2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-1

VOLUME 4, CHAPTER 2: “ACCOUNTING FOR CASH AND FUND BALANCES

WITH TREASURY”

SUMMARY OF MAJOR CHANGES

Changes are identified in this table and also denoted by blue font.

Substantive revisions are denoted by an asterisk (*) symbol preceding the section,

paragraph, table, or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue, and underlined font.

The previous version dated January 2016 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

3.0

(0203)

Deleted account numbers and directed users to the Department

of Defense U.S. Standard General Ledger Transaction

Library.

Revision

6.4

(020604)

Updated Fund Balance with Treasury (FBWT) reconciliation

requirements to align with the Treasury Financial Manual

(TFM).

Revision

7.3

(020703)

Modified language regarding refunds to align with the Office

of Management and Budget Circular A-11.

Revision

8.2

(020802)

Updated reconciliation roles and responsibilities for DoD

Components.

Revision

8.3

(020803)

Updated suspense accounts requirement for balances to be

moved to the appropriate Line of Accounting within

60 business days from the date of transaction to align with the

TFM.

Revision

8.5

(020805)

Updated FBWT reconciliation requirements to align with the

TFM.

Revision

8.6

(020806)

Added a deadline to transition to daily submission of FBWT

disbursement and collections to Treasury’s Central

Accounting Reporting System.

Addition

8.10

(020810)

Deleted the “Documentation Requirements to Support

Auditability” paragraph.

Deletion

Table 2-3

Added Table 2-3 to summarize availability dates for data files

used to perform monthly FBWT reconciliations.

Addition

Table 2-4

Added Table 2-4 to summarize monthly FBWT reconciliation

deadlines.

Addition

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-2

Table of Contents

VOLUME 4, CHAPTER 2: “ACCOUNTING FOR CASH AND FUND BALANCES WITH

TREASURY” .................................................................................................................................. 1

1.0 GENERAL (0201) ...................................................................................................... 4

1.1 Purpose (020101) ................................................................................................. 4

1.2 Authoritative Guidance (020102) ........................................................................ 4

2.0 DEFINITIONS (0202) ................................................................................................ 4

2.1 Cash (020201) ...................................................................................................... 4

2.2 Cash Held Outside of Treasury (020202) ............................................................ 4

2.3 Entity Cash (020203) ........................................................................................... 5

2.4 Non-entity Cash (020204) .................................................................................... 5

2.5 Restricted Cash (020205) ..................................................................................... 5

2.6 FBWT (020206) ................................................................................................... 5

2.7 FBWT Reconciliation (020207) ........................................................................... 6

2.8 FBWT Universe of Transactions (020208) .......................................................... 6

2.9 Undistributed Amounts (020209) ........................................................................ 7

*3.0 STANDARD GENERAL LEDGER ACCOUNTS (0203) ........................................ 7

4.0 ACCOUNTING FOR CASH HELD OUTSIDE OF TREASURY (0204) ................ 8

4.1 Cash and Investments Held Outside of Treasury (020401) ................................. 8

4.2 Recording Cash Held Outside of Treasury (020402) ........................................... 8

4.3 Reconciling Cash Held Outside of Treasury (020403) ........................................ 8

5.0 CASH AUDITS AND REVIEWS (0205) .................................................................. 9

5.1 Responsibility for Accounting and Internal Controls (020501) ........................... 9

5.2 Announced and Unannounced Audits (020502) .................................................. 9

5.3 Requirements for Investigation (020503) ............................................................ 9

6.0 DEFENSE WORKING CAPITAL FUND (0206) ..................................................... 9

6.1 DWCF Accounts (020601) .................................................................................. 9

6.2 DWCF Sub-Account (020602) .......................................................................... 10

6.3 DWCF Transfers (020603) ................................................................................ 10

*6.4 Recordation/Reconciliation of FBWT Transactions (020604) .......................... 10

6.5 DWCF Treasury Cash Balance (020605) .......................................................... 11

6.6 Current Balance of Funds with Treasury (020606) ............................................ 11

6.7 Undistributed Collections and Undistributed Disbursements (020607) ............ 11

7.0 FBWT TRANSACTIONS (0207) ............................................................................ 12

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-3

7.1 Collection or Disbursement (020701) ................................................................ 12

7.2 Advances Received (020702) ............................................................................ 12

*7.3 Refunds and Prepayments (020703) .................................................................. 13

8.0 FBWT RECONCILIATIONS (0208) ....................................................................... 13

8.1 FBWT Reconciliation Overview (020801) ........................................................ 13

*8.2 Reconciliation Roles and Responsibilities (020802) ......................................... 14

*8.3 Treasury Reconciliation Requirements (020803) .............................................. 15

8.4 Other Defense Organizations Reconciliation Requirement (020804) ............... 16

*8.5 Reconciliation of FBWT for Comparison of Transactions (020805) ................ 17

*8.6 FBWT – CARS Account Statement Reconciliation (020806) ........................... 19

8.7 Treasury Budget Clearing (Suspense) Accounts (020807) ................................ 20

8.8 Requirement for Written Procedures (020808) .................................................. 20

8.9 Expenditure and Receipt Accounts Annual Review (020809) .......................... 21

8.10 FBWT Reconciliation Quarterly Scorecard (020810) ....................................... 21

Table 2-1: FBWT Relationship between the SBR and the Balance Sheet ............................... 22

Table 2-2: DoD Component Treasury Assigned Account Number for DWCF ....................... 23

*Table 2-3: FBWT Reconciliation Data Files and Monthly Availability Dates ...................... 23

*Table 2-4: FBWT Reconciliation Deadlines .......................................................................... 23

Figure 1. Critical Focus Areas to Address FBWT Risks .......................................................... 24

2B

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

CHAPTER 2

ACCOUNTING FOR CASH AND FUND BALANCES WITH TREASURY

1.0 GENERAL (0201)

1.1 Purpose (020101)

This chapter prescribes Department of Defense (DoD) accounting policy and related

management requirements necessary to establish financial control over fund balances with the U.S.

Department of the Treasury (Treasury) and cash resources that are not part of the Fund Balance

with Treasury (FBWT). Unless otherwise stated, this chapter is applicable to the Military

Departments and Defense Agencies, hereinafter referred to as DoD Components including the

Defense Working Capital Fund (DWCF) activities.

1.2 Authoritative Guidance (020102)

The Statement of Federal Financial Accounting Standards (SFFAS) 1, "Accounting for

Selected Assets and Liabilities,” promulgated by the Federal Accounting Standards Advisory

Board, recognizes both cash and FBWT as assets and establishes specific standards for both. The

Treasury Financial Manual (TFM), Volume I, Part 2, Chapter 5100, (I TFM 2-5100) “Fund

Balance with Treasury Accounts,” provides policies and procedures for reconciling agencies’

FBWT accounts.

2.0 DEFINITIONS (0202)

2.1 Cash (020201)

Cash, including imprest funds, must be recognized as an asset in accordance with SFFAS 1,

Paragraph 27: “Cash consists of: (a) coins, paper currency and readily negotiable instruments, such

as money orders, checks, and bank drafts on hand or in-transit for deposit; (b) amounts on demand

deposit with banks or other financial institutions; and (c) foreign currencies, which, for accounting

purposes, must be translated into U.S. dollars at the exchange rate on the financial statement date.”

2.2 Cash Held Outside of Treasury (020202)

I TFM 2-3400, Section 3420 defines “Cash Held Outside of Treasury” as funds under the

custodial responsibility of Federal Government agencies and/or their employees, officers, or agents

that are deposited in non-Treasury general accounts or held in an imprest fund. “Cash Held

Outside of Treasury” includes “Disbursing Officer’s (DO’s) Cash” which are Treasury funds

(cash) held by the DO in local accounts, but which are not directly associated with any DoD

appropriation and are not part of DoD FBWT. See also section 0204 and Chapter 1.

2-4

2B

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2.3 Entity Cash (020203)

SFFAS 1, Paragraph 28 defines entity cash as the amount of cash that the reporting entity

holds and is authorized by law to spend. Imprest Funds are cash advances against a specific Line

of Accounting (LOA) from the DO to an appointed cashier. As advances, these funds are a form

of “Cash Held Outside of Treasury” but because an entity LOA is cited as the basis of the Imprest

Fund, the advance is considered “entity cash.” The advance encumbers FBWT for the LOA but it

is separate from the DO's physical cash in U.S. Standard General Ledger (USSGL) account 113500

“Funds Held Outside of Treasury.” In this instance, the physical cash (account 113500) is still

under the DO's pecuniary liability and is non-entity cash, while the "accounting cash" is entity

cash.

2.4 Non-entity Cash (020204)

Non-entity cash is cash that a federal entity collects and holds on behalf of the U.S.

Government or other entities. This is a liability account. In some circumstances, the entity

deposits cash in its accounts in a custodial capacity for the Treasury or other federal entities, or in

a fiduciary capacity for non-federal parties. In accordance with SFFAS 1, Paragraph 29,

Components must recognize non-entity cash that does not meet the definition of a fiduciary asset

on the Balance Sheet, reported separately from entity cash. Fiduciary cash that meets the definition

of a fiduciary asset must be disclosed in accordance with the provisions of SFFAS 31, “Accounting

for Fiduciary Activities.” DO’s cash is non-entity cash, which is a subset of Treasury cash. The

DO’s Cash is reported in dollars as described in Volume 5, Chapters 13 and 15.

2.5 Restricted Cash (020205)

Restrictions imposed on cash deposits are usually from laws, regulations, or agreements.

Non-entity cash is always restricted cash. Entity cash may be restricted for specific purposes.

Such cash may be in escrow or other special accounts. For instance, restricted cash may be

non-entity seized cash from foreign governments, deposit funds for humanitarian relief and

reconstruction, or currency held by DOs to carry out their paying, collecting, and foreign currency

accommodation exchange missions. In accordance with SFFAS 1, Paragraph 30, Components

must disclose the reasons and nature of restrictions in the notes to the financial statements.

2.6 FBWT (020206)

SFFAS 1 provides the following definition for FBWT:

2.6.1. A federal entity’s FBWT is the aggregate amount of funds in the entity’s accounts

with Treasury for which the entity is authorized to make expenditures and pay liabilities.

2.6.2. According to SFFAS 1, paragraph 32, a federal entity's FBWT includes budget

clearing account balances (also known as suspense accounts) and the dollar equivalent of foreign

currency account balances (e.g., foreign burden sharing payments). Components must translate

foreign currency account balances into U.S. dollars at exchange rates determined by the Treasury

and effective at the financial reporting date in accordance with the

2-5

2B

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

Treasury Reporting Rates of Exchange, unless the exceptions stated in I TFM 2-3200 apply. A

federal entity's FBWT also includes balances for direct loan and loan guarantee activities held in

the credit reform program and financing accounts.

2.6.3. I TFM 2-5100 describes FBWT as an asset account that represents the future

economic benefits of monies that agencies can spend for future authorized transactions.

Transactions such as appropriation warrants, non-expenditure transfers, collections,

disbursements, and related adjustments reported to Treasury’s Bureau of the Fiscal Service (BFS);

and classified to a Treasury Account Symbol (TAS) increase or decrease to the FBWT account

balance. See Table 2-1 for examples of financial events that impact a Component’s FBWT on the

Balance Sheet and on the Statement of Budgetary Resources (SBR).

2.7 FBWT Reconciliation (020207)

2.7.1. Reconciliation is a process that compares two sets of records (usually the balances

of two accounts), identifies, and explains the differences between the records or account balances.

The timing of transactions, an invalid LOA, or insufficient detail may cause differences, or

reconciling items. Reconciliation is not complete until all differences are identified, aged,

accountability is assigned, and differences are explained. Once reconciliations are complete,

appropriate actions must be documented and any necessary adjustments must be recorded. The

corrective action must address the root cause of the difference in order to prevent recurrence.

2.7.2. A FBWT reconciliation is a specific reconciliation of the actual accounting

transactions (including funding, disbursements, collections, and transfers) back to the detailed

amounts posted to both entity general ledgers and entity Treasury accounts, USSGL accounts

101000 (FBWT) and 109000 (FBWT While Awaiting a Warrant). Reconciliation involves

identifying and comparing accounting events or transactions to determine whether transactions are

recorded properly and can be cleared, have not yet been recorded (in-transit), or were recorded

improperly and require correction either in the general ledger or at Treasury.

2.7.3. Reconciling FBWT is a reconciliation of available funds as recorded on the Central

Accounting Reporting System (CARS) Account Statement. FBWT reconciliation includes DO’s

cash reconciliation (cash and monetary assets and the Statement of Accountability), the focus of

which is reconciling the account activity to the cash activity (checks issued, deposits, electronic

funds transfer). Refer to Volume 5 for information and requirements of the DO’s cash

reconciliation.

2.8 FBWT Universe of Transactions (020208)

The FBWT universe of transactions includes all valid funding, disbursements, collections,

or transfers of funds (including warrants) to or from an entity over a given time period. These

transactions affect the amounts and balances in appropriation accounts reported to or by Treasury,

recorded in an entity’s general ledger, or presented in an entity’s financial reports. When these

transactions are reconciled from the entity disbursing systems, general ledgers, and financial

statements to Treasury’s records, voucher level detail must support all identified differences. Note

that there are two universes of transactions for FBWT: Treasury detail and accounting detail. For

2-6

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-7

purposes of FBWT reconciliations, transaction-level detail begins with the LOA and must have

the following data elements (at a minimum): TAS, Sub-Allocation Holder Identifier (SAHI)

(formerly limit) for Treasury Index (TI)-097, reimbursable flag indicator, accounting station

identifier code, agency disbursing identifier code, and the voucher number and amount.

2.9 Undistributed Amounts (020209)

2.9.1. Undistributed amounts are amounts that have been reported to Treasury but have

not been posted to the appropriate obligation in a Component’s general ledger in the source

accounting system or vice versa. Undistributed amounts can be a result of timing, invalid LOA,

or invalid TAS information, among other reasons. Unsupported undistributed amounts are

amounts that are not yet researched/reconciled to supporting documentation.

2.9.2. A “forced balance entry” represents any amount posted, usually at a summary-level

in a suspense account, to eliminate differences between the Component’s general ledger balance

(USSGL accounts 101000 and 109000) and the Treasury’s control total. Typically, these

adjustments appear as “undistributed” amounts when in fact, they are differences. Although

Treasury requires the Components to match the Treasury’s balance, a forced balance entry is not

an adequate reconciliation of the USSGL accounts 101000 and 109000. When reconciling FBWT

USSGL accounts 101000 or 109000, Components must research the causes of the differences at

the detail voucher level, identify undistributed amounts, and clear the aged undistributed amounts

in accordance with I TFM 2-5100, Section 5130. All differences must be cleared within

60 business days from the date of the transaction (see Table 2-4 and the TFM Volume 1,

Bulletin 2020-05).

2.9.3. In accordance with the Government Accountability Office (GAO) and the Council

of the Inspectors General on Integrity and Efficiency (CIGIE), Financial Audit Manual,

Volume 2, (GAO-08-625G), section 921, Paragraph 12, entities must avoid arbitrarily adjusting

accounts to the amounts reported by Treasury and/or recorded differences in suspense accounts

without adequately researching the causes of the differences

1

. Unreconciled differences recorded

in suspense accounts may represent transactions that have not been properly recorded by the entity

to the appropriate accounts. For more detailed instructions on the various reconciliation tools,

refer to I TFM 2-5100.

*3.0 STANDARD GENERAL LEDGER ACCOUNTS (0203)

Components must use the appropriate accounts to record transactions for FBWT or foreign

currency transactions. The general ledger accounts and accounting entries for these accounts are

specified in the USSGL TFM Supplement and the DoD USSGL Transaction Library.

1

Office of Management Budget (OMB) Circular A-136 states: “An entity’s FBWT must tie to the sum of the balances

reflected on the CARS Account Statement for the entity’s TAS. An adjustment will need to be made for available

receipts appropriated/credited to the related expenditure accounts, since the balances will appear in both the receipt

ledger and the account statements for the expenditure account.”

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-8

4.0 ACCOUNTING FOR CASH HELD OUTSIDE OF TREASURY (0204)

4.1 Cash and Investments Held Outside of Treasury (020401)

I TFM 2-3400 provides guidance on Cash and Investments Held Outside of Treasury and

the requirements for accountable officers who have responsibilities for funds received, certified,

disbursed, and held in their custody (e.g., DOs).

4.2 Recording Cash Held Outside of Treasury (020402)

The amount of “Cash Held Outside of Treasury” must be recorded using one of these

USSGL accounts: 112000 (Imprest Funds), 113000 (Funds Held Outside of Treasury-Budgetary),

113500 (Funds Held Outside of Treasury-Non-Budgetary), and 120000 (Foreign Currency) for

cash held by DOs at personal risk. There are no budgetary accounts impacted from recording this

type of non-entity cash. The SF 1219, Statement of Accountability, is used to determine the

accountability of DOs for funds held outside of Treasury (cash on hand). The balance in this

account is not an asset of a DoD Component for external statement purposes because it represents

Treasury cash held by DOs under various authorities, including:

4.2.1. Title 10, United States Code, section 2206 (10 U.S.C. § 2206) (Disbursement of

funds of a Military Department to cover an obligation of another DoD agency);

4.2.2. 31 U.S.C. § 3324 (Advances); and

4.2.3. Title 31, Code of Federal Regulations, § 240.12(a) (drawing disbursing cash).

DO’s cash is non-entity, restricted cash. A liability account for the total amount advanced by the

Treasury (USSGL account 298500) must be maintained in accordance with I TFM 2-3400,

Section 3435.10 “Financial Accounting and Reporting Requirements.”

4.3 Reconciling Cash Held Outside of Treasury (020403)

The information reported on the SF 1219 must be posted consistent with Volume 6B,

Chapter 4 and the quarterly guidance found on the Office of the Under Secretary of Defense

(Comptroller) (OUSD(C)) web page, OUSD(C) Policies and Guidance (DoD Common Access

Card required). Components must reconcile all transactions involving cash on a periodic basis,

but no less frequently than monthly for DO’s cash and quarterly for imprest funds, to ensure cash

reported on the Statement of Accountability reconciles with the CARS Account Statement for the

DO’s Cash TAS, the agency’s accounting records and related financial statements in accordance

with I TFM 2-3400, Section 3440. Treasury’s BFS reports to the Office of the Fiscal Assistant

Secretary of Treasury all discrepancies disclosed from periodic review and analysis of agencies’

reported cash and investment outside of Treasury.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-9

5.0 CASH AUDITS AND REVIEWS (0205)

5.1 Responsibility for Accounting and Internal Controls (020501)

Managers who supervise personnel holding cash are responsible for maintaining

appropriate accounting and internal controls. This responsibility includes ensuring the legality,

propriety, and correctness of disbursements and collections of public funds. See Volume 5,

Chapter 3; and Volume 5, Appendix A for more information on requirements for securing cash

and other assets.

5.2 Announced and Unannounced Audits (020502)

Audits, both announced and unannounced of each fund, must determine whether:

5.2.1. All funds are properly accounted for and reported;

5.2.2. The amount of funds not in excess of requirements; and

5.2.3. Procedures are established and followed to protect the funds from loss or misuse.

In accordance with DoD Instruction 5010.40, “Managers’ Internal Control Program Procedures,”

management must determine the frequency of audits based on vulnerability assessments.

5.3 Requirements for Investigation (020503)

Any unauthorized use, irregularity, or improper accounting for a cash fund must be

investigated and reported to the approving authority and to the DO involved. A report must state

whether prescribed procedures were followed and recommend any actions considered necessary

or desirable to prevent recurrence.

6.0 DEFENSE WORKING CAPITAL FUND (0206)

6.1 DWCF Accounts (020601)

The DWCF FBWT, account symbol 097X4930, is subdivided at the Treasury into five

sub-accounts. Each reporting entity of the five sub-accounts reports a FBWT amount on its

Balance Sheet. A DWCF activity below the Treasury sub-account reports a FBWT amount on the

agency’s Accounting Report (Monthly) (AR (M)) 1307, Statement of Operations, as well.

However, this amount represents a clearing account for recording collection and disbursement

activity that reflects a net of collections and disbursements. Volume 6A, Chapter 15 describes

how to prepare the AR (M) 1307, as well as other FBWT reporting requirements. Each individual

activity must also report the balance of FBWT transactions on the Balance Sheet.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-10

6.2 DWCF Sub-Account (020602)

DoD Components DWCF sub-account identifiers assigned by the Treasury are shown in

Table 2-2 and in the Treasury Federal Account Symbols and Titles (FAST) Book, I TFM 2,

Supplement 1. One of the sub-accounts is the Defense-wide Treasury account (097X4930.005).

Other DWCF accounts include, but may not be limited to 097X4931, Building Maintenance Fund,

and 097X4932, Defense Counterintelligence and Security Agency. The Defense-wide account

includes a number of Defense Agencies operating under the DWCF. The Defense Agencies within

the Defense-wide account provide and use funds from the centralized FBWT account under the

Defense-wide Treasury account. An entity provides or uses funds depending on whether it needs

to provide a collection or make a disbursement. If an entity’s collections exceed its disbursements,

it is providing funds to the centralized pool for other entities’ use. If an entity’s disbursements

exceed collections, the entity is using funds from the centralized pool to make disbursements. See

Volume 2B, Chapter 9 for additional information about cash management policy.

6.3 DWCF Transfers (020603)

Program managers for each Treasury sub-account have the authority to realign (delegate)

balances to the activity or installation-level at their discretion. If the program managers realign

balances between Treasury Appropriation Fund Symbols (TAFS), they must document all such

approved transfers on an SF 1151, Nonexpenditure Transfer Authorization. TAFS are a

combination of a TAS and availability code (for example, annual, multi-year, or no-year). TAFS

refer only to the appropriation and fund accounts and exclude the receipt accounts. Distributions

between SAHIs, within the same TAFS, are not accounted for as transfers. In this instance, the

preparation of the SF 1151 is not required. See the Office of Management and Budget

(OMB) Circular A-11, subsection 20.4(j) for additional information on transfers. Program

managers must ensure that they do not make a transfer that is in excess of the balance available at

the DWCF SAHI making the transfer. See Volume 11B, Chapter 3 for additional information on

nonexpenditure fund transfers.

*6.4 Recordation/Reconciliation of FBWT Transactions (020604)

6.4.1. Components must record all FBWT transactions in the individual activity accounts

and must reconcile them to total monthly FBWT transactions reported by the Defense Finance and

Accounting Service (DFAS)

. Components must adhere to the 2-month (60 calendar days)

reconciliation requirement in accordance with the TFM and move toward a 1-month (30 calendar

days) reconciliation requirement following the end of the month being reconciled effective fiscal

year 2021. As mentioned in subparagraph 020207.A, reconciliation is not complete until all

differences are identified and aged, accountability is assigned, and differences are explained. The

timing of transactions, an invalid LOA, or insufficient detail may cause differences, or unmatched

items. If Components identify any policy or procedural problems during reconciliation that require

adjudication between a Component(s) or between the Department and Treasury, they must bring

it to the attention of DFAS, as their service provider, and if necessary, the Office of the Deputy

Chief Financial Officer.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-11

6.4.2. The Component must reconcile the Department’s FBWT general ledger account at

the DWCF sub-account level to Treasury in accordance with 10 U.S.C. § 2208 (n) and (q)(1). For

the Defense-wide sub-account (097X4930.005), DFAS will reconcile the general ledger accounts

to Treasury at the Component level.

6.5 DWCF Treasury Cash Balance (020605)

The cash on hand at the Treasury account-level must always be sufficient to pay liabilities

when due. The responsibility for DWCF cash management is prescribed in Volume 2B, Chapter 9.

Components must immediately investigate and report a transaction that causes a negative balance

in the funds with the Treasury account as a possible violation of the Antideficiency Act as

prescribed in Volume 14, Chapter 2, “Antideficiency Act Violations,” in accordance with

31 U.S.C. § 1341.

6.6 Current Balance of Funds with Treasury (020606)

The current balance of funds with Treasury is equal to the amount as of the beginning of

the fiscal year plus the cumulative fiscal-year-to-date amounts of collections, appropriations, and

transfers-in of FBWT received minus the cumulative fiscal-year-to-date amounts of withdrawals,

transfers-out, and disbursements.

6.7 Undistributed Collections and Undistributed Disbursements (020607)

Refer to Volume 3, Chapter 11 for additional information relating to financial control over

disbursements, collections and adjustment transactions affecting the FBWT. Components must

record and report undistributed collections and undistributed disbursements at the lowest

organizational level.

6.7.1. DFAS must identify undistributed FBWT transactions at the sub-account Treasury

account-level, SAHI level (i.e., formerly limit), and Component-level.

6.7.1.1. Sub-account TAFS Level Adjustments. Treasury Sub-accounts are shown

in Table 2-2. The DWCF undistributed collections and undistributed disbursements that are

identifiable to a DWCF sub-account but do not contain sufficient information to identify them to

a lower organizational (business area/Component) level are recorded in 097X4930.005. Any

transactions posted at this level must be researched and cleared, if necessary, within 60 business

days from the date of the transaction to ensure proper reporting by DoD Components. At year

end, there must not be any remaining unidentified/un-researched balances in the sub-account.

6.7.1.2. Business Area Adjustments. These are DWCF business area undistributed

collections and undistributed disbursements that are identifiable to the TAFS level but do not

contain sufficient information to identify them to a business area. Examples of business areas

include Supply Maintenance, Depot Maintenance, and Research and Development. Undistributed

collections and undistributed disbursements are the differences between the Treasury reporting

systems and the collections and disbursements reported through the general ledgers.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-12

6.7.1.3. Component-Level Adjustments. These adjustments are DWCF

Component-level undistributed (unmatched) collections and undistributed (unmatched)

disbursements that are identifiable through the Treasury reporting systems to the Component-level

but have not yet been matched at the Component-level to a specific obligation or receivable

subsidiary ledgers. In addition, these adjustments must be supported by detailed transactions from

the disbursing officers’ records to include at a minimum the voucher number or other unique

identifiers of the transactions. Limit Component-level adjustments at year-end and complete the

required reconciliations (necessary research must be conducted and transactions must be posted to

the proper LOA).

6.7.2. DFAS must identify collections or disbursements at the lowest identifiable level

described in subparagraph 020607.A. That level must record the undistributed collection or

undistributed disbursement and provide documentation necessary to research the account for

proper disposition.

6.7.3. Undistributed collections and undistributed disbursements are necessary to reflect

proper FBWT as contained in finance network reports. Components must research such

collections and disbursements recorded in account 101000 for proper disposition by the lowest

organizational level to which they can be identified. DFAS must correct erroneous collections by

making a payment to a vendor and erroneous disbursements by establishing a receivable pending

a receipt of the refund. In addition, supporting documentation must include detailed transactions

from the disbursing officers’ records to include at a minimum the voucher number or other unique

identifier of the transactions

7.0 FBWT TRANSACTIONS (0207)

7.1 Collection or Disbursement (020701)

Record a collection or disbursement only when documentary evidence, such as a Treasury

Financial Management Service (FMS) 6652, Statement of Differences (SOD) or a voucher,

supports an increase or decrease to the Treasury account. For the DWCF activities, Components

must segregate cash collections and cash disbursements between those for the DWCF operating

program (i.e., noncapital outlays) and the DWCF capital program (i.e., acquisition of capital assets)

to comply with 10 U.S.C. § 2208(m). See Volume 2B, Chapter 9 for a description of Capital

Investment Program. Additionally, Components must record and report undistributed cash

collections and undistributed cash disbursements at the lowest organizational level.

7.2 Advances Received (020702)

Components must record a customer advance or prepayment received as a liability in

accordance with SFFAS 1, Paragraph 60. OMB Circular A-11, section 20.11 provides guidance

on the treatment of advances received and deposit requirements, which vary depending on whether

the advance is with or without orders.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-13

*7.3 Refunds and Prepayments (020703)

OMB Circular A-11, section 20.9 states, “Refunds are the repayments of excess payments.”

Refund amounts directly relate to previous obligations incurred and outlays made. Refunds

received are deposited to the credit of the appropriation or fund account charged with the original

obligations in accordance with OMB Circular A-11, section 20.9. Any items returned to DWCF

supply activities from DWCF customers are to be considered as a recovery (and not classified as

a refund). Offsetting collections credited to expenditure accounts automatically offset outlays and

budget authority at the expenditure account-level. See Volume 3, Chapter 15 for more information

about refunds, and Volume 4, Chapter 5 for more information about prepayments. Refer to the

DoD USSGL Transaction Library for posting entry guidance.

8.0 FBWT RECONCILIATIONS (0208)

8.1 FBWT Reconciliation Overview (020801)

8.1.1. Reconciling FBWT is a key internal control in maintaining the accuracy and

reliability of the entity FBWT records. Therefore, Components must perform timely

reconciliations (see Table 2-4) and implement effective and efficient reconciliation processes.

Effective reconciliations serve as a detection control for identifying unauthorized and unrecorded

transactions at the entities and at Treasury. Effective reconciliations are also important in

preventing entity disbursements from exceeding appropriated amounts and providing an accurate

measurement of the status of available resources.

8.1.2. Reconciliation also allows Components to resolve differences in a timely manner.

When resolving differences, Components must maintain detailed reconciliation documentation

(reviewed and approved by appropriate official) that is readily available for review by

management, auditors and Treasury if requested. Components must reconcile any differences

caused by time lag and correct differences caused by error. Components must explain any

discrepancies between FBWT in the general ledger accounts and the balance in the Treasury’s

accounts and disclose them in the notes to the financial statements. Agencies must also provide

information on unused funds in expired appropriations that are returned to Treasury at the end of

a fiscal year in accordance with SFFAS 1, Paragraph 39.

8.1.3. Components must ensure that all adjustments are researched and traceable to

supporting documents as instructed in I TFM 2-5100, Section 5120. Supporting documentation,

including reconciliations, transaction-level detail, journal vouchers and adjustments, Standard

Operating Procedures (SOPs), and Customer Service Provider agreements (i.e., Memorandums of

Agreement (MOA)/Memorandums of Understanding (MOU)/Service Level Agreements (SLAs)),

are necessary to provide an audit trail. Components must ensure the supporting documentation is

readily accessible to management for oversight and auditors to support auditability.

8.1.4. An effective FBWT reconciliation in which all reconciling differences are resolved

ensures that the FBWT universe of transactions (see definition at paragraph 020208) is complete

and transactions included in the FBWT accounts are valid. Effective FBWT reconciliation also

supports reporting accurate, valid, and timely FBWT account balances. Unrecorded or improperly

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-14

recorded transactions, usually referred to as “reconciling items,” are expected and are the result of

timing differences or errors. I TFM 2-5100, Section 5130 states that agencies must reconcile the

FBWT USSGL account 101000 balances for each fund symbol with BFS’ records (i.e., CARS

Account Statement; Expenditure Transaction Report; SODs, and Available, Unavailable, and

Unappropriated Receipt Account Reports) on a monthly basis.

*8.2 Reconciliation Roles and Responsibilities (020802)

DFAS, in their role as a service provider, and their Component customers are jointly

responsible for performing FBWT reconciliations.

8.2.1. DFAS is responsible for:

8.2.1.1. Reporting transactions affecting FBWT accounts to Treasury

(e.g., disbursements and collections) that are disbursed under DFAS Disbursing Station Symbol

Numbers (DSSNs) and non-DFAS DSSNs (e.g., Army DSSNs).

8.2.1.2. Ensuring that information submitted to Treasury on the SF 224, Statement

of Transactions, or SF 1219, for those Agency Location Codes (ALCs) where DFAS is the

Designated Agent, matches the information reported to Treasury.

8.2.1.3. Researching and resolving differences identified on the Treasury’s FMS

6652, i.e., SOD for DFAS DSSNs (DFAS is responsible for reporting and assisting with the

resolution of differences for non-DFAS DSSNs). BFS provides FMS 6652 to federal agencies for

both disbursements and deposits. An FMS 6652 is generated for each ALC by accounting month

(month the report is generated) and accomplished month (month the difference occurred) if there

is a discrepancy. Differences resulting from deposits indicate there is a discrepancy between the

monthly totals submitted through the banking system via the SF 215, Credit Voucher, or the

SF 5515, Debit Voucher, and the totals provided by the agency on the SF 224 or SF 1219. The

SOD for disbursement transactions reveal discrepancies between monthly totals reported in the

agencies’ accounting systems and the transactions reported to Treasury by the Regional Finance

Centers and/or through the Intra-Governmental Payments and Collections (IPAC) system on the

SF 224 or SF 1219. FBWT reconciliation variances, to include unmatched, suspense, and SOD

balances, must be cleared within 60 business days from the date of the transaction (see Table 2-4).

8.2.1.4. Reconciling FBWT appropriation accounts at the TI, main appropriation

account-level, and at the ALC level, including ensuring the FBWT universe of transactions for

each TAS recorded to USSGL accounts 101000 and 1090000 for all DoD funds is complete and

fully reconciled to all of the individual appropriation account balances recorded at Treasury.

8.2.1.5. Reconciling the Components’ FBWT USSGL accounts 101000 and

109000 at the SAHI level. SAHI is a unique account identifier code specific to DoD that represents

the structural level below the sub-account level. These codes are typically four digits, and used to

identify, manage, and report the financial activity of Defense Agencies, Component, and other

operational units reported by the Treasury as the combined activities of TI- 097.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-15

8.2.1.6. Aging, assigning, and tracking the status of reconciled differences.

8.2.1.7. Researching and resolving differences originating from operations under

the control of DFAS, and clearing these transactions in the FBWT source system(s). Key

supporting documentation must be maintained and provided upon request. This documentation

includes evidence of reconciliation performed and confirmation that all differences were

successfully reconciled.

8.2.2. DoD Components are responsible for:

8.2.2.1. Reporting transactions affecting FBWT accounts to Treasury

(e.g., disbursements and collections) that utilize Treasury Disbursing.

8.2.2.2. Ensuring that information submitted to Treasury on the SF 224 or SF 1219,

for those ALCs where the Component is the Designated Agent, matches what is reported to

Treasury. Ensuring a valid and proper LOA is on the original obligating documents that will be

used throughout the procure-to-pay process.

8.2.2.3. Researching, resolving, and reporting status of reconciled differences

originating from operations under their control.

8.2.2.4. Monitoring and approving the reconciliations performed by DFAS on their

behalf. Ensuring all reconciling differences are supported by detail-voucher level transactions.

Key supporting documents must be kept and provided as requested; include evidence of

reconciliation performed and confirmation that all differences were successfully reconciled.

8.2.3. Coordination between DFAS and their Component customers is necessary to

properly identify, assign, age, track, research and resolve reconciled differences in a timely

manner. DFAS’ roles and responsibilities in Disbursing and Treasury Reporting Operations are

described throughout Volume 5 and in Volume 6A

2

, Chapter 3.

8.2.4. DFAS and their Component customers must formally establish and document their

understanding and agreement of roles and responsibilities in accordance with

DoD Instruction 4000.19, “Support Agreements.” DFAS and their Component customers must

have written MOAs, MOUs, or SLAs in place that define the roles and responsibilities between

the Service Provider and the Customer(s).

*8.3 Treasury Reconciliation Requirements (020803)

Treasury requires reconciling FBWT accounts to the Treasury reported amounts by

Department, Period of Availability, and Main Account (i.e., TI, fiscal year, and fund symbol)

monthly

3

. During reconciliation, DFAS and their Component customers must:

2

Volume 6A, Chapter 3 discusses SF 1220, “Statement of Transactions.”

3

Treasury sets forth the requirements for reconciling FBWT in I TFM 2-5100 and the I TFM 2-5100 Supplement.

Audit issue guidance is provided in the FAM Substantive Procedures Section 921-Auditing Fund Balance with

Treasury, jointly published by the GAO and the CIGIE.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-16

8.3.1. Research and resolve the underlying causes of differences reported by the Treasury

on the SOD (FMS 6652) each month and make corrections to monthly Treasury reports and agency

accounting records.

8.3.2. Reconcile general ledger balances by Department, period of availability, and main

account with the balances reported by Treasury.

8.3.3. Ensure that all adjustments are researched and traceable to supporting documents in

accordance with I TFM 2-5100.

8.3.4. Document detailed reconciliations and make available to auditors and Treasury if

requested, as instructed in I TFM 2-5100.

8.3.5. Ensure differences recorded in Treasury budget clearing accounts (suspense

accounts) are reconciled monthly as instructed in I TFM 2-5100, and moved to the appropriate

LOA within 60 business days from the date of transaction. In accordance with TFM Volume I,

Bulletin 2020-05, the agency Chief Financial Officer (CFO) must annually certify that the ages of

the balances in the suspense accounts are no more than 60 business days old with clear explanations

of exceptions. See paragraph 020805.

8.4 Other Defense Organizations Reconciliation Requirement (020804)

Every DoD Component with FBWT accounts must perform detailed reconciliations of their

FBWT accounts (USSGL accounts 101000 and 109000). DFAS and their Component customers

must perform the reconciliations monthly to ensure the accuracy and reliability of the Component’s

FBWT records and the integrity of their financial statements.

8.4.1. In addition to the Treasury Main Account requirement, DoD Components must

ensure that FBWT accounts are reconciled to their sub-allocations as provided by OUSD C.

8.4.2. For Treasury reporting purposes, DoD must add the balances in the TI-097 accounts

together and reconcile to the Treasury’s control total at the TAS level in CARS.

8.4.3. To support effective FBWT reconciliation, Components must ensure that

reconciliations include and address amounts reported in:

8.4.3.1. Treasury’s CARS Account Statement;

8.4.3.2. Trial balances (for both budgetary (outlays/collections) and proprietary

(101000/109000 USSGL accounts) from the accounting system (including budgetary FBWT to

proprietary FBWT Governmentwide Treasury Account Symbol Adjusted Trial Balance System

edits and validations);

8.4.3.3. Financial statements (outlays and collections on the SBR; FBWT on the

Balance Sheet);

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-17

8.4.3.4. FMS 6652 (for deposits and disbursement/IPAC transactions);

8.4.3.5. Check issue data processed in the Treasury Check Information System.

8.4.4. Additionally, Components must ensure that they perform monthly reconciliations at

the individual voucher level detail and include:

8.4.4.1. All budget fiscal years,

8.4.4.2. All appropriations/Treasury accounts (including general funds, working

funds, revolving funds, special funds, deposit funds, and trust funds),

8.4.4.3. All SAHIs of the TI-097, and

8.4.4.4. All activity, including suspense accounts

4

(also see “Treasury Budget

Clearing Accounts” in paragraph 020807),

8.4.5. DFAS and DoD Components must also demonstrate they have controls in place to

ensure that amounts reported daily or monthly to Treasury reconcile to collections and

disbursements processed through the disbursing systems and recorded accurately and timely in the

accounting systems. Monthly Treasury reporting includes SF 224 or SF 1219 and SF 1220 by

DFAS or other federal agencies (e.g., Department of State and General Services Administration).

Components who are the ALC Designated Agents and submit information to Treasury on the

SF 224, SF 1219, or SF 1220 must ensure that the information matches what is submitted to DFAS.

Any differences between what was submitted to Treasury and what was submitted to DFAS must

be corrected by the ALC Designated Agent (either DFAS or the Components) in 15 business days

after identification by DFAS. See Volume 5, Chapter 15 for information on the requirements for

the SF 1219.

*8.5 Reconciliation of FBWT for Comparison of Transactions (020805)

8.5.1. Reconciling FBWT includes a comparison of transactions at a level of detail

sufficient for specific identification of differences to establish that the entity’s FBWT general

ledger accounts and the Treasury control totals are accurately stated. Detail sufficient for specific

identification of differences are voucher numbers for cash disbursements and collections, summary

bill numbers for interfund transactions, and authorizing document numbers for nonexpenditure

transfers and funding events.

8.5.2. Components must comply with certain operational requirements and deadlines

when performing reconciliations to compare transactions. Components must:

8.5.2.1. Perform reconciliations and identify differences at the voucher level (or

equivalent). Components must adhere to the 2-month (60 calendar days) reconciliation

requirement in accordance with the TFM and move toward a 1-month (30 calendar days)

4

Sensitive activity may undergo an equivalent reconciliation process in a separate environment, if the balances can

be matched with the summary reconciliation.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-18

reconciliation requirement following the end of the month being reconciled effective fiscal

year 2021. See Table 2-3 for a list of data files used to perform reconciliations and data file

monthly availability dates.

8.5.2.2. Ensure processes are in place to assign, track, age, research, and resolve

differences between Treasury, disbursing system records and accounting system records, as

prescribed by Treasury, at the voucher level detail on a monthly basis. (Note: Since Treasury

reports information at the summary-level, Components must roll up voucher level detail disbursing

system and accounting system records and compare to the summary-level Treasury reports.) These

balances must be analyzed and reconciled monthly in the SF 224 to ensure all collected amounts

are properly credited to the proper appropriation and applicable accounts receivable accounts. For

any suspense account, items or transactions more than 60 business days old, investigate and

document the reason why the transaction cannot be reclassified to the correct appropriation. All

differences must be cleared within 60 business days from the date of the transaction. See Table 2-4

for a summary of the required deadlines.

8.5.2.3. Record journal vouchers in the system of record at the account-level and/or

SAHI-level to resolve suspense account and SODs, if necessary, until the proper LOA can be

identified. DFAS and their Component customers must maintain all journal vouchers and

supporting documentation, including list of journal vouchers that comprise the differences.

8.5.2.4. Complete both Service Provider supervisory and Component reviews and

approvals within 10 business days following the completion of researching and resolving all

identified differences from the monthly reconciliation. Refer to Volume 6A, Chapter 2 for

guidance on journal voucher adjustments and approvals.

8.5.3. Components must ensure they have addressed all of the critical areas and key control

points in the FBWT end-to-end reconciliation, as shown in Figure 1. These key control points are:

8.5.3.1. When on daily reporting, reconciling the Component’s general ledger

system(s) to the Disbursing Systems daily;

8.5.3.2. Reconciling the Cash Management Report (CMR) to the Component’s

general ledger system(s) monthly (note: this key control point only applies to the TI- 097

Components);

8.5.3.3. Researching and resolving unsupported differences identified on the

CMR, as identified by the SAHI “9999,” monthly (note: this key control point only applies to the

TI-097 Components);

8.5.3.4. Reconciling the Treasury CARS Account Statement to either the CMR (for

TI-097 Components) or the Component’s general ledger system(s) (for the Military Departments’

General Funds) monthly. Refer to 020807 for additional information on the CARS reconciliations;

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-19

8.5.3.5. Researching and resolving activity identified in the budget clearing

accounts (suspense accounts) on the CARS Account Statement monthly. Refer to

paragraph 020807 for additional information on the budget clearing accounts; and

8.5.3.6. Researching and resolving all differences identified on the FMS 6652 for

all DoD ALCs reported to Treasury by each of the DFAS Centers monthly.

8.5.4. Components must work to achieve a complete match rate of 99 percent each month

over the transactions for each key control point.

*8.6 FBWT – CARS Account Statement Reconciliation (020806)

8.6.1. The CARS Account Statement Module is an online, query driven component that

provides a daily refreshed view of a Federal Program Agency’s (FPA’s) FBWT. This

Governmentwide Accounting (GWA) Module replaced the reports formerly available through the

Government-wide On-line Accounting Link System II. The primary goal of the Account

Statement is to provide an up-to-date source of balance and transaction information to assist FPAs

with their reconciliation process. All agencies must transition to daily submission of FBWT

disbursement and collections to the Treasury’s CARS by the end of fiscal year 2020. More

information about the Account Statement is available at the Treasury’s website.

8.6.2. Each DoD Component must reconcile its transactions to the beginning balance, net

activity, and ending balance on the CARS Account Statements

5

. The Account Statement consists

of three sections: (1) Account Summary, (2) Expenditure Activity, and (3) the Transactions

reports. Agency users can generate the Account Statement reports at either a TAS or ALC level.

FMS 6652 arise from ALC-based SF 1219 and SF 1220 reporting submitted by each of the three

DFAS centers. The Support Listings provide links to other FMS Accounting Systems that support

the monthly SOD reconciliations.

8.6.3. Users can access CARS Account Statement information at the Department Level

and can view both a daily Accounting View (Dynamic) and a monthly Published View (Static) of

their account balances and supporting transactions. The SOD application receives a daily

transmission from CARS. This daily transmission allows BFS to provide more up-to-date

information to FPAs. Deposit data and agency statements of transactions are updated daily in

CARS; for these items, the FPAs are receiving daily reconciliation information from the GWA

Module. This enables the FPAs to identify and correct differences earlier, sometimes before

closing the monthly processing. More information about the SOD and detail support listings is

available at the Treasury’s website.

8.6.4. Agencies report changes in the FBWT accounts to Treasury’s BFS. All agencies

must transition to daily submission of FBWT disbursement and collections to Treasury’s CARS

by the end of fiscal year 2020. “CARS Daily Reporters” submit the TAS/Business Event Type

5

Currently, this requirement does not apply to Defense Agencies and Field Activities that are part of shared Treasury

Account Symbols. These organizations, comprising TI-097, must reconcile their FBWT balances individually to

internal TI-97 CMR with support from DFAS as their service provider. DFAS is responsible for reconciling the totals

of all TI-97 to Treasury.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-20

Codes and/or Classification-keys into the Classification Transactions and Accountability module

within CARS on a daily basis for each payment via the Payment Information Repository or the

Secure Payment System, and a collection via the Collection Information Repository.

8.6.5. Until agencies are in compliance with being “CARS Daily Reporters,” they must

continue to report disbursements and collections to an appropriation through monthly reporting on

the Standard Form (SF) 224, Statements of Transactions; or in one of the following: SF 1219,

Statement of Accountability; SF 1220, Statement of Transactions According to Appropriations,

Funds, and Receipt Accounts, in accordance with I TFM 4A-4000, Section 4030. See Volume 6A,

Chapter 3 for information on the requirements for the SF 1219 and SF 1220.

8.7 Treasury Budget Clearing (Suspense) Accounts (020807)

8.7.1. According to I TFM 2-1500, Section 1520.25, BFS established clearing accounts to

temporarily hold unidentifiable general, special, or trust fund collections that belong to the Federal

Government until they are classified to the proper receipt or expenditure accounts by the Federal

Entity.

8.7.2. Effective FBWT reconciliations include clearing transactions recorded in Treasury

budget clearing accounts (suspense accounts) in a timely manner (see paragraph 020806). On

behalf of the Components, DFAS must be able to provide:

8.7.2.1. A list of individual vouchers and dollar amounts that comprise/equal the

difference between Treasury, disbursing system activity and accounting system trial balance

amounts for monthly reconciliations;

8.7.2.2. Vouchers, records, reports, disposition and supporting documentation for

all transactions posted to the suspense accounts for auditor-selected sample items for monthly

reconciliations. Components with key supporting documents must provide it as requested.

8.7.2.3. A monthly list of journal vouchers and dollar amounts (by Component)

that comprise/equal suspense account amounts at year-end; and

8.7.2.4. Journal vouchers and supporting voucher documentation that

demonstrates the voucher was recorded to the appropriate Component. DoD Components must

maintain records for transactions input into their general ledger.

8.8 Requirement for Written Procedures (020808)

Components must ensure that they have current written SOPs and other forms of process

documentation (e.g., narratives and process maps), in accordance with the Managers’ Internal

Control Program, to direct and document the proper reconciliation processes. SOPs must also

include evidence of dated supervisory review and approval certifying that it is current and accurate.

In the written procedures, Components must require the practice of segregating the journal entry

for unsupported undistributed amounts from the journal entry for the undistributed amounts that

can be supported. This practice is essential for efficient cash reconciliation management and for

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-21

audit support and measurement. For example, if the total undistributed amount is 95 percent

supported and 5 percent not supported, then record two journal voucher entries to segregate the

amounts. See Volume 6A, Chapter 2 for information on proper preparation and documentation of

a journal voucher.

8.9 Expenditure and Receipt Accounts Annual Review (020809)

DFAS must review and validate all expenditure and receipt accounts reported by Treasury

annually to determine if the TAS are valid. DFAS must work with Treasury to remove invalid and

unused TAS from Treasury reports/systems on an annual, or as needed basis.

8.10 FBWT Reconciliation Quarterly Scorecard (020810)

8.10.1. Treasury’s BFS provides a Quarterly Scorecard to all CFOs of federal agencies

(see I-TFM Bulletin 2020-05).

8.10.2. This scorecard focuses on FBWT reconciliation metrics from the disbursing

operations perspective. This Quarterly Scorecard reflects agencies’ performance by ALCs in

compliance with the BFS Cash Accounting Branch financial reporting standards. Accuracy of

Reporting, SOD Reconciliation, Suspense/Default Account Reconciliation (F3502, F3875 and

F3885), and Timeliness of Reporting are the reporting standards. The Treasury uses a traffic light

grading system. For example, agencies score “green” if they successfully met all standards,

“yellow” if they met some, but not all standards, and “red” if they have not met any of the standards

based on the criteria outlined in the scorecard.

8.10.3. OUSD(C) requires each ALCs to explain the cause of each discrepancy no later

than 30 calendar days after the Scorecard is issued, along with corrective action taken to address

the discrepancy, when the discrepancy will be corrected, and what processes are in place to prevent

similar discrepancies in the future.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-22

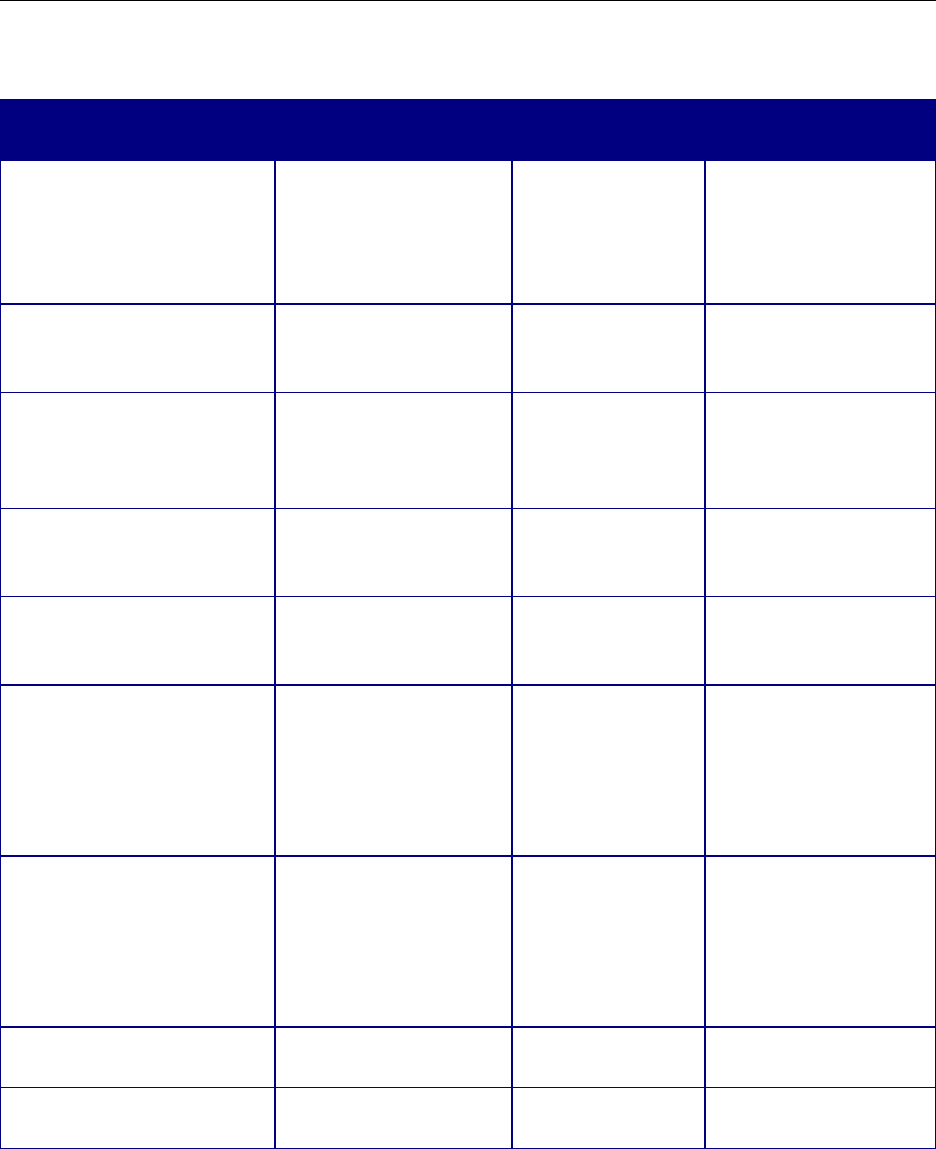

Table 2-1: FBWT Relationship between the SBR and the Balance Sheet

Example Financial Event

SBR Impact

Balance Sheet –

FBWT Impact

Transaction-Level

Detail Required

Appropriation Received

Increase to

Appropriation

Increase to

FBWT

Funding document

(e.g., Funding

Authorization

Document [FAD],

warrant)

Rescissions

Increase to

Permanently not

Available

Decrease to

FBWT

Funding document

(e.g., FAD, warrant)

Unfilled Customer Orders

Received with Advance

Increase to Unfilled

Customer Orders

Received with

Advance

Increase to

FBWT

Military

Interdepartmental

Purchase Request

Collection (IPAC

collections)

Increase to Actual

Offsetting Collections

Increase to

FBWT

Voucher/ Summary

Interfund Bill

Number

Disbursement (IPAC

disbursements)

Increase to Gross

Outlays

Decrease to

FBWT

Voucher/ Summary

Interfund Bill

Number

Clearing of Suspense

Account Disbursement

Transaction, undistributed

and SODs (and posting to

a valid appropriation

account and obligation)

Increase to Gross

Outlays

Decrease to

FBWT

Voucher/ Summary

Interfund Bill

Number

Clearing of Suspense

Account Collection

Transaction, undistributed

and SODs (and posting to

a valid appropriation

account and obligation)

Increase to Actual

Offsetting Collections

Increase to

FBWT

Voucher/ Summary

Interfund Bill

Number

Nonexpenditure Transfer-

In

Increase

Increase to

FBWT

Funding Document

Nonexpenditure Transfer-

Out

Decrease

Decrease to

FBWT

Funding Document

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-23

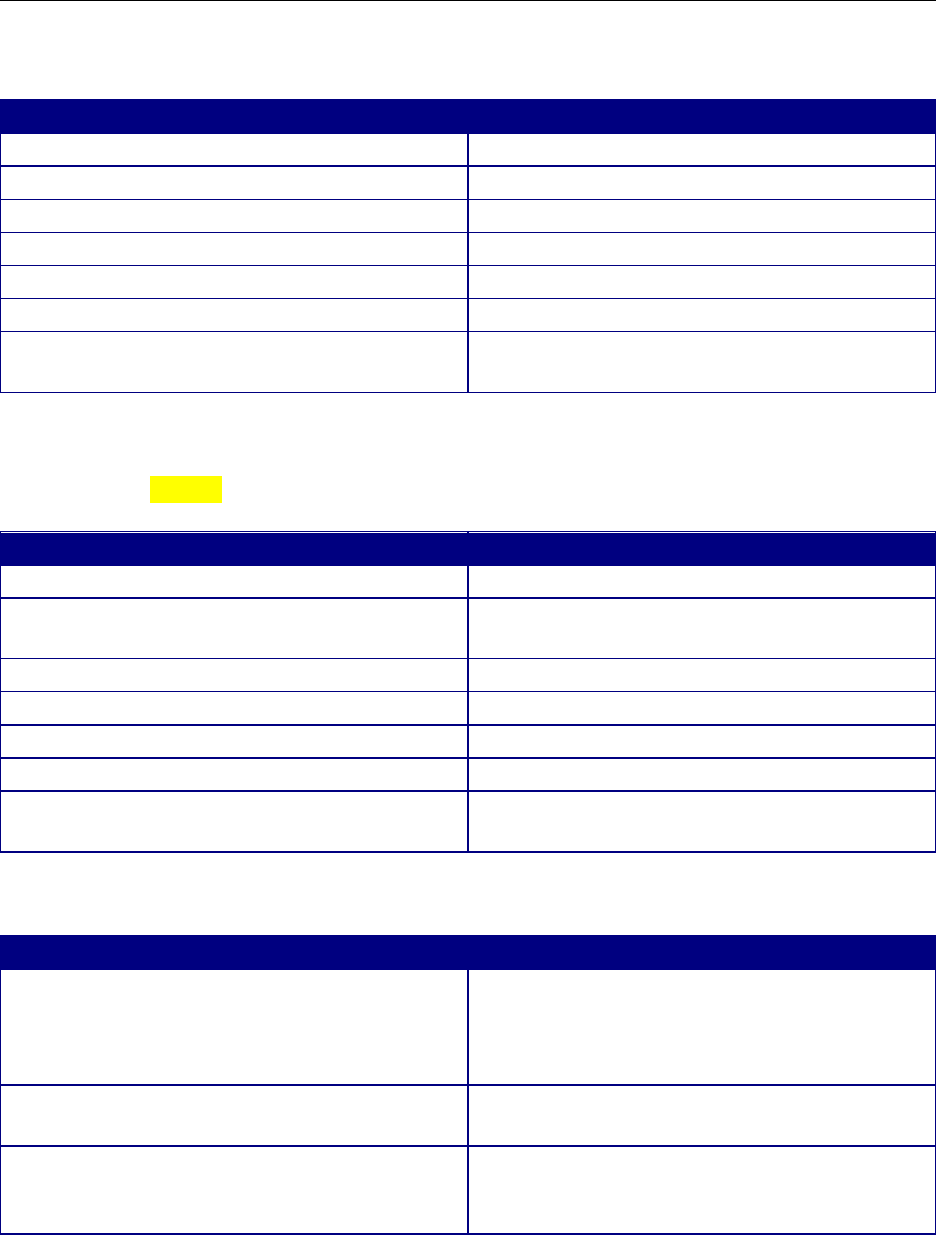

Table 2-2: DoD Component Treasury Assigned Account Number for DWCF

DoD Component

Treasury Assigned Account Number

Army

097X4930.001

Navy

097X4930.002

Air Force

097X4930.003

Defense Commissary Agency

097X4930.004

Defense Agencies

097X4930.005

Building Maintenance Fund

097X4931

Defense Counterintelligence and Security

Agency

097X4932

*Table 2-3: FBWT Reconciliation Data Files and Monthly Availability Dates

(See paragraph 020805 for FBWT reconciliation information.)

Data File

Monthly Availability Date

DD Form 1329 – Statement of Transactions

3

rd

business day

DD Form 1400 – Statement of Interfund

Transactions

3

rd

business day

Preliminary CMR

4

th

business day

Trial Balances

7

th

business day

Treasury CARS Account Statement

8

th

business day

FMS 6652 – Statement of Differences

10

th

business day

Defense Departmental Reporting System

(DDRS) Budget Execution Reports

15

th

business day

*Table 2-4: FBWT Reconciliation Deadlines

Requirement

Deadline

Complete FBWT reconciliation

1-month (30 calendar days) following the end

of the month being reconciled effective Fiscal

Year 2021 (e.g., a reconciliation of October

FBWT must be completed by November 30).

Clear all FBWT reconciliation variances:

undistributed, suspense, and SOD balances

60 business days from the date of the

transaction.

Service Provider Supervisory review and

Component review and approvals

Complete both reviews within 10 business

days following the completion of the monthly

reconciliation.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 2

* April 2020

2-24

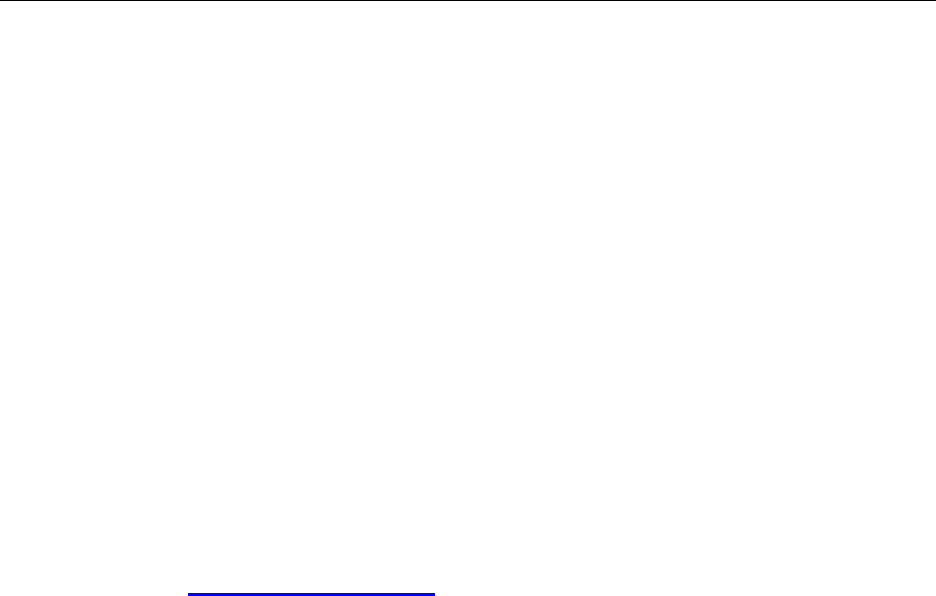

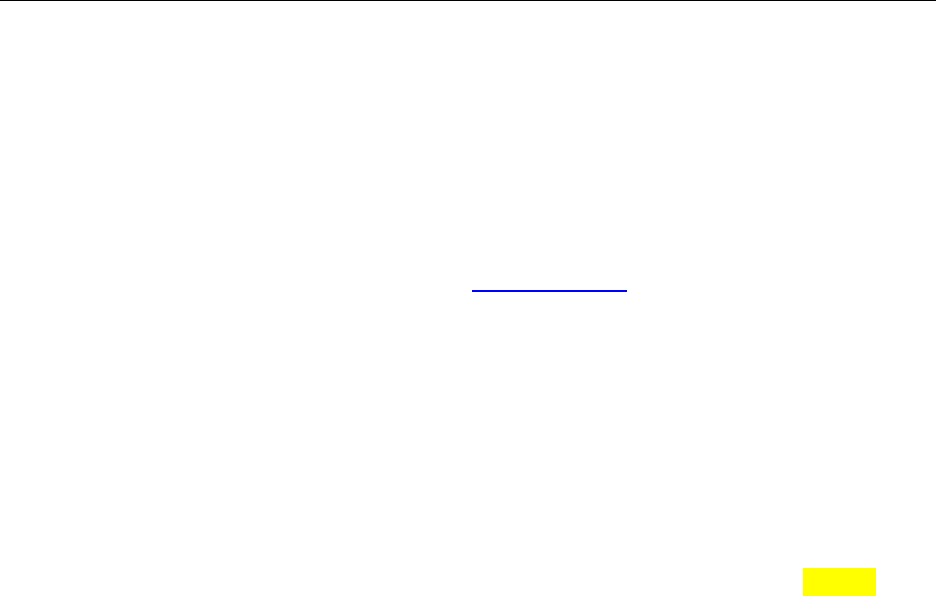

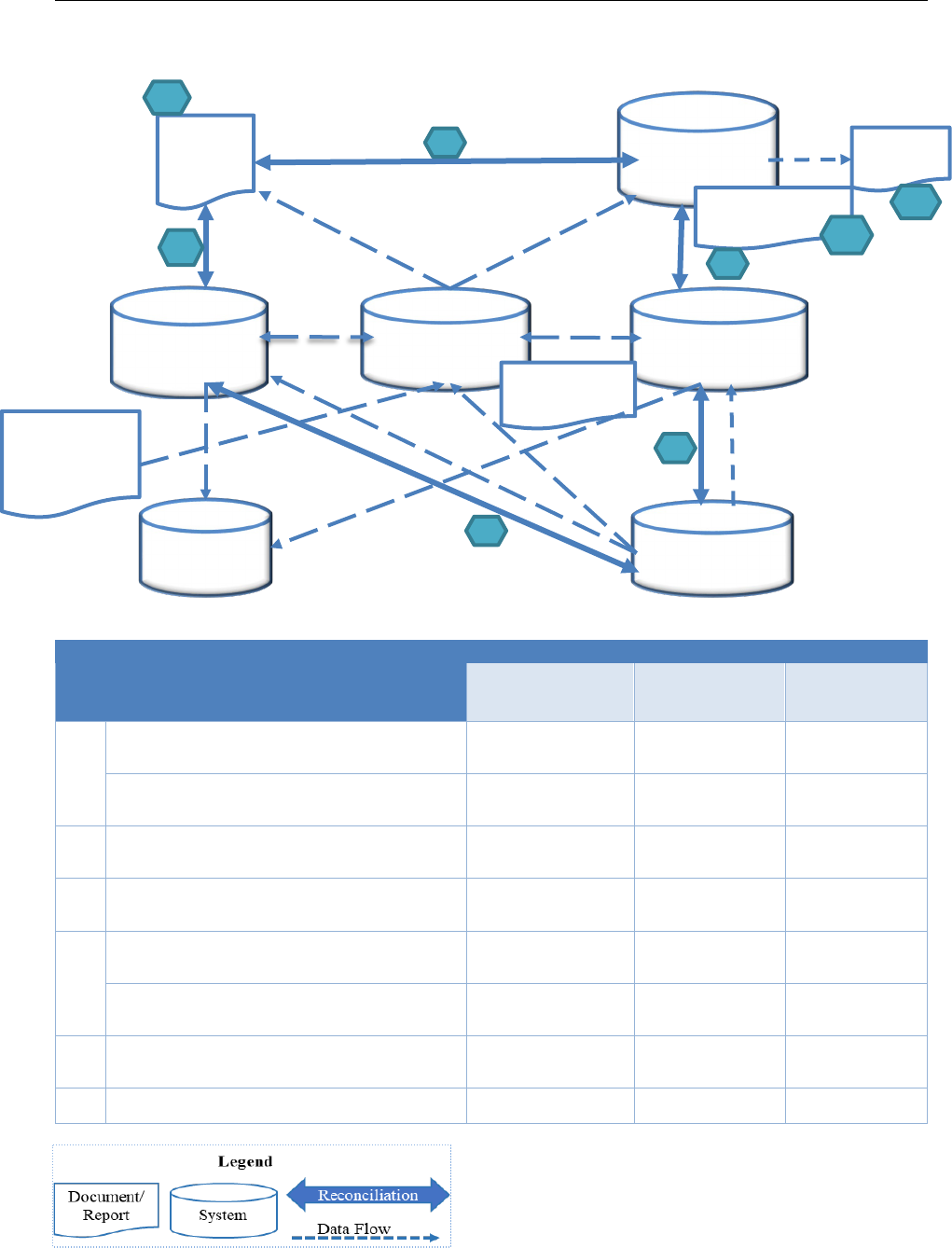

Figure 1. Critical Focus Areas to Address FBWT Risks

CMR

DoD

disbursements

made outside of

DoD

FMS 6652

SOD

Treasury CARS

system

CARS Account

Statement

Military Services GF

General Ledgers

Treasury Reporting

Systems

TI-097 General

Ledgers

DDRS

Disbursing Systems

FMS

224/1219/1220

3

2

5

6

4a

1a

1b

4b

Key Control Point

Is there a place to:

Reconcile and

identify differences at

the transaction-level?

Age, research, and

resolve differences

identified?

Record temporary

journal voucher in

DDRS?

1b

a. Disbursing Systems to Accounting Systems: Reconcile

TI-097 General ledgers to Disbursing Systems daily (for

daily reporters) (TI-097 only).

b. Disbursing Systems to Accounting Systems:

Reconcile Military Services GF General Ledgers to

Disbursing Systems daily.

2

Differences between Accounting Systems and CMR:

Reconcile CMR to General Ledgers monthly (TI-097

only).

3

CMR expenditure and collections: Research and resolve

expenditures and collection activity differences identified

on the CMR monthly

4

a. CMR to Treasury Differences: Reconcile CMR to

Treasury CARS Account Statement monthly (TI-097

only).

b. Differences between Accounting Systems and

Treasury: Reconcile Military Services GF General

Ledgers to CARS Account Statement.

5

Suspense Accounts: Research and resolve activity

identified in budget clearing accounts (suspense) on

Treasury CARS Account Statement monthly.

6

SODs: Research and resolve differences identified on the

FMS 6652s.