate the option

of bringing the trainer on site instead of authorizing employees to travel to an off-site

location. The agency shall document the comparative cost of an on-site session and

retain such documentation on file with the agency travel records. The agency must

also explore the practicality of fulfilling the desired staff development goals through

use of studio and video teleconferencing where these options may be more cost-

effective.

In selecting locations for meetings, agencies shall give first preference to State-

owned facilities. For meetings of policy, advisory, or supervisory boards, the

selection of a meeting site should avoid the appearance of overly extravagant or

luxurious arrangements.

See Conference Procurement guidelines on the next page.

____________________________________________________________________

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 12 Commonwealth of Virginia

Travel Planning, Continued

Conference

Procurement

In planning for an agency-sponsored conference, the Lodging and M&IE guidelines

in these regulations should be used as a measure of reasonableness. Agencies should

be prudent in selecting the most cost-effective option available. Agencies should

follow the Department of General Services, Division of Purchases and Supply

procurement guidelines. Documentation supporting the procurement must justify any

costs in excess of the guidelines based on the overall conference procurement costs

(example: free room space or other free or low-cost amenities needed for meetings).

For reimbursements where these guidelines are used, “Cost based on Procurement

Guidelines” must be clearly stated on the Expense Report.

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 13 Commonwealth of Virginia

Approval and Exceptions

Lodging

Exceptions

Agency Heads or designees are responsible for ensuring that travelers understand

their responsibilities for making good faith efforts to secure lodging within the

guidelines before requesting exceptions.

For all official State business travel, the Agency Head or designee is authorized to

approve reimbursement in advance, for lodging up to 50% over the guidelines when

circumstances warrant. An explanation of the circumstances justifying the lodging

exception must be attached to the Expense Report. A justifiable situation could be

when the additional cost for the conference hotel is offset by reduced local travel

costs (taxi, rental car, etc.) between a less expensive non-conference hotel and a more

expensive conference hotel.

Only the Comptroller or his designee (Deputy State Comptroller) may grant

exceptions for expenses exceeding 50% over the guidelines.* Such approvals must

be requested and granted prior to the travel and the approved request must be

attached to the Expense Report for reimbursement. Requests for such exceptions

must include sufficient documentation showing alternative cost comparisons

justifying the exception. The cost comparisons must include the name and complete

address of the hotels, including zip code, used for the cost comparison. These

requests must be reviewed by the agency fiscal office, which must evaluate and

approve the request prior to sending it to [email protected].

*The only exception to this is travel for Cabinet Members. See Approving

Authority and Exceptions for Cabinet Members and Agency Heads Section,

below.

Business Meal

Exceptions

Agency Heads or their designee may authorize business meal reimbursements up to

50% over the applicable per diem guideline with sufficient justification and the

original, itemized receipt. Business meal reimbursements above 50% over the

applicable per diem guideline are not permitted. (See Business Meals for additional

guidance.)

Designee

Documentation

As noted in the Definitions section (page 5), an Agency Head may designate

approval authority to other individuals in writing. These designee listings should

adhere to the record retention policy in order to provide adequate evidentiary support

of appropriate approvals for audit/review purposes. Copies of written designee

listings must be provided to the Department of Accounts upon request.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 14 Commonwealth of Virginia

Approval and Exceptions, Continued

Sponsored

Program Funds

Exception

All monetary travel reimbursements for meals, lodging, airfare, etc. funded solely

from sponsored program funds are governed by the terms and conditions of the

individual grant or contract. If the grant or contract is silent regarding these monetary

reimbursements, the limitations in CAPP - Cardinal Topic Nos. 20335 and 20336

will apply. In all cases, administrative requirements cited in CAPP - Cardinal Topic

Nos. 20335 and 20336 must be followed. “Sponsored Program” must be clearly

stated on the Expense Report. (See Definitions in this CAPP – Cardinal Topic No.

20335 and CAPP – Cardinal Topic No. 20336, Agency Travel Processing, for further

guidance).

Travel

Involving the

Governor

To accommodate security concerns for travel accompanying the governor on trade

missions or other travel involving marketing, the governor’s Chief of Staff may

authorize certain exceptions to the regulations.

Approving

Authority and

Exceptions for

Cabinet

Members and

Agency Heads

Approval for all trips must accompany the Expense Report.

Approving Authority for Agency Heads – All non-exception based Agency Head

Expense Reports must be reviewed and approved by the Agency Head’s Fiscal

Officer or designee. Any exceptions to the Regulations for Agency Heads for

domestic or international travel including exceptions (example: lodging up to 50

percent above the guideline) must be justified and submitted in advance to the

respective cabinet secretary for approval. This approval must be kept with the

Agency Head’s Expense Report. In the case of domestic travel by university

presidents, such exception requests must be submitted to the Rector of the Board of

Visitors.

Approving Authority for Cabinet Member Exceptions – All cabinet and staff

travel Expense Reports must be reviewed and approved by the Director of Selected

Agency Support Services. Any exceptions for domestic or international travel (up to

50% over approved travel lodging guidelines) must be justified and submitted in

advance to the Director of Selected Agency Support Services for approval.

Exceptions for travel exceeding 50% of the guidelines must be routed from the

Director of Selected Agency Support Services to the Chief of Staff for approval. This

approval must be kept with the traveler’s Expense Report.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 15 Commonwealth of Virginia

Approval and Exceptions, Continued

Reimbursement

by Exempt

Organizations

When travel expenses for Agency Heads and employees of non-exempt State

agencies are reimbursed by organizations that are exempt from the State

Travel Regulations, and exceed any of the guidelines established in these

regulations, the respective cabinet secretary must approve the travel in

advance. Reimbursement must comply with the travel policy in effect for the

funding organization. When travel expenses for Cabinet Secretaries, which

exceed the guidelines established by the regulations, are reimbursed by

similar organizations, the Director of Selected Agency Support Services must

approve exceptions up to 50 percent above the guidelines and the Chief of

Staff must approve all other exceptions in advance. Reimbursement must

comply with the funding organization’s travel policy.

The Expense Report package should include a notation “exempt

organization,” a copy of the approval if the usual limits are exceeded, and

documentation of the actual reimbursement.

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 16 Commonwealth of Virginia

Lodging

Introduction

Lodging may be reimbursed when an individual is traveling overnight on official

business outside his/her official station. Lodging expense reimbursement varies with

the travel destination, but all expenditures must be necessary and reasonable.

Primary responsibility for ensuring the reasonableness of amounts reimbursed rests

with the Agency Head or designee. This includes ensuring that all travel

expenditures have been approved at the appropriate level required, as defined in these

regulations.

For exceptions, refer to “Approval and Exceptions” section.

Lodging Rates

All lodging rates are governed by the U.S. General Services Administration (GSA)

rates effective October 1, 2015. The traveler must search for the travel destination

using the search criteria on the website:

http://www.gsa.gov/portal/content/104877

**NOTE: The travel destination or lodging destination is the city or county in which

the hotel is physically located. The hotel’s mailing address should not be used for

verification of city/county. If the hotel is not within the city limits, the county in

which it is located should be used for lodging rates. If a location is not listed in the

GSA table, the standard rate applies.

Lodging guidelines for all travel destinations (in-state and out-of-state) are provided

in the Lodging Rates section. The appropriate rate is determined by the physical

location (county or city) of the hotel and not the mailing address. When overnight

stays are required while on travel status, first preference shall be given to selecting

lodging in the economy class. Check, request and confirm government rates both at

the time reservations are made and during check-in.

Reimbursement for lodging is limited to actual expenses incurred up to the guideline

amount, plus hotel taxes, fees, and surcharges. Expenses in excess of the guidelines

will not be reimbursed, unless approved in advance as required in the Approval and

Exceptions section. Travelers who do not plan with careful consideration to these

guidelines will bear the additional expense personally. In such cases, taxes and

surcharges will be prorated and reimbursed only for the appropriate rate.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 17 Commonwealth of Virginia

Lodging, Continued

Alternative

Lodging

Authorization

When lodging other than hotels and motels is used, apartments for example, a

comparison statement including authorization by the Agency Head or designee

must be submitted with the Expense Report. The comparison statement should show

the total cost for using the alternate accommodations and length of contract, the cost

of the alternative accommodations, and net savings.

Number of

Persons in a

Hotel Room

Generally when two or more people travel on official State business and stay in the

same hotel room, the lodging guideline applicable to the travel destination in the area

they are staying, plus the cost charged by the hotel for any additional persons in the

room, will apply. Documentation from the hotel listing additional hotel charges for

each additional person, per room must be provided. This regulation is not intended to

discourage agencies from employing cost saving measures such as multiple travelers

staying in the same room. However, do not diminish the overall savings that might

otherwise be obtained by upgrading to luxury or premium accommodations.

For non-luxury, conference hotels the Agency Fiscal Officer may approve lodging

rates that are less than the lodging guideline applicable to the travel destination

multiplied by the number of official business travelers in the room.

Continued on next page

Non-Canceled

Hotel

Reservations

Communicate travel plan changes to the hotel as soon as possible when a confirmed

reservation is being held. Since hotels can charge for non-canceled reservations,

these charges will not be reimbursed if the traveler is negligent in canceling

reservations.

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 18 Commonwealth of Virginia

Lodging, Continued

Advance

Payments

Advance payments for direct billed hotel/motel expenses are discouraged. Use of the

State-sponsored Travel Charge Card is encouraged to secure room confirmations.

Actual advance payments using the travel charge card program will not be

reimbursed prior to the trip. If circumstances make advance payments a necessity,

advance payments are limited to one night deposit for direct bill payments.

Direct agency billing of lodging expenses (rates, taxes, and surcharges only) incurred

during overnight travel is permitted. Direct bill charges, however, are still

considered travel expenditures and are governed by these travel policies and should

be included with the estimated costs of the trip if the trip is expected to exceed $500.

A copy of the travel estimate should be included with the vendor payment. Direct

agency billing of meal expenses incurred during overnight travel, including charging

meals to direct-billed hotel rooms, is not permitted. Documentation supporting

direct bills must include the name of traveler, dates, and purpose of travel.

____________________________________________________________________

Hotel Bills

Submit with the original Expense Report the original, itemized hotel bills obtained at

time of checkout, and other supporting receipts for lodging expense. For hotel rooms

obtained through Internet providers, the traveler must submit the “hardcopy final

page from the Internet site showing total cost and confirmed services.” Any unusual

charges must be fully documented.

____________________________________________________________________

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 19 Commonwealth of Virginia

Meals and Incidental Travel Expenses (M&IE)

Introduction

Generally, meals and certain incidental travel expenses are reimbursable on a per

diem basis (not actual expenses) for overnight official business travel outside the

traveler’s official station. (See exceptions for business, overtime and law

enforcement meals later in this topic.) For exceptions, refer to “Approval and

Exceptions” section.

M&IE Per

Diem

Allowance

Information regarding standard meal and incidental reimbursement guidelines

(including all related taxes and tips) are provided in the M&IE Rates Section below.

Regardless of destination, a flat $5 per diem amount is paid for each day of overnight

travel for incidental expenses such as bellhop/waiter tips, valet, personal telephone

calls, laundry, and transportation between lodging or business and places where

meals may be taken.

The M&IE rate shall be paid directly to the traveler even where it can be shown that

one traveler incurred the expenses on behalf of another. The applicable M&IE rate,

or fraction thereof, is payable to the traveler without itemization of expense or

receipts. Reimbursement for actual expense incurred during overnight travel for these

expense categories is not permitted. Agencies may be more restrictive and pay the

actual expenses up to the appropriate M&IE rate in place of maximum per diem.

M&IE Rates

All M&IE Rates are governed by the U.S. General Services Administration (GSA)

rates located at the link below. These rates should also be used to determine the

maximum meal reimbursement amounts for official business meals and/or the M&IE

reduction.

The M&IE must be reduced for the applicable meal when meals are provided at no

cost during an overnight travel period. Refer to the Prorations and Reductions

section on the next page for additional guidance. The M&IE Rates listed on the GSA

website include amounts for the 75% travel days. The M&IE Rates must be used

unless a traveler needs to make an adjustment for provided meals, as noted in the

Prorations and Reductions section.

http://www.gsa.gov/portal/content/101518

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 20 Commonwealth of Virginia

Meals and Incidental Travel Expenses (M&IE), Continued

The following reimbursement policies apply.

The M&IE per diem must correspond to the location specified for the overnight

lodging.

Direct agency billing of meal expenses incurred during overnight travel, including

charging meals to direct-billed hotel rooms, is not permitted.

Prorations and

Reductions

The following link must be used to calculate prorations and deductions for

meal per diems:

http://www.gsa.gov/portal/content/101518

On a travel departure or return day, 75% of the M&IE rate is reimbursed.

For trips involving multiple travel destinations, base the reduction rate in

effect for where the night was spent as follows:

Departure Day: Where you spend the night.

Return Day: Where you spent the night before returning to home

base.

When meals are provided at no cost in conjunction with travel events, the

applicable M&IE rate must be reduced by the amount shown for the

applicable meal in the M&IE Rate Table. For example, if the M&IE rate

allows a $51 total reimbursement, and lunch was provided at no cost, the

total allowable reimbursement for that day would be $39 ($51 - $12

lunch).

However, when meals are provided at no cost in conjunction with travel

events on a travel departure or return day, the full M&IE rate must be

reduced by the full amount of the appropriate meals followed by a 75%

prorating of the balance. For example, if the M&IE rate allows a $51

total reimbursement, and lunch was provided at no cost on a travel

departure or return day, the total allowable reimbursement for that day

would be $29.25 [($51 - $12 lunch = $39) $39 * .75 = $29.25].

______________________________________________________________

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 21 Commonwealth of Virginia

Meals and Incidental Travel Expenses (M&IE), Continued

When meals are included with registration or lodging expense as part of a package,

the number and type of meals (breakfast, lunch, dinner) must be recorded on the

Expense Report. If a continental breakfast or reception is offered as part of the travel

event and the food/timing is sufficient to serve as a meal, the traveler must reduce the

per diem by the appropriate allowance amount. If a breakfast is offered at no charge

by the hotel and the traveler does not partake in the breakfast due to any reasonable

circumstance (e.g. early work hours do not allow for participation in the provided

breakfast, the food provided was not adequate, the traveler’s dietary needs were not

met, etc.), then the traveler must notate this on the Expense Report. If a meal is

offered as part of a conference and the traveler has medical restrictions, the traveler

should make every effort to have the conference facilitate his/her needs by the

deadline specified by the conference. If the conference does not honor the request,

the traveler is not required to deduct the applicable meal allowance from the per

diem. However, the traveler must include a note or other documentation with the

Expense Report documenting this information.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 22 Commonwealth of Virginia

Meals and Incidental Travel Expenses (M&IE), Continued

Allowed

Expenses

Taxes, fees, and surcharges paid by the traveler for lodging.

Business Telephone Calls, Telegrams, Internet Access , Hotel Business Center

Charges, and Facsimiles for official business purposes and paid for by the traveler

may be claimed on the Expense Report. A full explanation must be stated on the

Expense Report accompanied by supporting documentation. Individuals using

personally owned cellular telephones may be reimbursed for business calls when

shown to be cost beneficial or necessary. In this case, an itemized cell phone

statement must be included and attached to the Expense Report. In the event that free

minutes are used for business calls, reimbursement is not permitted.

Tolls and parking fees are reimbursable when paid for by the traveler in the course of

conducting official State business. A receipt is required for reimbursement claims

where each individual claim is greater than $75 per instance. Reimbursement must

be claimed as an “other expense” on the Expense Report.

Funeral attendance expenses for travel outside of the official station are reimbursable

for one employee selected by the Agency Head or designee to represent the agency.

Lodging and M&IE are allowed if the representative is considered to be in travel

status and overnight stay is required.

Disallowed

Expenses

Disallowed expenses include:

Lost or stolen articles

Alcoholic beverages

Damage to personal vehicles, clothing, or other items

Services to gain entry to a locked vehicle

Movies charged to hotel bills

All expenses related to the personal negligence of the traveler, such as fines

Entertainment expenses

Travel Insurance (Personal injury or loss, trip interruption / cancellation, etc.)

Towing charges, and

Expenses for children, spouses, and companions while on travel status.

The above list is not all-inclusive. Travelers should use prudent judgment and

remember that all travel expense accounts are open to the public and must be able to

sustain the test of public review.

________________________________________________________________________

Travel Credits

Travel credits, reduced rates, or free services received from public facilities

(examples: airline, car rental agencies, motels, etc.) by individuals for whatever

reason accrue to the Commonwealth. Any such credit, reduced rate, or free service

must be reported to the agency fiscal office and must be deducted from the amount of

travel expenses claimed.

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 23 Commonwealth of Virginia

Non-Travel Related Meals

Business Meals

Generally, meal expenses must involve an overnight stay to qualify for reimbursement.

In these instances, the traveler must adhere to the travel regulations outlined earlier for

meal reimbursement.

Individuals who are not in a travel status are eligible for meal reimbursement if they

participate in a business meal. Individuals in travel status may occasionally attend

meals that qualify as business meals.

Such meals occur while the individual is on official business and must:

Include Agency Head or designee approval.

Involve substantive and bona fide business discussions and include the original,

itemized receipt.

List by name all persons involved in the meal and the reason for the meal. If the

reimbursement is for a group of conference participants, identify the number of

people fed and an explanation of additional meals, if necessary (example: coverage

of walk-ins).

Be reimbursed for actual expenses up to the amount shown for the applicable meal

in the M&IE Rate Table, excluding the incidental allowance. (See Business Meal

Exceptions)

For individuals in travel status, the per diem allowance applicable to the business

meal must be clearly excluded from the daily reimbursement.

Delivery costs and a reasonable tip are reimbursable as long as the total cost does

not exceed the allowable per diem for the meal.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 24 Commonwealth of Virginia

Non-Travel Related Meals, Continued

IRS Reporting

Requirements

for Business

Meals

Non-Law Enforcement Personnel

Business meal reimbursements which are not related to overnight travel, and are made

under an accountability plan, are not generally considered by the IRS to be reportable

income. Employees are responsible for reviewing and conforming to current IRS

regulations.

Overtime meals are not considered Business Meals. See the “Overtime Meal

Allowance” section for further information.

Law Enforcement Personnel and Sponsored Programs

IRS income reporting requirements for meals reimbursed under the law enforcement

personnel meal reimbursement policy or the sponsored program exception must be

determined by the disbursing agency based on the specific circumstances of each case.

Overtime Meal

Allowance

Agency conditions that necessitate overtime vary greatly. An agency with special or

unique conditions may submit, in writing, an agency-specific overtime meal policy

to the Department of Accounts (Assistant State Comptroller). When developing an

overtime meal policy, prudent judgment is expected to recognize only reasonable

and necessary costs. An overtime meal allowance is a fixed dollar amount allowed

while working or traveling in an overtime status. Overtime status is when work or

travel time occurs beyond an employee’s normal, scheduled work hours, but not

overnight. Therefore, overtime meal allowance does not apply during overnight

travel. In the case of overnight travel, per diem rates apply.

An overtime meal allowance is allowed when overtime worked is:

Essential to the agency’s mission

Permitted by agency policy

Approved by appropriate agency personnel, and

In excess of the employee’s normal, scheduled work hours.

Note: Scheduled work hours and overtime hours worked for overtime meals must

be included on the Expense Report.

Agencies are required to comply with IRS regulations regarding reportable meals.

An overtime meal allowance based on the number of hours worked is considered

taxable wages.

___________________________________________________________________

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 25 Commonwealth of Virginia

Non-Travel Related Meals, Continued

Overtime Meal

Rates

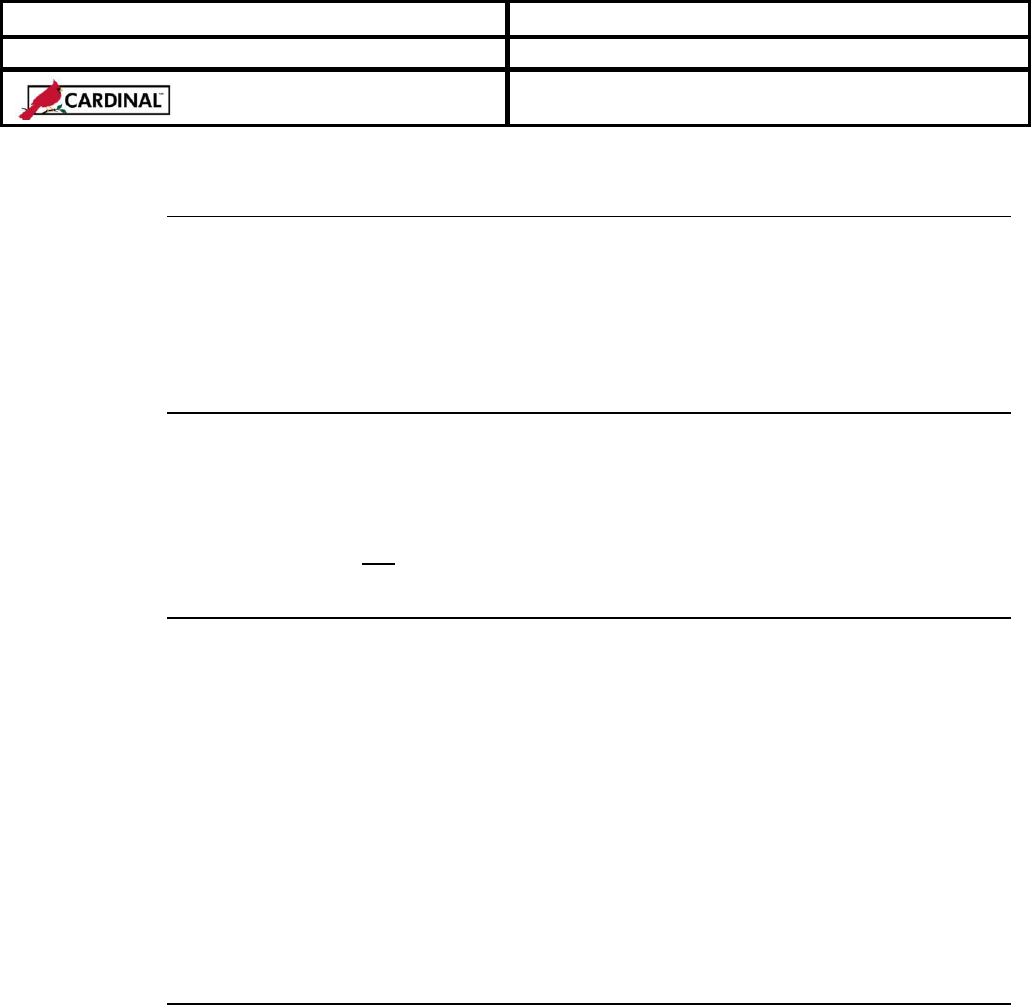

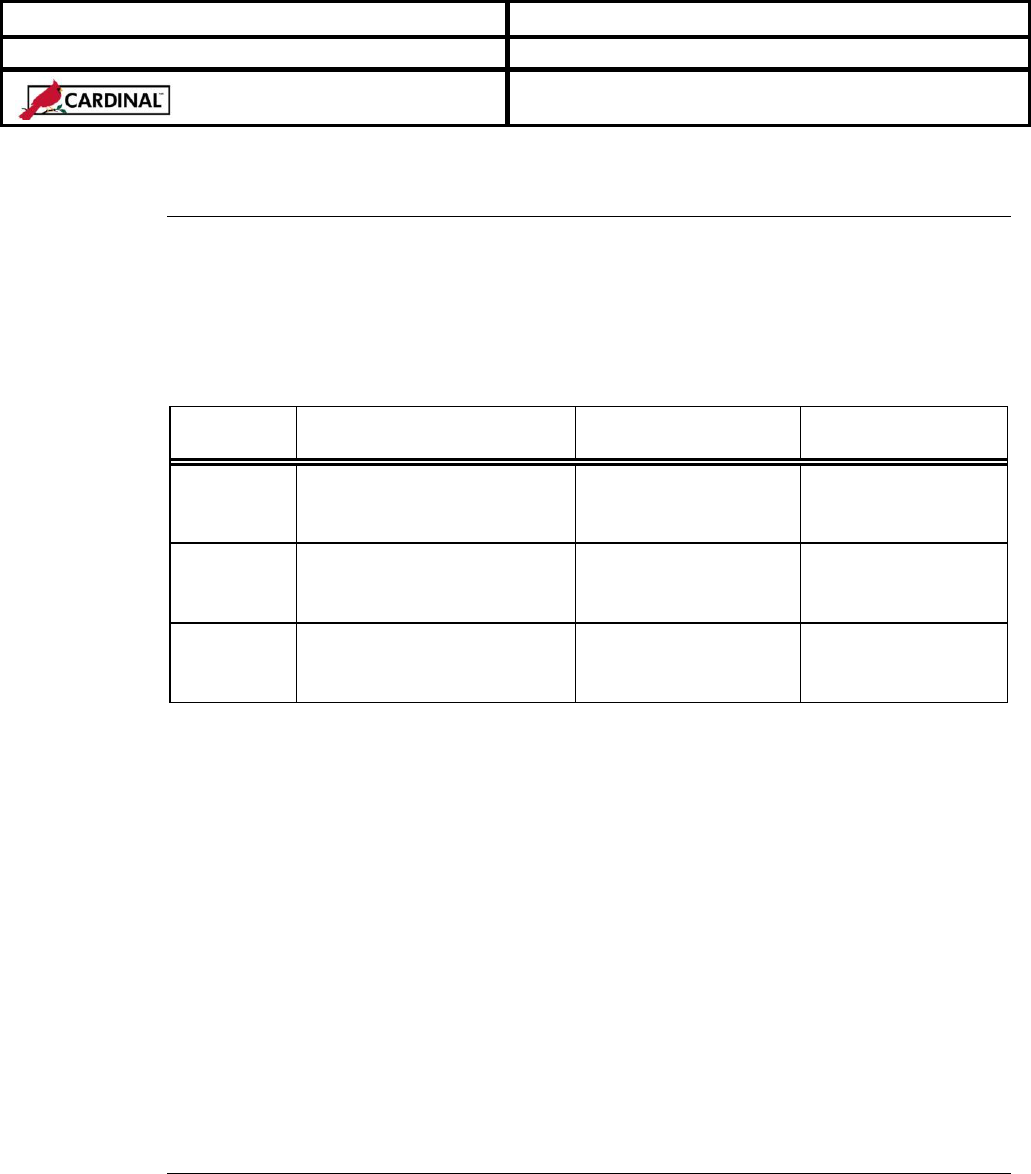

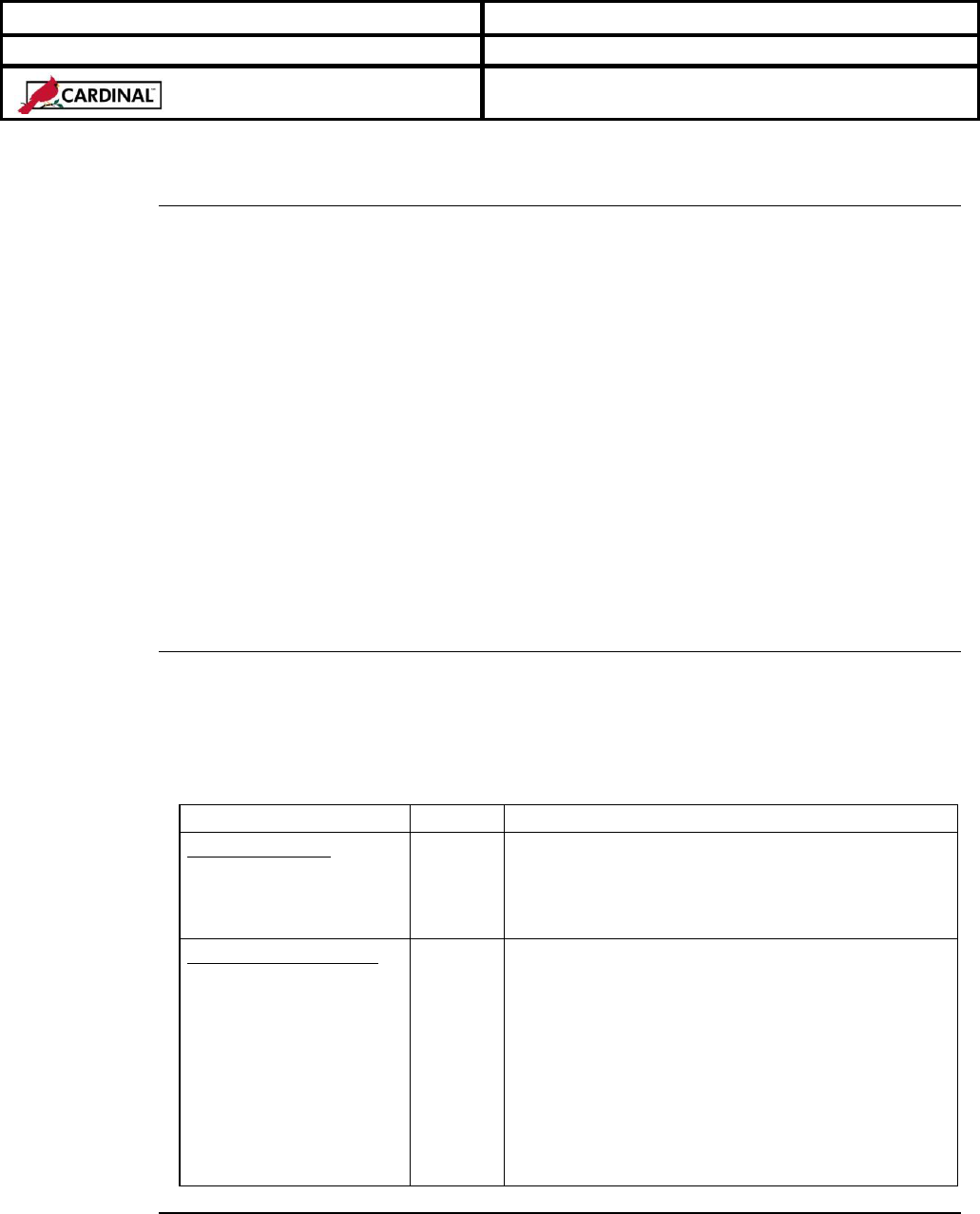

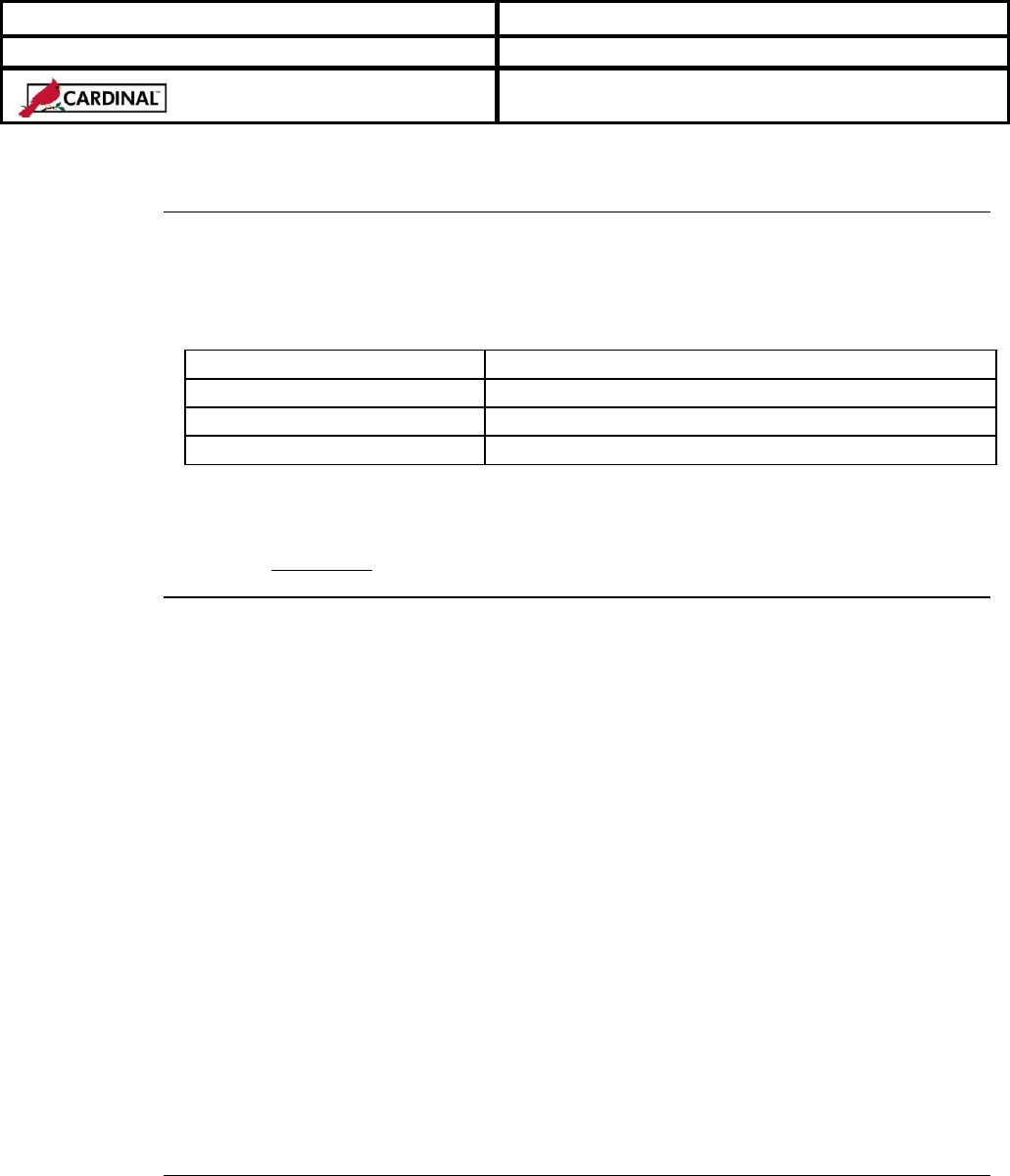

The Overtime Meal Allowance policy described in the following table must

be followed unless an agency-specific overtime meal policy is approved by

DOA.

* Note Or if comparable overtime is necessitated by shift schedule or beyond a

routine, scheduled 40-hour work period.

Continued on next page

IF...

Are worked or traveled

AND the overtime occurs…

THEN an overtime

meal allowance is…

Documentation

Required

2 or more

overtime

hours

during a

normal workday

$5.00

($7.50 if outside the

official station)

Workday and

Overtime Start/End

Times

5 or more

overtime

hours

on a Saturday, Sunday,

holiday or an alternate work

schedule day off *

$5.00

($7.50 if outside the

official station)

Overtime Start/End

Times

10 or more

overtime

hours

on a Saturday, Sunday,

holiday or an alternate work

schedule day off *

$10.00

($15.00 if outside the

official station)

Overtime Start/End

Times

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 26 Commonwealth of Virginia

Non-Travel Related Meals, Continued

Law

Enforcement

Personnel

Meals

Under certain circumstances, meals may be reimbursed when an overnight stay is not

involved for law enforcement personnel. Reimbursement for actual meal expenses or

fixed meal allowances may be paid by agencies which have a policy providing for

such payments. Additionally, the employees must meet each of the following criteria.

The officer:

has arrest powers

is sworn to uphold the law

is permitted to carry a firearm, according to the Code of Virginia, and

is required, according to agency policy, to be in an “on Duty” or “Ready” status

during the meal period.

Minimum requirements for the On Duty or Ready status are as follows:

The duties require the employee to be available during the meal period to perform

public service such as reporting of accidents or dissemination of information

concerning traffic, motor vehicle, or other laws (examples: marine, game, forestry

laws).

The employee is required to stay in close communication during the meal period

for possible immediate response to emergency situations. Such response may

interrupt or cancel the employee’s meal period.

The employee is required to have his/her meal in an area accessible to the public

so that public services can be readily provided.

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 27 Commonwealth of Virginia

Transportation

State-Owned

Automobile

Rules and policies for use of a State vehicle are defined in the Office of Fleet

Management Policies & Procedures issued by the Department of General Services.

Agency Heads shall limit authorization for commuting in State-owned vehicles to

those employees whose job travel requirements make commuting the only cost-

effective or practical alternative. No appointee, serving at the pleasure of the

Governor, shall use a State-owned vehicle for the purpose of commuting, except:

where the commute is connected to a departure for or return from a trip on

official State business, or

where authorized by the Secretary of Public Safety for job-related emergencies.

Permanent use of State-owned vehicles by persons performing official State business

is permitted as determined by the Agency Head. A written request must be made by

the Agency Head explaining in detail the purpose or reason for such an assignment

on forms prescribed by the Office of Fleet Management Services.

State-Owned

Automobile

Permanent

Basis

Agencies that have employees who travel frequently on official State business should

request a State-owned vehicle on a permanent basis, if it is cost beneficial to the

State. Such agencies should conduct a cost/benefit analysis on an annual basis to

evaluate whether the use of permanently assigned, agency vehicles would be cost

beneficial to the State. The cost/benefit analysis should consider the actual costs

associated with providing State-owned vehicles including Office of Fleet

Management charges, incremental administrative costs of establishing an agency

fleet or adding vehicles to an existing agency fleet, vehicle parking costs, and any

vehicle maintenance and operating costs not paid by the Office of Fleet Management

Services. For further information and guidance concerning the use and availability of

permanently assigned vehicles, refer to the Office of Fleet Management Policies &

Procedures issued by the Department of General Services.

State-Owned

Aircraft

State-owned aircraft are available on a priority basis and can be scheduled through

the Department of Aviation (DOAV). Refer to the Aircraft Use Policy and

Guidelines that can be found on DOAV’s website at www.doav.virginia.gov. Costs

should be compared with commercial rates to determine the best air carrier travel for

State travel.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 28 Commonwealth of Virginia

Transportation, Continued

Personally-

Owned

Automobile

Employees are permitted to use their personally owned automobile when a State-

owned vehicle or Office of Fleet Management Services (OFMS) rental vehicle is not

available, or when the use of a personally owned vehicle is cost-beneficial to the

agency. Employees electing to use their personal vehicle as a matter of convenience

will be reimbursed for mileage at the lowest combined capital and operational trip

pool rate charged by OFMS. The applicable Personal Mileage Expense Type option

(Convenience, Cost Justified, Over 15K Miles) should be selected in the Expense

Report.

When processing mileage reimbursement in Cardinal for a personally-owned

automobile, the mileage traveled should be rounded to the nearest whole mile.

Cardinal does not allow for entry of a fraction of a mile.

Current

Mileage Rates

Reimbursement rates are set in the current Appropriation Act (Section 4 - 5.04e.2).

Currently, the rates for the first 15,000 miles of use each fiscal year are:

Current IRS rate - when a personally owned vehicle is cost justified or a State-

owned vehicle/OFMS rental is not available.

$.246 mile - when use of a personally-owned vehicle is elected for the

convenience of the employee.

Reimbursement rates are reduced to $.13/ mile for travel in excess of 15,000 miles in

one fiscal year, unless a State-owned vehicle is not available; then, the rate shall be

the current IRS rate.

The current IRS rates can be found at the following site:

https://www.irs.gov/newsroom/irs-issues-standard-mileage-rates-for-2019

If the higher mileage rate is used for reimbursement, the Agency Fiscal Officer is

responsible for ensuring the appropriate justification has been documented and

approved by the Agency Head or designee (as outlined in the following sections).

This documentation and approval must be attached to the Expense Report.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 29 Commonwealth of Virginia

Transportation, Continued

Short Term

Trip

Vehicle—

Enterprise

Rental Car

The Department of General Services, Office of Fleet Management Services (OFMS),

maintains a contract with Enterprise Leasing to provide vehicles for short term travel by

state employees.

When preparing for a trip, the traveler should visit the OFMS website (at least 24 hours

in advance)

http://www.dgs.virginia.gov/OfficeofFleetManagementServices/TravelPlanning/tabid/170/Defa

ult.aspx

and use the trip calculator to determine the vehicle cost for their proposed trip.

This cost should be used in the agency’s cost benefit analysis as required in the

following section. All vehicle reservations must be made at least 24 hours in

advance of the anticipated pickup of the vehicle. Otherwise, the traveler may be

restricted to reimbursement at the Personal Convenience Rate.

Rental of vehicles which exceed 30 days must have the prior approval of the Office of

Fleet Management Services.

Operators of Short-Term Trip Vehicles are subject to the OFMS Policies and

Procedures that apply to State or Agency owned vehicles. Including use for official

business only. See OFMS Policies and Procedures Manual (Page 14; II Travel

Planning)

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 30 Commonwealth of Virginia

Transportation, Continued

Cost Benefit

Analysis

Agencies must conduct a cost/benefit analysis to determine whether a State-

owned/OFMS rental or a personally-owned vehicle should be used in official

State travel. It is expected that a good faith effort will be made to use the

Enterprise Rental contract when practical. (See “Short Term Trip Vehicle—

Enterprise Rental Car” section) Generally, a personal automobile is

considered cost beneficial under the following circumstances:

When occasional travel is planned for distances up to 200 miles per

day. This distance may vary for agency-owned or operated fleets. For

overnight travel, consider the average daily mileage over the period

the State vehicle would otherwise be needed.

For constant daily routine travel (agencies should consider the cost

effectiveness of an agency fleet).

When an emergency exists and is approved by the Agency Head or

designee.

For all other circumstances, the OFMS TRIP CALCULATOR (See “Short

Term Trip Vehicle—Enterprise Rental Car” section) should be used routinely

to obtain the Enterprise vehicle cost for the cost benefit analysis.

Examples of other factors that can be considered in the cost benefit analysis

are:

Distance to the nearest Enterprise location and the hours of operation

Administrative time required to obtain the Enterprise rental car

The type of vehicle required and the number of travelers

The Agency Head or designee is authorized to approve the IRS rate in lieu of

the Enterprise contract when a personally owned vehicle is deemed to be cost

beneficial to the agency. This justification and approval must be documented

and attached to the Expense Report.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 31 Commonwealth of Virginia

Transportation, Continued

Mileage Versus

Air Costs

Planned personal vehicle or rental car costs cannot exceed the total cost of the

trip using the most economical public air transportation available. All travel

costs (including meals, lodging, parking, ground transportation, etc.) should

be considered for each option. Reimbursement shall be limited to the least

expensive option (flying vs driving). Agency Heads or their designees are

authorized to grant exceptions to this policy when justified. Comparative

statements should be attached to the Expense Report for reimbursement.

Commuting

Mileage

Round-trip mileage traveled routinely and directly by the employee between

his residence and base point incurred on a scheduled workday is considered

commuting mileage. An employee can have only one assigned base point.

Commuting mileage and other commuting costs incurred on normal

workdays are considered a personal expense and are not reimbursable.

Travel Routing

Travel routing, whether by public transportation, privately-owned vehicle,

State-owned vehicle or for-hire conveyance, shall be the most direct

practicable route.

Base Point

An employee can only have one base point, even if the employee has multiple work

locations. It is the agency’s responsibility to assign the base point to be used for

reimbursement purposes.

The employee’s residence can be assigned by the agency as base point when it is cost

beneficial to the State. In this case, the mileage driven from the employee’s

residence to one or more temporary work locations, including the employee’s central

office, is official State business mileage and is fully reimbursable. Agencies are

expected to establish stringent administrative controls at sufficiently high levels

to ensure that the assignment of an employee’s residence as their base point is

authorized only when justifiable.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 32 Commonwealth of Virginia

Transportation, Continued

Weekend and

Holiday

Mileage

Mileage incurred when the individual is required to work on a Saturday,

Sunday, or holiday that is not a scheduled workday may be reimbursed

subject to an agency policy permitting such reimbursement.

Out of Country

Mileage

Reimbursement for out-of-country travel will be at the rate established in the

current Appropriation Act. However, if a higher personal mileage rate is

justifiable, a request must be sent to the Assistant State Comptroller for

approval. This request must have appropriate documentation to support the

proposed reimbursement.

Parking & Toll

Expenses

Parking and Toll expenses are reimbursable. A receipt is required for

reimbursement claims where each individual claim is greater than $75 per

instance. Reimbursement must be claimed as an “other expense” on the

Expense Report.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 33 Commonwealth of Virginia

Transportation, Continued

Public

Transportation

Public transportation travel includes:

Rental Car

Plane

Train

Bus

Taxi, Shuttle, or other “for hire transportation”

Public transportation rates must not exceed those for tourist or coach class

accommodations. Receipts for such expenses must be retained for submission with

the Expense Report. Because of the liquidity of air and rail tickets, any unused

portions must be returned to the agency for credit. Each agency must have a written

policy and assigned responsibility for obtaining and controlling airline and rail

tickets, particularly any unused portions.

Charges for changes to tickets/reservations to accommodate personal comfort,

convenience and taste are not reimbursable. Change fees must be explained on the

Expense Report.

For taxis, shuttle vans and other forms of on demand or reserved “for hire

transportation,” receipts are required only if the reimbursement claim exceeds $75

per instance. A reason must be identified on the voucher of the necessity for

reserved “for hire” transportation. Reimbursement for limousine or other forms of

luxury transportation services are not allowed. A maximum tip of 15% of the taxi

cab or shuttle service fare is reimbursable as a transportation cost separate from

Meals and Incidental Expenses. For reimbursement, the Expense Report must

separate the amount for the tip from the amount of the fare.

Public transportation from place of lodging to restaurants is allowed only for official

business needs.

Continued on next page

Volume No. 1—Policies & Procedures

TOPIC NO. 20335 – Cardinal

Section No. 20300—Cash Disbursements Accounting

TOPIC STATE TRAVEL REGULATIONS

DATE December 1, 2015

Office of the Comptroller 34 Commonwealth of Virginia

Transportation, Continued

Air & Rail