Network for Greening the Financial System

Technical document

Nature-related Financial Risks:

a Conceptual Framework

to guide Action by Central Banks

and Supervisors

July 2024

NGFS REPORT

2

T

he twin crises of environmental degradation and climate change pose a signicant threat to life on this planet.

Economic activity depends on nature and society cannot function without the various services that nature provides.

Consequently, the degradation of nature, but also actions aimed at preserving and restoring it, can have material

macroeconomic, macroprudential, and microprudential consequences. Given these far-reaching implications for

economies and nancial systems, central banks and supervisors ought to consider these existential challenges.

Encouragingly, awareness of nature-related risks is growing within the nancial system and beyond. At the end of 2022, nations

around the world adopted the Kunming-Montréal Global Biodiversity Framework (GBF) at the 15

th

Conference of the Parties

(COP15) to the Convention on Biological Diversity. The GBF aims to halt biodiversity loss and restore ecosystems by 2030 and

for humans to live in harmony with nature by 2050. It assigns a prominent role to the nancial sector, with explicit targets for

disclosure and the alignment of nancial ows.

Despite laudable progress, addressing these twin challenges remains a dicult task. The interaction between nature, climate

and the economy is exceptionally complex. At the same time, the window of opportunity for an orderly transition is rapidly

closing. The coming years are going to be critical for achieving both nature and climate goals. It is crucial that policies to address

climate change and nature degradation are designed in conjunction with each other, because without the consideration for

nature, actions to address climate change are bound to fall short. Despite the complexity, it is essential that central banks

and supervisors start to assess nature degradation and its eects on the economy and the nancial system, enhancing and

harmonising our data, metrics and scenarios along the way.

In that spirit, we are proud to publish the nal version of the NGFS Conceptual Framework on nature-related nancial risks which

seeks to guide policies and actions of central banks and supervisors. Following the release of its beta version in September 2023,

it establishes a common understanding of nature-related risks to help central banks and supervisors navigate these complex

challenges. To add colour to that understanding, the Conceptual Framework now also includes two illustrative cases that

demonstrate the application of the risk assessment framework to freshwater and forest ecosystems.

The publication of the nal Conceptual Framework is only the beginning. It marks the starting point of a continuous process to

develop knowledge and experience in this eld, being mindful of the fact that failing to act due to imperfect knowledge would

almost certainly result in a ‘too little, too late’ scenario.

We genuinely appreciate the commitment and dedication of all Task Force members, who contributed to this document, as well

as the valuable engagement of other stakeholders who provided input in the past year. Our special thanks go out to the team

lead and the illustrative cases team in helping to complement and rene the beta version.

Emmanuelle Assouan

Banque de France

Co-Chair of the Task Force

on Nature-related Risks

Sabine Mauderer

Deutsche Bundesbank

Chair of the NGFS

Foreword

Marc Reinke

De Nederlandsche Bank

Co-Chair of the Task Force

on Nature-related Risks

NGFS REPORT

3

Table of Contents

Foreword 2

1. Introduction 5

2. Understanding nature-related nancial risks 7

3. Assessing nature-related nancial risks 12

Phase 1: Identify sources of physical and transition risk 12

Exposures to impacts and dependencies 12

Forward-looking dimension 13

Scale: local and systemic dimensions 14

Climate-nature nexus 14

Phase 2: Assess economic risks 16

Direct and indirect eects 16

Micro, sectoral/regional and macro level eects 16

Substitutability 17

Phase 3: Assess risk to, from and within the nancial system 19

Contagion 19

Eects on the nancial system 19

Endogenous risk: eects of the nancial system on nature 19

4. Pathways to action 21

Introduction to the illustrative cases 23

Forests Illustrative Case: The Amazon Rainforest 25

Phase 1: Identifying sources of nature-related nancial risk 25

Phase 2: Assess economic risks 29

Phase 3: Assess risk to, from and within the nancial system 31

Freshwater Illustrative Case: the Colorado River Basin 35

Phase 1: Identifying sources of nature-related nancial risk 35

Phase 2: Assessing economic risks 38

Phase 3: Assess risks to, from and within the nancial system 41

NGFS REPORT

5

1. Introduction

As is widely acknowledged, nature is fundamental to human

well-being, a healthy planet, and economic prosperity.

Without always realising it, humans depend on nature for

food, medicine, energy, clean air and water, security from

natural disasters, recreation, and cultural inspiration (among

many other things).

But human demands have exceeded

the planet’s ability to provide such services, resulting in

a degradation of nature and its diversity at unprecedented

rates

1

. For example, monitored wildlife populations have

declined by an average of 69% since 1970

2

, and the global

rate of species extinction is tens to hundreds of times

higher than it has been over the past 10 million years

3

.

Furthermore, six of the nine boundaries that maintain the

resilience and stability of the Earth have been exceeded

4

.

This continued degradation poses a threat to well-being

5

and, more fundamentally, to the planet’s habitability

6

.

In response, the Kunming-Montreal Global Biodiversity

Framework (“GBF”) was adopted in 2022 with a new set

of goals and targets to halt and reverse biodiversity loss.

Its overarching vision is for humans to live in harmony

with nature by 2050. 23 targets are set for 2030 to achieve

this vision

7

.

The degradation of nature, and actions aimed at preserving

and restoring it, will aect our economies and nancial

systems. To illustrate, the GBF requires, among other things,

the alignment of all nancial ows by 2030 with its targets

and goals

8

. Based on the ndings of a joint NGFS-INSPIRE

study group, the NGFS has acknowledged that nature-

related nancial risks could therefore have signicant

macroeconomic implications, and that failure to account

for, mitigate, and adapt to these implications is a source of

risks relevant for nancial stability

9

. To eectively address

these risks, the NGFS has set up a task force on Biodiversity

Loss and Nature-related Risks (“Task Force”). The objective

of the Task Force is to help mainstream the consideration

of nature-related financial risks across the NGFS.

As part of this eort, the Task Force is mandated to develop

a conceptual framework on nature-related nancial

risks to guide action by central banks and supervisors

10

.

This document contains the NGFS Framework for nature-

related nancial risks (the “Framework”). The Framework

seeks to create a common science-based understanding of,

and language for, these nature-related nancial risks among

NGFS members. Its aim is to provide greater clarity on the

meaning of key concepts and the way these interrelate.

In doing so, the Framework adopts an integrated approach.

This means that climate-related nancial risks are strongly

interconnected with the broader environmental-related

nancial risks, and therefore considered within the scope

of nature-related nancial risks (without prejudice to the

relevance of the NGFS’ work on climate)

11

.

The Framework also contains a principle-based risk

assessment framework to help operationalise the

conceptual understanding of nature-related nancial

risks. In this way, the Framework helps central banks and

supervisors to identify and assess material nature-related

nancial risks. Where relevant, it may also help to develop

policies and actions in respect of those material risks while

taking into consideration the relevant jurisdictional context

and mandate. Considering that purpose, and without

being prescriptive, the Framework draws attention

1 Kunming-Montreal Global biodiversity framework (CBD/COP/DEC/15/4), December 2022.

2 Living Planet Report 2022 – Building a nature-positive society, World Wildlife Fund (“WWF”), 2022.

3 Global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services,

The Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (“IPBES”), 2019.

4 Richardson, J. , et al. (2023) Earth beyond six of nine Planetary Boundaries, Science Advances.

5 Kunming-Montreal Global biodiversity framework (CBD/COP/DEC/15/4), December 2022.

6 Final Report, NGFS-INSPIRE Study Group, March 2022.

7 Kunming-Montreal Global biodiversity framework (CBD/COP/DEC/15/4), December 2022. The GBF succeeds the UN Strategic Plan for Biodiversity

2011-2020 that included the Aichi Biodiversity Targets (none of which were fully met).

8 Ibid. See Target 14.

9 Statement on Nature-Related Financial Risks, NGFS, 24 March 2022.

10 Task force “Biodiversity Loss and Nature-related Risks” Mandate April 2022 – April 2024, NGFS, 2022.

11 Consequently, nature-related nancial risks cover both “climate-related risks” and “environmental-related risks” as previously dened in: A call for

action – Climate change as a source of nancial risk, NGFS, 2019 (p. 11).

NGFS REPORT

6

to the considerations that are most likely to be relevant

from a microprudential, macroprudential and/or

macroeconomic perspective (and which may therefore

aect nancial stability or price stability). At the same

time, it is acknowledged that other facets of nature and its

degradation – such as eects on well-being or nature-related

economic opportunities – could merit consideration outside

the context of this Framework. Two illustrative cases are

included in the Framework to provide colour to the

potential application of the risk assessment framework.

By applying the Framework to the specic examples of the

Amazon and Colorado River Basin, the illustrative cases

demonstrate in a largely qualitative manner how the

dierent phases and guiding questions in the Framework

can be navigated.

The Framework is only a starting point for analysis and

action. Its content is not meant to be comprehensive or

set in stone. As knowledge and experience develops, this

Framework may be rened and supplemented over time.

NGFS REPORT

7

2. Understanding nature-related nancial risks

To mainstream the consideration of nature-related nancial

risks beyond climate across the NGFS, it is important to

start with a shared understanding of the meaning of, and

language for, these risks. This chapter denes nature-related

nancial risks and related concepts that are needed for

a high-level understanding of these risks. In doing so,

it draws on scientic literature including reports by the

Intergovernmental Science-Policy Platform on Biodiversity

and Ecosystem Services (“IPBES”). Full denitions for the

key concepts (highlighted in bold), and references to their

sources, can be found in Annex 1.

The natural world

As a starting point, it is necessary to reect briey on the

meaning of nature. Nature itself is challenging to dene,

and its interpretation depends strongly on the context in

which it is used

12

. In the IPBES Conceptual Framework, it

has been described as: “The natural world with an emphasis

on the diversity of living organisms and their interactions

among themselves and with their environment

13

.” For this

Framework, the key consideration is that the term ‘nature’

captures both the biotic (living) and abiotic (non-living)

elements on our planet, including biodiversity but also

climate. Some of these elements, such as natural resources

(plants, animals, air, water, soils, minerals etc.), are sometimes

also referred to as natural capital

14

.

12 Final Report, NGFS-INSPIRE Study Group, March 2022.

13 Díaz, S., et al. (2015) The IPBES Conceptual Framework – connecting nature and people. This denition is also referenced by the Taskforce on Nature-

related Financial Disclosures (“TNFD”) to describe nature.

14 Although not a key concept to understand or act on nature-related nancial risk, the term is referenced in the Framework to place it into context.

This terminology focuses especially on nature’s contributions to human economic activity, emphasising that nature is a stock of assets that provide

a ow of benets to people. For completeness, a full denition is provided in the glossary.

15 See Díaz, S., et al. (2018) Assessing nature’s contributions to people, Science.

16 Final Report, NGFS-INSPIRE Study Group, March 2022. See also Mace, G.M., Norris, K. & Fitter, A.H. (2012). Biodiversity and ecosystem services:

a multilayered relationship. Trends in Ecology & Evolution.

17 See for example The Economics of Biodiversity: The Dasgupta Review, February 2021. The treatment of the link between biodiversity and ecosystem

functioning in the Dasgupta review is taken from the following major reviews: Hooper, D.U., et al. (2005) Eects of Biodiversity on Ecosystem Functioning:

a Consensus of Current Knowledge. Ecological Monographs; Cardinale, B. J., et al. (2012) Biodiversity Loss and its Impact on Humanity. Nature; Tilman,D.,

Isbell, F. & Cowles, J. M. (2014) Biodiversity and Ecosystem Functioning. Annual Review of Ecology, Evolution, and Systematics.

18 Global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services,

IPBES, 2019.

The living and non-living elements of nature combine in

ecosystems, which provide a ow of benets described as

ecosystem services (or nature’s contribution to people

15

).

Ecosystem services provide society with tangible goods

(e.g., timber or food); the regulation of natural processes

(e.g., carbon sequestration, surface temperature cooling,

watershed protection and erosion control); supporting

services (e.g., nutrient cycling and soil formation); and

cultural services (e.g., recreation and tourism). See Annex2

for more details on dierent types of ecosystems and

ecosystem services.

The ability of nature to provide these ecosystem services

depends on biodiversity

16

. Biodiversity relates to the living

elements of nature, and refers specically to variability

among living organisms which includes the diversity

within species, between species and of ecosystems.

There is strong scientic evidence that this diversity is

critical for the resilience, adaptability and productivity of

ecosystems

17

. Biodiversity should therefore be understood

as an integral characteristic of healthy ecosystems.

Degradation of nature

Human society and the global economy cannot exist

without ecosystem services. Yet, human activities have

driven an unprecedented degradation of nature and its

biodiversity that threatens the continued provision of

the very ecosystem services on which humans depend

(14 of the 18 global ecosystems have declined since 1970

18

).

NGFS REPORT

8

Five main drivers of nature degradation have been identied,

starting with the most impactful drivers at a global level:

(i) changes in land and sea-use; (ii) over-exploitation of

natural resources (i.e., extraction of living and non-living

materials); (iii) climate change (iv) pollution; and (v) invasive

alien species

19

.

The degradation of nature can be acute (i.e. shocks such as oil

spills, forest res or pests aecting a harvest) and/or chronic

(i.e. gradual changes such as pollution stemming from

pesticide use or climate change)

20

. When that degradation

occurs, and at what scale, is often dicult to measure or

predict. Among other things, this is because changes in the

natural environment are not linear and characterised instead

by compounding eects and ‘tipping points’

21

. These tipping

points are abrupt and possibly irreversible shifts between

alternative ecosystem states

22

. The likelihood of reaching

tipping points increases when ‘planetary boundaries’ are

crossed. Planetary boundaries are a concept that indicate

limits of the Earth’s ‘safe operating space’. Leaving the

safe operating space increases the risk that large-scale

abrupt or irreversible environmental changes occur

23

.

Evidence suggests that, because of human changes and

pressures, several of these boundaries have already been

exceeded (see gure 1)

24

. To illustrate, climate change

and human alterations to water bodies and land have

led to global-scale river ow changes and shifts in water

vapour ows

25

. Such shifts in the hydrological system can

be permanent and occur abruptly.

The crossing of planetary boundaries could be therefore

interpreted as an indication of the Earth’s susceptibility to

physical hazards or shocks

26

. For example, in the case of

climate, multiple tipping points could already be triggered

when 1.5 °C global warming is exceeded (e.g. collapse

19 Described as direct drivers of change in nature in the Global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-

Policy Platform on Biodiversity and Ecosystem Services, IPBES, 2019.

20 Final Report, NGFS-INSPIRE Study Group, March 2022.

21 Kedward, K., Ryan-Collins, J., & Chenet, H. (2022) Biodiversity loss and climate change interactions: nancial stability implications for central banks and

nancial supervisors. Climate Policy.; Lenton, T. M. (2013) Environmental tipping points. Annual Review of Environment and Resources.

22 Dakos, V., et al. (2019) Ecosystem tipping points in an evolving world. Nature, Ecology and Evolution. Description referenced in Final Report, NGFS-INSPIRE

Study Group, March 2022.

23 Rockström, J., et al. (2009) Planetary boundaries: exploring the safe operating space for humanity. Ecology and Society.

24 Richardson, J., et al. (2023) Earth beyond six of nine Planetary Boundaries, Science Advances.

25 See e.g. Porkka, M. (2024) Notable shifts beyond pre-industrial streamow and soil moisture conditions transgress the planetary boundary for freshwater

change. Nature Water.

26 In this context, it should be noted that the global planetary boundaries only provide a coarse indication and may not always reect the transgression

of these boundaries at a more local level.

27 Armstrong McKay, D. I., et al. (2022) Exceeding 1.5 C global warming could trigger multiple climate tipping points, Science.

28 The Framework emphasises the relevance of nature for economic activity, but a broader spectrum of values and ways of relating to nature may

motivate actions to restore nature. See also Methodological Assessment Report on the Diverse Values and Valuation of Nature, IPBES, 2022.

of ice sheets, coral reef die-o and permafrost thaw)

27

.

Crossed boundaries could also indicate domains where

action might be expected to bring the Earth back to its

safe operating space and reduce the risk of reaching

tipping points (e.g., in respect of freshwater, novel entities

such as plastics or nitrogen emissions). The latter is in

recognition of the fact that, driven by various motives

and values

28

, nature degradation has triggered action to

protect, restore, and/or reduce negative impacts on nature.

Such action can manifest as changes in regulation and policy,

legal precedent, technology, or investor sentiment and

consumer preferences.

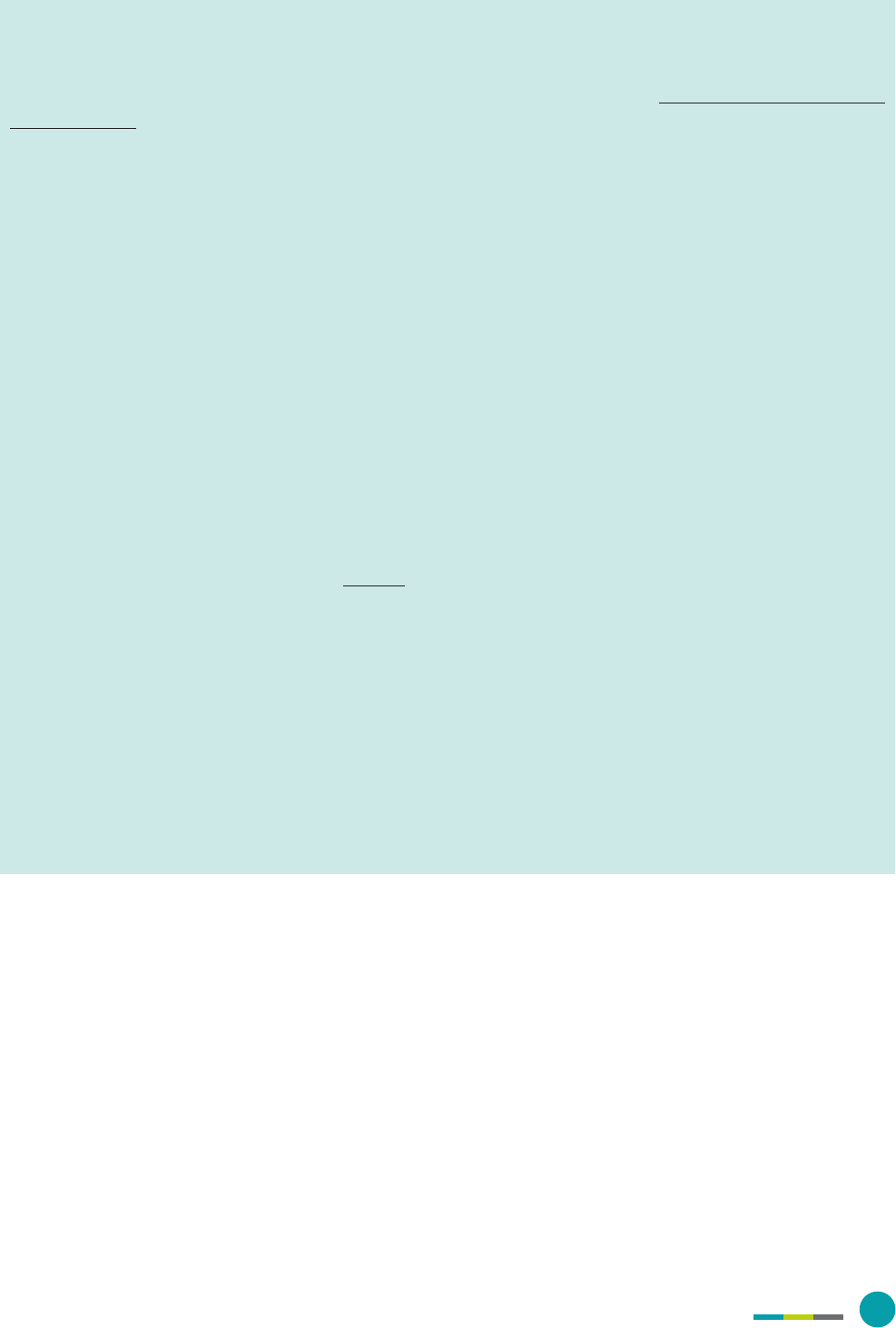

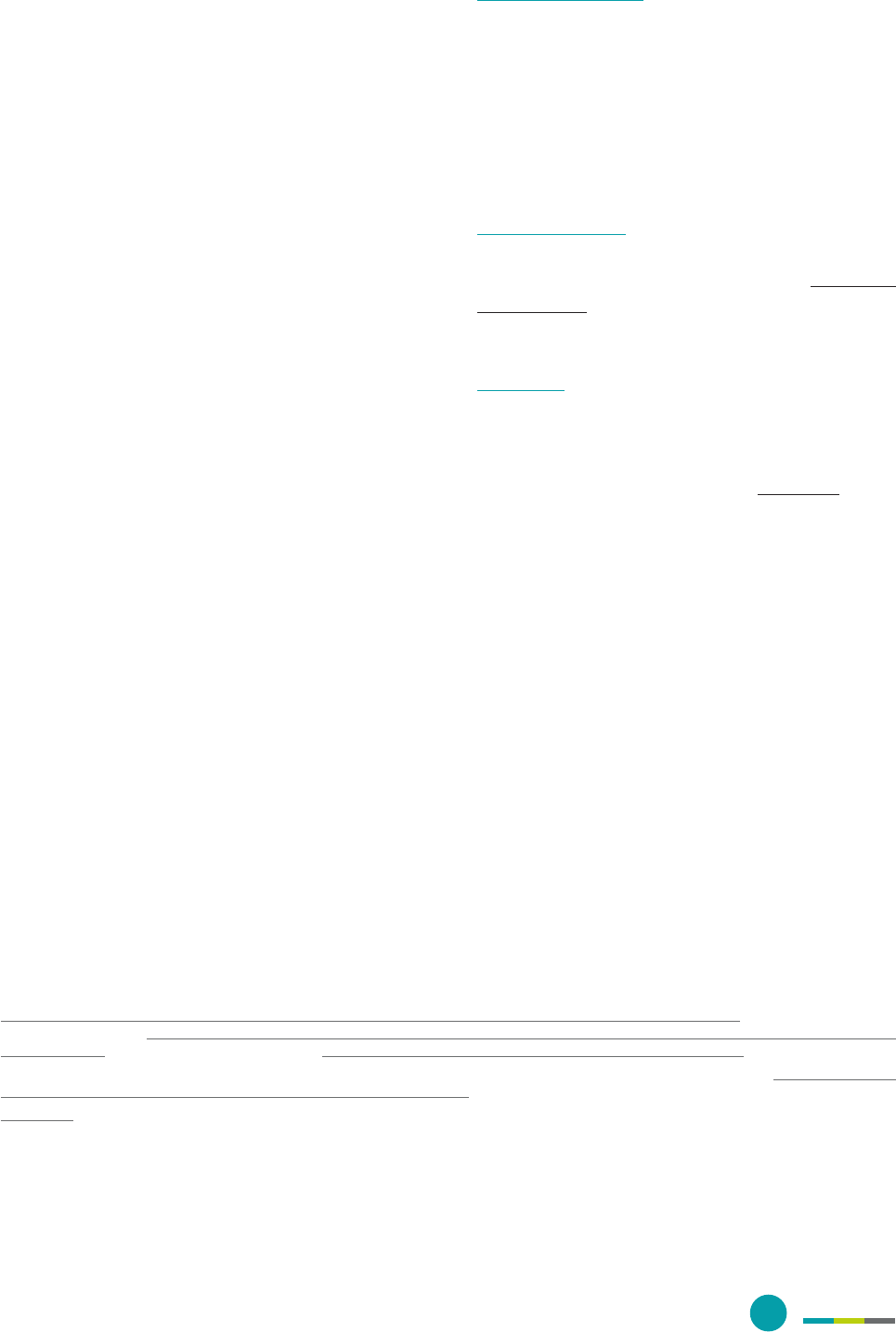

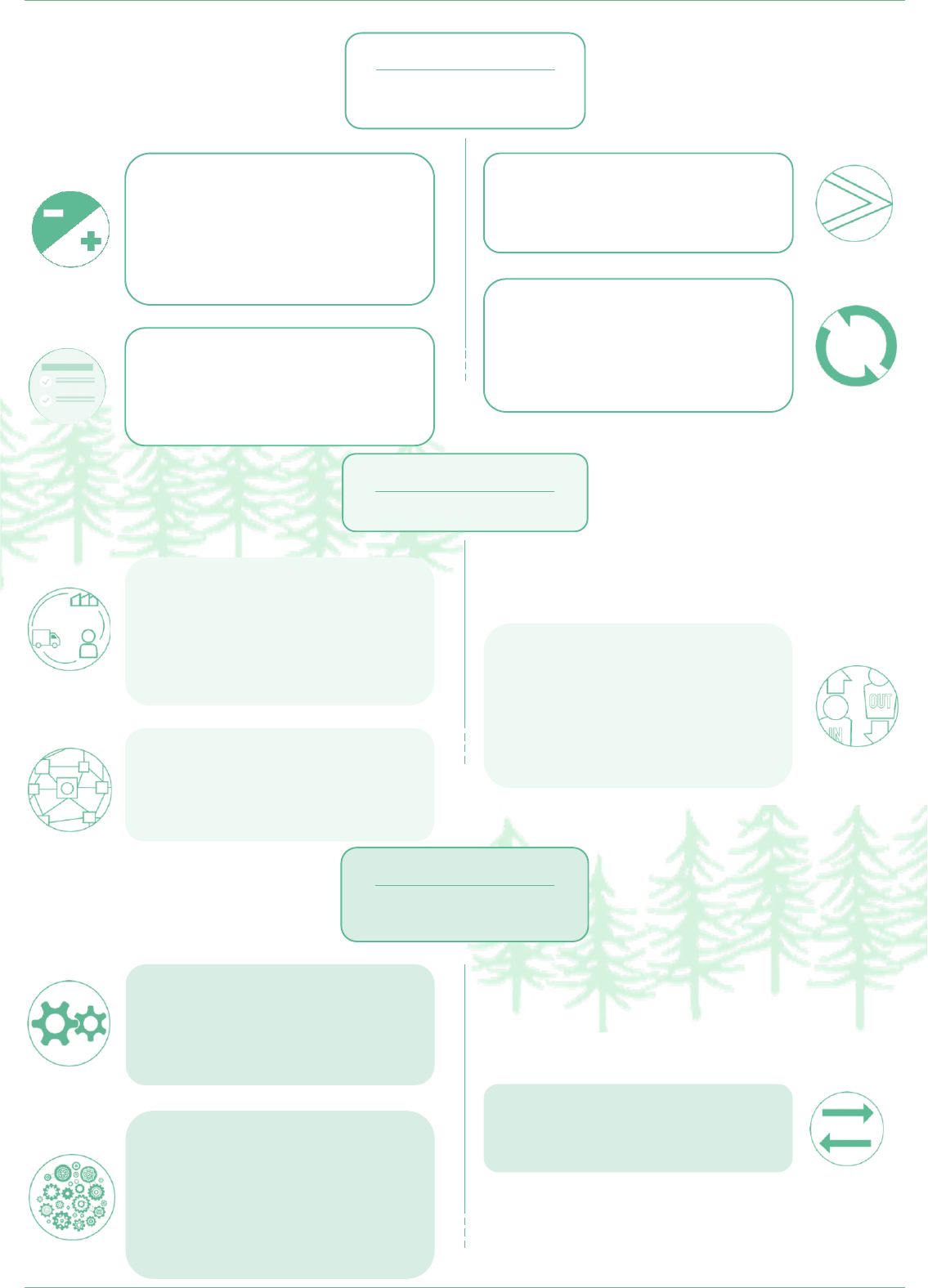

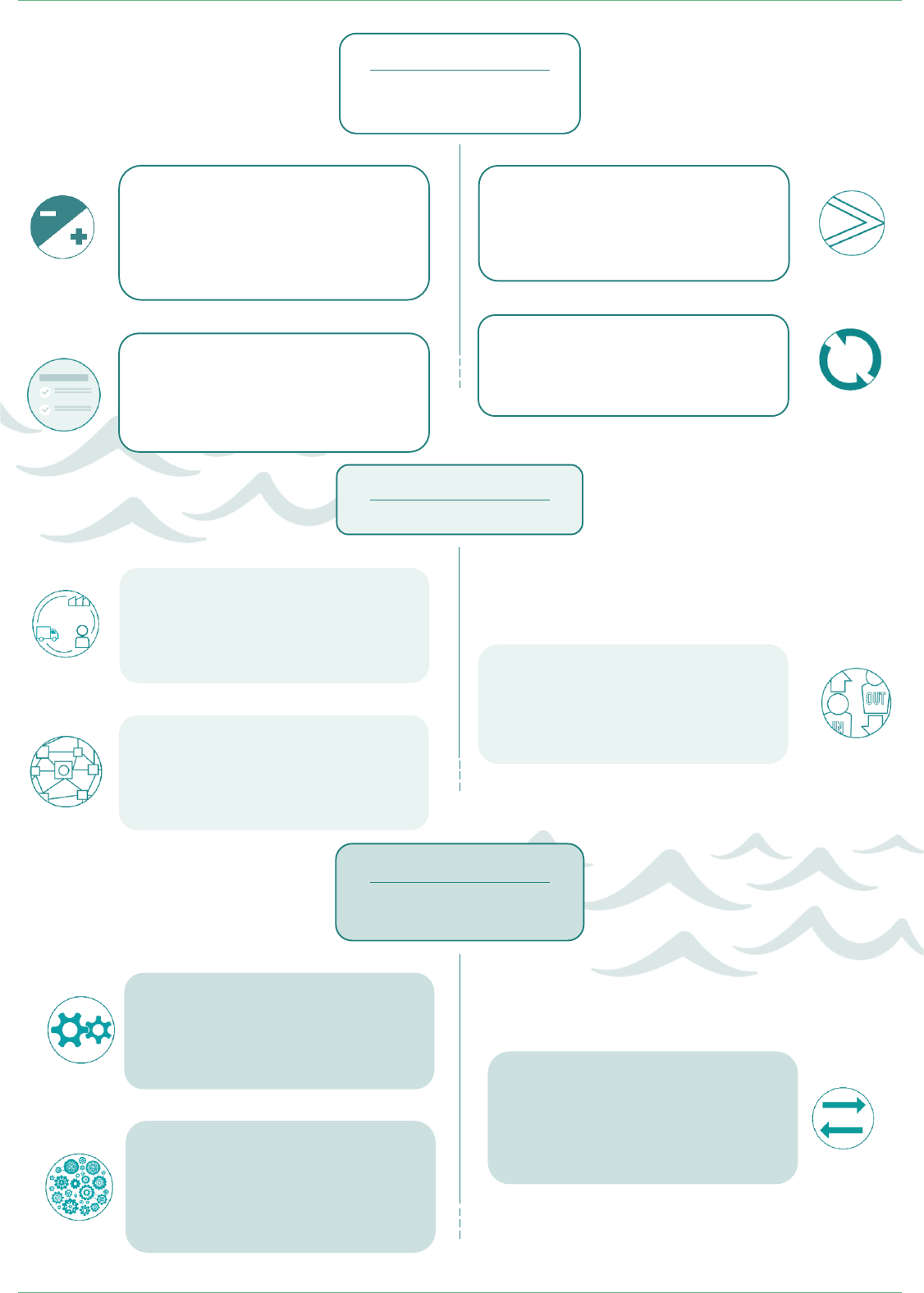

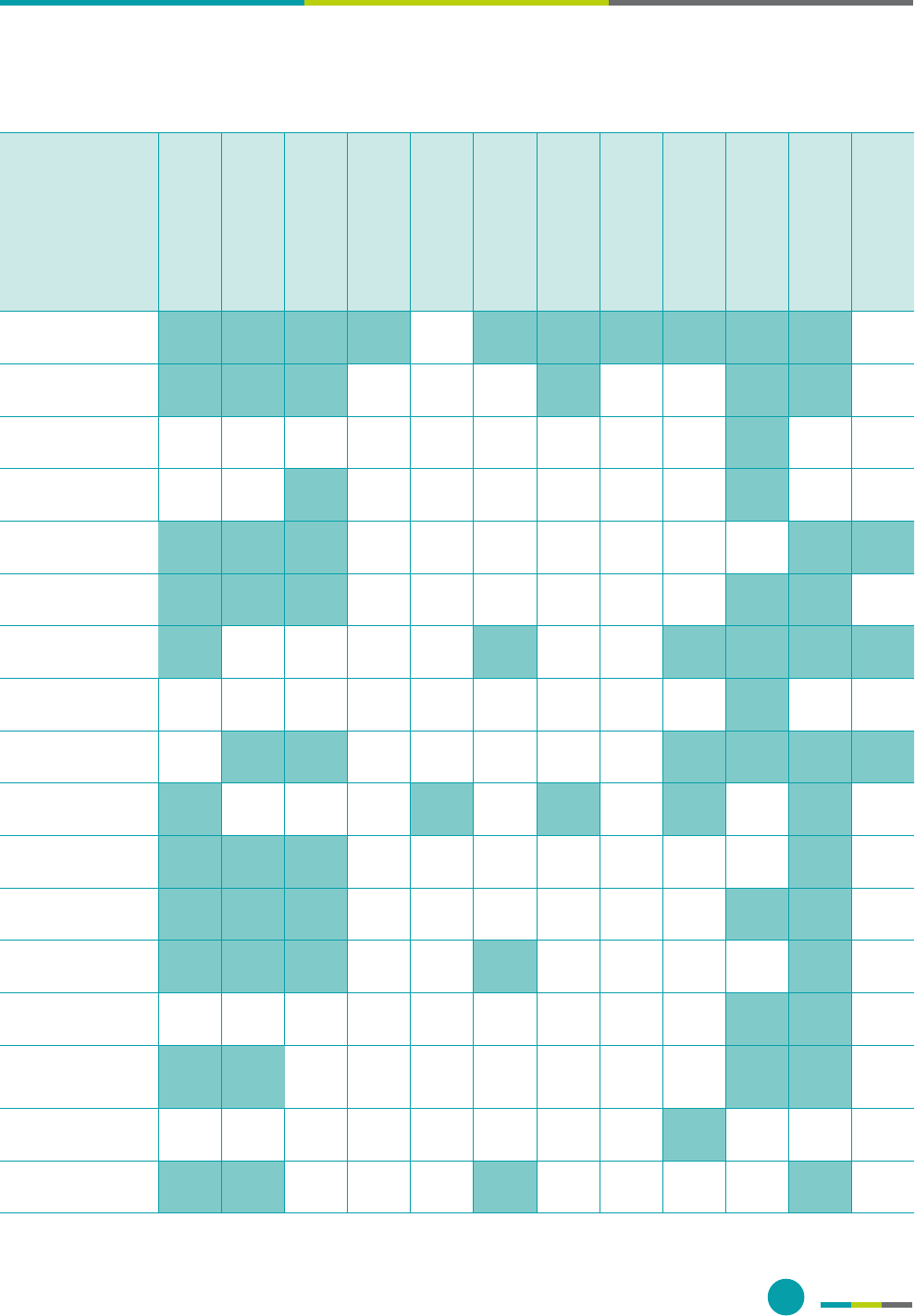

Figure 1 Planetary boundaries

CLIMATE CHANGE

Radiative

forcing

Genetic

Functional

Freshwater use

(Blue water)

Green

water

CO

2

concentration

STRATOSPHERIC OZONE

DEPLETION

LAND-SYSTEM

CHANGE

OCEAN

ACIDIFICATION

ATMOSPHERIC

AEROSOL

LOADING

NOVEL ENTITIES

FRESHWATER CHANGE

Increasing risk

S

a

f

e

o

p

e

r

a

t

i

n

g

s

p

a

c

e

a

f

f

f

f

f

f

f

e

f

f

o

p

e

r

a

a

a

t

t

t

t

i

n

g

s

p

a

c

e

S

a

f

f

f

p

a

f

f

f

e

f

f

e

p

e

o

o

e

o

s

p

a

a

c

e

s

p

g

g

g

PN

BIOGEOCHEMICAL

FLOWS

BIOSPHERE

INTEGRITY

Source: Azote for Stockholm Resilience Centre, based on analysis in Richardson

et al. 2023).

NGFS REPORT

9

Planetary boundaries, ecosystem services and scenarios

Planetary boundaries and ecosystem services are also key concepts in the NGFS Recommendations toward the

development of scenarios for assessing nature-related economic and nancial risks (“NGFS Technical Document on

Nature Scenarios”). An understanding of these concepts may therefore help to assess nature-related risks on a forward-

looking basis. Specically, planetary boundaries and ecosystems services play an important role in the development

of nature scenario narratives (i.e., storylines that describe how the world could evolve in the future as a result of nature

degradation or actions to address it).

Planetary boundaries indicate, on a global level, the distance between the current and safe operating space for nine natural

processes that regulate the Earth system (e.g., climate change, changes in the freshwater system or the introduction of

novel entities such as microplastics). This global concept is relatively coarse, but when scaled down to a national level,

it becomes possible to identify which ecosystems are more degraded than others and therefore more likely to collapse.

This is the general idea behind the ESGAP-SESi approach for narrative development as presented in the NGFS Technical

Document on Nature Scenarios. Using 21 indicators of ecosystem health (e.g., outdoor air pollution, soil erosion rate,

sh resources), ESGAP-SESi provides an aggregate measure to determine the distance between current state and a

“healthy” operating state for dierent ecosystems. This distance can be used as a proxy to determine the potential

occurrence of physical hazards. In other words, the closer a country is to crossing thresholds for these indicators, the

less resilient the relevant ecosystem is and the more likely it becomes that physical hazards occur.

The state of these ecosystems matters because it aects the ecosystem services provided by those ecosystems on

which economic actors depend. One ecosystem can provide a number of dierent ecosystem services. These services

are typically categorised as follows (see also Annex 2):

• Provisioning services: e.g. food, raw materials like timber, fresh water;

• Regulating services: e.g. carbon sequestration and erosion control;

• Cultural services: e.g. recreation and tourism; and

• Support services: e.g. nutrient cycling and soil formation.

Ecosystem services also play a central role in the other approach to narrative development highlighted in the NGFS

Technical Document on Nature Scenarios: the INCAF-Oxford approach. This approach focuses on potential hazards and

maps the relationship between those hazards (i.e. shocks such as a grain crop pest) the particular ecosystem services

in a country or region (e.g. backwards to the disrupted ecosystem service ‘pest control’) and forwards to the eects it

has on the food provisioning services and sectors that depend on it). Relevant hazards can be selected from a initial

set of over fty hazards based on the vulnerability of the relevant county or region to those hazards.

NGFS REPORT

10

Physical and transition risks

Like climate-related risks

29

, nature-related nancial risks

can thus be categorised as physical risks (stemming from

the degradation of nature and loss of ecosystem services)

or transition risks (stemming from a misalignment of

economic actors with actions aimed at protecting, restoring,

and/or reducing negative impacts on nature). With regard

to transition risk, the misalignment often results from the

negative impacts that economic actors have on nature.

But, it is important to note that risks could also arise

from activities originally aimed at restoring nature that

no longer align with, for example, revised best practices,

new technologies or updated regulatory requirements.

Consistent with the NGFS approach for climate change,

litigation risk is considered in this Framework as a subset of

both physical and transition risks

30

. Litigation risks can arise

from a variety of factors, including liability claims, policy and

regulatory changes, and misconduct. In the case of physical

risks, litigation may be brought against a company, state or

public entity that is alleged to be responsible for causing

harm to ecosystems (which, given the often more localised

impacts on nature, may be easier to attribute to a particular

company). Equally, as part of transition risks, litigation risk

may arise when businesses fail to adapt to new regulations

and face legal consequences

31

. Mismanagement of nature

and climate risks can also lead to legal action, including

cases against directors who intentionally mislead investors

32

.

Key emerging trends related to nature-related litigation are

explored in greater detail in an NGFS Report on nature-

related litigation

33

that also explores the potential impact

of nature-related litigation for central banks, supervisors

and the nancial system.

29 A call for action – Climate change as a source of nancial risk, NGFS, 2019.

30 Climate-related litigation: Raising awareness about a growing source of risk, NGFS, 2021. It is recognised that other frameworks may adopt a dierent

approach, for instance viewing litigation risk as a separate risk category.

31 Ibid. The approach for climate-related litigation could be extended to broader nature-related litigation risks.

32 Biodiversity Risk: Legal Implications for Companies and their Directors, Commonwealth Climate and Law Initiative, December 2020.

33 Nature-related litigation: emerging trends and lessons learned from climate-related litigation, NGFS, 2024.

34 Final Report, NGFS-INSPIRE Study Group, March 2022.

Physical and transition risks can aect the economy at

micro, sectoral/regional and macro levels (including as

eects on price stability). These include eects resulting

from permanent changes in nature that have already

occurred, as well as eects from potential future changes.

Those economic risks can subsequently translate into nancial

risks that adversely aect individual nancial institutions or

nancial systems as a whole. In this context, it is important to

note that nature-related nancial risks are also endogenous:

the impacts that economic and nancial actors have on

nature aect the nancial risks these actors need to manage.

For instance, through the economic activities that they

nance, nancial institutions can contribute to the build-up

of nature-related financial risks (or contribute to the

reduction of such risks)

34

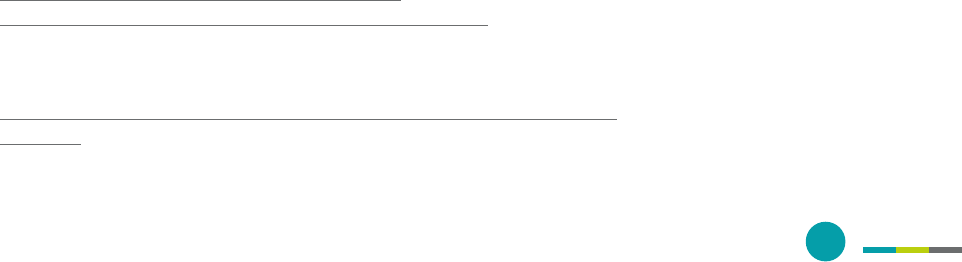

. Figure 2 provides an overview

of the relevant transmission channels.

In light of the above, nature-related nancial risks are

dened as follows for the purposes of this Framework:

Nature-related nancial risks refer to the risks of negative

eects on economies, individual nancial institutions and

nancial system that result from:

i. the degradation of nature, including its biodiversity, and

the loss of ecosystem services that ow from it (i.e., physical

risks); or

ii.

the misalignment of economic actors with actions aimed

at protecting, restoring, and/or reducing negative impacts

on nature (i.e., transition risks).

NGFS REPORT

11

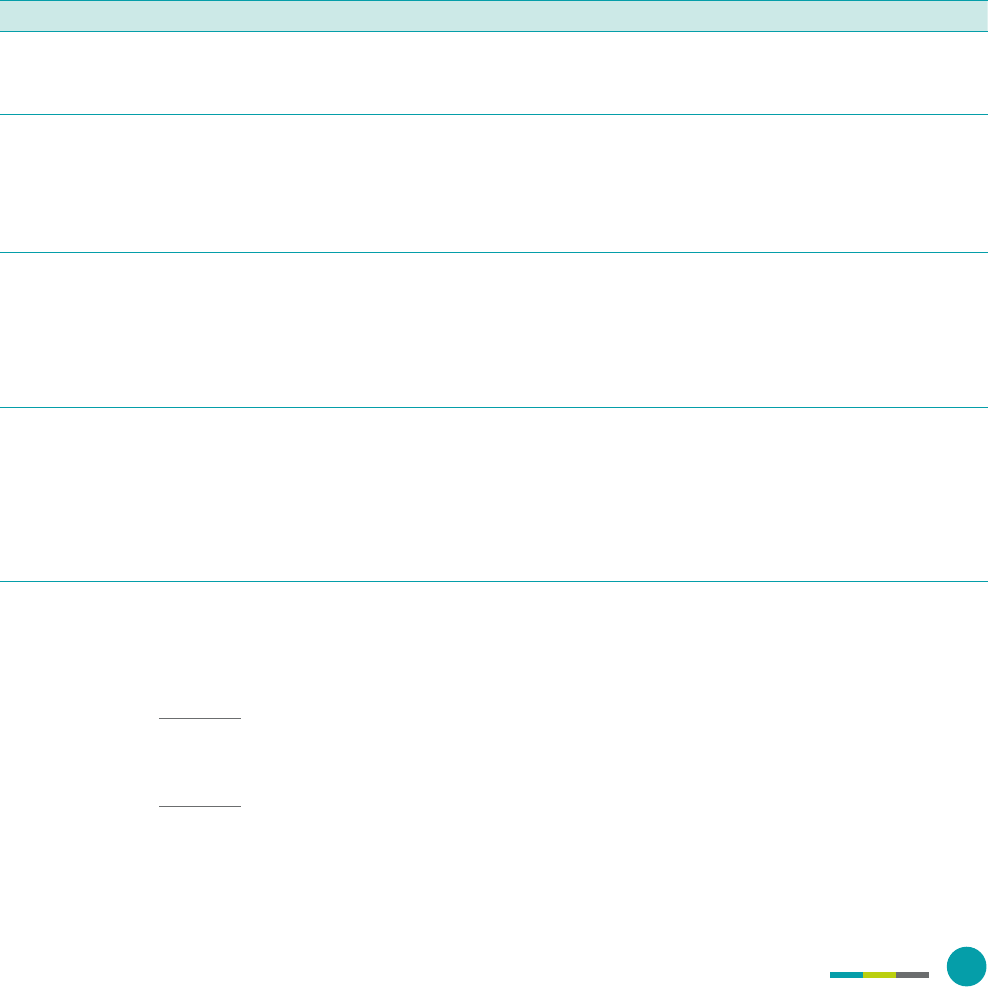

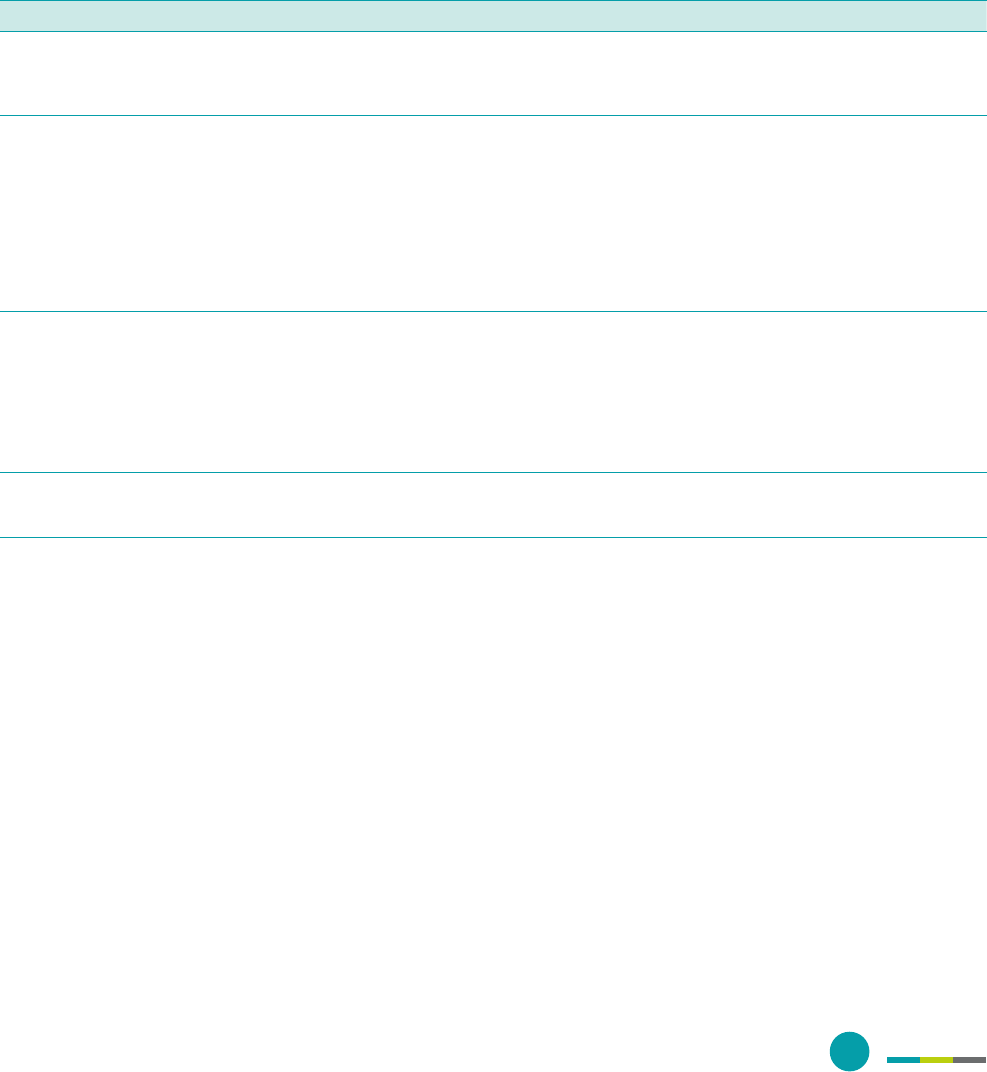

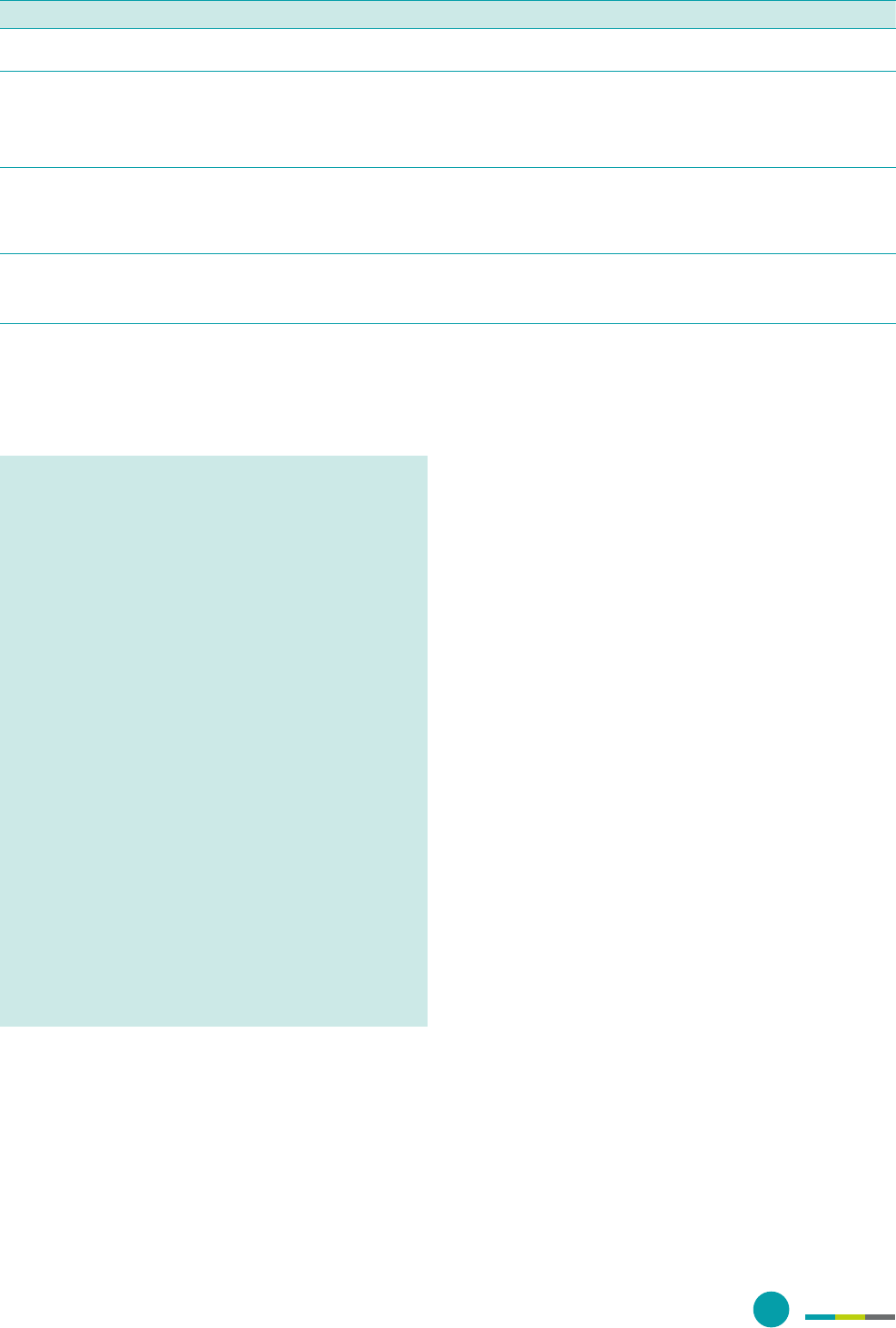

Figure 2 Transmission channels

Sources

of risk

Physical risk

Provisions (sh, timber, energy)

Climate, surface temperature

and hydrological cycle regulation

Water capture and ltration

Soil quality

Hazard protection from storms

and oods

Habitat, species and

biodiversity intactness

Transition risk

Misalignment with actions aimed

at protecting, restoring, and/or

reducing negative impacts on

nature, e.g. via:

-

Regulation/policy/legal precedent

-

Technology

-

Consumer and investor

preferences

Economic

risks

Micro

Microeconomic eects on

businesses/households, e.g. via:

-

Damage to assets

-

Stranded assets

-

Higher or more volatile prices

-

Disruption of processes

-

Relocation and adjustment

of economic activities

-

Reduced human health and/or

labour productivity

Macro

Macroeconomic eects, e.g. via:

-

Prices

-

Productivity

-

Trade and capital ows

-

Capital (investment

needs/depreciation)

-

Socio

-economic changes

-

Fiscal balances

Financial

risk

- Increases in defaults

- Collateral depreciation

Nature

Degradation of nature

and its ecosystems

driven by:

Land use change

Overexploitation

Climate change

-

Pollution

Invasive alien species

Regional/sectoral

- Repricing of assets

- Fire sales

-

Increased insured losses

-

Increased insurance gap

-

Shortages of liquid assets

-

Renancing risk

Operational risk

-

Disruption of nancial

institution’s processes

Risks from

dependence

and impact

on nature

Endogenous risk (impact of

nanced activities on nature)

Feedback between economy

and nancial sector

Contagion within

nancial system

Liquidity risk

Underwriting risk

Market risk

Credit risk

Strategic risk

-

Increased uncertainty

-

Change of business model

Decline of ecosystem services, e.g.:

-

-

-

-

-

-

-

-

-

-

-

Sources: Adapted from Svartzman, R. et al. (2021) A “Silent Spring” for the Financial System ? Exploring Biodiversity- Related Financial Risks in France.

NGFS REPORT

12

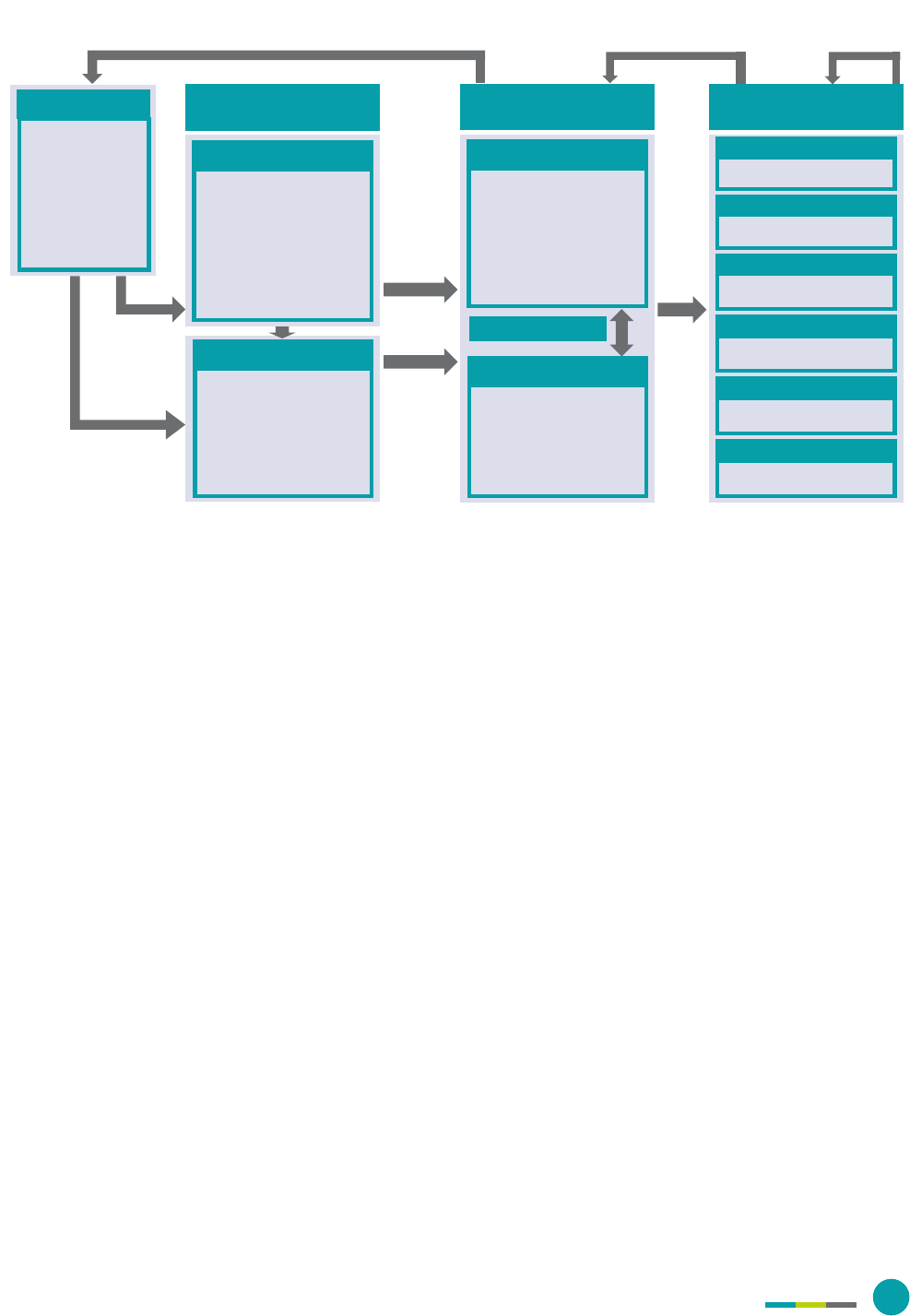

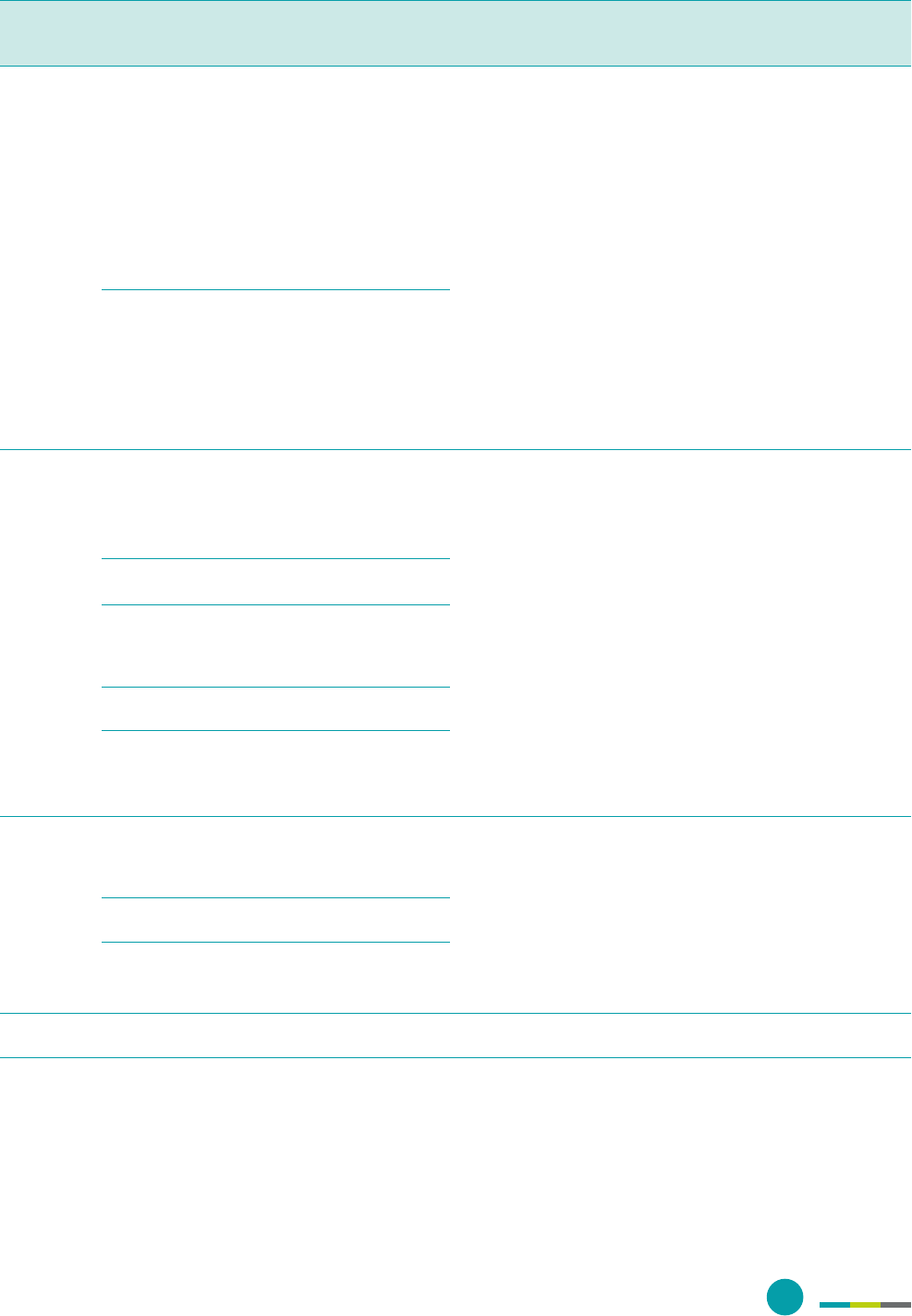

3. Assessing nature-related nancial risks

Based on the understanding of nature-related nancial

risks, this chapter oers a framework to help central

banks and supervisors identify and assess those nature-

related nancial risks that are material for their economy

and nancial system. Its aim is to help operationalise

the conceptual understanding of nature-related nancial

risks. At the same time, it should be noted that analytical

methodologies and risk management practices are still being

developed

35

. Furthermore, actions taken will depend on the

context in each jurisdiction and organisation, including

Phase 1: Identify

sources of physical

and transition risk

Phase 2: Assess

economic risks

Phase 3: Assess risk

to, from and within

the nancial system

35 For instance, the NGFS Technical Document on Nature Scenarios provides several recommendations to advance the development of scenarios to

assess economic and nancial risk. See Recommendations toward the development of scenarios for assessing nature-related economic and nancial

risks, NGFS, December 2023.

36 Adapted from the approach for forward-looking risks assessments in the Final Report, NGFS-INSPIRE Study Group, March 2022.

37 This phase shares similarities with the ‘Locate’ and ‘Evaluate’ phases in the TNFD LEAP approach.

38 For a more detailed description and references to the risk assessments, see the Final Report, NGFS-INSPIRE Study Group, March 2022.

For more recent work, see also: Martinez-Jaramillo, S., et al. (2023) Dependencies and impacts of the Mexican banking sector on ecosystem services;

Boldrini S., et al. (2023) Living in a world of disappearing nature: physical risk and implications for nancial stability, European Central Bank (“ECB”);

Ceglar, et al. (2023) The impact of the euro area economy and banks on biodiversity, ECB; Assessing Nature-Related Financial Risks: The Case of Lithuania,

Bank of Lithuania, December 2023; The Nature of Finance – Assessing the nature-related risks and opportunities for the Irish Financial Sector;

KPMG on behalf of Ireland’s International Sustainable Finance Centre of Excellence; December 2023; Bayangos, V. B., et al. (2023) The Impact of

Biodiversity Loss on the Philippine Banking System: A Preliminary Analysis; Nikuradze, E. & Tvalodze, S. (2023) Biodiversity-related Financial Risks –

why it matters and how can we measure them?, National Bank of Georgia.

dierences in mandates. Considering this need for exibility,

the current Framework adopts a principle-based approach

(as opposed to providing detailed, prescriptive guidance).

The principle-based risk assessment framework consists of

three phases

36

. A few guiding questions are provided at

the end of each phase to draw attention to key elements

that central banks and supervisors could consider as part

of their risk identication and assessment. For an overview,

see Annex 3.

Phase 1: Identify sources of physical

and transition risk

As a rst step, central banks and supervisors could identify

the sources of risk that are potentially material from a

microprudential, macroprudential and/or macroeconomic risk

perspective

37

. This section provides a high-level approach to

the identication and prioritisation of sources of physical

and transition risk based on exposures. As part of the

approach, particular attention is drawn to the relevance of

forward-looking, location-specic and systemic dimensions.

Further details are also provided on the interlinkages

between climate and the broader dimensions of nature.

The latter is intended to help supplement existing climate-

related eorts and enable a more integrated approach to

risk management.

Exposures to impacts and dependencies

Analysing the exposures to dependencies on nature and/or

impacts of economic activity on nature can be a rst step

to identify sources of physical and transition risks (both as

dened in chapter 2). Examples of such exposure analyses

include the physical risk analyses based on the ENCORE

database as conducted in the Netherlands, France, Brazil,

Malaysia, Mexico, the euro area and other jurisdictions

38

.

The outcomes of the initial exposure analysis can help to

identify sectors and/or ecosystems services that are more

likely to be sources of material risk (and could therefore

be prioritised as a starting point for the assessment of risk

in phases 2 and 3).

NGFS REPORT

13

•

Sector-based prioritisation: Identify key economic

activities or sectors that are more likely to be at risk based

on the level of their dependencies/impacts on nature

(including via value chains) as well as their relevance to

the economy, individual nancial institutions or nancial

sector (e.g. the value of the exposure compared to the

total value of exposures analysed). To illustrate, economic

activities with high impacts and dependencies on nature

occur in sectors that include agriculture, aquaculture

and sheries, forestry, metals and mining, transport,

energy and utilities, textiles and apparel, chemicals

and pharmaceuticals, construction and infrastructure

39

;

and/or

•

Ecosystem-based prioritisation: Identify key ecosystem

services on which economic activities depend, thereby

considering the ecosystems from which they originate

and the vulnerability of those ecosystems given negative

impacts on them (see also Annex 2 for more detail on

the dierent ecosystems and ecosystem services)

40

.

The above analysis may only yield a partial picture of

potential sources of risk due to remaining uncertainties

and data constraints. Other indications of potential risks

(both quantitative and qualitative) may therefore need to

be considered. The sections below seek to complement

the initial exposure analysis by drawing attention to

the relevance of forward-looking, location-specic and

systemic dimensions.

Forward-looking dimension

The initial analysis as described above provides a static

snapshot of current exposures. This could be supplemented

with scenario analyses to explore exposures – and therefore

sources of physical and transition risks – on a forward-

looking basis

41

. For physical risks, the source of risk can be

the extrapolation of a trend or hypothetical shock in which

one or more ecosystems or ecosystem services degrade

or collapse

42

. For transition risks, existing and announced

nature-related policies on a global, regional and/or national

level could provide a starting point to develop scenarios

(for example the GBF, which denes 2030 targets on, among

other things, protecting 30% of land and water

43

or the

reduction of harmful subsidies

44

)

45

. It is relevant to understand

and consider the expected time horizon for these scenarios

(i.e., will they materialise in the short, medium or long term).

Lessons can be learnt from previous work on climate

scenarios when developing such forward-looking exposure

analyses (and, if feasible, forward-looking risk assessments

in phases 2 and 3). But nature presents a number of open

questions and unique challenges that must be carefully

accounted for

46

. To assist central banks and supervisors with

forward-looking analyses, the Task Force has produced a

Technical Document on Nature Scenarios. The documents

identies a number of challenges that must be accounted

for when developing nature scenarios. At the same time,

39 Based on sectors highlighted in Sector Guidance – Additional guidance for nancial institutions (v. 1.0), TNFD, September 2023, WWF Risk Filter –

Overview – dependencies and impacts, WWF; The Biodiversity Crisis Is a Business Crisis, Boston Consulting Group (“BCG”), 2021; Nature Risk Rising:

Why the Crisis Engulng Nature Matters for Business and the Economy, World Economic Forum (“WEF”), 2020.

40 For examples, see also Guidance on biomes (v. 1.0), TNFD, September 2023.

41 And, in phases 2 and 3, assess risk on a forward looking basis (e.g. via a stress test).

42 See for instance: An Exploration of Nature-Related Financial Risks in Malaysia, World Bank Group and Bank Negara Malaysia, 2022; Prodani, J., et al. (2023)

The economic and nancial stability repercussions of nature degradation for the Netherlands: Exploring scenarios with transition shocks, DNB. For an

assessment of economic risk (i.e. phase 2), see also: Johnson, J. A., et al. (2021) The Economic Case for Nature: A Global Earth-Economy Model to Assess

Development Policy Pathways.

43 See e.g. Indebted to nature: Exploring biodiversity risks for the Dutch nancial sector, De Nederlandsche Bank (DNB) and The Netherlands Environmental

Assessment Agency (PBL), 2020.

44 More information on the targets is at www.cbd.int/gbf/targets/. For a discussion, see also COP15 marked a decisive moment for central banks and

supervisors to address nature risks in the Anthropocene, Grantham Research Institute on Climate Change and the Environment, January 2023.

45 The NGFS Technical Document on Nature Scenarios also contains a review of various transition policies and trends to help identify plausible

transition shocks.

46 For further details: Final Report, NGFS-INSPIRE Study Group, March 2022. See also The TNFD’s proposed approach to scenario analysis, TNFD,

November 2022.

NGFS REPORT

14

it oers approaches that central banks and supervisors

can use to better understand the nature-related nancial

risks on a forward-looking basis. This includes suggestions

for the use of input-output tables and models, biophysical

models, and nature-economy models. First examples

of such forward-looking risks assessments include the

two case studies incorporated in the Technical Document on

Nature Scenarios, an explorative scenario study published

by DNB and an assessment of nature-related nancial risks

for the UK

47

.

Scale: local and systemic dimensions

Nature is spatially explicit. In other words, nature is distinct

for each location and diers across locations. This is also the

case for the impacts and dependencies on it. For example,

activities may rely on ecosystem services provided by local

ecosystems, or negative impacts may occur in ecosystems

that are already fragile. Therefore eorts to identify and

prioritise risks should take into account the geographical

location of impacts and dependencies

48

.

At the same time, local impacts and dependencies can

have systemic implications due to spill-over and feedback

eects. In addition to any direct eects of impacts and

dependencies on a limited number of individual parts

or actors in the system (such as a particular ecosystem,

household, company or nancial institution), risk may

therefore also originate from more complex and indirect

causal chains

49

. This ‘local-global trade-off’ presents

challenges in coordinating between the micro-level scale

of analysis (location-specic) and the macro-level global

scale (systemic eects)

50

.

Considering these systemic dimensions may help to

prioritise, e.g. by focusing eorts on identifying critically

important ecosystems and the dierent risk transmission

channels that stem from them. These considerations include:

•

Compounding eects: The degradation of one ecosystem

or ecosystem service may trigger a degradation or a

collapse of others

51

. To illustrate, the collapse of globally

important ecosystems like the Amazon may disrupt other

ecosystems at a global level, including via eects on

climate change. Physical and transition risks also interact

over time. In particular, the loss of certain ecosystems

may trigger local, regional or global policy responses

that result in transition risk.

•

Cascading eects: Physical and transition risks may

cascade and amplify via value chains (included in

the Framework as part of phase 2 under Direct and

indirect eects). When taking a sector-based approach to

prioritisation, this systemic dimension should particularly

be kept in mind to avoid an underestimation of risk

52

.

•

Contagion: The eect of physical and transition risks

on individual nancial institutions has the potential

to spread throughout nancial systems and/or create

feedback loops to the real economy (included in the

Framework as part of phase 3 under Contagion).

Climate-nature nexus

As already highlighted, nature is multifaceted, which, as

stated previously, covers both biotic and abiotic elements

such as water, land use, nitrogen and phosphorus ows,

biodiversity as well as climate. Previous work of the NGFS

has focused largely on climate, and rmly established the

relevance of climate-related risks for central banks and

supervisors. However, the relevance of the broader nature

dimensions – described as environmental risks – has been

recognised by the NGFS

53

. This has led to a positioning

of climate and environmental risks as two distinct but

interrelated issues.

The various dimensions of nature have unique features,

and are distinct in some respects. However, it is important

to recognise that the dierent dimensions of nature are

47 Recommendations toward the development of scenarios for assessing nature-related economic and nancial risks, NGFS, December 2023;

Prodani, J., et al. (2023) The economic and nancial stability repercussions of nature degradation for the Netherlands: Exploring scenarios with

transition shocks, DNB.; Ranger, N. & Oliver, T. (2024) Assessing the Materiality of Nature-Related Financial Risks for the UK.

48 For an example of a spatially-explicit study taking into account the location of exposures, see e.g. Hadji-Lazaro, p., et al. (2023) Socioeconomic and

spatially-explicit assessment of Nature-related risks: The case of South Africa.

49 Final Report, NGFS-INSPIRE Study Group, March 2022. See also Crona, B., Folke, C., & Galaz, V. (2021) The Anthropocene reality of nancial risk. One Earth.

50 See pp. 27-28 of the NGFS Technical Document on Nature Scenarios.

51 For instance, regulating and maintenance ecosystem services are complementary to one another, meaning that if one of them is disrupted suciently,

the others will be disrupted as well. See The Economics of Biodiversity: The Dasgupta Review, February 2021.

52 For a recent example of an indirect exposure analysis, see Boldrini S., et al. (2023) Living in a world of disappearing nature: physical risk and implications

for nancial stability, ECB.

53 A call for action – Climate change as a source of nancial risk, NGFS, 2019.

NGFS REPORT

15

also closely interconnected

54

. Therefore, even as the NGFS

continues its work in further understanding climate-related

nancial risks, it is equally important to consider risks

stemming from climate and the other dimensions of nature

in an integrated manner. To facilitate such an integrated

assessment, nature-related nancial risks as dened in this

Framework incorporate the full spectrum of climate and

environmental risks

55

. In other words, for the purposes of

the Framework, climate-related risks are considered to be

part of nature-related nancial risks.

There may be pragmatic reasons why an integrated

assessment of nature-related nancial risks is not always

possible or desirable (e.g., as a result of modelling

challenges). Furthermore, from a practical perspective,

climate-related nancial risks are more established and will

in many cases be the starting point for action on broader

nature-related nancial risks. To enable the shift towards

an integrated assessment of nature-related nancial risks,

the Framework has therefore generalised the existing NGFS

approach to climate where possible. In addition, the table

below describes some of the key interlinkages between

climate and broader-nature-related nancial risks that

could be considered when taking rst steps toward a more

integrated approach

56

. In short, the physical dynamics

driving climate change and the degradation of nature

are mutually reinforcing. Additionally, climate mitigation

and nature restoration present potential trade-offs

and synergies

57

.

Connection Description

Climate change as a driver of nature risk Climate change, and the resulting rising global temperatures, is one of the main

direct drivers of nature degradation. For example, increases in ooding, wildres,

ocean acidication and cyclones as a result of climate change can disrupt the

water cycle, alter soil temperatures and accelerate habitat and wildlife loss.

Nature degradation as a driver of climate risk Loss of key ecosystems increases the pace of climate change through adverse

changes in the carbon, nitrogen, and water cycles. Additionally, the destruction

of forests, peatlands, and other carbon-sequestering ecosystems may accelerate

climate change through the release of long-stored carbon into the atmosphere

alongside a reduced ability to sequester future carbon. The destruction of

ecosystems such as wetlands or mangroves may also alter natural infrastructure

that is important for climate resilience.

Climate change mitigation and adaptation as a potential

driver of nature risk

Combating climate change can slow the climate-driven deterioration of

ecosystems. But, certain strategies for climate change mitigation/adaptation and

achieving net-zero goals have the potential to cause inadvertent negative eects

on ecosystems. For example, biodiversity can be harmed by poorly planned tree

planting to capture carbon dioxide emissions (e.g. of non-native species and

monocultures), mining of materials for battery storage technology, destruction of

natural areas to install solar installations, or land use changes to full bioenergy

needs (e.g. deforestation for wood or planting biofuel crops).

Nature as a solution to decrease climate risk

(i.e. nature-based solutions

1

)

Restoration and preservation of ecosystems contributes substantively to

mitigating climate change and therefore plays a key role in achieving the goals

of the Paris agreement. As suggested above, combatting deforestation and

peatland destruction can prevent the release of stored carbon and facilitate

future carbon sequestration. Conservation or extension of natural systems can

also help to adapt to the eects of climate change (e.g. disaster risk reduction).

For example, ecosystems such as wetlands, forests, mangroves and dune habitat

increase resilience to physical shocks (e.g. storms, wildres, landslides or oods)

by providing protective barriers or buers.

1 Nature-based Solutions are dened by the UN Environment Assembly (Resolution 5/5 of 2 March 2022) as: “actions to protect, conserve, restore,

sustainably use and manage natural or modied terrestrial, freshwater, coastal and marine ecosystems which address social, economic and environmental

challenges eectively and adaptively, while simultaneously providing human well-being, ecosystem services, resilience and biodiversity benets.”

54 Based on, inter alia: Final Report, NGFS-INSPIRE Study Group, March 2022; Pörtner, H. O., et al. (2021) IPBES-IPCC co-sponsored workshop report on

biodiversity and climate change. IPBES and IPCC.

55 Kedward, K., Ryan-Collins, J., & Chenet, H. (2022) Biodiversity loss and climate change interactions: nancial stability implications for central banks and

nancial supervisors. Climate Policy.

56 Based on, inter alia: Final Report, NGFS-INSPIRE Study Group, March 2022; Pörtner, H.O., et al. (2021) IPBES-IPCC co-sponsored workshop report on

biodiversity and climate change. IPBES and IPCC.

57 Kedward, K., Ryan-Collins, J., & Chenet, H. (2022) Biodiversity loss and climate change interactions: nancial stability implications for central banks and

nancial supervisors. Climate Policy.

NGFS REPORT

16

Phase 2: Assess economic risks

Analysing exposures in phase 1 only provides an indication

of potential physical and transition risks, which does not

yet equate to a risk assessment. As a second step, central

banks and supervisors could assess the potential economic

eects and identify material economic risks that can stem

from these exposures

58

. These may be relevant in their own

right as macroeconomic risks (e.g., inationary pressures) or

transmit physical and transition risks to the nancial sector.

This section draws attention to three elements that should

at least be considered when assessing economic risks:

(i) direct and indirect eects; (ii) micro, sectoral/regional

and macro eects; (iii) substitutability.

Direct and indirect eects

Physical and transition risks affect households and

businesses via their direct dependence or impact on

nature. This eect on primary producers (e.g. farmers) and

consumers is also described as the direct eect (or rst-

order eects). However, the economic eects of physical

and transition risks are not limited to direct eects. Instead,

as also mentioned in phase 1, risks may cascade through

value chains – and between sectors – to other parts of

the economy and/or across borders. Indirect eects (or

second-order eects) capture this transmission of direct

eects via value chains.

Micro, sectoral/regional and macro level eects

Via direct and indirect transmission channels, physical

and transition risks can have both microeconomic and

macroeconomic eects. On a micro level, physical and

transition risks can affect businesses and households

dependent on ecosystem services to sustain their livelihood.

For instance, households may suer a loss of income and

higher livelihood costs as a result of weather-related

damages or the eects of nature degradation on health and

productivity. On a macro level, physical and transition risks

may have implications for prices, productivity, investment,

socio-economic changes, scal balances and trade and

capital ows (in particular aecting ination and gross

domestic product (“GDP”)).

Questions for members to consider when identifying sources of physical and transition risks:

1) Current exposures: Which direct and indirect dependencies does the economy and the nancial sector (incl. via

insured and nanced activities) have on ecosystem services? Which direct and indirect negative impacts does the

economy and the nancial sector have on nature? Which of those dependencies and negative impacts could be

material sources of physical and transition risk from a microprudential, macroprudential and/or macroeconomic

risk perspective?

2) Priorities: What are the key sectors with the highest impacts and dependencies (both direct and indirect) on nature?

What are the critical global, regional and/or local ecosystems these key sectors, or the economy/nancial sector as a

whole, interact with, and where are they located? What is the current or estimated state of these critical ecosystems?

3) Forward-looking view: Are there any future developments that should be considered when assessing sources of

physical and transition risks such as emerging policy frameworks or the sudden collapse of one or more ecosystem

services? Over what time horizon are these forward-looking developments expected to materialise?

4) Climate-nature nexus: How does the consideration of climate change (and related mitigation/adaptation strategies)

aect the identication of potential nature-related nancial risk? Could sectors with large dependencies or impacts

on nature be contributing to climate change, or be aected by it? Which strategies for climate change mitigation have

the potential to cause inadvertent negative eects on ecosystems, thereby amplifying nature-related nancial risks?

58 This phase shares similarities with the ‘Assess’ phase in the TNFD LEAP approach. For more information on measurement approaches, see also:

Assessing biodiversity-related nancial risks: Navigating the landscape of existing approaches, OECD, April 2023.

NGFS REPORT

17

The micro and macro level effects are not isolated.

Microeconomic eects can translate into macroeconomic

eects, while macroeconomic eects also can in turn

aect households and businesses (potentially giving rise

to feedback loops). Introduction of a sectoral/regional

level eects in the analysis might be benecial to better

capture these dynamics (see also gure 2). The table above

highlights some of the key economic eects

59

:

Substitutability

To assess the economic eects and risks, it is relevant

to account for the fact that actors react dierently to

shocks depending on their sensitivity to the shock and

their ability to adapt

60

. The notion of substitutability

is particularly relevant in that regard. Two dimensions

can be distinguished: geographical substitution and

technological substitution.

• Geographical substitution (i.e., between ecosystem

services): In the case of direct eects, the ability to adapt

and rely on dierent ecosystem services may be limited.

For example, when ecosystem services decline in a

particular location, it could require a business to move its

operations (with economic implications for the aected

region) or make expensive alterations to its production

processes. Businesses which are indirectly aected –

i.e., through their value chain – may be in a better position

to substitute, for example by changing suppliers or using

dierent products (although such substitutes may not

always exist). Consequently, jurisdictions or businesses

with a higher reliance on primary sectors could be more

exposed to economic eects

61

. At the same time, the

large scale global degradation of ecosystems could make

it increasingly dicult to nd alternative sources of the

required ecosystem services, including for jurisdictions

and businesses that are indirectly exposed.

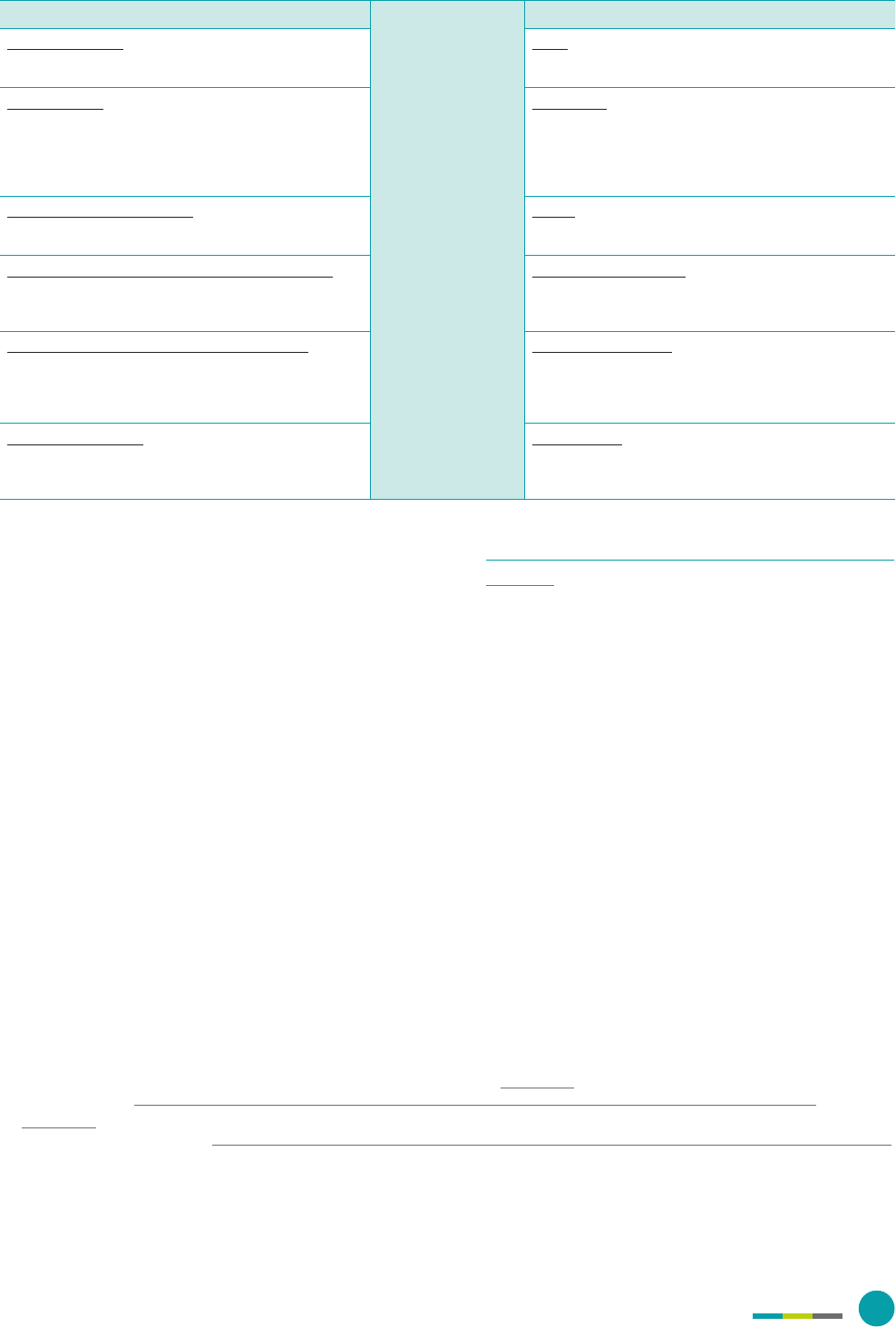

Micro level eects

Regional/

sectoral level

Macro level eects

Capital destruction: Damage to assets arising from

physical shocks and hazards such as ooding

or landslides.

Prices: Changes in prices of commodities, energy or water

could create inationary pressure.

Stranded assets: New regulations or changing consumer

preferences resulting in premature write-os of assets,

for instance because a factory is located in an area that

becomes designated as protected.

Productivity: Eects on GDP from a diversion of

investment or lower risk appetites for innovation, reduced

labour productivity (e.g. as a result of heat or pollution),

the loss of provisioning or regulating service productivity

(e.g. aecting agriculture) or damage and disruptions

to assets.

Price volatility of raw materials: Higher or more volatile

prices of commodities due to, for instance, failed harvests

of food crops.

Capital: Higher investment needs for mitigation or

adaptation to prevent nature degradation and potentially

accelerated depreciation of the current capital base.

Disruptions of production processes and value chains:

Increases in costs as a result of temporary disruption to

businesses or households processes, such as a suspension

of services due to ooding.

Socio-economic changes: Eects from structural changes

to the economic system, changing societal preferences,

arising inequalities, migration or conict.

Relocation and adjustment of economic activities:

Relocation or alteration of economic activities to account

for a reduction or loss of ecosystem services, or to reduce

negative impacts, such as planting dierent crops

on a farm.

Trade and capital ows: Changes to trade and capital

ows may result from shocks in ecosystem service

provision, potentially amplied via value chains, which

aects exchange rates and sovereign credit ratings.

Pricing of externalities: Cost increases as a result of pricing

in negative (or positive) impacts on nature, for instance a

tax on certain pollutants.

Fiscal balances: The lack of access to ecosystem services

may require an increase in social protection spending on

e.g. water or food. Losses in production and employment

may also reduce scal revenues.

59 Based on, inter alia: Indebted to nature: Exploring biodiversity risks for the Dutch nancial sector, DNB and PBL, 2020; Handbook for Nature-related

Financial Risks, Cambridge Institute for Sustainability Leadership (“CISL”), 2021; Final Report, NGFS-INSPIRE Study Group, March 2022. For further

examples, see also A Supervisory Framework for Assessing Nature-related Financial Risks – Identifying and navigating biodiversity risks, OECD, 2023.

60 Final Report, NGFS-INSPIRE Study Group, March 2022; Svartzman, R., et al. (2021) A “Silent Spring” for the Financial System? Exploring Biodiversity-

Related Financial Risks in France; Recommendations toward the development of scenarios for assessing nature-related economic and nancial risks,

NGFS, December 2023.

61 See for instance: Johnson, J. A., et al. (2021) The Economic Case for Nature: A Global Earth-Economy Model to Assess Development Policy Pathways.

The higher decline in GDP that was measured for low-income and lower-middle-income countries was due, in part, to a high dependency on forestry

or pollinated crops along with limited possibilities to switch to other production and consumption options.

NGFS REPORT

18

•

Technological substitution (i.e., between natural

and manufactured/human capital): There is a broader

question to consider around the ability of businesses

to adapt to physical shocks by substituting the loss

of ecosystem services with technologies and other

alternatives. For example, loss of pollinators may be

replaced by mechanical pollination technologies.

But if nature cannot be fully substituted – or substituted

at all – the eects of losing ecosystem services will

be far larger than if replacement technologies are

used. Assumptions on the availability of replacement

technologies in a particular sector or region are therefore

important because they inuence the size of estimated

potential economic eects. Standard macroeconomic

models generally assume a high degree of possible

substitutability, and therefore have tended to estimate

relatively small economic costs of nature degradation

as a percentage of GDP

62

. Given that a broad academic

literature has argued that substitution possibilities may be

limited or even impossible for environmental goods and

services (including, regulating and maintenance services),

models may therefore need to embrace the possibility that

nature cannot be – or not easily be – substituted

63

.

When accounting for substitution, it may be appropriate

to consider how adaptation possibilities might change

over time and at what scale. For instance, there may be

very low or even no adaptation options in the short-term

period following a physical shock (e.g. due to contractual

obligations, entrenched consumer preferences or

technological limitations). However, this might change

as replacement technologies become available over the

medium term. Equally, it is possible to imagine some

substitution possibilities for quite small changes in

ecosystem services, but these might reduce drastically

for substantial nature degradation (such as those resulting

from tipping points). Other factors such as costs (especially

in the short run) and negative impacts on nature may

also inuence the availability and eects of substitutes

over time.

Questions for members to consider when assessing economic risks:

1) Value chains: Where are the direct economic eects located (domestically or abroad)? Can direct eects transfer

across borders and/or amplify (including domestically) through value chains, thereby resulting in indirect economic

eects? Can risks cascade to dierent value chains?

2) Micro-macro interaction: To what extent do economic eects on households and businesses as a result of nature-

related nancial risks lead to macroeconomic deterioration, including lower productivity or inationary pressures?

Are there any risks that directly create eects at the macro level? Could macroeconomic deterioration aect or

create a feedback loop to the micro level?

3) Vulnerability, adaptation and substitution: How vulnerable are economic actors given their ability to adapt

(e.g. via substitution)? For the identied economic transmission channels, what technological or geographical

substitution possibilities are available that could mitigate the eects of shocks and hazards? How would these

possibilities change as the size of the shock or hazard increases?

62 The Economics of Biodiversity: The Dasgupta Review, February 2021. See also Recommendations toward the development of scenarios for assessing

nature-related economic and nancial risks, NGFS, December 2023; Svartzman, R., et al. (2021) A “Silent Spring” for the Financial System? Exploring

Biodiversity-Related Financial Risks in France.

63 Recommendations toward the development of scenarios for assessing nature-related economic and nancial risks, NGFS, December 2023 (referencing:

The Economics of Biodiversity: The Dasgupta Review, February 2021; Neumayer, E.; (2013) Weak versus Strong Sustainability: Exploring the Limits

of Two Opposing Paradigms. Cheltenham: Edward Elgar Publishing.

NGFS REPORT

19

Phase 3: Assess risk to, from

and within the nancial system

As a third step, central banks and supervisors may want to

consider the nancial risks that stem from the exposures

to sources of physical and transition risks (directly, or more

likely, via nanced activities)

64

.

Prudential risk categories Examples of potential nature-related factors aecting prudential risks

Strategic and business model risk The loss of ecosystems aects the ability of pharmaceutical companies to rely on

particular natural resources for their drug development or production.

Credit risk Soil degradation aects agricultural productivity, inuencing the collateral value of

agricultural land or the ability of farmers to repay debt.

Market risk The market value of a company is aected by assets that have decreased in value

because there is insucient fresh water for the production process, or the value of

the business’ production process is reduced by the emergence of new technologies

that require less water to operate.

Underwriting risk Pandemic causes more claims under insurance than usual or soil erosion leads to

more damaging eects of oods.

Operational risk Financial institution faces reputation or litigation risks as a result of nancing

a company engaged in activities that contribute to deforestation.

Facilities/suppliers of the nancial institution are aected by ooding or landslides.

Liquidity risk There may be pressure to liquidate assets due to rapid nature degradation as a

result of crossing a tipping point or new regulations aecting particular assets that

inuence cash ows and collateral values.

64 Like Phase 2, this phase shares similarities with the ‘Assess’ phase in the TNFD LEAP approach.

65 Based on, inter alia: Final Report, NGFS-INSPIRE Study Group, March 2022; Indebted to nature: Exploring biodiversity risks for the Dutch nancial sector,

DNB and PBL, June 2020; Handbook for Nature-related Financial Risks Key concepts and a framework for identication, CISL, 2021. For further examples,

see also A Supervisory Framework for Assessing Nature-related Financial Risks – Identifying and navigating biodiversity risks, OECD, 2023.

66 Interim Report, NGFS-INSPIRE Study Group, October 2021.

67 A Supervisory Framework for Assessing Nature-related Financial Risks – Identifying and navigating biodiversity risks, OECD, 2023.

Eects on the nancial system

The eects of nature degradation and related policies on

the economy can transmit to nancial institutions and can

have an impact on the nancial system. Similar to climate-

related risks, they can lead to the impairment of assets and

collaterals; lower corporate protability and the impairment

of insurability, aecting traditional nancial risk categories.

The table below illustrates this

65

.

Contagion

The effect on individual financial institutions has the

potential to spread throughout nancial systems and/or

create feedback loops to the real economy. These dynamics

may amplify shocks that are initially relatively mild, but

may have the potential to propagate across financial

institutions and therefore merit consideration. Similarly,

shocks that aect nancial stability could trigger further

macroeconomic deterioration, e.g. via market losses or

credit tightening

66

. Potential examples might include

inationary shocks from rising food prices causing a rise

in interest rates and weakening balance sheets of nancial

institutions such as banks. Likewise, uncertainty around

policy measures could aect credit conditions and therefore

the ability of economic actors in the system to transition.

Factors that would inuence the level of contagion include

the market concentration of businesses withing high-risk

sectors, the concentration of exposures to high-risk sectors

within the nancial system, the interconnectedness of

highly exposed nancial institutions and the presence

of information asymmetries between economic actors

67

.

Endogenous risk: eects of the nancial

system on nature

Economic actors are not only exposed to nature-related

physical and transition risks. Via the negative impacts they

have on nature, these actors also contribute to the risks

they need to manage. That eect is not always symmetrical.

NGFS REPORT

20

Some businesses may have a large negative impact on

nature but are not most directly and signicantly exposed

to the physical risks stemming from nature degradation.

Instead, they increase physical risks for the system as a

whole

68

. Those activities that give rise to endogenous risks

are also likely to be a source of transition risks when the

negative impacts attract the attention from policy makers,

innovators, investors or consumers.

The nancial sector is not solely responsible for economic

activities that exert negative impacts on nature, but it

does play a role as enabler of economic activities. In this

context, it should be noted that economic actors may also

exert a positive impact on nature via their activities, e.g. by

nancing activities that contribute to the conservation and

restoration of nature and thereby decreasing physical risks.

68 Final Report, NGFS-INSPIRE Study Group, March 2022.

Questions for members to consider when assessing nancial risks:

1) Transmission: How can economic risks transmit to traditional nancial risk categories?

2) Systemic dimension: How can nature-related nancial risks amplify via feedback loops within the nancial sector,

or between the nancial sector and the real economy?

3) Endogenous risk: Is the nancial sector materially contributing to the physical risks to which it is exposed to?

NGFS REPORT

21

4. Pathways to action

By providing a common understanding of nature-related

financial risks and a principle-based risk assessment

approach, this document has created a shared framework

for central banks and supervisors to assess the interactions

between nature, the macroeconomy and the nancial

system in a way that is intended to be actionable.

To assist with the operationalisation, the Framework

includes two illustrative cases which demonstrate how

the various steps and guiding questions included in the risk

assessment framework can be applied (see Illustrative Cases).

The Framework is also complemented by the NGFS Technical

Document on Nature Scenarios. This document contains

further information on methodologies to identify relevant

forward-looking physical and transition shocks, as well as

detailed information on models that can be used to assess

the economic and nancial risks that stem from them.

The recommendations in that Technical Document, as well as

examples provided in this Framework and tools highlighted

in supplementary frameworks produced by the OECD

70

and

TNFD

71

, provide relevant data sources, methods and tools

that may help central banks and supervisors move from

a conceptual understanding to a data driven assessment

of nature-related nancial risk. These documents will not

have all the relevant answers and tools. But by taking rst

steps, central banks and supervisors can provide important

methodological contributions to help rene those data

and methods over time.

In the meantime, the Framework and its guiding questions

may be used to facilitate a dialogue with the nancial sector

about the identication, assessment, management and

disclosure of nature-related nancial risks. In light of this, it will

be relevant to consider how the Framework could inform –

and be made interoperable with – eorts of stakeholders

beyond the NGFS such as regional and global standard setters

(e.g., the Basel Committee on Banking Supervision (“BCBS”),

the Financial Stability Board (“FSB”) and the International

Association of Insurance Supervisors (“IAIS”)).

To conclude, considering the relevance of nature-related

financial risks for their mandates

72

, central banks and

supervisors are encouraged to identify, assess and – where

relevant – act on material economic and financial risks

stemming from dependencies and impacts on nature and

their nexus with climate change. While doing so, dierences

in mandate, capacity, experience and context should be taken

into account. These dierences not only inform the starting

point, but can also enrich the understanding of nature-related

nancial risks and the spectrum of actions available to address

them. This Framework is intended as a common starting point

for such action across the NGFS membership.

70 A Supervisory Framework for Assessing Nature-related Financial Risks – Identifying and navigating biodiversity risks, OECD, 2023.

71 Recommendations of the Taskforce on Nature-related Financial Disclosures, TNFD, 2023; Tools Catalogue, TNFD.

72 Statement on Nature-Related Financial Risks, NGFS, 24 March 2022.

Illustrative Cases

NGFS REPORT

23

Introduction to the illustrative cases

To assist with the use of the principle-based risk assessment

framework, this section illustrates the application of the

guiding questions to two examples of specic ecosystems

(“Illustrative Cases”). The Illustrative Cases are intended

to demonstrate, in a largely qualitative way, how the

three phases in the Framework can be navigated. In doing so,

ndings are incorporated from existing academic literature,

newspaper articles, analyses and tools such as ENCORE and

WWF risk lters to arrive at a best-eort understanding

of the relevant nature-related nancial risks related to

those ecosystems

73

.