The Economic and Fiscal Impacts

of Locating Amazon’s HQ2 in Arlington County, Virginia

By

Stephen S. Fuller, Ph.D.

Dwight Schar Faculty Chair and University Professor

Director, The Stephen S. Fuller Institute

and

Jeannette Chapman

Deputy Director and Senior Research Associate

The Stephen S. Fuller Institute

The Schar School of Policy and Government

George Mason University

Arlington, Virginia

Prepared for

The Virginia Economic Development Partnership

November 8, 2018

1

Executive Summary

The location of Amazon’s HQ2 in Arlington County would generate significant

impacts to the benefit of the County’s and Commonwealth of Virginia’s economies.

These economic and fiscal impacts would be seen in job and income growth

including the HQ2 workforce and the supporting jobs and personal and business

earnings that would be generated annually by HQ2, its workforce, and their families

by their spending for goods and service within the Arlington County economy and

throughout the Commonwealth of Virginia. This new economic activity would

generate substantial new revenues in excess of new public expenditure

requirements for both Arlington County and the Commonwealth of Virginia.

These economic impacts would be generated by the construction and related

activities to supply the 8 million square feet of office space needed to house up to

50,000 jobs planned for HQ2. These outlays would occur over a proposed base-case

period of 20 years (see Appendix II Table C for details). With the occupancy of

renovated and newly constructed office space, Amazon’s outlays to operate its

business functions at HQ2, daily spending by its workforce and household spending

by Amazon workers’ households residing in Arlington County would generate

economic benefits in support of the County’s local business base spanning the

breadth of the local economy with these benefits recurring annually.

The magnitudes of these economic impacts would be a function of the number of

workers comprising the HQ2 workforce in any year building up to the planned total

of 50,000 jobs and the number of Amazon workers’ households choosing Arlington

County as their place-of-residence. In this analysis, total impacts are estimated for

the build-out year. These economic impacts can be annualized or calculated for

intervening years by prorating the end-period totals according to the projected pace

of hiring for the intervening years.

The direct outlays associated with HQ2 construction, operations, and daily worker

and annual household spending would generate additional impacts on the Arlington

County economy as these outlays are recycled through the County’s economy

generating new payroll supporting non-Amazon jobs and generating business

transaction that further expand the County’s and State’s economies. Some of these

impacts would also extend into the economies of the District of Columbia and

Maryland; for example, it is projected that approximately 30 percent of HQ2’s

workforce would choose to reside outside of the Commonwealth of Virginia.

The economic and fiscal impacts accruing to Arlington County, as the headquarters

site for Amazon, are summarized in Table 1 while the economic and fiscal impacts

flowing to the Commonwealth of Virginia, inclusive of Arlington County, are

reported in Table 2.

2

The key findings of these analyses are:

Construction outlays associated with building out the office space

requirements totaling 8 million square feet to house Amazon’s HQ2 in

Arlington County, including site preparation and on-site infrastructure, soft

costs, renovation and new construction and tenant improvements, would

total approximately $5.5 billion and contribute an estimated total of $6.5

billion to Arlington County’s economy over the construction period.

These direct construction outlays would also generate up to $521.8 million

in new labor income over the construction period to the benefit of workers

residing in Arlington County, supporting up to 5,072 jobs in the County and,

in total, would generate $3.4 billion in new personal earnings and as many as

50,112 full-time, year-round equivalent jobs within the Commonwealth of

Virginia.

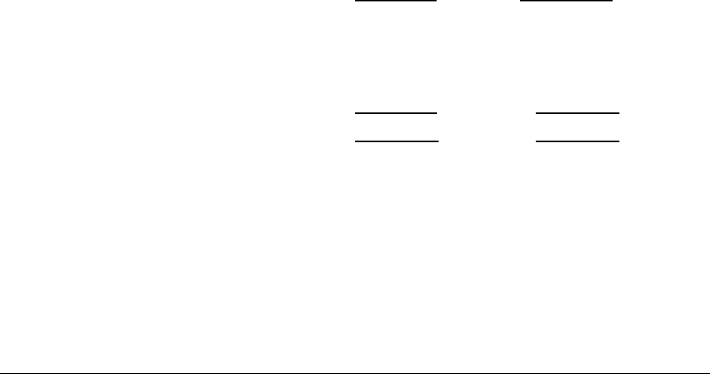

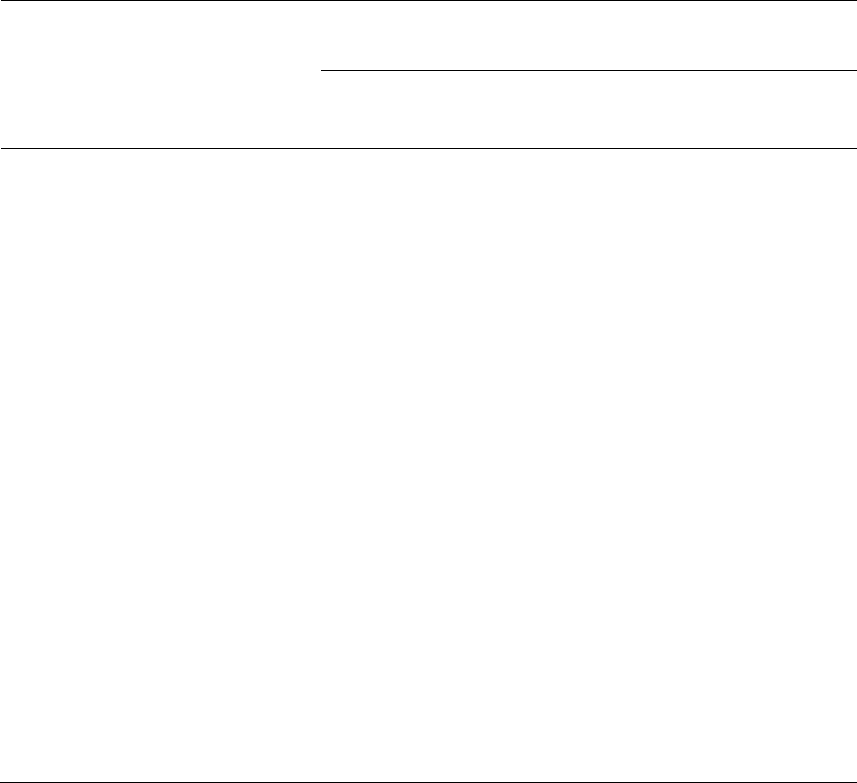

Table 1

Summary of Amazon’s HQ2 Economic and Fiscal Impacts

on Arlington County at Build-Out

(economic impacts in millions of 2030$s; fiscal flows in millions of 2017$s)

____________________________________________________________________________________________

Source Direct Total Personal Jobs

Outlay Output

1

Earnings

1

Supported

1

____________________________________________________________________________________________

Construction

2

$5,474.8 $6,476.4 $521.8 5,072

Post-Construction (annual)

3

$2,622.9 $3,339.3 $248.6 2,310

Post-Construction (annual)

4

$2,643.9 $3,366.0 $251.8 2,321

___________________________________________________________________________________________

Revenues - Expenditures = Fiscal Impact

____________________________________________________________________________________________

Fiscal Flows

@ $150,000 (annual)

5

$203.985 - $151.157 = $52.828

@ $200,000 (annual)

5

$196.770 - $144.488 = $52.282

____________________________________________________________________________________________

Source: The Stephen S. Fuller Institute at the Schar School, GMU

1

See Table 3 or 4 for column notes.

2

total impacts over construction period

3

impacts recur annually, assuming $150,000 average salary; dollars need to be adjusted

for inflation past 2040.

4

impacts recur annually, assuming $200,000 average salary; dollars need to be adjusted

for inflation beyond 2040.

5

calculations based on the residential and indirect job differences associated with

alternative average salary levels for HQ2’s employees.

3

The direct new annual spending in Arlington County generated following

completion of construction is estimated to total $2.6 billion and to contribute

$3.4 billion to the Arlington County economy.

HQ2’s projected 50,000 on-site jobs would support a payroll ranging

between $10.0 and $13.3 billion annually with an estimated fifteen percent

of these jobs (8,218 to 7,265 depending on average salary level) held by

workers residing in Arlington County and 69.5 percent (34,727 to 34,578

depending on average salary level) living in the Commonwealth of Virginia.

Direct post-construction spending would support an estimated 2,310 to

2,321 indirect and induced new jobs in Arlington County and from 44,321 to

49,498 new jobs statewide spanning the breadth of the economy.

This new economic activity would generate annual fiscal benefits of $52.3 to

$52.8 million for Arlington County and from $328.6 to $471.9 million for the

Commonwealth (in 2017$s).

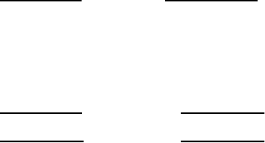

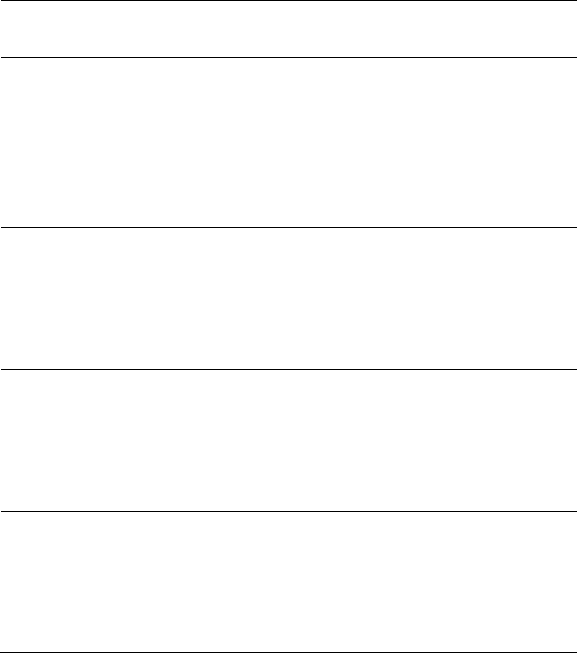

Table 2

Summary of Amazon’s HQ2 Economic and Fiscal Impacts

on the Commonwealth of Virginia at Build-Out

(economic impacts in millions of 2030$s; fiscal flows in millions of 2017$s)

____________________________________________________________________________________________

Source Direct Total Personal Jobs

Outlay Output

1

Earnings

1

Supported

1

____________________________________________________________________________________________

Construction

2

$5,474.8 $10,686.1 $3,384.1 50,112

Post-Construction (annual)

3

$5,053.4 $9,780.8 $3,039.2 44,321

Post-Construction (annual)

4

$6,165.1 $11,932.6 $3,707.8 49,498

___________________________________________________________________________________________

Revenues

5

- Expenditures

6

= Fiscal Impact

____________________________________________________________________________________________

Fiscal Flows

7

@ $150,000 (annual) $438.341 - $109.729 = $328.612

@ $200,000 (annual) $592.946 - $121.038 = $471.908

____________________________________________________________________________________________

Source: The Stephen S. Fuller Institute at the Schar School, GMU

1

Column and tables notes 1-4 the same as for Table 1.

5

Individual income tax and sales and use tax revenues

6

required educational expenditures in support of HQ2-related increases in K-12 school

children, direct, indirect and induced, in Northern Virginia.

7

based on respective average salaries of HQ2 workers residing in the Commonwealth

and the average salaries of indirect and induced jobs in the State generated by HQ2-

related spending adjusted for job location in Northern Virginia or elsewhere in the State.

4

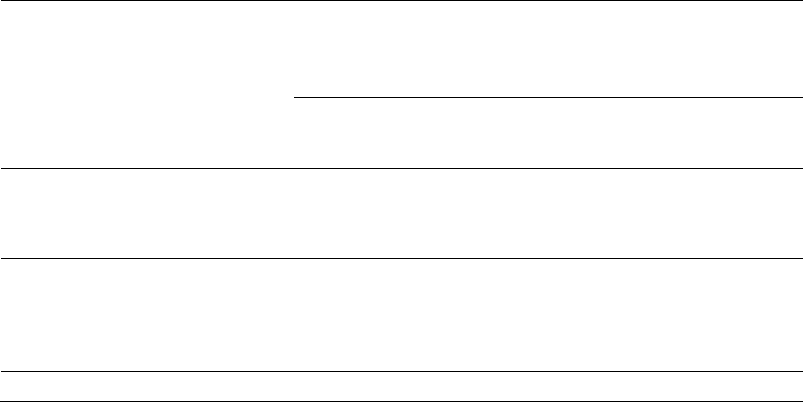

Table of Contents

The Analytical Dimensions of Amazon’s HQ2 .............................................................................. 5

The Economic Impacts of Locating Amazon’s HQ2 in Arlington County and the

Commonwealth of Virginia ................................................................................................................. 6

Construction-Related Economic Impacts of HQ2 ......................................................... 7

Post-Construction-Related Economic Impacts ............................................................. 8

The Fiscal Impacts of Locating Amazon’s HQ2 in Arlington County and the

Commonwealth of Virginia ................................................................................................................. 9

Amazon’s HQ2: Jobs and Population, Direct, Indirect and Induced ................... 10

Arlington County’s Fiscal Impact Analysis Methodology ....................................... 10

The Fiscal Impact of Amazon’s HQ2 on Arlington County ..................................... 12

The Fiscal Impact of Amazon’s HQ2 on the Commonwealth of Virginia .......... 13

Fiscal Impacts Summary ..................................................................................................... 16

Implications of Demographic, Economic and Fiscal Impacts ............................................. 17

Arlington County Growth Implications ......................................................................... 17

Commonwealth of Virginia Growth Implications ..................................................... 20

APPENDIX I: The Residential Impacts of Locating Amazon’s HQ2 in Arlington

County ...................................................................................................................................................... 23

APPENDIX II: Annual Tables ............................................................................................................ 29

5

The Economic and Fiscal Impacts

of Locating Amazon’s HQ2 in Arlington County, Virginia

The objectives of the analyses reported herein are to calculate the demographic,

economic, and fiscal impacts of constructing and operating Amazon’s HQ2 with its

proposed 50,000 worker employment base, 8 million square feet of office, and

annual payroll total ranging from $9.9 to $13.3 billion at build-out on Arlington

County and the Commonwealth of Virginia (see Appendix II Table C for the build-out

schedule).

The Analytical Dimensions of Amazon’s HQ2

Amazon’s HQ2 represents a significant source of demographic, economic and fiscal

impact to the benefit of its host jurisdiction. These direct impacts would be a

function of HQ2’s magnitude of operations and the payroll and non-payroll

expenditures associated with the construction of the facilities to house HQ2’s

workforce, HQ2’s continuing expenditures for its annual operations, and the payroll

of its workforce and where these outlays are likely to be made and for what goods

and services and the fiscal effects (demands of public services and generation of

new revenues) that these new jobs and related households would have at the local

and State levels.

HQ2, as proposed, would generate up to 50,000 new headquarters jobs in Arlington

County at build-out, currently proposed by 2040, occupying a total of 8 million

square feet of office space. For this analysis, two annual payrolls for this workforce

are considered: one averaging $150,000 per job and one averaging $200,000 per job

with respective build-out payroll totals of $9.9 billion and $13.3 billion (in 2040

dollars).

It is estimated that fifteen percent of these new Amazon workers (8,218 to 7,265)

would choose to reside in Arlington with sixty-nine percent of these workers

(34,727 to 34,578) residing in the Commonwealth. The remainder would largely

reside in Maryland and the District of Columbia. These new households—ranging

from 7,100 to 8,000 in Arlington County and approximately 34,300 in Virginia—

would generate a total household income ranging from $7.9 to 9.5 billion (in 2017

$s) representing new demand for locally provided goods and services and housing,

supporting the growth of the local and statewide economies as well as expanding

the host jurisdictions’ tax bases while correspondingly increasing the demand for

publicly provided services.

The impacts of locating Amazon’s HQ2 in Arlington County would accrue to the

County’s and to the Commonwealth of Virginia’s economies and tax bases during

HQ2’s construction phases—soft and hard costs, site development and tenant

improvements, and continue annually thereafter from outlays to support HQ2’s

operations as well as from daily on-site spending by HQ2 workers for food and

6

beverages, retail sales and transportation. These annual outlays related to the place-

of-work of Amazon’s workforce would be complemented by these workers’

household spending within their jurisdictions of residence.

As this new HQ2 employee and household spending circulates within the local and

State economies, it would generate additional business transactions and support the

payroll of local workers and workers located more broadly with this re-spending

generating additional income and supporting additional employment within the

economy. These economic effects can be measured using “multipliers” calculated by

the U.S. Bureau of Economic Analysis for Arlington County and the Commonwealth

of Virginia to derive the total contribution of this new spending to these respective

economies, the new personal earnings (labor income) generated to the benefit of

workers residing in Arlington County and the Commonwealth and the total jobs this

new spending would support locally, within the State and beyond.

For construction outlays, these economic impacts would be those spanning the full

period of the construction activity; these impacts are calculated based on the totals

and do not continue beyond the construction period. The post-construction

outlays—HQ2’s operations, employee on-site spending, and workers’ household

spending by place-of-residence—would be annual outlays and would recur each

year as long as Amazon retains its headquarters in Arlington County. All of these

economic activities and the growth that they support would have important fiscal

implications for Arlington County and the Commonwealth of Virginia.

The Economic Impacts of Locating Amazon’s HQ2 in

Arlington County and the Commonwealth of Virginia

The location of Amazon’s HQ2 in Arlington County would impact the County’s

economy throughout the construction period; with the completion of construction,

these impacts would have been realized. These economic impacts would span the

pre-construction and construction periods including design and engineering

services and other soft costs, site development and landscaping, and building

renovation or new construction and pre-occupancy improvements including tenant

improvements; that is, all direct outlays required to produce the move-in-ready

product.

Post-construction economic benefits would recur annually as the office space is

delivered over the 2020-2040 period for the lifetime of Amazon’s HQ2 in its

Arlington County location. These economic benefits would reflect the continuing

expenditures for building and headquarters operations, the on-site spending by

HQ2’s workforce and the disposable income that the new HQ2 workers’ households,

those choosing to reside in Arlington County and more broadly in the

Commonwealth, would bring into the County and State to spend on consumer goods

and services.

7

Construction-Related Economic Impacts of HQ2

The economic impacts generated by the construction of Amazon’s HQ2—its hard

and soft costs inclusive of site development, infrastructure and tenant

improvements but excluding land acquisition, taxes, insurance and financing costs—

are reported in Table 3 for build-out spanning the FY 2019-2037 period. During this

period direct outlays for the hard and soft costs and tenant improvements

associated with the renovation and new construction of 8 million square feet of

office space and preparing these structures for occupancy are projected to total $5.5

billion (construction costs are inflated at 1.5 percent per year and averaged over the

18-year construction period).

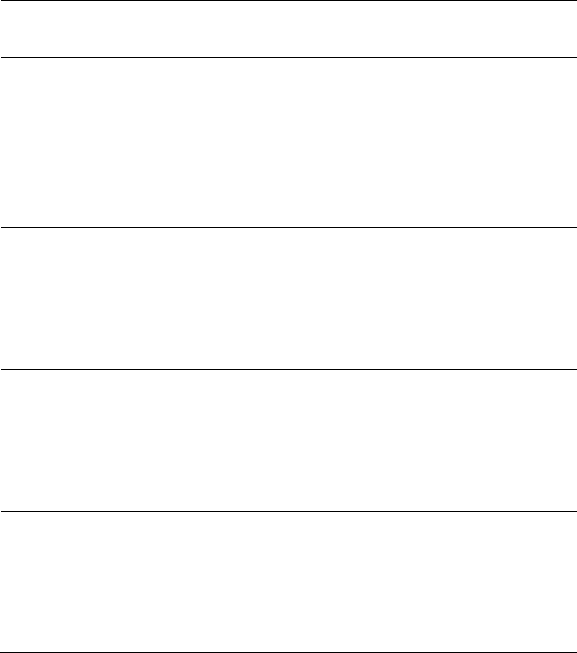

Table 3

The Economic Impacts of Amazon’s HQ2 Total Construction Spending

on Arlington County and the Commonwealth of Virginia

(economic impacts in millions of 2030$s)

_____________________________________________________________________________________________

Source Direct Total Personal Jobs

Outlay Output

1

Earnings

2

Supported

3

_____________________________________________________________________________________________

Arlington County $5,474.8 $6,476.4 $521.8 5,072

Virginia $5,474.8 $10,686.1 $3,384.1 50,112

_____________________________________________________________________________________________

Sources: VEDP and The Stephen S. Fuller Institute at the Schar School, GMU.

1

total contribution to the Arlington County and State’s economies.

2

generation of new personal earnings beyond HQ2’s payroll accruing to workers residing

in Arlington County and the Commonwealth of Virginia.

3

jobs supported by the construction and related outlay over the construction period.

The build-out of HQ2’s office space requirements, up to 7 million square feet of new

construction and including the outlays for the renovation of up to 1 million square

feet of existing office space, over the base-line period of 20 years represents major

direct outlays that would generate even greater contributions to these economies,

as shown in Table 3. The $5.5 billion in total construction spending over the

construction period would add $6.5 billion to the Arlington County economy and

$10.7 billion to the Commonwealth of Virginia’s economy over the full construction

period. These direct construction outlays would generate significant new taxable

personal earnings to the benefit of workers residing in Arlington County and

elsewhere in Virginia. For the base-case construction period, these new earnings

would translate into 5,072 and 50,112 year-round, full-time equivalent jobs,

respectively, for the County and Commonwealth spanning the construction period.

8

Post-Construction-Related Economic Impacts

The economic impacts generated during the development period, as presented in

Table 4, would represent significant contributions to the economies of Arlington

County and the Commonwealth of Virginia and to generate significant levels of local

and statewide labor income and employment. While these impacts would be fully

realized with the completion of construction activity, the daily operations of HQ2,

the spending by its workforce, and the spending by the new workers’ households

choosing to reside in Arlington County and the Commonwealth would continue to

generate annual economic benefits as long at Amazon retains its HQ2 in Arlington

County. These continuing economic impacts are presented for Arlington County and

the Commonwealth in Table 4.

Table 4

Economic Impacts of Amazon’s HQ2 Annual Post-Construction Outlays

on Arlington County and the Commonwealth of Virginia

(economic impacts in millions of 2030$s)

_____________________________________________________________________________________________

Source Direct Total Personal Jobs

Outlay Output

1

Earnings

2

Supported

3

_____________________________________________________________________________________________

Arlington County

HQ2 Operations

4

$2,167.0 $2,722.7 $195.4 1,554

Employee Spending

5

222.9 295.5 26.6 411

Household Spending

6

233.0 321.1 26.6 345

Totals $2,622.9 $3,339.3 $248.6 2,310

Totals

7

$2,643.9 $3,366.0 $251.8 2,321

Commonwealth of Virginia

HQ2 Operations

4

$2,167.0 $4,086.0 $1,205.6 13,717

Employee Spending

5

222.9 441.6 141.5 2,660

Household Spending

6

2,663.5 5,253.2 1,692.1 27,944

Totals $5,053.4 $9,780.8 $3,039.2 44,321

Totals

7

$6,165.1 $11,932.6 $3,707.8 49,498

_____________________________________________________________________________________________

Sources: VEDP and The Stephen S. Fuller Institute at the Schar School, GMU.

1

total contribution to the Arlington County and State economies.

2

generation of new personal earnings beyond HQ2’s payroll accruing to workers residing

in Arlington County and the State.

3

jobs supported by the post-construction outlays annually at the end of the period.

4

based on 50,000 employees.

5

on-site daily spending for food and beverages, retail sales and transportation.

6

local spending for goods and services by households of HQ2 employees residing in Arlington

County and the Commonwealth of Virginia with $150,000 average salary.

7

total post-construction spending reflecting an average salary of $200,000.

9

Arlington County’s continuing economic benefits from hosting HQ2 would be

realized by a broad base of its local businesses both in support of the business

operations of Amazon’s HQ2 and its workforce’s daily consumption requirements—

its on-site spending for food services, retail sales and transportation including

parking. The approximately 15 percent of Amazon’s workforce who would choose to

reside in Arlington County, accounting for from 8,054 to 7,139 households and

8,218 and 7,265 HQ2 workers respectively (depending on HQ2’s average salary

level), represent a major source of consumer outlays. These households would

represent a total household income projected to range between $1.4 and $1.7

billion. Based on an average household consumer spending profile, developed by the

U.S. Bureau of Labor Statistics, and adjusting for consumer spending that is likely to

be captured locally, Arlington County’s businesses would likely captured 17.9

percent of average, after tax, consumption spending by these new Amazon workers’

households with the State’s share being 37.3 percent.

Annual outlays associated with Amazon’s operations and workforce spending are

estimated to slightly exceed $2.6 billion annually in Arlington County (in 2017 $s)

contributing up to $3.4 billion to the County’s economy, reflecting a multiplier of

1.27. This annual spending would generate new personal earnings of $249.8 million

that would accrue to workers residing in the County and represent County-based

employment—full-time, year-round equivalent—ranging from 2,310 to 2,321 jobs.

These same levels of post-construction spending would generate even greater

magnitudes of economic benefits when measured for the Commonwealth of

Virginia. The multipliers for the State economy are larger than for Arlington County

reflecting its larger and more complex economy, which retains more of these outlays

and provides a greater proportion of the services and labor required to service HQ2

at its Arlington County location. As a result the economic impacts, new personal

earnings and jobs supported per dollar of outlay would be substantially greater for

the Commonwealth than reported for Arlington County.

With all 50,000 HQ2 employees in place in Arlington County, annual spending to the

benefit of the Commonwealth’s economy would range from $5.0 billion to $6.1

billion. The total contribution of this new spending to the Virginia economy, with a

multiplier of 1.94, would range from $9.8 billion to $11.9 billion, generate new

personal (and taxable) earnings ranging from $3.0 billion to $3.7 billion annually

and support from 39,415 to 44,041 indirect and induced jobs being held by workers

residing in Virginia.

The Fiscal Impacts of Locating Amazon’s HQ2 in

Arlington County and the Commonwealth of Virginia

The framework for the fiscal impact analysis of Amazon’s HQ2 is provided by the

per capita and per employee fiscal impacts calculated for Arlington County based on

its FY 2017 Comprehensive Annual Financial Report as summarized on Table A in

Appendix II. These per capita averages for public expenditures and revenues

10

provide the basis for calculating the fiscal impact of Amazon’s HQ2 reflecting its mix

of at-place jobs and HQ2 workers and related indirect and induced workers likely to

reside in Arlington County.

Amazon’s HQ2: Jobs and Population, Direct, Indirect and Induced

The data inputs to the fiscal impact analysis for Amazon’s HQ2 on Arlington County

and the Commonwealth of Virginia include the HQ2 jobs and Amazon workers’

households (number of residents and number of school-age children) residing in

Arlington County and the Commonwealth of Virginia. These inputs are presented in

Table 5.

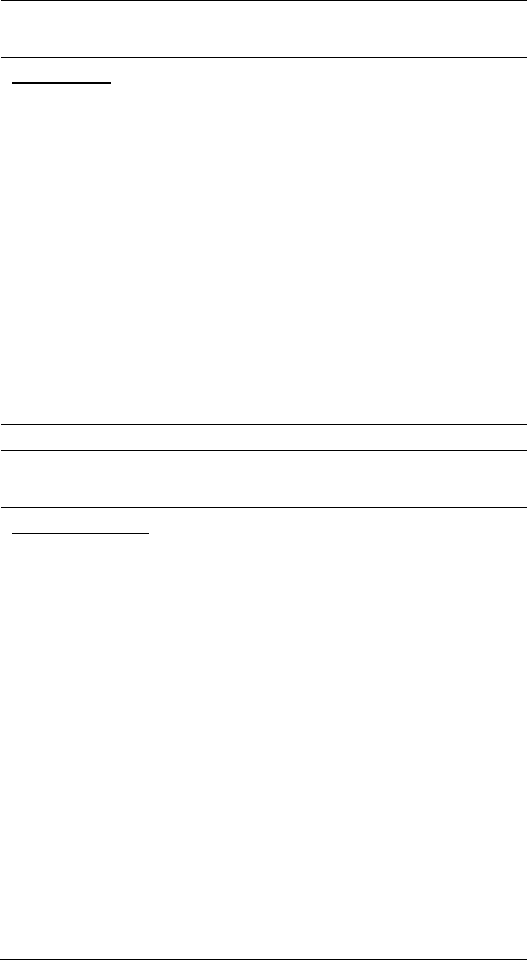

Table 5

Direct and Indirect Jobs and Population Generated by

Amazon’s HQ2 Location In Arlington County

________________________________________________________________________________

Development Period Jobs Population School-Age

________________________________________________________________________________

Arlington County

Direct Impacts

Build-out @ $150,000 50,000 17,585 1,513

Build-out @ $200,000 50,000 15,240 1,377

Indirect Impacts

Build-out @ $100,000 2,310 2,358 182

Build-out @ $200,000 2,321 2,546 195

Commonwealth of Virginia

Direct Impacts

Build-out @ $150,000 50,000 96,870 16,196

Build-out @ $200,000 50,000 97,654 17,593

Indirect Impacts

Build-out @ $150,000 44,321 125,472 22,133

Build-out @ $200,000 49,498 140,339 24,765

_____________________________________________________________________________________

Sources: VEDP and The Stephen S. Fuller Institute at the Schar School, GMU

Arlington County’s Fiscal Impact Analysis Methodology

The objective of this fiscal assessment is to answer the question: If Amazon’s HQ2

was already built-out in Arlington County during the 2017 budget year would it and

its employee’s households residing in Arlington County have generated more

County revenues than the cost burden of the public services it and its resident

workers would have required; that is, would hosting HQ2 generate a fiscal benefit to

the County? In order to answer this question, Arlington County’s fiscal impact

analysis is based on the expenditure and revenue data presented in the most

11

current Arlington County Comprehensive Annual Financial Report (CAFR). All data

utilized in this fiscal analysis are for 2017. This analysis divides the County’s

expenditures and revenues into those that serve or are generated by the residents of

the County (its population) and those that are related to or generated by the

County’s non-residential functions (as represented by its employment base, its

workers). This assignment of expenditures (demands for County services) and

revenues is expressed for the County’s 222,800 residents on a per capita basis and

for the County’s non-residential functions based on its estimated 173,002 at-place

jobs across all sectors (private and public) on a per employee basis that existed in

2017.

This analysis of the County’s revenues in FY 2017, including all taxes, fees, permits,

fines, user charges, and intergovernmental transfers, found that these were divided

between residents (population) and non-residential functions (jobs in the County),

respectively, on a 62.3% and 37.7% basis. An analysis of the County’s expenses

(demand for services) for FY 2017 found that these were distributed between

residents and non-residential functions, respectively, on a 78.1% and 21.9% basis.

These differences in the percentage shares for revenues and expenditures between

residents and non-residential functions explain why it is fiscally important for the

County to balance residential and non-residential growth. These revenue and

expenditure distributions are shown in Table 6.

Table 6

Fiscal Flows in Arlington County for

Resident and Non-Residential Functions, FY 2017

(in 2017 dollars)

_______________________________________________________________________________

Source Per capita

1

Per Job

2

Expenditures:

County-wide average $4,207.04 $1,515.96

Education Only

3

2,135.09

All Other Expenditures 2,071.95

Revenues:

County-wide average $3,356.98 $2,610.72

Real Property 2,281.51 1,101.63

All Other Sources 1,075.47 1,509.09

Net Fiscal Impact -$850.06 $1,094.76

_______________________________________________________________________________

Source: The Stephen S. Fuller Institute at the Schar School, GMU.

1

the County’s population in 2017 totaled 222,800 (CAFR, page 247).

2

the County’s at-place employment in 2017 totaled 173,002 (BLS).

3

educational costs per student in FY 2017 were $18,015.46 based on

enrollment of 26,405 (CAFR page 247).

12

For this analysis, the real estate tax revenue generated by multifamily structures has

been included on the residential side of the equation (these data are normally

reported as commercial revenue). While tax-exempt properties do not generate real

estate tax revenues, these facilities and their employees do place demands on the

County’s services. In this fiscal analysis the workers (jobs) accommodated in these

tax-exempt properties are included on the non-residential side of the fiscal

equation. All educational expenditures, the largest single source of County

expenditures, are assigned to the resident’s (population) side of the equation. Other

assignments are based on the identified sources, where these are identified, or

based on access or use patterns in the County. Where service patterns cannot be

identified, such as for General Government, it is assumed that every resident and

every worker in the County has equal access to these services and, therefore, their

costs are assigned equally to all residents and workers in the County.

For the fiscal analysis of Amazon’s HQ2, this fiscal model has been tailored to reflect

the differences between Amazon’s HQ2 as a place-of-employment and its workers’

households (and HQ2’s indirect and induced jobs and their households) and the

averages reflecting all current residents and workers in Arlington County as shown

in Table 6. These adjustments include an estimate for the real estate tax revenues

that would be generated by 8 million square feet of renovated and new office

buildings, with a construction value of $5.5 billion, including estimated land value, in

2017 dollars to house HQ2’s planned 50,000 workers. Additionally, the cost of

educating the new school-age children of HQ2 workers’ household and households

associated with indirect and induced jobs linked to HQ2 and locating in Arlington

County is calculated in this analysis at the per student cost of $18,015.46. All other

average values, based on the FY 2017 budget, are used even though they may

overstate demands for public services given the above-average incomes and

demographic profile of the new HQ2 and related households projected to reside in

Arlington County should Amazon select the County for its HQ2 location.

The Fiscal Impact of Amazon’s HQ2 on Arlington County

These analyses of Amazon’s HQ2 fiscal impacts on Arlington County show that the

location of HQ2 in Arlington County, with its job base and related tax base, would

generate a substantial fiscal benefit to the County that would more than compensate

for the fiscal costs associated with the new HQ2 workers’ households who would

choose to locate in the County as a result of HQ2’s location there and the households

related to the indirect and induced jobs generated by HQ2-related spending

choosing to reside in the County.

These net fiscal benefits for HQ2 at build-out with its planned 50,000 jobs on site,

the new households choosing to reside in Arlington County, and the additional

indirect and induced jobs generated within the County’s economy and their related

households, as enumerated on Table 5, are estimated to range between $52.8

million and $52.3 million (in 2017 dollars) reflecting two average salary levels, as

presented in Tables 7a and 7b. The annual, inflation adjusted value of these

13

revenues and expenditures are presented in the Appendix II reflecting the

differences generated by two average salaries for HQ2’s workforce: $150,000 and

$200,000.

Table 7a

The Fiscal Impact of the Amazon’s HQ2 on Arlington County At Build-Out:

Direct, Indirect and Induced—Average Employee Salary of $150,000

(in millions of 2017 dollars)

___________________________________________________________________________

Source Residents Non-Residential

___________________________________________________________________________

Revenues

Other Than Real Estate $45.500 $78.940

Real Estate Tax 21.448 58.097

Total Revenues $66.948 $137.037

Expenditures

Public Schools $30.536 --------

Other Expenditures 41.321 $79.300

Total Expenditures $71.857 $79.300

Fiscal Impact -$4.909 $57.737

___________________________________________________________________________

Combined Fiscal Impact $52.828

___________________________________________________________________________

Source: The Stephen S. Fuller Institute at the Schar School, GMU

The Fiscal Impact of Amazon’s HQ2 on the Commonwealth of Virginia

The fiscal impact of Amazon’s HQ2 location in Arlington County would generate

demands on the Commonwealth of Virginia for services and, at the same time, this

growth would generate new revenues that would flow to the State. For the

purposes of this fiscal impact analysis, the one mandated increase in State-level

spending that would result from the location of Amazon’s HQ2 in Arlington County

is the increase in per student contributions to the counties experiencing increases in

enrollment tied directly or indirectly to this location decision.

HQ2’s direct employment would add approximately 34,300 new households and

between 16,200 and 17,600 new school-age children at build-out to the

Commonwealth. In addition, HQ2’s spending in the Commonwealth would support

from 44,321 and 49,498 indirect and induced jobs and related households. These

households, combined with HQ2’s resident workers in Virginia, would generate an

estimated total increase in school-age children ranging between 27,100 and 29,980

in Northern Virginia jurisdictions. Based on the State’s FY 2017 contribution to each

14

jurisdiction, the required costs of this additional enrollment (assuming that all of the

school-age children identified attended public school) would range from $109.7

million to $121.0 million, depending on the salary profile of the HQ2 workforce.

Table 7b

The Fiscal Impact of the Amazon’s HQ2 on Arlington County At Build-Out:

Direct, Indirect and Induced—Average Employee Salary of $200,000

(in millions of 2017 dollars)

___________________________________________________________________________

Source Residents Non-Residential

___________________________________________________________________________

Revenues

Other Than Real Estate $40.579 $78.957

Real Estate Tax 19.128 58.106

Total Revenues $59.707 $137.063

Expenditures

Public Schools $28.320 --------

Other Expenditures 36.852 $79.316

Total Expenditures $65.172 $79.316

Fiscal Impact -$5.465 $57.747

___________________________________________________________________________

Combined Fiscal Impact $52.282

___________________________________________________________________________

Source: The Stephen S. Fuller Institute at the Schar School, GMU

These new residents to the Commonwealth, the holders of HQ2 jobs and the indirect

and induced jobs linked to HQ2-related spending in the State, would generate new

revenues across all budget categories. The three largest, accounting for 85.3

percent of the State’s revenues in FY 2017, include: individual income taxes

accounting for 63.3 percent of total revenues, sales and use taxes accounting for

18.0 percent and corporate income taxes accounting for 4.0 percent.

Estimates can be developed for these major sources of tax revenues. Individual

income tax revenue estimates are based exclusively on the average salaries related

to HQ2 employees residing in the Commonwealth and the average salaries of the

indirect and induced jobholders by place of residence, Northern Virginia or

elsewhere in the State. Similarly, estimates for these new jobholders’ exposure to

sales and use taxes based on their annual earnings can be calculated.

Other taxable income generated by these households are excluded from this fiscal

analysis as these sources may already have existed in the Commonwealth or are not

directly generated by the location of HQ2 in Arlington County. These exclusions

15

would include other taxable income (e.g., investment earnings) and earnings by

other wage earners in HQ2 households. The average household income (assuming

the average HQ2 salary of $150,000) of HQ2 workers who would reside in the

Commonwealth is estimated at $228,187. With the HQ2 workers’ average salary at

$150,000, this would leave $78,187 in other household earnings. These excluded

earnings would total $2.7 billion for all HQ2 households residing in the

Commonwealth. These earnings of second wage earners would generate an

estimated $122.2 million in individual income tax and $23.8 million in individual

sale and use tax revenues. At the upper end of the proposed HQ2 salary average,

these untaxed (non-HQ2 earnings) household incomes would be greater and yield

greater income and sales and use tax revenues than at the $150,000 salary average.

Table 8

Summary of Amazon’s HQ2 Annual Fiscal Impacts

on the Commonwealth of Virginia at Build-Out

(in millions of 2017 dollars)

____________________________________________________________________________________________

Revenues

1

- Expenditures

2

= Fiscal Impact

Fiscal Flows

3

@ $150,000 (annual) $438.341 - $109.729 = $328.612

@ $200,000 (annual) $592.946 - $121.038 = $471.908

____________________________________________________________________________________________

Source: The Stephen S. Fuller Institute at the Schar School, GMU

1

Individual income tax, sales and use tax, and corporate income tax revenues,

construction and post-construction spending, direct, indirect and induced.

2

required educational expenditures in support of HQ2-related increases in K-12 school

children, direct, indirect and induced, in Northern Virginia.

3

based on respective average salaries of HQ2 workers residing in the Commonwealth

and the average salaries of indirect and induced jobs in the State generated by

construction and post-construction HQ2-related spending adjusted for job location in

Northern Virginia or elsewhere in the State.

Households of indirect and induced jobholders would also generate additional

incomes excluded from this analysis shown on Table 8. These indirect and induced

jobs are estimated to have a household income of $115,169. With the average

annual wage of the indirect worker being $65,630, reflecting the weighted average

of different salaries associated with jobs in Northern Virginia and jobs elsewhere in

the State, these additional earnings income would average $49,541 and would

generate a total of $2.2 billion in taxable earnings. These earnings would yield

individual income taxes of $99.5 million and support individual sales and use taxes

totaling $19.4 million.

Other important sources of annual income tax revenues would include: direct,

indirect and induced corporate income, and construction-related earnings (direct,

indirect, and induced) and sales and use taxes on these construction-related

16

earnings and on the purchase of construction materials. The results of these

calculations for these revenue sources and the costs for the required State

contribution per new student associated directly or indirectly with HQ2 are

presented in Table 8 in 2017 dollars at for build-out. These revenues and costs are

presented in Appendix II on an annualized and current-year basis (adjusted for

inflation) for the FY 2019-FY 2039 period.

These analyses of Amazon’s HQ2 direct and indirect fiscal impacts on the

Commonwealth of Virginia show that the location of HQ2 in Arlington County would

generate revenue flows to the Commonwealth that substantially more than

compensate for the required K-12 education costs associated with the new HQ2,

workforce and associated households taking up residence within the State and the

related indirect and induced jobs and related increase in public school enrollment.

This revenue surplus would range from $328.6 million to $471.908 million

(expressed in 2017 $s) annually at build-out, depending on the average HQ2 worker

salary of $150,000 or $200,000, respectively.

Fiscal Impacts Summary

The fiscal impacts on Arlington County of locating and operating Amazon’s HQ2 in

the County with its planned 50,000 on-site employees and the new residents that

would be attracted to live in the County, including indirect and induced employment

resulting from this new spending and additional households locating in Arlington to

support this new economic activity, would generate a net fiscal benefit to the

County. These fiscal benefits for the base-case at full build-out would total $52.8

million reflecting an average HQ2 employee salary of $150,000. With an average

HQ2 employee salary of $200,000, this fiscal net benefit would total $52.3 million.

These represent the returns, revenues over expenditures, that would have been

generated for Arlington County had HQ2 been in place and built-out in Arlington

County in its FY 2017 budget year.

The fiscal benefits accruing to the Commonwealth of Virginia from locating

Amazon’s HQ2 in Arlington County, comparing only the potential increases in

individual income tax and sales and use tax revenues generated by the salaries

associated with the new direct, indirect and induced jobs created within the

Commonwealth and several sources of business-related tax revenues (corporate,

sales and use, construction-related) with the required contributions to the local

jurisdictions where the HQ2 and related new workers would reside for the

additional K-12 enrollment generated by these new households, would result in a

net fiscal benefit to the Commonwealth. These net annual fiscal benefits of these

new direct, indirect and induced jobs and related new State residents would range

between $328.612 million and $471.908 million at build-out (in 2017$s) under the

current budget allocations. The annual, inflation adjusted value of these revenues

and expenditures are presented in the Appendix II, reflecting the differences

generated by three average salaries scenarios for HQ2’s workforce: $150,000 and

$200,000.

17

Implications of Economic and Fiscal Impacts

The scale of Amazon’s HQ2, with its up to 50,000 jobs, payroll of $9.9 to $13.3

billion and 8 million square feet of building space as projected for 2040 in the base-

case build-out would be a significant investment in Arlington County and the

Commonwealth of Virginia, even when spread out over a 20-year development

period. To put the Amazon HQ2 investment into perspective, it is worth considering

the projections for the County and Commonwealth in its absence. These are

presented in Table 9.

Arlington County Growth Implications

For Arlington County and the Commonwealth of Virginia their potential

demographic, economic and fiscal gains with the location the Amazon’s HQ2 would

account for varying shares of their projected growth over the base-case build-out

period likely extending their growth trajectory beyond current projections.

Arlington County’s small geographic scale constrains its capacity to accommodate

horizontal growth, such as single-family housing units, while it has substantially

greater capacity to add housing units vertically with these predominantly serving

the rental market and smaller households with fewer children.

Table 9

Forecast for Arlington County and the Commonwealth of Virginia

in the Absence of Amazon’s HQ2, 2019-2039

(in billions of current dollars, jobs and population in thousands)

___________________________________________________________________________________________

Metric Arlington County Commonwealth of Virginia

2019 2039 Change 2019 2039 Change

___________________________________________________________________________________________

Population 242.2 281.5 39.3 8,593.1 9,852.4 1,259.3

Households 112.3 136.9 24.6 3,289.6 4,030.0 740.4

Jobs 195.3 229.6 34.3 4,072.4 4,537.2 464.8

GCP/GSP

1

$37.4 $90.2 $52.8 $565.3 $1,314.1 $748.8

____________________________________________________________________________________________

Sources: IHS Markit, The Stephen S. Fuller Institute at the Schar School, GMU

1

gross county product/gross state product.

When compared to current forecasts for Arlington County’s growth over the 2019-

2039 period, Amazon’s proposed workforce of up to 50,000 (plus the 2,310 indirect

and induced jobs) is the one metric that substantially exceeds current forecasts: the

County’s job growth projections in the absence of Amazon’s HQ2 have the County’s

employment base adding 34,312 jobs over this period but with Amazon’s potential

addition of 52,310 jobs (including indirect and induced job growth), assuming that

these did not account for any of these previously projected jobs gains, the County’s

18

employment base would increase by 86,622 jobs or by 44.4 percent rather than by

the projected 34,312 jobs or 17.6 percent by 2039. This more than doubling of the

County’s job growth over this period would require significant growth of the

County’s capacity to accommodate this employment, well beyond the 8 million

square feet of office space required by HQ2, and result in additional investment in

new office and other commercial spaces during this period.

Table 10

Projected Growth Without and Including Amazon’s HQ2: 2019-2039

(percent change for 20-year period)

________________________________________________________________________________

Metric Arlington County Commonwealth of Virginia

Without Including Without Including

HQ2 HQ2 HQ2 HQ2

________________________________________________________________________________

Population Growth 16.2% 24.2% 14.6% 17.2%

Household Growth 21.9 29.9 22.5 24.7

Job Growth 17.6 44.3 11.4 13.7

GCP/GSP

1

growth 141.2% 246.8% 32.5% 53.7%

________________________________________________________________________________

Sources: IHS Markit, The Stephen S. Fuller Institute at the Schar School, GMU

1

gross county product/gross state product change over 2019-2039 period not

adjusted for inflation.

The current office market in Crystal City/Pentagon City and in Rosslyn, as is true

more broadly in Arlington County, has experienced improvement in 2018 following

a period of declining absorption dating back to the Sequester in 2014. These two

major submarkets have a total of 21.9 million square feet of gross office space with

4.6 million vacant as of mid-year 2018 for a 21.2 percent vacancy rate. Much of this

office space is Class B and C that would require substantial renovation to be

attractive in today’s market and some would ultimately be repositioned out of the

office market. The good news is, according to a mid-year report by

NewmarkKnightFrank, these office markets have experienced increasing absorption

in 2018 (224,617 square feet in Crystal City/Pentagon City and 548,459 in Rosslyn).

This absorption more than doubles the absorption achieved in the Crystal

City/Pentagon City submarket over the past two years and reverses the pattern of

negative absorption in the Rosslyn submarket experienced since 2014. At present,

there is no new office construction underway in these two submarkets. Still, there is

sufficient existing space to house Amazon’s short-term requirements in either

submarket; this would reduce the current vacancy rate by 50% in either assuming

that this vacant space is otherwise suitable for HQ2’s long-range purposes.

While the currently available office space could accommodate HQ2’s short-term

requirements, this availability of office space provides the capacity needed to house

19

the expanded requirements of businesses and their workers generated in support of

HQ2, the indirect and induced workforce (and opportunistic business locations)

needed to capture the full economic potentials associated with the location of

Amazon’s HQ2 in Arlington County. These currently above-normal office vacancy

rates in these two major Arlington County submarkets, which have presented a

fiscal challenge to the County over the past three years, would enable the County to

realize the ancillary economic and fiscal benefits from HQ2’s location. Alternatively,

if these office markets had been more limited, with attendant higher lease rates,

these tenants could have been discouraged from co-locating in Arlington County

with the resultant losses of these economic and fiscal benefits to neighboring

jurisdictions.

To house the new households directly and indirectly related to HQ2, Arlington

County would need between 8,233 and 9,065 housing units with 63-70 percent of

these being rentals, depending upon the average wage of the HQ2 jobs (See

Appendix I for details). While these housing requirements are not proportionally as

great as the new work space requirements, they would present a challenge to the

County due to an already constrained housing supply, an aging housing stock and

growing price pressures in the absence of the new housing demands generated by

Amazon’s HQ2. One result of this tight housing market would be shifting this new

housing demand to adjacent jurisdictions where vacant land is more available to

support single-family housing construction.

The increased economic activity that would flow to Arlington County’s business

base from the location of Amazon’s HQ2 in the County, generating construction

outlays totaling $5.5 billion and annual post-construction spending of $2.6 billion,

could increase the County’s economic growth rate during the build-out period by as

much as 3 percentage points; that is, from an average of 4% per year to more than

7% (not inflation adjusted), assuming all planned growth beyond the addition of

Amazon’s HQ2 is achieved. With the completion of construction, the annual

economic contributions from the presence of HQ2 would increase the County’s

growth rate by as much as 50% above its projected annual rate in the absence of

HQ2.

The total impact on Arlington County’s and the Commonwealth’s economies over

the twenty-year development period planned for HQ2 is captured by comparing the

projected economic growth rates projected including HQ2 and in its absence. For

the County, its economy is currently projected to grow by 141.2 percent (not

adjusted for inflation over the 2019-2039 period; with the addition of HQ2, both its

construction impacts and its annual post-construction expenditures, for operations

and by HQ2 employees, in combination with already projected growth would

increase the economy’s growth rate to 246.8 percent, a gain of 75 percent.

These demographic and economic gains are accompanied by a projected surplus of

County revenues (taxes) over expenses (demands for county-provide services)

attributable to HQ2, its workers and households living in Arlington County,

20

including indirect and induced growth effects. This budget surplus is estimated to

range from $52.3-$52.8 million at build-out (in 2017 dollars). If HQ2 had existed (at

full build-out) during FY 2017, it would have generated a surplus equivalent to 4.4

percent of the County’s total budget.

Commonwealth of Virginia Growth Implications

For the Commonwealth of Virginia the significance of these gains compared to

forecasted growth, as seen in Table 10, is much smaller than they would be for

Arlington County even though the potential magnitude of these demographic,

economic and fiscal gains from the location of Amazon’s HQ2 in Arlington County

would be much greater in absolute terms than those achieved by Arlington County.

This is due to the scale and complexity of the State’s economy in contrast to the

small geographic size of the County.

The State’s employment base is projected to increase by 464,820 jobs between 2019

and 2039, for a total increase of 11.4 percent for that 20-year period. With HQ2’s

direct and indirect jobs, if these were all net new jobs—with no displacement, the

State’s job increase would be up by from 73,705 to 78,319 additional jobs for a 13.7

percent gain for this period.

This job growth would be accompanied by household growth. Adding this increase

of from 73,705 to 78,319 new households attributable to Amazon’s HQ2 to the

currently projected 740,380 households would bring the household growth rate to

24.7 percent for the 2019-2039 period, compared to 22.5 percent in the absence of

HQ2. While this difference may not appear significant by itself, what makes this

more significant is the household income differentials between the Amazon-related

household gains and the non-Amazon household gains.

The average household income for the Amazon-related households statewide is

projected at $167,749 (in 2017 $s) compared to the statewide average of $97,639.

This income differential has significant implications on State revenues; individual

income tax revenues accounted for 63.3 percent of the State’s total revenues in FY

2017. Sales and use taxes, taxes reflecting resident spending capacity, accounted for

18.0 percent of the State’s revenues in FY 2017. Combined, these two revenue

sources accounted for 81.3 percent of all State revenues in that budget year. For

this reason, new household growth reflecting above-average salaries (and a

correspondingly lower demand for State-provided services) would generate a

revenue surplus in the State budget and accordingly strengthen the State’s fiscal

capacity.

The result of the fiscal analysis confirms this outcome. Had Amazon’s HQ2 base-case

build-out been completed in FY 2017, its operations and the earnings of its workers

residing in the State in combination with their indirect and induced jobs would have

generated a total of $438.3 million in revenues from individual income taxes and

sales and use taxes plus several major business taxes (corporate income, sales and

21

use, and construction) and a required increase in the State’s contribution for K-12

education totaling $109.7 million (at the $150,000 average HQ2 salary level) in

2017 dollars, for a revenue surplus of $328.6 million. At the HQ2 average salary

level of $200,000, this net revenue surplus would have totaled $471.908 million, in

2017 dollars. Had HQ2 existing in FY 2017, its net fiscal benefit would have

generated a budget surplus of 2.3 percent over the balanced budget total of $20.6

billion as reported in the Comprehensive Annual Financial Report.

Amazon HQ2’s impacts on the Commonwealth of Virginia’s economy would

represent a total contribution of $10.7 billion to the Gross State Product during the

construction period (base-case 2019-2037) and, following the completion of

construction, a total annual contribution of $10.9 billion to the State’s Gross State

Product thereafter and would accumulate during the build-out period as HQ2

expands its operations. For the Commonwealth, these gains would represent a

significant increase in economic growth rate from the current projected rate in the

absence of HQ2 of 32.5 percent, not adjusted for inflation, to 53.4 percent with

HQ2’s economic impacts included for a gain of 64.3 percent.

Closing Observations

The location of Amazon’s HQ2 in Arlington County would generate significant and

enduring impacts on the County’s and Commonwealth of Virginia’s economies and

their respective fiscal conditions. These economic and fiscal impacts would be seen

primarily in: (1) job and income growth, including the HQ2 workforce and the

supporting jobs and in the personal and business earnings that HQ2, its workforce

and their families would generate annually by their spending for goods and service

within the Arlington County economy, in nearby jurisdictions and throughout the

Commonwealth of Virginia and (2) the new tax revenues and increased demands for

public services that these new direct and related economic activities and associated

new residents would generate.

A less quantifiable and important benefit that would accrue to Arlington County and

the Commonwealth of Virginia from the location and operation of Amazon’s HQ2

would be a positive shift in the County’s, Northern Virginia’s and State’s recent

domestic migration patterns. Over the past four years, Northern Virginia and the

State have been experiencing net domestic outmigration and, in the process, have

been losing highly educated workers and workers with critical skill sets to

competing regions.

A principal condition contributing to the increase of these residents’ outmigration to

other regions is that they have been able to offer competitive quality employment

accompanied with lower costs of living. This loss of talent has slowed the region’s

and State’s economic growth and could threaten its ability to achieve its future

economic growth potentials. The location of HQ2 in Arlington County would

generate a large number of high-skilled jobs directly and indirectly that would offer

well-above average salaries and, as a result, would create an employment

22

environment that would increase the retention of the talent required to support an

advanced economy as well as attract increased in-migration of these types of

workers and other talent sensing the new opportunities that would come to define

the Northern Virginia and statewide economies. Where Northern Virginia and the

State have been experiencing a downward shift in the average salaries of their

employment bases that has emerged since 2010, the additional of HQ2 and the other

business development opportunities it would attract to the Commonwealth, would

likely reverse this job-quality trend.

The analyses of the economic and fiscal impacts presented herein provide

information regarding the benefits and costs of accommodating this major private

investment in Arlington County and the Commonwealth of Virginia. The principal

conclusion from these analyses is that location and operation of Amazon’s HQ2 in

Arlington County would have a substantially beneficial and enduring impact on the

diversification of its and the Commonwealth of Virginia’s economies and their long-

term performance.

23

APPENDIX I:

The Residential Impacts of

Locating Amazon’s HQ2 in Arlington County

24

Where HQ2 Workers Would Live: The Residential Impacts of Locating

Amazon’s HQ2 in Arlington County on the County and the Commonwealth of

Virginia

The location of Amazon’s HQ2 in Arlington County, VA would result in an increase in

households living both in the County and in the Commonwealth of Virginia. These

households would include at least one worker employed at HQ2 or employed in a

job supported by HQ2 spending. Two HQ2-wage scenarios are presented here: one

averaging $150,000 per job ($150,000-wage scenario) and one averaging $200,000

per job ($200,000-wage scenario). The difference in the average wage in each

scenario would result in different household incomes and, by extension, differing

residential characteristics.

At full build-out, Arlington County, VA would have an increase of 9,065 households

in the $150,000-wage scenario and an increase of 8,233 households in the

$200,000-wage scenario as a result of Amazon’s HQ2 locating in the County. The

Commonwealth of Virginia would have an additional 73,705 net new households in

the $150,000-wage scenario and an additional 78,319 new households in the

$200,000-wage scenario if HQ2 located in Arlington County, VA.

As shown in Table 11, this net increase in households would be the result of two

sources of job growth: the Amazon HQ2 jobs and the jobs that are supported by HQ2

payroll and other operations spending.

1

The 50,000 HQ2 jobs would generate the

largest demand for housing in Arlington County, VA, resulting in 7,139 or 8,054 net

new households, depending upon the scenario. Of all the households with an HQ2

job, 16.7 percent would live in the County in the $150,000-wage scenario and 14.4

percent would in the $200,000-wage scenario. In addition to the households with an

HQ2 job, the jobs supported by HQ2-spending would generate new household

growth. Of all the net new indirect and induced jobs, approximately 40 percent

would be located inside the Commonwealth and the remainder would be located

elsewhere. This analysis only examines the households resulting from indirect and

induced jobs located in Commonwealth. In Arlington County, these Virginia-based

indirect and induced jobs would result in an additional net increase of 1,012 or

1,093 net new households in the County, depending upon the scenario. A

significantly smaller share of these households would live in the County (about 2%)

because these jobs would not be concentrated in the County, resulting in a larger

geographic distribution of the households associated with these jobs.

In the Commonwealth of Virginia, 34,278 or 34,290 net new households would have

an HQ2 job, depending on the scenario, accounting for about 70 percent of all

1

See The Economic Impacts of Locating Amazon’s HQ2 in Arlington County and the Commonwealth

of Virginia starting on page 10 of this report for more detail about the indirect and induced jobs used

in this analysis. This housing and demographic analysis only estimates the impacts of indirect and

induced jobs located in the Commonwealth of Virginia.

25

households with an HQ2 job. In the Commonwealth, households with an HQ2 job

would be concentrated in Northern Virginia; 96.1 percent or 97.5 percent would live

in Northern Virginia, including Arlington, and about two-thirds would live in

Northern Virginia, excluding Arlington, depending on the scenario.

Table 11

Households Related to HQ2 At Full Build-Out By Source

By Place of Residence

Households With an

HQ2 Job

Households With a Job

Supported by HQ2

Spending (1)

$150k

Wage

$200k

Wage

$150k

Wage

$200k

Wage

Arlington County, VA 8,054

7,139

1,012

1,093

Rest of Northern Virginia 25,388

25,817

18,631

21,108

Rest of Virginia 848

1,321

19,772

21,839

Virginia 34,290

34,278

39,415

44,041

D.C. 6,484

6,676

619

676

Maryland 7,988

8,004

2,001

2,227

Elsewhere 479

454

671

750

Total (2) 49,241

49,412

42,706

47,692

Source: The Stephen S. Fuller Institute at the Schar School, GMU

(1) Includes payroll and operations expenditures

(2) A small share of the workers holding HQ2-related jobs are anticipated to cohabitate

either with another HQ2-related worker or become part of an existing household. Therefore,

the number of households is projected to be fewer than the number of jobs. Only the indirect

and induced jobs located in the Commonwealth were analyzed.

In addition to the households with an HQ2 job, the Commonwealth would have a

significant increase in households with a job supported by HQ2 spending. The

Commonwealth would add 39,415 net new households with a job supported by HQ2

spending in the $150,000-wage scenario and 44,041 new households in the

$200,000-wage scenario. The difference in households reflects the larger number of

jobs supported by the $200,000-wage scenario as detailed in the following sections.

Of all the households with a Virginia-based job supported by HQ2 spending, about

92 percent, would live in the Commonwealth in either scenario.

Altogether, Arlington County, VA would have an additional 9,065 net new

households with an HQ2-related job living in the County at full build-out in the

$150,000-wage scenario, or 9.9 percent of all HQ2-related households (Table 12,

above). The $200,000-wage scenario would result in slightly fewer new households

in the County, at 8,233, primarily because the HQ2-related workforce with the

26

highest household incomes are projected to be somewhat less likely to live in the

County, based on the patterns of current Professional & Business Service job-

holders in the County.

Table 12

Households Related to HQ2 At Full Build-Out

By Place of Residence

$150k

Wage

$200k

Wage

Arlington County, VA 9,065

8,233

Share in Arlington County, VA 9.9%

8.5%

Rest of Northern Virginia 44,020

46,926

Northern Virginia, Total 53,085

55,159

Share in Northern Virginia 57.7%

56.8%

Rest of Virginia 20,620

23,160

Virginia, Total 73,705

78,319

Share in Virginia 80.2%

80.7%

D.C. 7,103

7,351

Maryland 9,989

10,231

Elsewhere 1,150

1,204

Total, All Locations 91,947

97,105

Source: The Stephen S. Fuller Institute at the Schar School, GMU

The Commonwealth of Virginia would have 73,705 net new households with an

HQ2-related job, including jobs at HQ2 and those supported by HQ2 spending, in the

$150,000-wage scenario. In the $200,000-wage scenario, the Commonwealth would

have 78,319 such households. In either scenario, about 80 percent of all HQ2-related

households would live in Virginia and the households would be concentrated in

Northern Virginia (57% of all HQ2 households).

Table 13, on page 28, summarizes the characteristics of the households related to

HQ, both households with an HQ2 job and households with a job supported by HQ2

operations, in Arlington County, VA and the Commonwealth of Virginia.

In Arlington County, the households associated with HQ2 would include 17,786 or

19,944 people, in the $200,000-wage and $150,000-wage scenarios, respectively.

The average household size of HQ2-related households would be about 2.2 in both

scenarios and all households would include at least one adult worker in an HQ2-

27

related job. Nearly two-thirds of these households would have more than one adult,

while the remaining one-third would live alone.

HQ2-related households in the County would primarily live in units in multifamily

buildings and rent. About 70 percent of all HQ2-related households would live in a

multifamily building. In the $150,000-wage scenario, the homeownership rate of

HQ2-related households would be 30.2 percent and it would be 36.6 percent in the

$200,000-wage scenario.

In the Commonwealth of Virginia, the households associated with HQ2 would

include 237,993 or 222,342 people, in the $200,000-wage and $150,000-wage

scenarios, respectively. The average household size of HQ2-related households

would be about 3.0 in both scenarios and all households would include at least one

adult worker in an HQ2-related job. The vast majority (85%) of these households

would have more than one adult.

HQ2-related households in the Commonwealth would be most likely to live in

single-family detached housing and own their home. More than one-half of all HQ2-

related households would live in a single-family detached home in either scenario.

In the $150,000-wage scenario, the homeownership rate of HQ2-related households

would be 65.1 percent, and it would be somewhat larger, at 67.5 percent, in the

$200,000-wage scenario.

As with all the estimates in this section, the presence of these households in the

County and the Commonwealth would be contingent upon the availability of

housing units at prices that are within the households’ budgets. Households that

cannot find a unit in their desired price range may become shift from ownership to

rental units, as possible, or downsize to a less expensive building type in order to

live in the County. Alternatively, these households may opt to not live the County or

the Commonwealth if they find a house that better suits their needs within a

commuting range that is acceptable to both the HQ2-related worker and any other

workers in the household.

The HQ2-related households’ incomes are shown in Table 13 for both the County

and the Commonwealth. In general, households can afford to spend up to 30 percent

of their household income on housing costs, either rental costs or ownership costs.

Because many of the main commuters in these households would also work in the

same jurisdiction as they reside, their transportation costs would be relatively small,

which could allow for a larger share of their incomes to be spend on housing costs

while still remaining affordable. This would be especially true for households living

in Arlington County, VA. Additionally, the household incomes of the HQ2-related

households would be larger, on average, compared to all households living their

respective geographies, resulting in a higher likelihood that they would be able to

find housing that suits their needs within their budget.

28

Table 13

Characteristics of Amazon HQ2-Related Households

At Full Build-Out, By Place of Residence

Arlington County, VA

Commonwealth of

Virginia

$150k

Wage

$200k

Wage

$150k

Wage

$200k

Wage

Households 9,065

8,233

73,705

78,319

Residents 19,944

17,786

222,342

237,993

Average Household Size 2.20

2.16

3.02

3.04

Building Type

Single-Family Detached 1,001

1,001

41,081

45,857

Single-Family Attached 1,817

1,414

16,309

16,185

Multifamily 6,247

5,818

16,315

16,276

Tenure

Owner 2,735

3,014

47,970

52,890

Renter 6,330

5,218

25,735

25,429

Owners by Income Group*

<$100k 431

307

12,279

12,938

$100-199.9k 1,049

835

16,451

15,940

$200-299.9k 772

1,217

11,633

12,566

$300k+ 483

655

7,608

11,446

Renters by Income Group*

<$75k 1,415

1,138

11,116

11,491

$75-124.9k 1,804

1,462

6,628

6,801

$125-199.9k 1,424

1,130

4,496

4,055

$200k+ 1,687

1,489

3,495

3,082

Source: The Stephen S. Fuller Institute at the Schar School, GMU *in 2016 dollars

The location of Amazon’s HQ2 in Arlington County, VA would result in household

and population growth in the County and the Commonwealth. This household

growth would be driven by the jobs at HQ2 and the jobs generated by HQ2’s

operations expenditures. At full build-out, the County would gain 9,065 households

or 8,233 households, depending upon the average wage of HQ2 jobs. These

households would primarily hold an HQ2 job, live in multifamily units and be

renters. At full build-out, the Commonwealth of Virginia would gain 73,705

households or 78,319 households, depending upon the average wage of HQ2 jobs.

These households would primarily hold a job supported by HQ2 spending, live in

single-family detached units and own their home.

29

APPENDIX II:

Annual Tables

30

Table A1. Amazon's HQ2 Annual Fiscal Impact

on Arlington County, VA

$150,000-Wage Scenario

In millions of current dollars, Assumes 1.5% inflation per year

Revenue Expenditures

Net Fiscal

Impact

FY 2019 1.681 1.246 0.435

FY 2020 6.740 4.995 1.746

FY 2021 15.346 11.371 3.974

FY 2022 21.900 16.229 5.672

FY 2023 34.117 25.281 8.836

FY 2024 45.278 33.552 11.726

FY 2025 53.508 39.651 13.858

FY 2026 64.606 47.874 16.732

FY 2027 79.779 59.118 20.661

FY 2028 95.393 70.688 24.705

FY 2029 108.067 80.080 27.987

FY 2030 127.486 94.470 33.016

FY 2031 139.952 103.707 36.245

FY 2032 161.943 120.003 41.940

FY 2033 180.421 133.696 46.725

FY 2034 198.892 147.383 51.509

FY 2035 223.476 165.600 57.876

FY 2036 248.753 184.331 64.422

FY 2037 274.738 203.587 71.152

FY 2038 278.859 206.640 72.219

FY 2039 283.042 209.740 73.302

Source: The Stephen S. Fuller Institute at the Schar School, GMU

31

Table A2. Amazon's HQ2 Annual Fiscal Impact

on Arlington County, VA

$200,000-Wage Scenario

In millions of current dollars, Assumes 1.5% inflation per year

Revenue Expenditures

Net Fiscal

Impact

FY 2019 1.622 1.191 0.431

FY 2020 6.502 4.774 1.728

FY 2021 14.803 10.870 3.933

FY 2022 21.126 15.513 5.613

FY 2023 32.910 24.166 8.744

FY 2024 43.677 32.072 11.605

FY 2025 51.616 37.901 13.714

FY 2026 62.321 45.762 16.559

FY 2027 76.957 56.510 20.448

FY 2028 92.019 67.569 24.449

FY 2029 104.244 76.547 27.698

FY 2030 122.977 90.302 32.675

FY 2031 135.002 99.131 35.870

FY 2032 156.215 114.709 41.507

FY 2033 174.040 127.797 46.243

FY 2034 191.857 140.880 50.977

FY 2035 215.572 158.294 57.278

FY 2036 239.955 176.198 63.756

FY 2037 265.021 194.604 70.416

FY 2038 268.996 197.523 71.473

FY 2039 273.031 200.486 72.545

Source: The Stephen S. Fuller Institute at the Schar School, GMU

32

Table A3. Amazon's HQ2 Annual Fiscal Impact on Arlington County, VA