Does Credit Aect Deforestation?

Evidence from a Rural Credit Policy in the

Brazilian Amazon

CPI Technical Report

Climate Policy Initiative

Juliano Assunção

Clarissa Gandour

Romero Rocha

Rudi Rocha

January 2013

About CPI

Climate Policy Initiative (CPI) is a policy eectiveness analysis and advisory organization whose

mission is to assess, diagnose, and support the eorts of key governments around the world to

achieve low-carbon growth.

CPI is headquartered in San Francisco and has oces around the world, which are aliated

with distinguished research institutions. Oces include: CPI Beijing aliated with the School

of Public Policy and Management at Tsinghua University; CPI Berlin; CPI Hyderabad, aliated

with the Indian School of Business; CPI Rio, aliated with Pontifical Catholic University of

Rio (PUC-Rio); and CPI Venice, aliated with Fondazione Eni Enrico Mattei (FEEM). CPI is an

independent, not-for-profit organization that receives long-term funding from George Soros.

Descriptors

Sector Forestry and Land Use

Region Brazil

Keywords credit, land use, deforestation, conservation policies

Contact Juliano Assunção, CPI Rio

JEL codes Q23, Q24, Q28

Copyright © 2013 Climate Policy Initiative www.climatepolicyinitiative.org

All rights reserved. CPI welcomes the use of its material for noncommercial

purposes, such as policy discussions or educational activities, under a Creative

Commons Attribution-NonCommercial-ShareAlike 3.0 Unported License.

For commercial use, please contact admin@cpisf.org.

Author Aliations

J. Assunção, C. Gandour, Romero Rocha: Núcleo de Avaliação de Políticas Climáticas da

Pontifícia Universidade Católica do Rio de Janeiro (NAPC/PUC-Rio) & Climate Policy

Initiative Rio de Janeiro (CPI Rio)

Rudi Rocha: Universidade Federal do Rio de Janeiro (UFRJ)

Abstract

The concession of rural credit in the Brazilian Amazon became conditional upon stricter legal and

environmental requirements in 2008. This paper uses this policy change to investigate credit

constraints in the region, and how the variation in credit impacts deforestation. Dierences-in-

dierences estimation based on a panel of municipalities shows that the policy change led to a

reduction in rural credit, particularly for cattle ranching. The eect is concentrated on medium and

large loans. A two-stage estimation shows that the decrease in rural credit has curbed deforesta-

tion, especially in municipalities where cattle ranching is the main economic activity.

1. Introduction

How does the availability of rural credit affect defo restati on ? Theory alone offers

ambiguous answers to this question. On the one hand, should credit be used to increase

rural production by incorpora ting new lands for production, g reater availability of credit

will likely lead to rising deforesta tion, as forest areas are cleared and converted into

agricultural land. On the other hand, should it be used to fund the capital expenditures

required to improve agricultural technology and productivity, increases in availability of

rural credit may actually reduce land use and curb deforestation.

This paper shows that a reduction in rural credit has contributed to curb deforestatio n

in the Brazilian Amazon Biome. The evidence is provided by the evaluation of Resolu-

tion 3,545, introduced in 2008 by the Brazilian National Monetary Council (Conselho

Monetário Nacional, CMN). This resolution conditioned the concession of rural credit in

the Amazon Biome upon proof of compliance with legal and environmental regulations.

We investigate several aspects of b oth the implementation and impact of this novel credit

policy, and explore variations in rural credit concessions caused by this new regulation to

estimate the effect of credit on deforestation.

We interpret the impact of credit on deforestation as evidence of credit constraints in

the region. Based on Banerjee and Duflo (2012), we argue that this potential rationing

in the availability of subsidized credit may have tightened credit constraints, leading to

changes in farmers’ production decisions and thereby affecting deforestation. We develop

a very stylized econo mic model, which guides the interpretation of our results, showing

how a change in the availability of subsidized credit may either increase o r decrease forest

clearings.

Our results have two key policy implications. First, the evidence shows that condi-

tional rural credit can be an effective policy instrument to combat deforestation. Second,

and perhaps more important, our analysis suggests that the financial environment in the

Amazon is characterized by significant credit constraints. Thus, policies that increase the

availability of financia l resources may potentially lead to higher deforestation rates. This

issue lies at the core of the recent debate about REDD policies that ultimately invo lve

payments for environmenta l services (see Alston and Andersson (2011), Angelsen (201 0 ),

and Angelsen and Wertz-Kanounnikoff (2008)).

Rural credit is an important source of funding for Brazilian agriculture, as well as

akeypolicyinstrumentinthecountry. Ruralcreditissubsidizedbythegovernment.

When Resolution 3,545 was implemented in 2008, the rural credit portfolio proposed by

the federal government and carried out by official banks and credit cooperatives totaled

BRL 78 billion (USD 38.5 billion) for all of Brazil. In that same year, the Amazon Biome

portfolio provided BRL 2.5 billion (USD 1.24 billion) in rural credit. In this region,

rural credit is distributed mostly through government banks, such as Banco do Brasil,

2

Banco da Amazônia and Banco do Nordeste. According to MAPA (2003), the official

rural credit portfolio covers about a third of the annual financia l needs of the agricultural

sector in Brazil. As part of these needs are covered by producers’ own resources, this

portfolio represents an even larger share of external finance in the sector. Thus, any policy

measure that affects rural credit also affects one of Brazil’s main support mechanisms for

agricultural production.

Three key aspects in the implementation of Resolution 3,545 helped us design our

empirical analysis. First, its conditions applied only to rural credit used in landhold-

ings inside the Amazon Biome. Having access to b oth contract-level credit concession

microdata and deforestation satellite data for all of the Legal Amazon (a larger admin-

istrative region), we are able to use Legal Amazon municipalities that are not in the

Amazon Biome as a control group to evaluate the impact of the resolution in the biome.

This aspect allows us to use a difference-in-differences approach for the evaluation of the

resolution.

Second, credit takers who were beneficiaries of the National Program for the Strength-

ening of Family Agriculture (Programa Nacional de Fortalecimento da Agricultura Fa-

miliar, Pronaf) were subject to far less stringent conditions for credit concession. Pronaf

is designed to target sma ll-sca le producers, where eligibility for the program depends on

the producer’s farm size. As our data allows us to identify whether credit was contracted

through Pronaf or non-Pronaf channels, we explore how, for a given municipality, credit

concession differed between small and mid-to-large-scale pro ducers after the adoption of

Resolution 3,545. We explore this second aspect in an alternative difference-in-differences

formulation.

Third, the resolution’s conditions were such that borrowers who proved that they

had the intention to comply with environmental regulation were allowed access to credit.

The key requirement was a formal commitment to adapt to the environmental rules over

time rather than at the current time. For practical purposes, this made intention to

comply equivalent to compliance, helping us validate our strategy for the estimation of

the relationship between credit and deforestation. A possible concern for our identifica-

tion strategy co uld arise from financially unconstrained farmers changing their choices

about deforestation to prevent future credit restrictions. The way Resolution 3 ,5 4 5 was

implemented mitigates the relevance of this issue.

Our analysis is based on a contra ct-level microdata set compiled by the Central Bank

from Common Registry of Rural Operations (Registro Comum de Operações Rurais,

Recor) data. This data set contains detailed information on all rural credit contracts

negotiated by official banks (public and private) and credit cooperatives in the 2002

through 2011 period in the Legal Amazon states of Acre, Amazonas, Amapá, Ma ra nhã o ,

Mato Grosso, Pará, Rondônia, Roraima and Tocantins. We use this data to construct

3

apaneloftotalamountofruralcreditatthemunicipalitylevel. Wealsocollectmunic-

ipality level data on satellite-based deforestation from the National Institute for Space

Research’s (Instituto Nacional de Pesquisas Espaciais, INPE) Project for Monitoring

Deforestation in the Legal Amazon (Projeto de Monitoramento do Desflorestamento na

Amazônia Le gal, PRODES/INPE).

Our main difference-in-differences results indicate that Resolution 3,545 led to a reduc-

tion in the concessio n of rural credit in the Amazon Biome. In counterfactual simulations,

we estimate that approximately BRL 2.9 billion (USD 1.4 billion) were not loaned in the

2008 through 2011 period due to restrictions imposed by Resolution 3,545. A reduc-

tion in loans specific to cattle ranching activities accounted for 90% of this effect. The

resolution also led to a decrease in the concession of non-Pronaf credit, as compared to

Pronaf credit, within a given municipality. This is to be expected in light of the legal

exemptions that were introduced for small-scale producers. Counterfactual simulations

conducted using the Pronaf vs non-Pronaf specifications yield results similar to those

obtained using the biome vs non-biome specifications, which is reassuring in terms of

support for our identification strategy. Several robustness checks corroborate the use of

our main specifications.

We investigate p otential heterogeneous effects of Resolution 3,545 by exploring specific

elements of municipality and contract-level heterogeneity. First, we test if the policy’s

impact differed among municipalities with different leading economic activities. Munici-

palities are categorized as being either cattle or crop-oriented. Our findings suggest that

the resolution had a signifi cant negative impact on rural credit concession in both types

of municipalities, with a stronger effect on cattle-oriented ones.

Second, we analyze how Resolution 3,545 affected the size and the composition of

rural credit contracts in the Amazon Biome. Results show that the policy had a distribu-

tional effect on ca ttle-specific contracts. The number of medium and large cattle-specific

contracts, as well as the number of medium crop-specific contracts decreased, while the

number of small cattle-specific contracts slightly increased. W e document no impact on

small crop-specific contra cts. This effect is likely the consequence of credit agents striving

to reallocate resources away from credit takers subject to the resolutio n’s conditions and

towards those facing less stringent legal restrictions.

Having shown that Resolution 3,545 caused a reduction in rural credit concession in

the Amazon Biome, we move on to test whether this reduction affected deforestation.

Results from instrumental variable regressions indicate that the decrease in rural credit

helped contain deforestation in the biome. In counterfactual simulations, we estimate that

over 2,700 square kilometers of forest would have been cleared from 2009 through 2011

in the absence of the resolution-induced credit constraint. Considering that deforestation

rates in the late 2000s and early 2010s were between 5,00 0 and 7, 00 0 square kilo meters

4

per year, the effect attributed to the resolution is quite substantial. We also find that

the relationship between rural credit and deforestation varies according to the regionally

leading economic activity, with municipalities where cattle ranching predominates over

crop farming showing a stronger impact of credit on deforestation. Overall, the results

suggest that there are relevant credit constraints affecting the deforestation activity in the

Brazilian Amazon Biome, and that the expansion of agriculture at the extensive margin

in the biome - particularly in cattle-oriented municipalities - is financially constrained.

Again, we run several robustness checks that corroborate our results.

The remainder of the paper is structured as follows. Next section presents a short

literature review. Section 2 presents an overview of related literature. Section 3 describes

the institutional co ntext of rural credit and Resolution 3,545 at the time of policy im-

plementation. Section 4 introduces the model that guides our empirical analysis and

defines the role of credit constraints within our framework. Section 5 describes the data

and presents stylized facts and trends on credit concession and deforestation. Section 6

details the empirical strategy used to calculate the impact of Resolution 3,545 on credit

and deforestation. Section 7 discusses results on policy effectiveness in restricting credit.

Section 8 discusses results on the relationship between credit and deforestation. Section

9 clo ses with final remarks.

2. Related literature

The literature analyzing the direct link between credit and deforestation is scarce.

Binswanger (1991) discusses whether there exists a positive relationship between credit

and deforestation. He argues that subsidized rural credit tends to increase the demand

for land, leading to a more rapid expansion of crop farmland and pasture, but does not

formally test his hypotheses. Yet, rural credit policies could also encourage producers

to increase productivity within a given area of land. Pfaff (1999) empirically studies the

relationship between a proxy for credit supply and deforestation in the Brazilian Amazon.

He finds that the number of bank branches is positively correlated with deforestation,

thought this result is not significant in all specifications. Hargrave and Kis-Katos (2010)

also find positive correlation between credit and deforestation in some regressions, and no

such impact in others (including their preferred specification). Unlike previous studies,

we explore a policy-induced and exogeno us source of variation in rural credit. By using

the policy change as an instrumental variable for credit supply, we are able to identify a

causal relationship between credit and deforestation. We find a positive and robust effect

of rural credit on deforestation.

Our results also provide a better understanding of the determinants of the recent

Brazilian Amazon deforestatio n slowdown. After peaking at over 27,000 square kilome-

ters per year in 2004, the deforestation rate in the Brazilian Legal Amazon decreased

5

substantially in the second half of the 2000s to about 5,000 square kilometers in 2011

(INPE (2012)). The Amazon forest is the planet’s largest rainforest tract, as well as the

world’s most active agricultural frontier in terms of forest loss and CO

2

emissions (FAO

(2006), Morton et al. (2 0 0 6 ), Santilli et al. (2005)).

There is a substantial stream of literature documenting the impact of long-run so-

cioeconomic drivers of deforestation activity in the Amazon (for instance, previous works

investigate the effect of population, road density, and agroclimatic characteristics on de-

forestation in the Amazon - see Chomitz and Thomas (2003), Reis and Guzmán (1994),

Reis and Margulis (1991)). However, there is scarce empirical evidence on the imme-

diate drivers of the recent and sharp deforestation slowdown in the region. This paper

complements the findings of Assunção et al. (2011). The authors show that, even when

controlling for commodity prices and relevant fixed effects, conservation policies intro-

duced starting in 2004 and 2008 helped avoid half of the forest clearings that would have

been observed from 2002 through 2009 should the policies not have been adopted. Our

paper isolates the credit channel and specifically tests whether credit constra ints have

been effective in curbing deforestation vis-a-vis other recent conservation efforts adopted

in the Brazilian Amazon.

Finally, our results contribute to a broader literature on rural credit. Previous studies

have found beneficial effects of the availability of credit in rural contexts. Credit sup-

ply ha s been positively associated with poverty reduction (Burgess and Pande (2005)),

agricultural investment and consumption smoothing (Rosenzweig and Wolpin (1993),

Conning and Udry (2007)). In this paper we unfold a potential negative externality by

documenting that the ava ila bility of rural credit may also lead to higher deforestation.

3. Institutional Context

Rural credit is one of Brazil’s most traditional ways to support agriculture (MAPA

(2003)). It encompasses significant government subsidy. The Ministry of Agriculture

(Ministério da Agricultura, Pecuária e Abastecimento , MAPA) estimates that approxi-

mately 30% of the resources needed in a typical harvest year a re funded by rural credit

(MAPA (2003)). The remaining 70% come from producers’ own resources, as well as

from other agents of agribusiness (such as trading companies) and other market mech-

anisms (such as legal instruments that enable the pre-sale of production). In light of

this, any policy measure that affects rural credit also affects one of Brazil’s main support

mechanisms for agricultural production.

In Brazil, rural credit is loaned according to rules and conditions established in the

Central Bank’s Manual of Rural Credit (Manual de Crédito Rural, MCR). It is used to

finance short-term operating funds, investment, and commercialization o f rural produc-

6

tion.

1

All agents comprising the National System of Rural Credit (Sistema Nacional

de Crédito Rural, SNCR), which encompasses public banks, private banks, and credit

cooperatives, must abide by the MCR’s norms.

One of the key policy instruments for determining the concession of rural credit in

Brazil is the annual Crop and Livestock Plan (Plano Agrícola e Pecuário, PAP), com-

monly known as the Harvest Plan (Plano Safra). Published in the first semester of each

year by the MAPA, the PAP summarizes the directives established for agricultural policy

in each harvest year.

2

The document is intended to serve as guidance for producers,

informing them about elements central to agricultural production in the country. At the

PAP’s core are the government’s plans regarding amounts of credit to be loaned to b o th

commercial and family production

3

,aswellasthesubsidizedinterestratesthatapplyto

alargefractionofplannedcreditloans.

From a total of BRL 14.7 billion (USD 7.3 billion) in the 2001/2002 harvest year, the

amount of credit planned for rural commercial production in the PAP increased to BRL

50.0 billion (USD 24.7 billion) in 2006/2007 and reached BRL 102.7 billion (USD 50.7

billion) in 2011/2012. A large share - typica lly over half - of these resources were loaned

under fixed per year interest rates: 8.75% up to and throug hout the 2006/2007 harvest

year, and 6.75% thereafter (see MAPA (2001), MAPA (2006), and MAPA (2011)).

Considering the annua l SELIC

4

rate of over 18% in the beginning of the 2000s and over

8% in the beginning of the 2010s, the interest rates established in the PAP represented a

very significant government subsidy for rural credit. Family production, whose planned

amount of credit increased from BRL 2.5 billion (USD 1.2 billion) in the 2001/2002 PAP

to BRL 10.0 and 16.0 billion (USD 4.9 and 7.9 billion) in the 2006/2007 and 201 1 /2012

PAPs respectively, received even greater subsidies, having access to annual interest rates

as low as 1% for specific categories of production.

3.1. Conservation Policy Efforts and Central Bank Resolution 3,545

Brazilian conservation policies underwent profound revision in the 2000s. Most of

these changes occurred within the framework of the Action Plan for the Prevention and

1

According to MAP A’s classification system, short-term operating funds credit is meant to cover the

usual expenses of production cycles; investment credit is to be applied to durable goods or services

whose benefits last over an extended period of time; and commercialization credit is intended f or use

in ensuring supply and allowing for storage during periods of falling agricultural output prices. As, in

practice, some activities may fall into multiple categories, we restrict our attention to aggregate credit.

2

In Brazil, a harvest year is the period covering July of a current year through June of the following

year.

3

A family producer is described in Law 11,326/2006 as one who practices rural activities while simultane-

ously meeting the following criteria: (i) holds no more than four fiscal modules, where a fiscal module is

defined as the minimum area needed in each municipality to ensure the economic viability of exploring

a rural establishment within that municipality; (ii) uses predominantly own family’s labor in establish-

ment’s economic activities; (iii) meets a minimum of family income originating from establishment’s

economic activities; and (iv) manages establishment alongside own family.

4

The SELIC rate is the Brazilian Central Bank’s overnight rate.

7

Control of Deforestation in the Legal Amazon (Plano de Ação para a Prevenção e o

Controle do Desmatamento na Amazônia Legal, PPCDAm). Launched in 2004, this plan

inaugurated a new form of dealing with deforestation. It integrated action across different

government institutions, and introduced innovative procedures for monitoring, environ-

mental control, and territoria l management in the Legal Amazon (Ipea et al. (2011),

IPAM (2009)). Henceforth, policymakers sought to inhibit forest clearings and promote

forest conservation through three main policy efforts: the strengthening of command and

control operations, the expansion of protected territory, and the adoption of more restric-

tive rural credit policies. The remainder of this section focuses on Resolution 3,54 5 , the

major rural credit policy change of the end of the 2000s.

Published by the CMN on February 29

th

,2008,Resolution3,545conditionedthe

concession of rural credit for use in agricultural activities in the Amazon Biome upon

presentation of proof of borrowers’ compliance with environmental legislation, as well as

of the legitimacy of their land claims and the regularity of their rural establishments. The

measure, aimed at restricting credit for those who infringed environmental regulations,

applied to all establishments in municipalities located entirely within the Amazon Biome.

Resolution 3,583, published on July 1

st

,2008,determinedthatinfrontiermunicipalities,

whose territory is only partially located within the biome, the conditions a pplied solely

to establishments located entirely or partially inside the biome. As the Amazon Biome

is contained within the Legal Amazon, all biome municipalities are necessarily located

in the Legal Amazon, but not all Legal Amazon municipalities are part of the Amazon

Biome (see Figure 1).

As all related institutions - public banks, private banks, and credit cooperatives - were

obligated to abide by the new rules, the resolution represented a potential restriction on

official rural credit, and thereby on the fraction of it that is largely subsidized via lower

interest rates. However, other sources of fina ncing for agricultural activity, such as traders

and supplier’s credit, suffered no such restriction.

As determined in Resolution 3,545, to prove eligibility for taking credit, the borrower

had to present: (i) the Certificate of Registry of the Rural Establishment (Certificado

de Cadastro de Imóvel Rural, CCIR); (ii) a declaration stating the absence of current

embargoes caused by economic use of illegally deforested areas; and (iii) a state-issued

document attesting the environmental reg ula rity of the establishment hosting the project

to be financed, or, in the absence of such document, a state-issued certificate indicating

that the documentation necessary for regularization had been received. The resolution’s

requirements applied not only to landowners, but also to associates, sharecroppers and

tenants. Implementation of Resolution 3,545 terms by all credit agents was optiona l as

of May 1

st

,2008,andobligatoryasofJuly1

st

,2008.

Although seemingly restrictive at first, the conditioning mea sures of Resolution 3,545

8

were subject to a series of qualifications that loosened the severity of the new credit

constraints. This was pa rticula rly relevant for small-scale producers. In its original text,

Resolution 3,545 already established exemptions for three groups of small credit takers.

The first group, composed of Pronaf beneficiaries and rural producers operating in areas

smaller than or equal to four fiscal modules

5

, was still required to present the CCIR, but

could replace the rest of the documentation by an individual declaration attesting the

existence of the required legal reserve and area of permanent protection, and the absence

of current embargoes caused by the economic use of illegally deforested areas within the

credit taker’s establishment.

The second group, encompassing beneficiaries of the National Program of Land Re-

form (Programa Nacional de Reforma Agrária, PNRA) who fit into Pronaf groups A

6

and A/C

7

,couldreplacealldocumentationbyadeclarationissuedbytheNationalIn-

stitute of Colonization and Land Reform (Instituto Nacional de Colonização e Reforma

Agrária,Incra)eitherattestingthelandreformsettlement’senvironmentalregularity,or

indicating that a term on the regularizatio n of the settlement had been agreed upon. An

annex with a list of all land reform settlement beneficiaries had to be included in the

documentation.

The third group, restricted to family producers fitting into Pronaf group B

8

,was

not required to present any documentation. As the three groups referred to small-scale

producers, these exemptions implied that Resolution 3,545 established less restrictive

conditions for small producers.

Soon after the compulsory adoption of the resolution, new CMN measures further

loosened the requirements for the co ncessio n of rural credit to small producers. With the

passing of Resolution 3,599 on August 2 9

th

,2008,borrowersfromthefirstgroupcould

5

The actual size of a fiscal module varies according to municipality. It depends mainly on the conditions of

pro duction in each municipality including, but not limited to, market dynamics, installed infrastructure,

technologic al availability, and natural features such as soil quality and water availability.

6

Pronaf Group A refers to family producers settled into PNRA land reform settlements, as well as

to beneficiaries of the National Program of Land Credit (Programa Nacional de Crédito Fundiário,

PNCF) who have not yet taken investment credit under the Program of Special Credit for Land Reform

(Programa de Crédito Especial para a Reforma Agrária,Procera)orthathavenotyetreachedthe

maximum credit limit for structural investment within Pronaf. The group also includes family producers

who were relocated due to the construction of dams for use in hydroelectric power generation or for the

provision of water to land reform settlements.

7

Pronaf Group A/C refers to family producers settled into PNRA land reform settlements, as well as to

beneficiaries of the PNCF who not only possess the Group A/C Declaration of Eligibility for Pronaf

(Declaração de Aptidão ao Programa, DAP), but who have also already contracted a first op eration in

Group A, and have not obtained financing for working capital in a Pronaf group other than A/C.

8

Pronaf Group B refers to family producers that meet all of following criteria: (i) explore a fraction of

land as owner, land reform settler, tenant or associate; (ii) live in or near the property; (iii) have access

to an area no greater than four fiscal modules; (iv) derive at least 30% of family income from both the

agricultural and non-agricultural exploration of the property; (v) base exploration of the prop erty on

family labor; and (vi) have total family income of up to BRL 6,000 (USD 2,962.20), excluding social

benefits. This group is known as Pronaf’s rural microcredit group.

9

present a declaration attesting not the existence, but the recomposition or regeneration of

the required legal reserve and area of permanent protection within their establishments.

Similarly, instead of attesting the land refo rm settlement’s environmental regularity, the

Incra declaration presented by borrowers from the second group could attest that the land

reform settlement had an environmental license or that the process for obtaining such

license had already been started. Resolution 3,599 and Resolution 3,61 8 from September

30

th

, 2008, also included the fo llowing in the list of Pronaf beneficiaries exempted from

presenting any documentation: indigenous people, quilombolas,

9

,small-scalefishermen,

inhabitants or users of conservation units of sustainable use, and reg ula r inhabitants of

river margins.

Small producers also benefitted from several exceptions introduced for specific harvest

years. The CMN determined that the CCIR could be substituted either by the DA P (a

document held strictly by eligible Pronaf beneficiaries) for program beneficiaries, or by a

CCIR request for all other rural producers operating in areas no greater than four fiscal

modules. Resolution 3,618 introduced this new rule for the 2008/2009 harvest year, and

Resolution 3,735, published on June 17

th

,2009,extendedittothe2009/2010harvest

year.

From an institutional perspective, Resolution 3,545 established the same restrictions

and exceptions in all municipalities to which it applied and, thus, represented a homoge-

neous policy change across regions. Even so, its impact on rural credit concession and,

consequently, on deforestation may have differed across economic sectors due to struc-

tural heterogeneity. A key structural difference we take into account is the composition

of sources used to meet financial requirements for crop and cattle production. According

to FAO (2007), the relative participation of official rural credit contracts has decreased,

as agricultural financing, particularly for soybean production, has increasingly been ob-

tained through contracts with traders, input and processing industries, and retailers and

market operators. Government credit meets an estimated 30% of the financial require-

ments of the soybean production sector in Brazil, but the remaining funds are provided

by traders and the processing industry (40%), the input industry (15%), and farmers’

own resources (10%), with the remaining 5% being attributed to other sources, such as

manufacturers of agricultural machinery (FAO (2007)). A crop farming sector that is not

heavily dependent on official rural credit, as appears to be the case in Brazil, could com-

pensate the decrease in official rural credit imposed by Resolution 3,545 with alternative

sources of financing. Producers operating in this sector would thus be able to sustain

investment and deforesta tio n at the same levels as before the credit policy intervention.

Crop production in Brazil also experienced relevant technological advances starting in

the early 1990s, particularly with the widespread adoption of direct seeding (FAO (2007)).

9

Quilombolas are inhabitants of quilombos settlements traditionally founded by escaped slaves.

10

No such pattern was observed for livestock farming, which remains a low-produ ctivity

practice in the country. Cro p fa rmers likely invest a larger share of rural credit loans

in the intensification of production, instead of expanding production by operating in the

extensive margin as cattle ranchers do. In this case, a decrease in rural credit for crop

farmers might not lead to a decrease in forest clearings, since resources were not originally

being used to push agricultural production into forest areas. We examine these potential

sectoral differences.

Resolution 3,545 was originally proposed as a means to restrict credit to those who did

not abide by environmental regulations in the Amazon Biome. However, the resolution

was flexible for small producers already a t its outset, and became increasingly so in a

relatively short period of time. Additionally, altho ugh the resolution constituted an insti-

tutional change at the federal level, regional heterogeneities may have influenced the way

in which the resolution impacted local access to credit and, thus, affected deforestation.

It is therefore likely that Resolution 3,545’s effects differed among different segments of

producers and regions. We explore this idea in the empirical analysis described in the

remainder o f this paper.

4. Model

This section presents the theoretical model that guides our empirical analysis. The

model, inspired by Banerjee and Duflo (2012), focuses on how credit constraints can influ-

ence deforestation when different production technologies are available to the producer.

Suppose a farmer operates in a forest a rea and chooses one among two agricultural

production technologies - traditional or modern. With the traditional technology, the

farmer produces agricultural output using labor and land inputs. This traditional tech-

nology is described by:

f(L, T ) (1)

where L is labor employed and T is area used for production. With the modern technol-

ogy, in addition to labor and land, the farmer also uses other inputs, K,suchastractors

and fertilizers. This modern technology is described by:

F (K, L, T )=A(K)f(L, T ) (2)

Assume that labor can be paid at the end of the harvest period, but that expenditures

with non-labor inputs must be paid in advance. Taking M as total working capital

av ailable to the farmer, working capital constraints are given by p

T

T ≤ M and p

K

K +

p

T

T ≤ M for the traditional and modern technologies, respectively. These constraints

allow for the possibility of existing binding credit financing as in Feder (1985) and Udry

(2010). A farmer using the traditional technology therefore faces the following decision

11

problem:

π

traditional

(M)=max

L,T

f(L, T ) − p

L

L − p

T

T (3)

subject to p

T

T ≤ M

Similarly, the decision problem for a farmer using the modern technolo gy can be described

as:

π

modern

(M)=max

K,L,T

A(K)f (L, T ) − p

K

K − p

L

L − p

T

T (4)

subject to p

K

K + p

T

T ≤ M

Thus, a farmer with available working capital M chooses the modern technology if, and

only if, π

modern

(M) ≥ π

traditional

(M).DefineM

0

such that π

modern

(M

0

)=π

traditional

(M

0

).

We assume that p

k

and A(K) are such that all farmers with M ≥ M

0

choose the modern

technology. In summary:

π (M)=

π

traditional

(M)ifM<M

0

π

modern

(M)ifM ≥ M

0

(5)

Within this framework, with the farmer operating in a forest area, the choice of area

to be used for productio n is equivalent to deforestation. We are therefore pa rticul arly

interested in how optimal farmland size is affected by the availability of capital when the

farmer is allowed a choice of production technology.

To simplify the analysis, we consider specific functional fo rms for the production

functions, assuming that f (L, T )=L

β

T

γ

and A(K)=K

α

, where α > 0, β > 0, γ > 0

and α + β + γ < 1. The assumption of decreasing returns to scale helps determine a finite

optimal farmland size. We focus on the characterization of the optimal land input. For

the traditio na l technology, the optimal choice of farmland is given by:

T

traditional

(M)=

M

p

T

, ifM<M

T

∗

traditional

ifM ≥ M

(6)

(7)

where T

∗

traditional

≡

γ

p

T

1−β

1−β−γ

β

p

L

β

1−β−γ

and M = p

T

T

∗

traditional

.Forthemoderntech-

nology, the optimal choice of farmland is given by:

T

modern

(M)=

γ

α + γ

M

p

T

ifM<M

T

∗

modern

ifM ≥ M

(8)

12

where T

∗

modern

≡

α

p

K

α

1−α−β−γ

β

p

L

β

1−α−β−γ

γ

p

T

1−α−β

1−α−β−γ

and M = p

K

K

∗

modern

+p

T

T

∗

modern

.

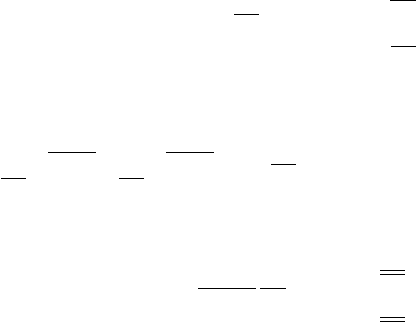

The relative values of M

0

,

M and M define different possible cases. For example, a

configuration such that M

0

< M<M implies in the optimal farmland size graph shown

in Figure 2.

Define M

∗

as the farm’s total investment if the farmer can borrow as much as he

wants at the interest rate r. Thus,

M

∗

(r)=argmax

M

Π(M) − (1 + r)M (9)

represents the first-best investment level.

We assume that a typical farmer can be financed by two different sources and ignore,

for the sake of simplicity, the possibility of self-financing. A subsidized rural credit line

is available at cost r

b

, which is b elow the market interest rate r

m

, r

b

<r

m

.Denotingthe

amounts of subsidized rural credit and market credit as M

b

and M

m

,respectively,total

investment is given by M = M

b

+ M

m

. Following Banerjee and Duflo (2012), we say

that a farmer is credit rationed at the subsidized interest rate if M

b

<M

∗

(r

b

),andthat

afarmeriscredit constrained if M<M

∗

(r

m

).

As argued in Section 3, Resolution 3 ,5 45 may have reduced the availability of sub-

sidized rural credit for some farmers in the Amazon Biome. Yet, the supply of credit

supplied at the market rate by agents other than official banks (private and public) and

credit cooperatives was not directly affected by the resolution. Our theoretical model

offers intuition on how farmers are expected to react to this change in the supply of

credit, and thereby potentially affect deforestation, under different assumptions about

the availability of financial reso u rces.

To restrict the ana lysis to a simple, yet interesting, situation, consider the case de-

picted in Figure 2, where M

0

< M<M .Otherconfigurationscanbeconsideredanal-

ogously. Start with the region where total investment lies below M .Increasesinthe

availability of resources within each technology region - (0,M

0

) or (M

0

, M) -affect land

size positively. There being no change in the choice of production technology, a reduction

in credit leads to a decrease in optimal farmland size a nd thereby reduces deforestation.

However, changes in the availa bility of resources that cause farmers to switch between

technology regions - from (0,M

0

) to (M

0

, M) or vice-versa - have an ambiguous effect on

land size. A reduction in credit may lead the farmer to substitute the modern technology

for the traditional one, potentially leading to an increase in optimal farmland size and

deforestation. In the region where total investment lies above M ,farmersarenotcredit

constrained, so changes within this region do not affect o ptimal farmland size. Thus, a

reduction in M

b

that keeps the farmer in the unconstrained region does not affect defor-

13

estation, but a reduction in the availability of resources that pushes that farmer into the

(M

0

, M) interva l will reduce optimal farmland size and deforestation. An even stronger

reduction in the availability of resources that further pushes the farmer into the (0,M

0

)

interval has an ambiguous impact on deforestation. Propositions 1-3 summarize these

results in the context of the credit reduction implied by Resolution 3,545.

Proposition 1: If the reduction in the availability of subsidized rural credit causes a

reduction in deforestation, we can conclude that: (i) farmers are credit constrained; and

(ii) credit and deforestation have a positive relationship in the region.

Proposition 2: If the reduction in the availability of subsidized rural credit does

not affect the amount of cleared land, we can conclude that: (i) either farmers are not

credit constrained (they could simply be substituting subsidized rural credit by market

credit); or (ii) farmers are credit constrained, but are changing from the modern to the

traditional technology.

Proposition 3: If the reduction in the availability of subsidized rural credit implies

an increase in deforestation, we can conclude that: (i) farmers are credit constrained; and

(ii) they are changing from the modern to the traditional technology.

In summary, a subsidized credit policy restriction can: (i) serve as evidence of credit

constraints if we observe an impact on deforestation; and (ii) reveal whether the rele-

vant margin is change in optimal farmland size within a given technology (decreasing

deforestation) or change across production technologies (increasing deforestation).

5. Data, Descriptive Statistics and Stylized Facts

This section introduces the data used in our empirical evaluation of Resolution 3,545,

presents descriptive statistics and discusses stylized facts to characterize aggregate trends

for our variables of interest.

5.1. Data on Rural Credit

Our analysis is based on two panels of municipality-level data covering the 2002

through 2011 period. The first panel is constructed from a contract-level microdata

set of rural credit loan contracts compiled by the Central Bank from Recor data. This

is an administrative microdata set enco mpa ssin g all rural contract records negotiated by

official banks - both public and private - and credit cooperatives in the Legal Amazon

states of Acre, Amazonas, Amapá, Maranhão, Mato Grosso, Pará, Rondônia, Roraima

and Tocantins.

10

It contains detailed information about each contract, such as the exact

day on which it was signed, its value in BRL, the contracted interest rate and maturation

date, its intended use by agricultural activity, and the category under which credit was

10

Only a fraction of the state of Maranhão is considered part of the Le gal Amazon. Our sample only

includes mu n ic ipalities from this fraction.

14

loaned (short-term operating funds, investment, or commercialization). The data set also

contains information about the official source of funding for each contract, allowing us to

identify whether lo a ns fit into Pronaf or non-Pronaf credit lines. All contracts are linked

to a code identifying the municipality in which the borrower’s landholding is located. We

add up the value of the contract loans across all days in each month and each municipality

to co nvert the microdata panel into a municipality-by-month panel.

Since Resolution 3,545 conditions applied to all esta blishments in municipalities lo-

cated entirely within the Amazon Biome, we merge our panel of municipality-by-month

credit loans data with a geocoded map containing information on the biome’s geographic

limits and municipalities’ location. We then identify, for each sample municipality,

whether it is entirely located inside the Amazon Biome. We also construct variables

indicating the shortest lin ear distance, in kilometers, between each municipality’s border

and the biome frontier. Using this variable, we can create subsamples of municipalities,

both inside and outside the Amazon Biome, located within sp ecific distances to the biome

frontier.

To smoothen the large cross-sectional variation in values of credit contracts generated

by different municipality sizes, we use a normalized measure of rural credit. This nor-

malization ensures that our analysis captures relative variations in credit lending within

municipalities. The variable is constructed according to the following expression:

Credit

it

=

C

it

− C

it

sd (C

it

)

(10)

where Credit

it

is the normalized amo unt of rural credit loaned in municipality i and

month-year t;thetermC

it

is the amount of rural credit loaned in municipality i and

month-year t in BRL; and the terms C

it

and sd (C

it

) are, respectively, the mean and the

standard deviation of the amount of rural credit loaned in municipality i over the 2002

through 2011 period. The variable C

it

replaces Credit

it

in robustness checks.

The final data set containing information on rural credit, time, and geographic vari-

ables at the municipality-by-month level is used to evaluate the impact of Resolution

3,545 on rural credit loans. Our sample does not include municipalities crossed by the

biome frontier, since only those farmers whose landholdings are entirely located within

the biome in these municipalities are subject to the resolution’s conditions. The full sam-

ple is composed by 713 Legal Amazon municipalities, of which 458 are located inside the

Amazon Biome and 255 outside it. We use our constructed distance variable to create

a restricted subsample that o nly includes municipalities located within 100 kilometers of

the biome frontier. This subsample has 387 municipalities, of which 132 are inside the

Amazon Biome and 255 outside it. We construct a second restricted subsample composed

by municipalities where the pre-2 0 0 8 average value of annual credit loans for cattle ranch-

15

ing was higher than that for crop production. This "cattle-oriented" subsample co ntains

301 municipalities located inside the Amazon Biome and 154 outside it. Finally, we con-

struct an analogous restricted subsample of municipalities where the pre-2008 average

value of annual credit loans for crop production was higher than that for cattle ranching.

This "crop-oriented" subsample contains 133 located inside the Amazon Biome and 101

outside it.

5.2. Data on Deforestation

The second panel of data relates rura l credit loans to deforestation at the municipality

level. Data on deforestation is built from satellite-based images that are processed at the

municipality level and publicly released by PRODES/INPE. Because PRODES data is

reported annually, we must first convert our municipality-by-month credit panel into a

municipality-by-year credit panel. We define deforestation as the annual deforestation

increment, that is, the area in square kilometers of forest cleared over the twelve months

leading up to August of a given year.

11

We recode credit loans accordingly, summing up

monthly data into an annual basis, where year t data sums information over the twelve

months leading up to August of t.

For any given municipality, cloud cover during the perio d of remote sensing may

compromise the accuracy of satellite images, requiring images to be produced at a different

time. As a result, image records for different years may span from less to more than twelve

months. To control for measurement error, variables indicating unobservable areas are

included in all regressions. This data is also publicly available at the municipality-by-year

level from PRODES/INPE.

To smoo then the cross-sectional variation in deforestation that arises from municipal-

ity size heterogeneity, we use a normalized measure of the annual deforestation increment.

The normalization ensures that our analysis considers relative variations in deforestation

increments within municipalities. The variable is constructed according to the following

expression:

Deforest

it

=

ADI

it

− ADI

it

sd (ADI

it

)

(11)

where Def or e st

it

is the normalized annual deforestation increment for municipality i and

year t; ADI

it

is the annual deforestation increment measured in municipality i between

the 1

st

of August of t − 1 and the 31

st

of July of t;andADI

it

and sd (ADI

it

) are,

respectively, the mean and the standard deviation of the annual deforestation increment

calculated for each i over the 2002 through 2011 period. The variable ADI

it

replaces

Deforest

it

in robustness checks. Our sample does not include municipalities that showed

11

More precisely, the annual deforestation increment of year t measures the area in square kilometers

deforested between the 1

st

of August of t − 1 and the 31

st

of July of t.

16

no variation in deforestation throughout the sample yea rs, as this variation is needed to

calculate the normalized variable.

The final data set containing information on deforestation, rural credit, time, and

geographic variables at the municipality-by-year level is used to estimate the effects of

the credit restriction on deforestation. Aga in, we do not include municipalities crossed

by the biome frontier. The full sample comprises 575 Legal Amazon municipalities, of

which 439 are located inside the Amazon Biome and 136 outside it. We also construct the

three restricted subsamples introduced in Section 5.1. Their composition is as follows:

251 municipalities within 10 0 kilometers of the Amazon Biome frontier (115 inside the

biome and 136 outside it); 406 cattle-oriented municipalities (301 inside the biome and

105 outside it); and 141 crop-oriented municipalities (110 inside the biome and 31 outside

it).

5.3. Agricultural Output Prices and the Demand for Credit

Agricultural prices a re endogenous to local agricultural production. Thus, to control

for fluctuations in the demand for rural credit at the municipality level, we must construct

output price series that capture exogenous variations in the demand for agricultural com-

modities produced locally. As argued in Assunção et al. (2011), agricultural commodity

prices recorded in the southern Brazilian state of Paraná are highly correlated with av-

erage local crop prices calculated for the Legal Amazon sample municipalities. Hence,

we use the Paraná agricultura l commodity price series as exogenous indicators of lo ca l

market conditions within our empirical context. Prices for beef cattle, soybean, cassava ,

rice, corn, and sugarcane were collected at the Agriculture and Supply Secretariat of the

State of Paranáą (Secretaria de Agricultura e do Abastecimento do Estado do Paraná,

SEAB-PR). Soybean, cassava, rice, and corn are predominant crops in the Legal Amazon

in terms of harvested area. Although not a predominant crop in the region, sugarcane is

also included to take into consideration the recent expansion of Brazilian ethanol biofuel

production. Together, the five crops account for approximately 70% of total harvested

area averaged across sample years.

The Paraná price series are used to build two variables of interest. The first of these

variables, an annual index of crop prices, is constructed in three steps. First, we calculate

nominal monthly price series for each calendar year-month and culture. Annual prices

are defla ted to year 2011 BRL and are expressed as an index with base year 2011.

Second, we calculate a weighted real price for each of the crops according to the

following expression:

PPA

itc

= PP

tc

∗ A

ic,2000−2001

(12)

where PPA

itc

is the weighted real price o f crop c in municipality i and year t; PP

tc

is the

Paraná-based real price of crop c in year t expressed as an index with base year 2000; and

17

A

ic,2000−2001

is the share of municipal area used as farmland for production of crop c in

municipality i averaged over the 2000 through 2001 period.

12

This latter term captures

the relative importance of crop c within municipality i’s agricultural production in the

years immediately preceding the sample periods. It thus serves as a municipality-specific

weight that introduces cross-sectional variation in the commodity price series.

Third, we use principal component analysis on the weighted real crop prices to derive

the annual index of crop prices. This technique allows the price variations tha t are

common to the five selected crops to be represented in one single measure. The resulting

index of crop prices captures the first principal component of the five weighted real

prices. As the index maximizes the price variance, it represents a more comprehensive

measure of the agricultural output price scenario for this analysis than the individual

prices themselves. Moreover, by using the index of crop prices, which absorbs b o th cross-

sectional and time-specific trends at the municipality level plausibly correlated with credit

demand, we overcome an important empirical limitation.

The second variable of interest is a n annual index of cattle prices, which is derived anal-

ogously to PPA

itc

.However,aslandpastureisnotobservable,inthiscaseA

ci,2000−2001

is the ratio of heads of cattle to municipal area in municipality i averaged over the 2000

through 2001 period.

5.4. Stylized Facts and Trends

This section presents stylized facts and trends for rural credit and deforestation over

the past ten years. In this set of descriptive results, the evolution of agg reg ate credit

is influenced by both economic conditions and changes in the regulatory and institu-

tional landscape. Tables and figures shown were built from the contract-level credit loan

microdata set and the deforestation data set.

Table 1 presents descriptive statistics for average annual amounts of rural credit and

deforestation at the municipality level. Figures for Amazon Biome municipalities before

and after the implementation of Resolution 3,545 are compared with those for Legal

Amazon municipalities outside the biome. The statistics point towards more accentuated

aggregate rural credit growth in the post-resolution period in Legal Amazon municipalities

located outside the Amazon Biome, where borrowers were not subject to the resolution’s

restrictions. Average Pronaf loans inside the biome also seem to have grown more than

non-Pronaf loans, as is to be exp ected in light of the exemptions introduced for small-scale

producers operating in the Amazon Biome. Average deforestation, which is significantly

12

Variables on annual municipality crop production (harvested area, quantum,orvalueincurrentprices)

are based on data originally from the Municipal Crop Survey of the Brazilian Institute for Geog-

raphy and Statistics (Pesquisa Agrícola Municipal do Instituto Brasileiro de Geografia e Estatística,

PAM/IBGE).

18

higher in Ama zo n Biome municipalities, dropped sharply both inside and outside the

biome.

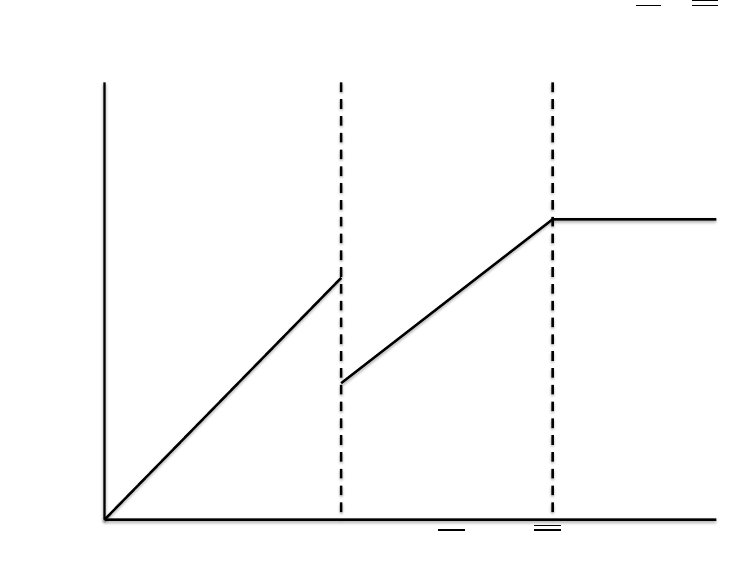

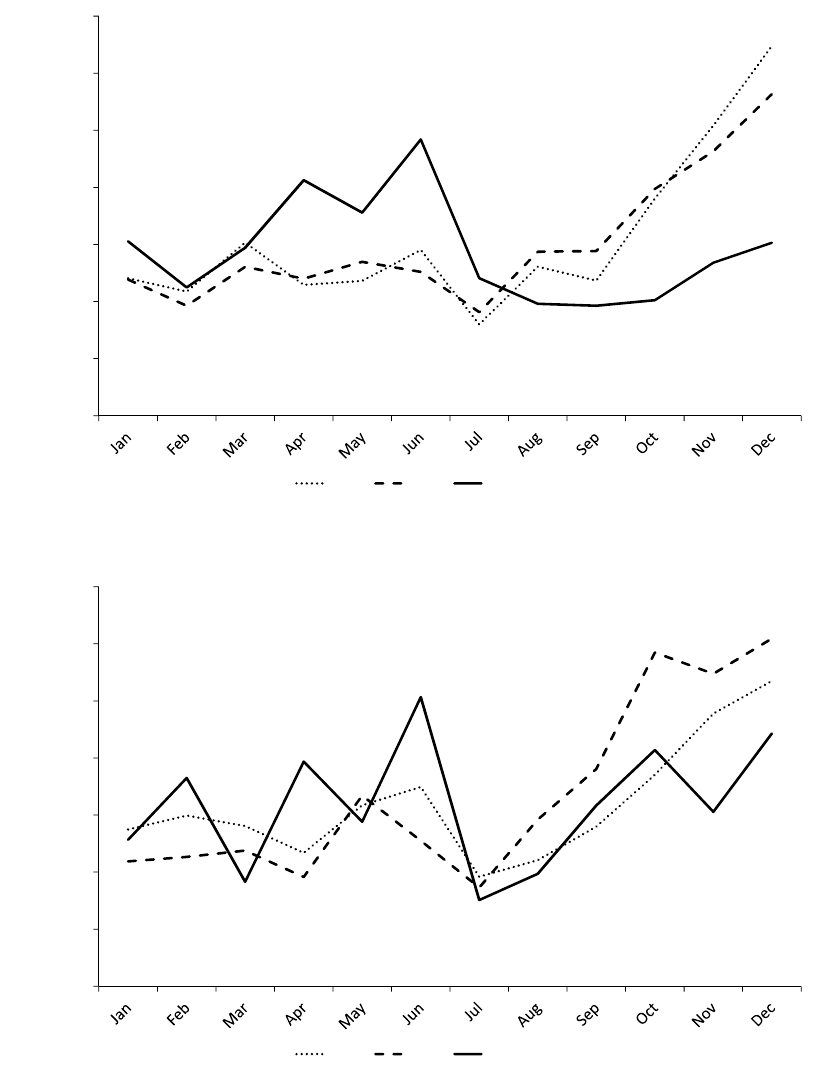

Stylized facts also hint at potential effects of Resolution 3,545. In Figure 3, average

rural credit loan trends for Amazon Biome municipalities do not seem to follow those for

its unrestricted counterpart outside the biome in the post-2008 period. The difference

in growth rates appears in both cattle and crop-oriented samples, suggesting that the

resolution imposed a binding credit constraint for rural producers within the biome.

Yet, as the pattern of credit loan trends differ for cattle and crop-oriented samples, our

empirical analysis explores whether the resolution’s impact depends on economic activity

heterogeneity.

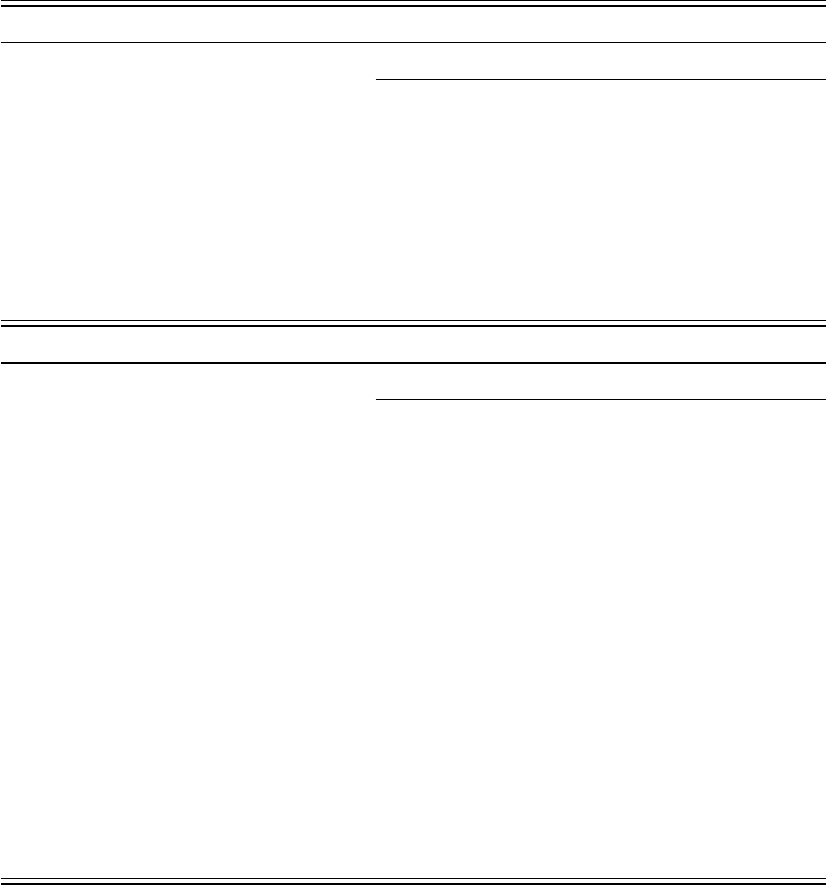

Acloserlookattheevolutionofruralcreditloansthroughout2008revealsthatthe

constraint seems to have been anticipated by credit takers. Figure 4 illustrates this

phenomenon. While credit concession in 2006 and 2007 concentrated in the second half

of each year, it followed a very different pattern in 2008, peaking in April and again

in June. The total amount of credit negotiated in 2008, however, is similar to that of

previous years. Considering that the adoption of the measures established in Resolution

3,545 was optional as of May 1

st

and compulsory as of July 1

st

,theunseasonablepeaks

in 20 0 8 likely reflect borrowers’ efforts to have early access to resources that would soon

be restricted. Consequently, an accentuated decrease in the concession of credit was not

observed in 2008 despite the restrictions imposed by Resolution 3,545. This behavio r is

more clea rly seen in the trends for cattle-specific contracts than for crop-specific ones,

perhaps due to the intrinsically seasonal component of crop production. Alternatively,

this could be because crop farmers were less vulnerable to the reduction in subsidized

rural credit. As they were able to access credit from other sources even after the resolution

had been adopted, they had less need to anticipate credit prior to the policy.

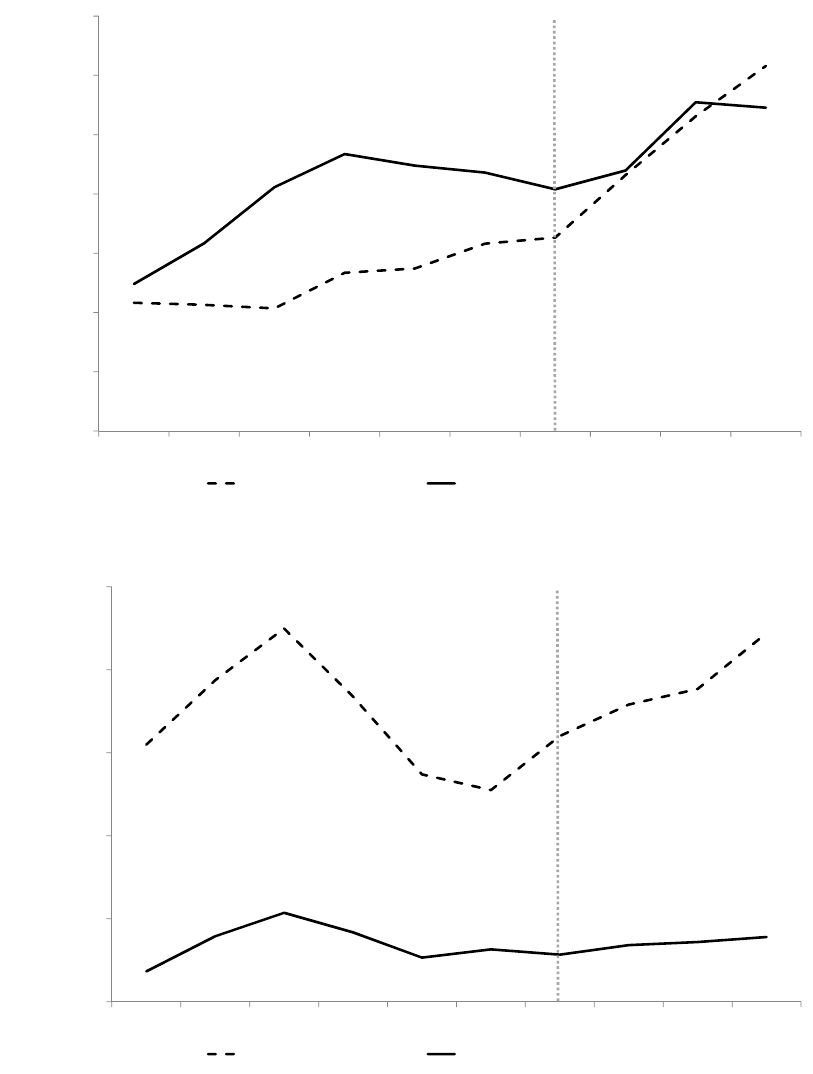

In addition to assessing the resolution’s impact on rural credit concession, we are

interested in understanding how it affected deforestation. Figure 5 portrays the evolution

of average municipality-level deforestation. Deforestation dropped significantly starting

in the mid-2000s in Lega l Amazon municipalities both inside and outside the Amazon

Biome. In the post-2008 period, however, trends for biome municipalities appear to

behave differently from those for non-biome municipalities - deforestation exhibits more

accentuated drops inside the biome immediately after the adoption of Resolution 3,545

both in the cattle and the crop-oriented subsamples. Although not yet conclusive, this

could be an indication both that deforestation is a credit-dependent activity and that

there are relevant credit constraints for forest clearing in the Amazon Biome.

The stylized facts discussed in this section provide a descriptive overview of how

Resolution 3,545 might have affected the evolution of rural credit and deforestation in

the Amazon Biome. However, these facts capture the effects of other influencing factors,

19

particularly those of eco no mic circumstances in the Amazon Biome during the period of

interest. To evaluate the impact of Resolution 3,545, we must isolate the effect of the

resolution from that of other determinants of rural credit.

6. Empirical Strategy

This section describes the empirical strategy used to identify the causal effect of rural

credit on deforestation. Since only equilibrium prices and quantities are observed in the

credit market, many of the identification concerns mentioned in the literature have been

related to reverse causality and omitted variables. Reverse causality might take place if

the expansion of agricultural activities beyond the farmer’s landholding is done at the ex-

pense of public areas of forest. In this case, deforestation and appropriation of public land

increase real estate and collateralized asset-based lending, thereby allowing the farmer to

overcome borrowing constraints. Omitted variables that are simultaneously associated

with credit and land use, such as regional growth and agricultural output prices, may

also trivially jeopardize identification. In this paper we limit identification problems by

exploring the different margins of a credit policy break that generated exogenous varia-

tions in credit supply, within and across municipalities of the Brazilian Amazon, in the

late 2 0 0 0 s.

Our strategy foll ows a two -sta g e procedure. First, we evaluate Resolution 3,545’s

impact on rural credit market quantities. Then, we use different margins of this policy

change to derive instrumental variables for rural credit, which help us identify a causal

effect of rural credit on deforestation in a two-stage least squares (2SLS) estimation.

6.1. First Stage: Impact on Rural Credit

We explore different dimensions of Resolution 3,545 to provide a general characteri-

zation of its impacts on rural credit. First, the resolution specifically established that the

conditions to credit concession applied to municipalities in the Amazon Biome only. This

generates an explicit geographic cleavage between two groups of municipalities within

the Legal Amazon. We refer to municipalities located entirely within the Amazon Biome

as the intervention group. Legal Amazon municipalities located outside the biome form

the control group. Although intervention and contro l groups may systematically differ in

terms of long-persistent geographical characteristics, both have been exposed to similar

economic fluctuations and political cycles. This is particularly consistent for municipal-

ities near the biome frontier. This specific geographic break in Resolution 3,545, nested

within our monthly data on municipalities, allows us to perform a difference-in-differences

estimation defined by the following equation:

Credit

it

= α

i

+ φ

t

+ β

1

(Biome

i

∗ Post2008

t

)+β

2

P rices

it

+ β

3

P riority

it

+ �

it

(13)

20

where Cred it

it

is the normalized amount of rural credit loaned in municipality i and time

t, which indexes a specific month throughout the period.

We estimate models for total municipality rural credit loans, as well as for cattle and

crop-specific loans separately. Our variable of interest is the interaction of a dummy indi-

cating whether the municipality is located within the Amazon Biome, Biome

i

, with a vari-

able that indicates the period after the implementation of Resolution 3,545, Post2008

t

,

which includes all years from 2008 o nwards. We consider all of 2008 as part of the post-

resolution p eriod to avoid finding a significant coefficient when, in fact, we are simply

capturing the anticipation effect (recall that credit concession in the biome was very low

in the first half of 2008 and very high in the second half).

The term α

i

includes municipality fixed effects, which absorb initial conditions and

persistent municipality characteristics, such as geography and transport infrastructure.

The term φ

t

includes month fixed effects, which also absorb year fixed effects by con-

struction. These variables control fo r common time trends, such as seasonal fluctuations

in agricultural activity, macro eco nomic conditions, common rural policies, and the po-

litical cycle. The term P rices

it

proxies for municipality-specific demand for credit, as it

includes annual cattle and crop price indices (current and lagged) varying over time at

the municipality level. Finally, the term P riority

it

indicates municipalities included in a

priority list of top deforesters, which have recently been the focus of conservation policy

efforts. The parameter of interest β

1

captures the causal effect of Resolution 3,545 on

rural credit if the residuals contain no omitted variables driving the correlation between

the policy and either the demand for and/or supply of credit loans.

We rely on another difference-in-differences strategy to explore a second dimension

of Resolution 3,545’s design. As explained in Section 3.1, Resolution 3,545 established

exemptions regarding requirements for small producers. Considering that Pronaf bene-

ficiaries are, by definition, small producers, and taking into account that the restrictive

conditions were eased specifically for credit loans contracted via Pronaf credit lines, the

comparison between Pronaf and non-Pronaf loans within municipalities, before and af-

ter the resolution, offers another source of exogenous variation in credit supply. The

specificities of the policy design therefore enable us to construct intervention and control

groups within municipalities located in the Amazon Biome. We take advantage of this

by estimating a triple-differences model that compares rural credit loans before and after

the implementation of Resolution 3,545, in municipalities located inside and outside the

biome, a nd between Pronaf and non-Pronaf groups within municipalities. This strategy,

based on an extension o f model (13), is defined by the following equation:

Credit

itk

= α

i

+ φ

t

+ β

1

Nonpronaf

it

+ β

2

(Nonpronaf

it

∗ Biome

i

)+

21

+β

3

(Nonpronaf

it

∗ Post2008

t

)+β

4

(Biome

i

∗ Post2008

t

)+ (14)

+β

5

(Nonpronaf

it

∗ Biome

i

∗ Post2008

t

)+β

6

P rices

it

+ β

7

P riority

it

+ �

itk

where Credit

itk

is now the amount of rural credit loaned in municipality i,attimet,and

of type k ∈ {Pronaf, non-Pronaf}. The term Nonpronaf

it

is a dummy assuming value 1

if (k = non-Pronaf) and 0 otherwise, which we interact with the dummies Post2008

t

and

Biome

i

. The parameter of interest β

5

is expected to capture the marginal variation in

non-Pronaf credit loans within the Amazon Biome after the implementation of Resolution

3,545.

We discuss some caveats associated with models (13) and (14) in robustness checks.

In all specifications, standard errors are robust to arbitrary forms of heteroscedasticity

and clustered at the municipality level to allow for correlation at a given time, and across

time within municipalities.

6.2. Second Stage: Impact on Deforestation

Using the municipality-by-year panel detailed in Section 5.2, we can therefore use

models (13) and (14) as first stage regressions in a 2SLS approach, which helps us identify

acausaleffect of rural credit on deforestation.

We begin by defining a second stage specification for which model (13) is the first

stage:

Deforest

it

= α

i

+ φ

t

+ δ

1

Credit

it

+ δ

2

P rices

it

+ δ

3

P riority

it

+ X

it

δ

4

+ �

it

(15)

where Def or e st

it

is deforested area in municipality i and year t,and

Credit

it

is the total

value of rural credit loans in municipality i and year t,instrumentedbytheinteraction

variable (Biome

i

∗ Post2008

t

). The terms α

i

, φ

t

, P rices

it

,andP riority

it

are defined

as in model (13), although the subscript t now indexes year. All regressions include the

term X

it

, which adds controls fo r the size of unobservable areas (or measurement error)

during the period of remote sensing.

The second stage specification alternatively uses model (14) as first stage, and is

defined analogously to model (15). In this case, however, the unit of observation is

the cell indexed by itk, where k ∈ {Pronaf, non-Pronaf}. The dependent variable is

now Def orest

it

,invarianttok. The variable of interest is

Credit

itk

,thetotalvalueof

rural credit loans in municipality i and year t,instrumentedbytheinteractionvariables

Biome

i

∗ Post2008

t

, N onpronaf

it

∗ Post2008

t

,andN onpronaf

it

∗ Biome

i

∗ Post2008

t

.

The identification hypo thesis in both 2SLS specifications is th at, conditioned upon

the control variables, instrumented credit is orthogonal to any latent determinant of

deforestation. Alternatively, the instrumental variables should be strongly correlated

with rural credit loans, but orthogonal to the error term in the second stage reg ressio n.

22

As arg ued above, this strategy is valid because Resolution 3,545 provides sources of

plausibly exo g eno us varia tion in rural credit loans in the Legal Amazon.

Resolution 3,545 was formally designed to restrict the concession of credit in the

Amazon Biome, with exceptions rendered to small producers. As argued in the previ-

ous section, these two dimensions of the resolution’s design provide potential sources of

exogenous variation in rural credit loans within the Legal Amazon.

Athirddimensionofitsdesignstrengthensthevalidityofusingtheresolution-induced

change in rural credit as an exogenous source of v ariation. Resolution 3,545 conditions

were such that borrowers who proved that they had the intention to comply with en-

vironmental regulation were allowed access to credit. This meant that producers who

feared the resolution might affect their future access to credit could signal an intent to

change their deforestation behavior in the future and be considered compliant with envi-

ronmental regulation at the present. This could invalidate the exclusion restriction of our

instrumental variable, si nce farmers who are not meeting environmental regulation at the

present alter their deforestation behavior for rea sons other than a concurrent reduction

in credit caused by Resolution 3,545. However, this introduces a bias that runs in the

opposite direction of our expected positive coefficient. After all, these producers will

suffer no credit effect (as their intention to comply makes them compliers), but still re-

duce deforestation, driving downwards the coefficient of interest. In terms of meeting the

resolution’s requirements, intention to comply is equivalent to compliance. Thus, there

were no other channels linking Resolution 3,545 and deforestation during the period of

interest. This eliminates a potential source of concern regarding the validity of using

the policy change as an instrument for credit and enables us to empirically examine the

relationship between credit and deforestation.

7. Policy Implementation and Effectiveness

This section evaluates the impacts of Resolution 3,545 on rural credit loans. We

start by describing the main results obtained using the empirical strategies detailed in

Section 6.1. We then explore heterogeneity and characterize the policy impact. Finally,

we discuss caveats and present robustness checks.

7.1. Credit Constraint

Table 2 presents the results for regressions based on model (13) (Panel A) and model

(14) (Panel B), using normalized rural credit at the municipality level as the dependent

variable. Coefficients in Panel A show that, conditioned upon controls, Resolution 3,545

was associated with a reduction in rural credit concession in the Amazon Biome, as com-

pared with the rest of the Legal Amazon. This effect is significant for total rural credit,

as well as for cattle and crop-specific loans. The impact on cattle-specific loans is larger

23

than that on crop-specific lo a ns, and the difference b etween their respective coefficients is

statistically significant. A plausible explanation for this difference is that cattle ranching

is relatively more land-intensive than crop farming, and therefore less compliant with

environmental regulation. In fact, previous studies show that three quarters of the land

cleared in the Legal Amazon have been used for cattle ranching-related activities, al-

though the relative participation of crop farming-related activities in cleared forest areas

has recently increased (see Chomitz and Thomas (2003) and Morton et al. (2006)).

Panel B corroborates the findings of Panel A, reporting even larger impacts when

considering the resolution’s impact on d ifferent kinds of credit takers. For a given mu-

nicipality in the Amazon Biome, credit for the non-Pronaf category decreased relatively

more than for the Pronaf category. These results are to be expected, given that Resolu-

tion 3,545 and associated legislation exempted small-scale producers - particularly Pro na f

beneficiaries - from the more restrictive conditions.

In Table 3, we present results from a counterfactual analysis to quantify the magnitude

of the impact. Our estimates indicate that, in the absence of the policy, total rural credit

and cattle-specific credit in the Amazon Biome would have been much greater than was

actually observed from 2008 onwards. Based on coefficients from Panel A, in which the

control group is composed of municipalities outsid e the Amazon Biome, we estimate that

approximately BRL 2.9 billion (USD 1.4 billion) were not loaned in the 2008 through

2011 period due to restrictions imposed by Resolution 3,545. This is equivalent to about

BRL 725 million (USD 350 million) less credit p er year. The reduction in cattle-specific

credit l oans accounts for 90% of this difference. Estimates obtained from comparing

the resolution’s impact on Pro na f and non-Pronaf credit are very similar, although the

relative role of cattle-specific loans is slightly smaller in this simulation.

7.2. Heterogeneity

Having estimated a significant impact of Resolution 3 ,5 4 5 on the concession o f rural

credit in the Amazon Biome, we are now interested in exploring potential heterogeneous

effects arising from sectoral heterogeneity. Using the cattle-oriented and crop-oriented

subsamples described in Section 5.1, we test whether the resolution’s impact differed

among municipalities with different leading econo mic activity. These restricted samples

further allow us to test whether our estimated coefficients have been jeopardized by

comparing municipalities that are not, in fact, economically comparable.

Table 4 presents results obtained by reproducing the specifications of Table 2 us-

ing the restricted cattle and crop-oriented subsamples. The significant negative coef-

ficient estimated for our variable of interest in the cattle-oriented subsample confirms

that Resolution 3,545 reduced cattle-specific loans inside the Amazon Biome, even when

the comparison is made using only cattle-o riented municipalities both inside a nd outside

the biome. This supports our main results, providing further evidence that the credit

24