1

Past Year Fund Reconciliation

When past year actuals are provided by departmental accounting offices to departmental

budget staff, a reconciliation between accounting and budgeting must be completed. This

training aid provides background and instructions for budget staff submitting past year fund

reconciliation documents to their Finance Budget Analyst.

Fund Classifications

In budgeting we categorize funds into five different classifications generally based on the fund’s

revenue source; General Fund, Special Fund, Bond Fund, Federal Fund, and Nongovernmental

Cost Fund.

General Fund (G): Used to account for revenues not specifically designated to be accounted for

by any other fund. Primary sources of revenue are personal income tax, sales tax, and

corporation tax.

Special Funds (S): Used to account for taxes, licenses, and fees that are restricted by law for

particular activities of government.

Bond Funds (B): Used to account for proceeds of general obligation (non-self liquidating) bond

authorizations.

Nongovernmental Cost Funds (N): Used to account for revenues from sources other than

general or special taxes, licenses, fees, or other state revenues (excluding bond proceeds and

federal receipts).

Federal Funds (F): Used to account for all monies received from an agency of the federal

government.

All special funds along with a select few federal, bond, and other non-governmental cost funds

are displayed in the fund administrators’ budget galley, Fund Condition Statement section. The

FCS section includes a detailed breakdown of all revenue and expenditure fund information and

allows readers to see how all the financial information ties together.

2

Matching vs. Reconciling

The goal of the past year fund reconciliation process is to tie budgeting and accounting fund

balances. This does not however mean matching between the two. It is our duty to the State to

provide the most accurate information possible to allow for elected officials to make informed

budgeting decisions.

Matching: Two numbers are the same. Do not force them to match if they don’t, we need to

understand which one is correct and why.

Reconciled: Explaining any differences between two numbers and providing the best number to

Finance to make the best recommendations on budget issues.

On accounting documents you will notice every dollar and cent is included, for budgeting we

round everything to the nearest thousand “000”. As such variances between the two will occur,

which is why we allow for a variance of up to $5,000 without a written explanation. Any amount

over the $5,000 threshold will require a reconciliation explanation.

Past Year Fund Reconciliation Package

A complete fund reconciliation package consists of a DF-117, DF-303 or DF-304, a Fund

Condition Statement if applicable, and all backup accounting documents.

Given the current telework requirements, due to the COVID pandemic, Finance will only be

requiring scanned signed copies of the certification forms this year.

DF-117: A Certification of Past and Prior Year Information, signed by the Department Director or

equivalent and may be designate one level down such as to a Chief Deputy Director.

DF-303 (Accounting Document): A fully annotated Detailed Fund Balance report for funds that

will have a Fund Condition Statement in the 2021-22 Governor’s Budget.

DF-304 (Accounting Document): A Past Year Expenditure Reconciliation report submitted for all

other funds with expenditure activity that do not have a Fund Condition Statement in the

2021-22 Governor’s Budget.

FCS (Budgeting Document): A Fund Condition Statement, if applicable, with an adjusted

beginning and ending balance that ties to the DF-303 rounded to thousands.

Backup accounting documents include but are not limited the Report 4, 6, 9, and 15. It is

expected these Year End Reports be fully annotated by department accounting staff to allow

budgeting to tie between them and the DF-303.

All past year fund reconciliation forms (DF-117, DF-303, DF-304, and FCS) can be located on

Finances website, directly link below:

http://www.dof.ca.gov/Accounting/Policies_and_Procedures/Fund_Reconciliation/index.html

3

Roles and Responsibilities

Departments are responsible for preparing the past year fund reconciliation package. It is crucial

that departmental accounting and departmental budgeting staff coordinate with each other.

Department accounting staff are responsible for preparing fully annotated DF-303 or DF-304

documents and for providing all relevant backup accounting reports also fully annotated.

Department budgeting staff are responsible for preparing fully annotated Fund Condition

Statements and submitting the past year fund reconciliation package as a whole to Finance.

Finance is responsible for reviewing past year fund packages, and will are instructed to return

any fund package to the department if it is incomplete or if corrections are necessary. Finance’s

central units are responsible for providing central technical instructions.

Information provided to Finance is subject to audit. If an audit does occur, the cost will be

funded by the department’s spending authority.

Shared Fund vs. Non-Shared Fund

It is important that a few distinctions be made between the roles and responsibilities of shared

funds and non-shared funds along with fund administrators and fund users. It is critical that fund

users and administrators coordinate amongst themselves in order to produce a successfully

reconciled fund.

Fund Administrator: The fund administrator is the designated department responsible for the

collecting, reviewing, reconciling and submitting a DF-117, a consolidated DF-303, and Fund

Condition Statement to Finance.

Fund User: The fund user is a department that spends, collects revenue, or transfers cash to a

fund that their department does not administer. Fund users are responsible for reconciling their

portion of the prior year adjustment, past year revenues, expenditures, and transfers between

their Year End accounting documents and their DF-303. Users will review, prepare and submit a

DF-303 report along with supporting reports and certification to the fund administrator by the

date established by the fund administrator.

Non-Shared Fund: Funds that have are only used by the fund administrator for expenditures,

revenues, or transfers. The fund administrator is solely responsible for submittal of the past year

fund reconciliation package.

Shared Fund: Funds that have one or more fund users that either have expenditures, revenues,

or transfers. A shared fund reconciliation package will include DF-303 reports from each

department along with a consolidated DF-303 and Fund Condition Statement report prepared by

the fund administrator.

4

General Fund Past Year Reconciliation

Finance is responsible for reconciling past year expenditures and revenues for the General

Fund between Finance (budgeting) and SCO (accounting), similar to the role of a fund

administrator.

Past year expenditure and past year revenue amounts reported to Finance from departments

must be reconciled by departments to amounts reported to the SCO in the year-end financial

statements, similar to the role of a fund user.

After submittal of past year updates by departments, no changes to the General Fund may be

made without prior approval from Finance.

Departments may be contacted by their Finance analyst for further clarification and assistance if

there are material differences between Finance and SCO.

5

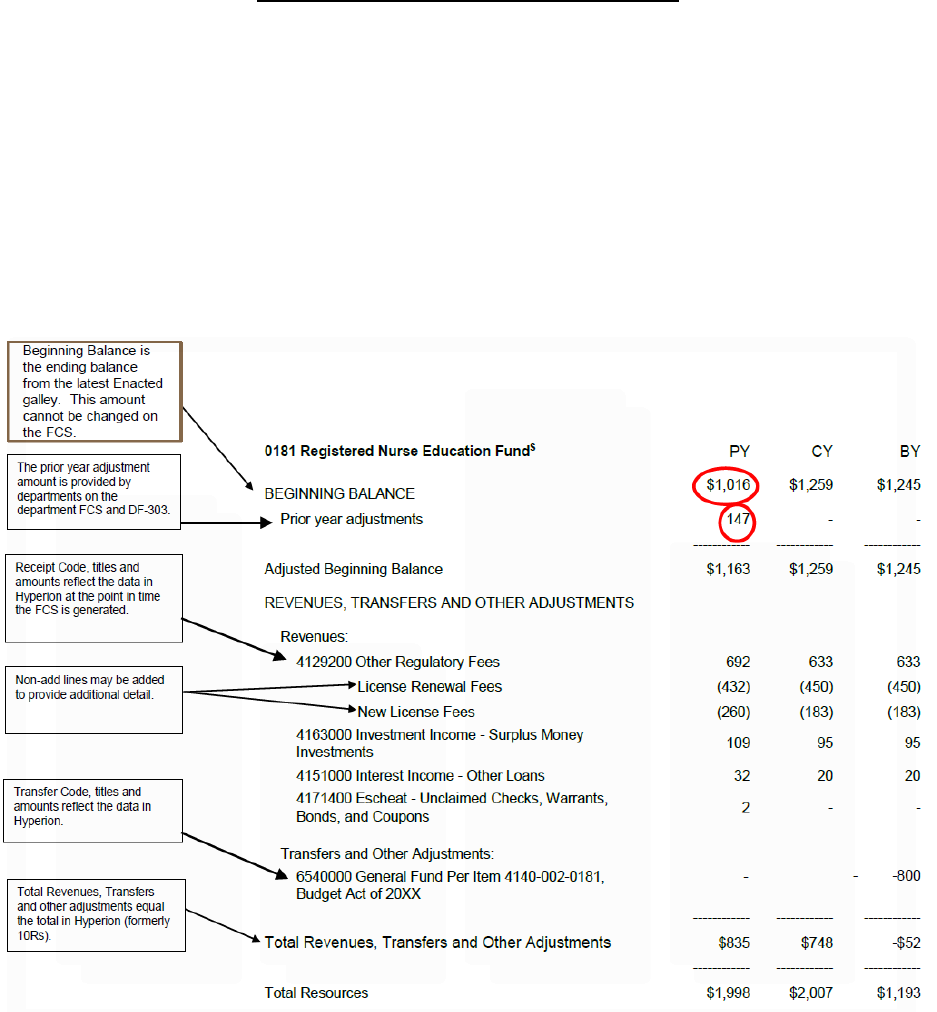

Fund Condition Statement Components

The fund condition statement is broken into two sections, Fund Resources and Fund

Expenditures.

Fund Resources include: Beginning Balance, Prior Year Adjustment, Adjusted Beginning

Balance, Revenues, Transfers, and Loans.

The Beginning Balance is always equal to the ending balance for past year as displayed in the

Enacted Budget Galley. If adjustments are needed to years prior to past year, they should be

incorporated into the Prior Year Adjustment. The Adjusted Beginning Balance should match

between the DF-303 and the FCS.

6

Fund Expenditures include: Expenditures and Expenditure Transfers, Statewide Adjustments,

the Ending Fund Balance.

The ultimate goal of past year fund reconciliation is to have the Ending Balance tie between the

DF-303 and the FCS. It’s more important the accounting and budgeting can reconcile ending

fund balances than any other section.

7

Prior Year Adjustments

Prior year adjustments are made to record the difference between previous accruals (including

encumbrances) and actual expenditures, transfers, or revenues for years prior to past year.

This can also include adjustments to statewide assessments.

A prior year adjustment will include all activity that occurred in years prior to the current past

year. Below is an example of how a prior year adjustment is calculated:

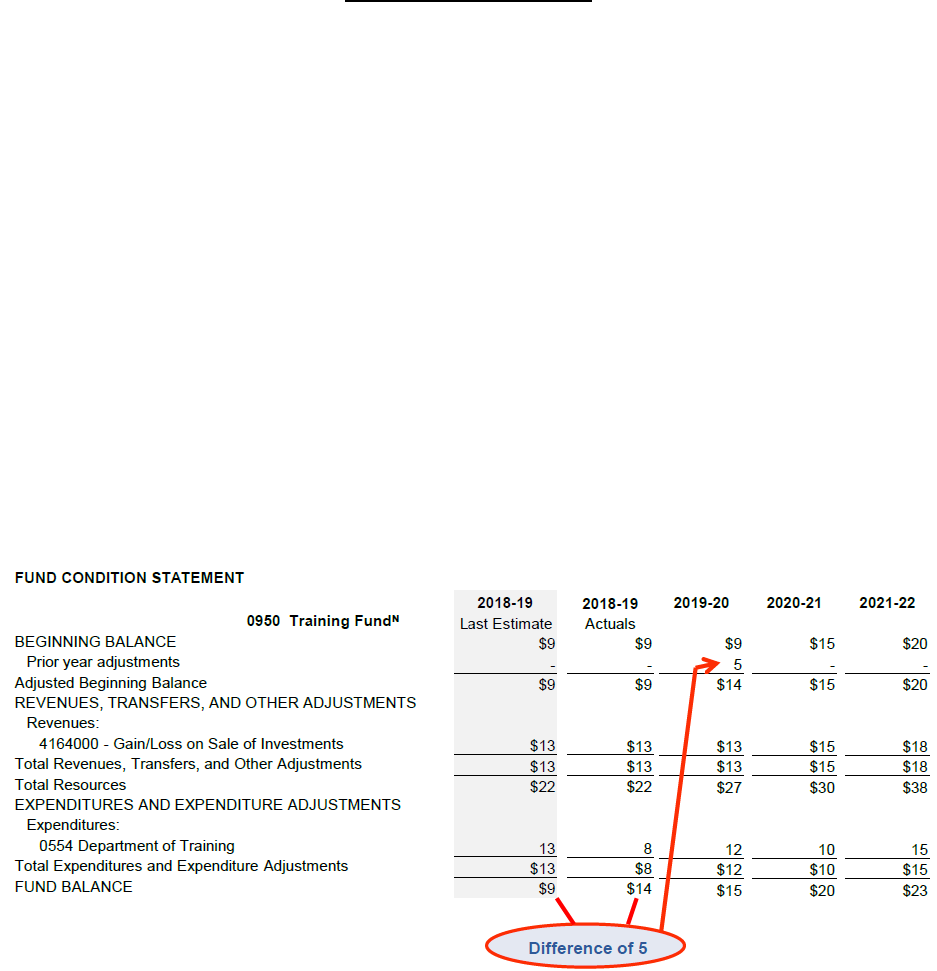

The first column, 2018-19 Last Estimates, represents past year estimated amounts reported at

Budget Act in a department’s enacted budget galley. The second column, 2018-19 Actuals,

represents the actual expenditure amounts reported by accounting after closing out the fiscal

year. The third column 2019-20 represents the current past year which will display in the

department’s Governor’s Budget galley.

For the example below in the first column an estimated expenditure amount of 13 was published

at enactment. The 13 included accruals and other estimations. In the second column accounting

reported an actual expenditure amount of 5, causing a difference between the ending fund

balance reported at enactment and the actual fund balance reported after year-end closing. In

order to transparently update the beginning balance to reflect actuals the difference will be

added as a Prior Year Adjustment.

8

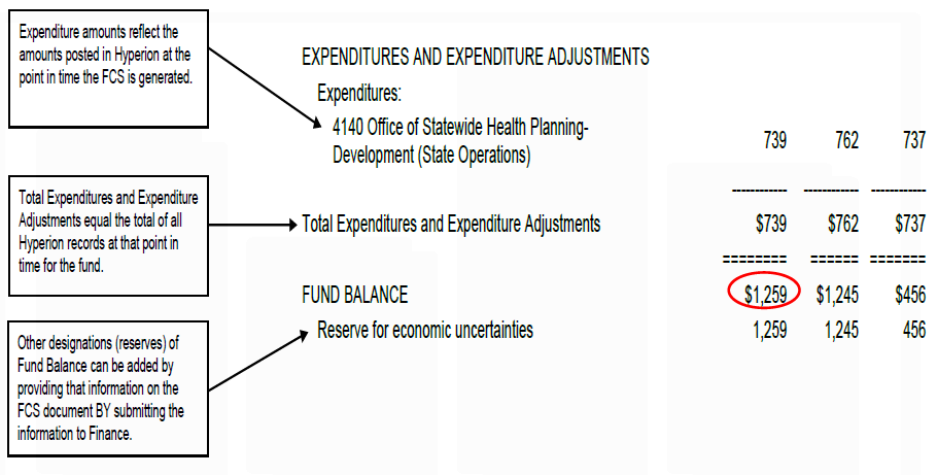

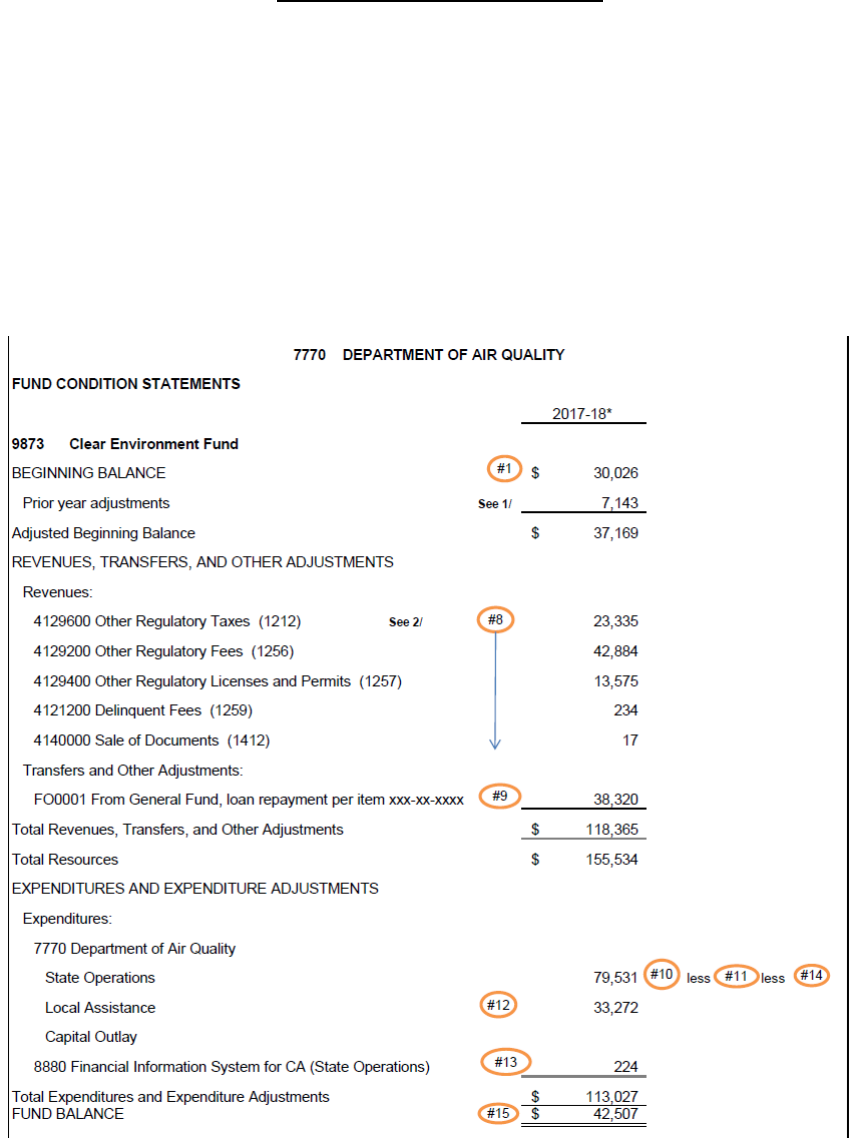

Tying Accounting to Budgeting

The FCS produced by a department’s budget office and the DF-303 populated by departmental

accounting should tie for the Adjusted Beginning Balance, Total Resources, Total Expenditures,

and most importantly Ending Fund Balance. The beginning balances may be different, but the

adjusted beginning balances should match. Below are examples of an FCS, DF-303, and

backup accounting reports that are fully annotated.

Below is an example of a FCS that has been annotated. Annotations should be numbered and

tie to the DF-303 and the backup accounting documents. This will allow for a smoother fund

reconciliation process and far less confusing dialogue between finance staff, departmental

budget staff, and departmental accounting staff. Note the “#1” circled on the FCS ties to the “1”

placed in the reference column of the DF-303 on the next page.

9

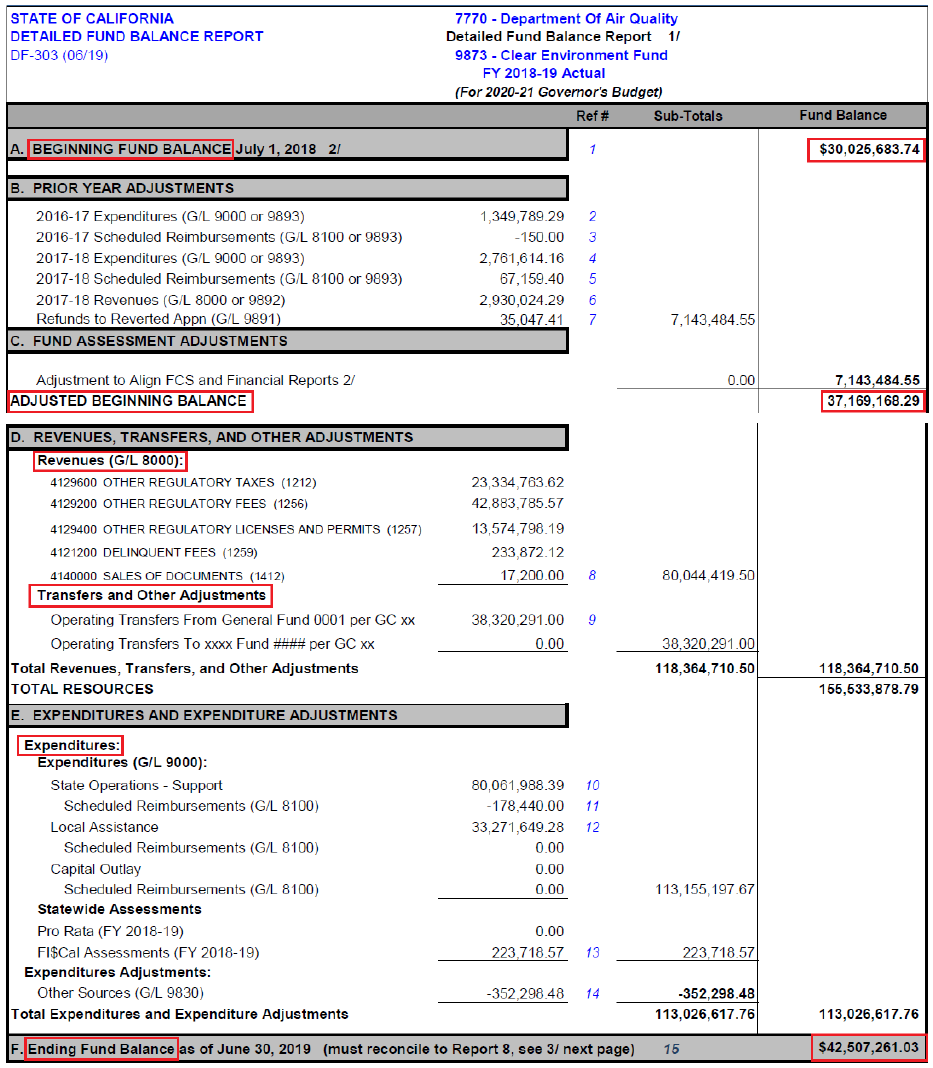

The Detailed Fund Balance Report (DF-303) is an accounting reconciliation document that

displays past year actuals for a fund. The DF-303 should tie to the Year End backup reports and

should be clearly annotated.

Below is an example of a DF-303 that has been annotated, annotations should be numbered

and tie to the FCS and the backup accounting documents. Note that the “8” entered into the

Ref # column next to “80,044,419.50” ties to the sum of the values annotated with a circled “#8”

on the FCS above.

10

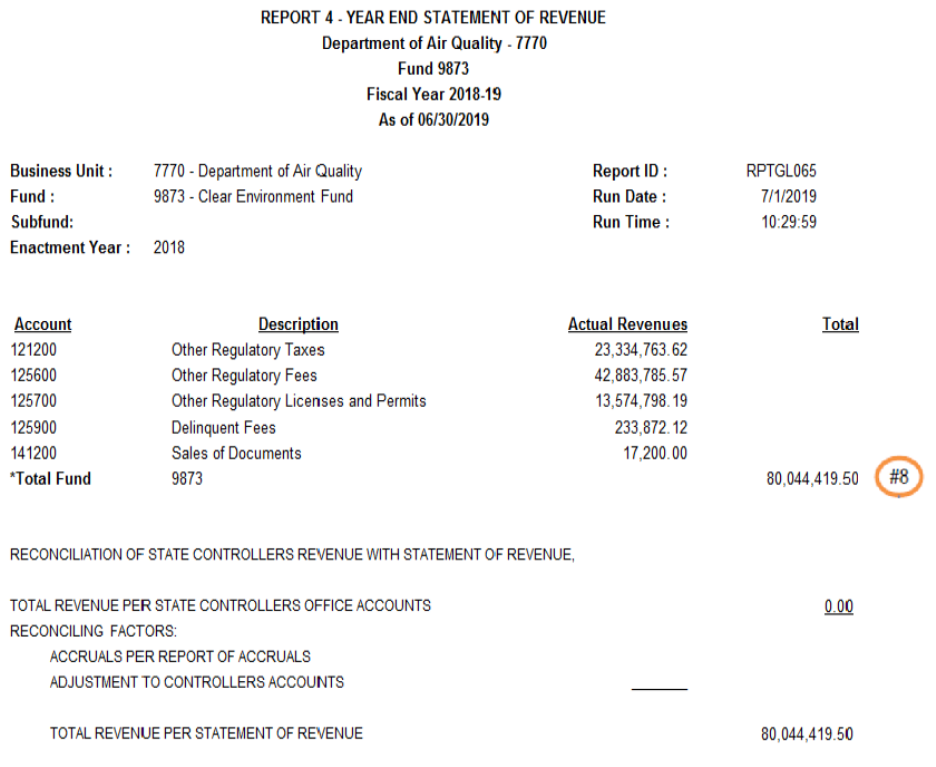

Year End Statement of Revenues (Report 4): An accounting reconciliation document that ties to

the Revenues, Transfers and Other Adjustments section of the DF-303.

Below is an example of provided accounting documents that is fully annotated, annotations

should be numbered and tie to the DF-303. Note that that the circled “#8” in this sample

Report 4 matches the amounts annotated with the #8 on the previous two samples.

11

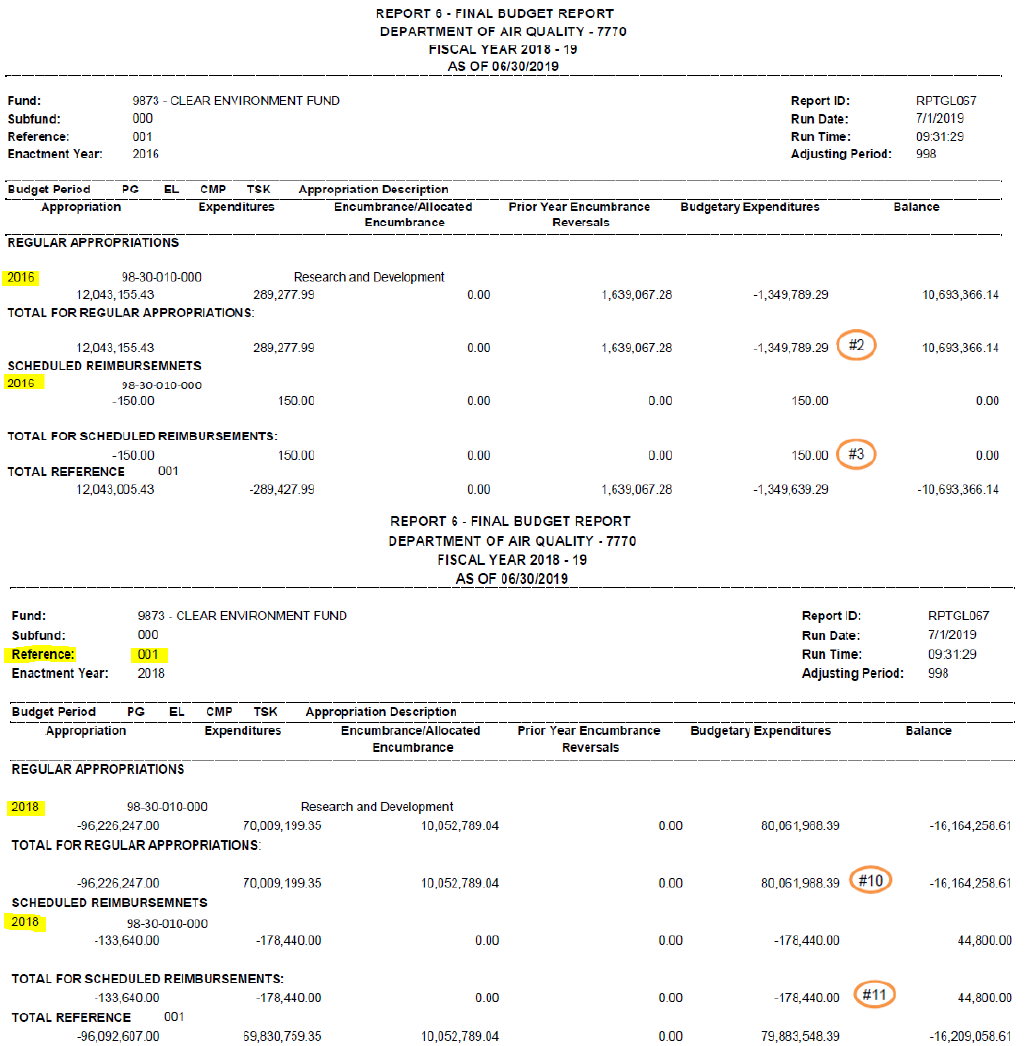

Final Budget Report (Report 6): Provides a detailed breakdown of expenditure amounts for both

past year and prior years. Below is an example of the accounting document that is fully

annotated. Annotations should be numbered and tie to the DF-303.

12

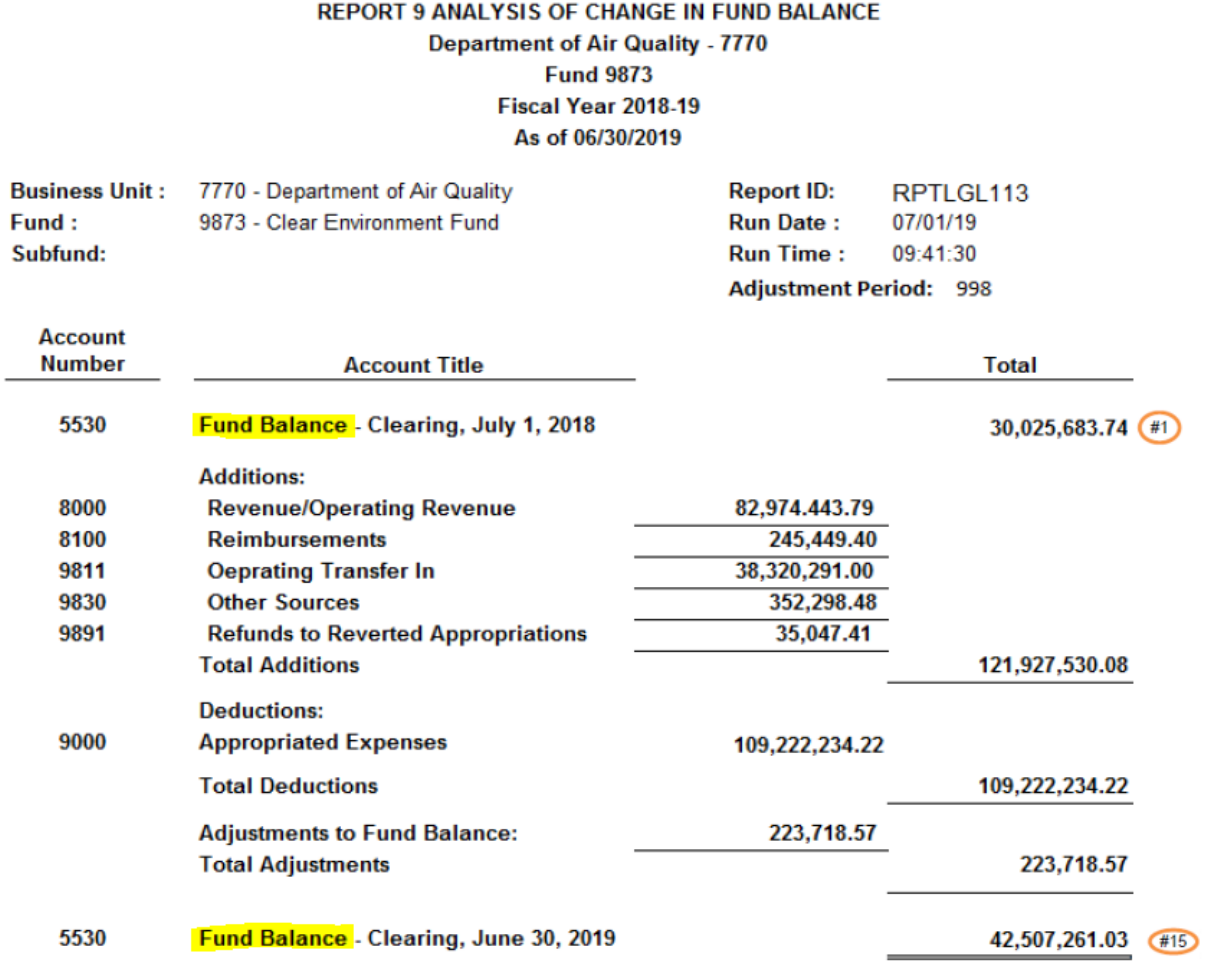

Analysis of Change in Fund Balance (Report 9): Provides a summarized view of the

components of a fund’s balance. Below is an example of the accounting document that is fully

annotated. Annotations should be numbered and tie to the DF-303.

13

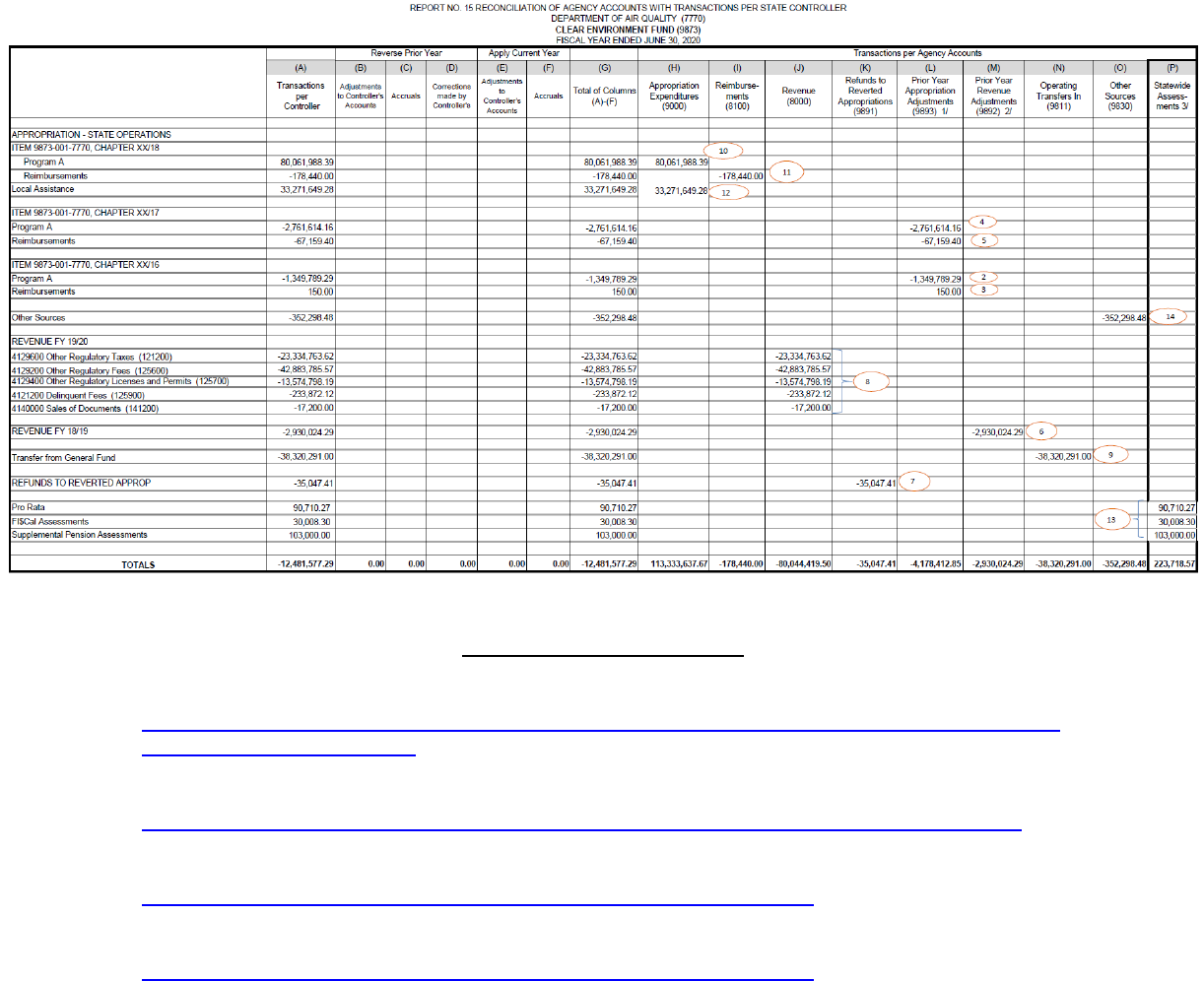

Reconciliation of Agency Accounts with Transactions per State Controller (Report 15): Provides

a summary of fund activity for expenditures and resources. Below is an example of the

accounting of a fully annotated document. Annotations should be numbered and tie to the

DF-303. This will allow for a smoother fund reconciliation process.

Other Resources Available

Fund Balance Reconciliation Guide:

http://www.dof.ca.gov/Accounting/Policies_and_Procedures/Fund_Reconciliation/documents/Fu

ndBalanceReconciliation.pdf

Past Year Fund Reconciliation Forms:

http://www.dof.ca.gov/Accounting/Policies_and_Procedures/Fund_Reconciliation/index.html

BL 20-17:

http://www.dof.ca.gov/Budget/Budget_Letters/documents/BL20-17.pdf

BL 19-07:

http://www.dof.ca.gov/Budget/Budget_Letters/documents/BL19-07.pdf