AgencyAuditedFinancialStatementstoGTASReclassifiedStatements–DetailReconciliation

Instructions.

Disclaimer:Thisinstructiondocumentassumesthatyouragencyhascompletedandcertified

(signedoff)boththeGTASandGFRSdatasubmissions.Eachagencyshouldbeperformingthis

analysisthroughouttheconcurrentsubmissionofeachsystem.ThedeliverablethatFiscal

Serviceisexpectingwillbeduethesamedaysubmissionsaredue.

DetailedInstructions:

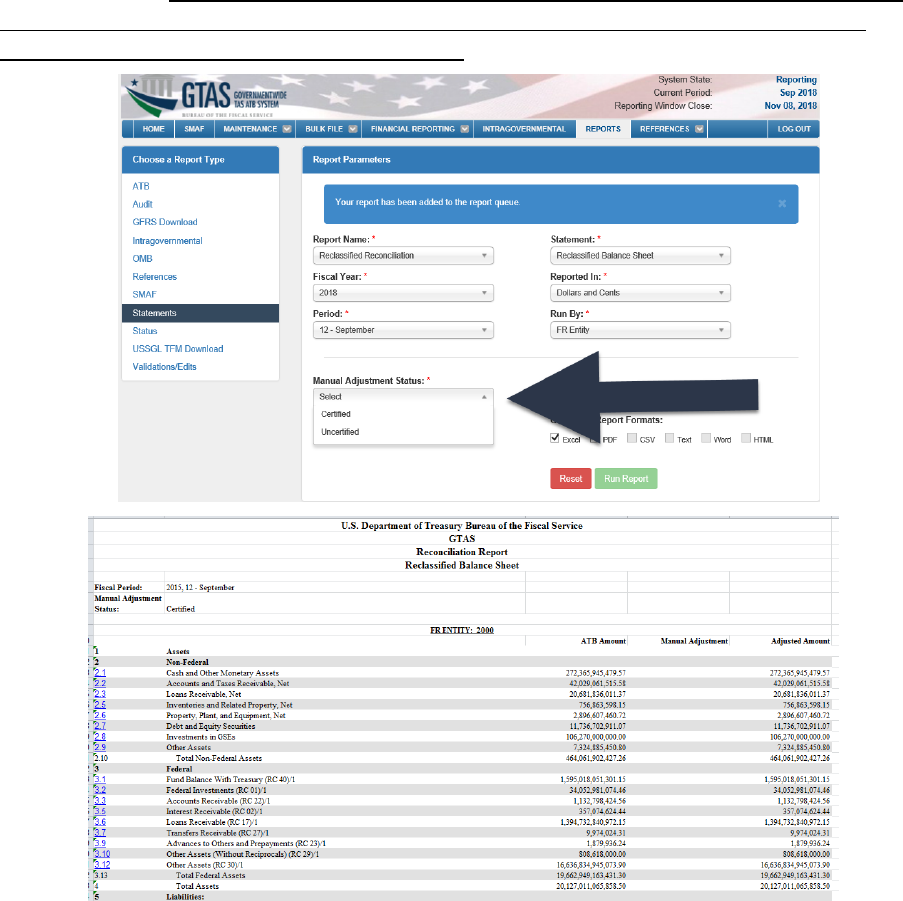

1. LogintoGTASandNavigatetothereportsModule–selectStatementsunderreporttype,

runtheNEWGTASReconciliationReportsbyyourFRentity(eachStatementwillneedtobe

runseparately).If your agency has certified manual adjustments thenselect“Certified”as

theAdjustmentStatus(seescreenshots below). If your agency does not have certified

manual adjustments then select "Uncertified".

2. GatheryourAgency’sAuditedFinancialStatements–thisincludestheBalanceSheet,the

StatementofNetCostandtheStatementofChangesinNetPosition.OtherStatementsthat

couldbeincludedaretheIncomeStatementortheStatementofCustodialActivity.

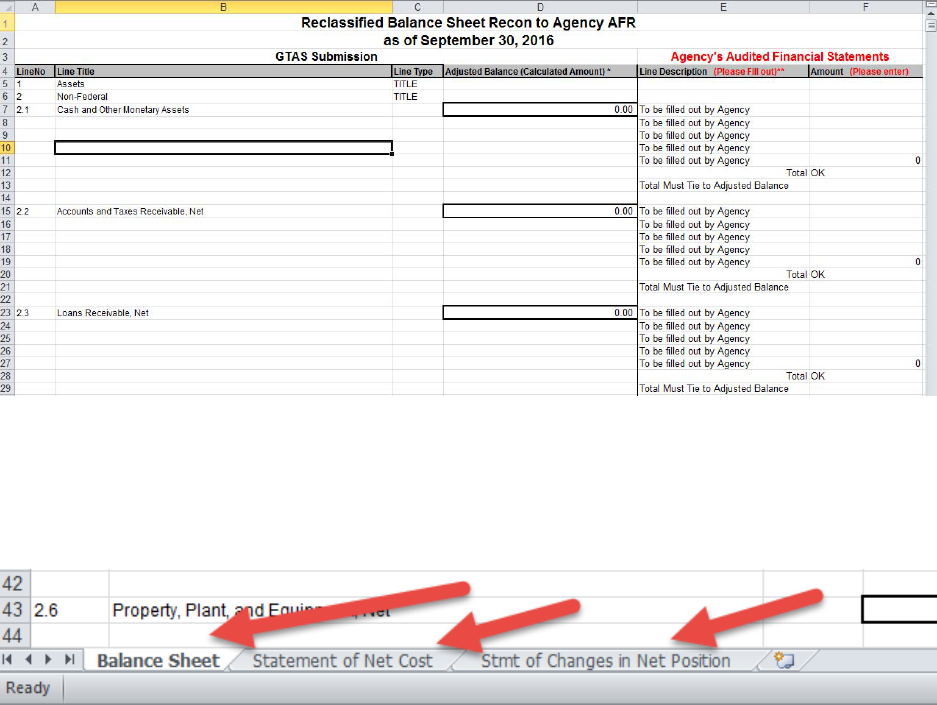

3. OpentheFiscalServiceproducedReconciliationtemplate–thisdocumenthasallofthe

reclassifiedclosingpackagelinesthatareavailabletouse(seescreenshotbelow).The

templatemaybefoundunder“Updates”onthefollowingwebpage:

https://fiscal.treasury.gov/fsreports/rpt/finrep/fr/fr_index.htm

4. PicktheappropriatetaboftheReconciliationtemplatefortheReclassifiedStatementyou

arereconciling(seescreenshotbelow).

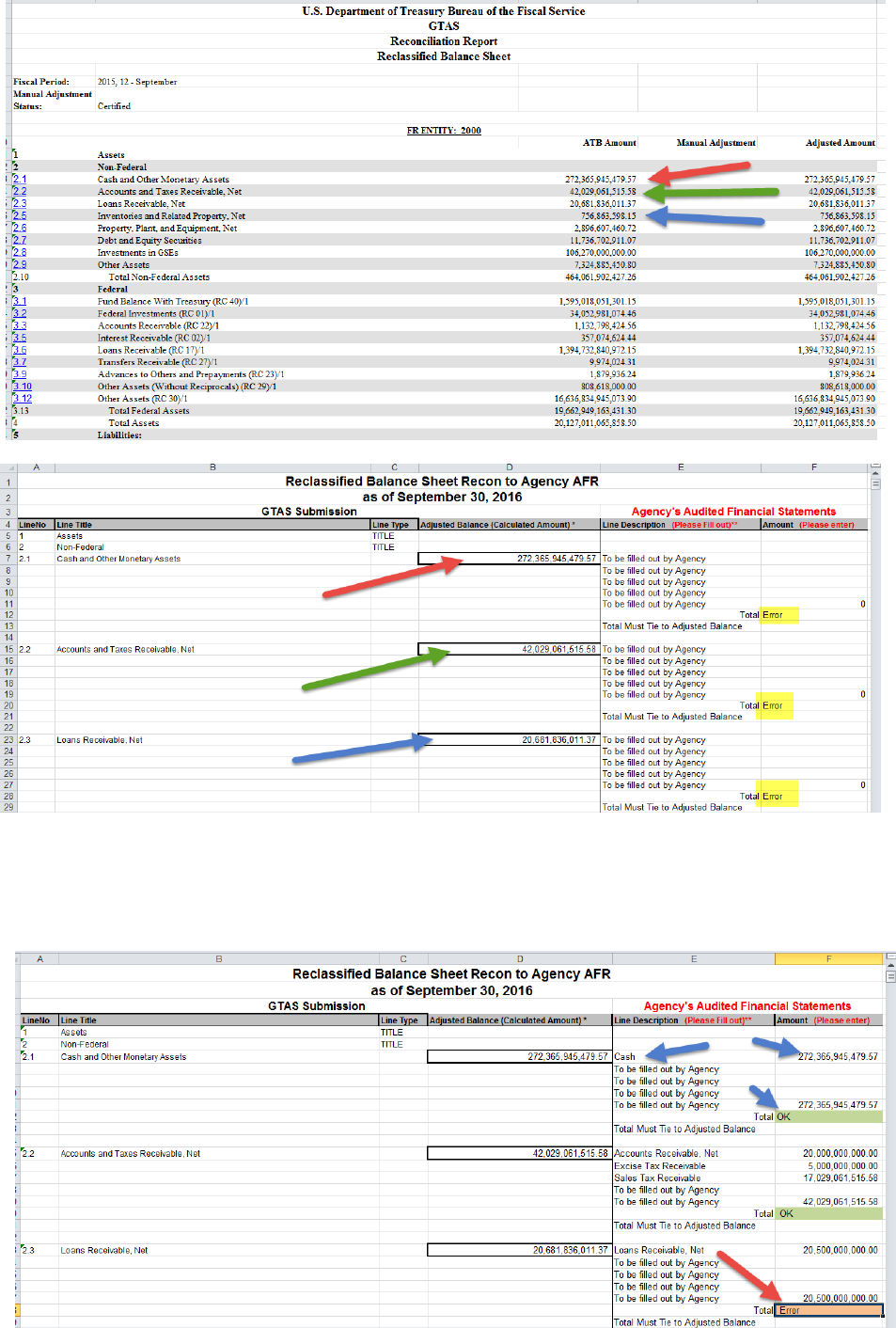

5. ManuallyinputtheamountsthatappearontheGTASReconciliationreportyouraninStep

1inColumnDoftheReconciliationtemplatefortheapplicableclosingpackagelines(see

screenshotsbelow).Youwilldothisforeverynoncalculatedclosingpackagelineitem.

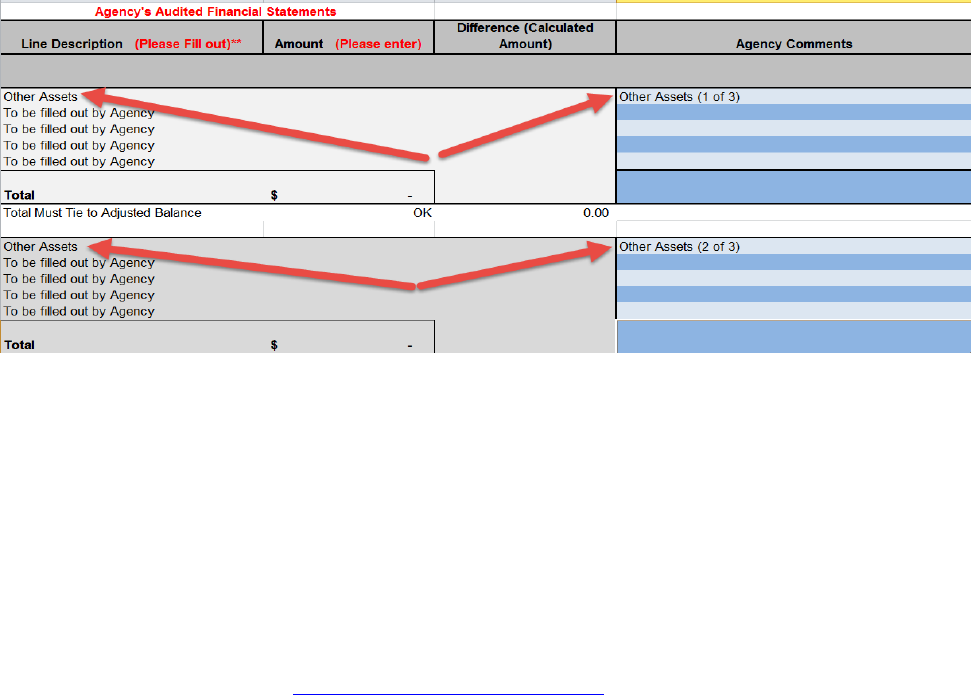

6. ManuallyfillouteachAuditedFinancialStatementLineitemfromyourAgencyAudited

FinancialStatements*(seescreenshotbelow).

• LineTitle=ColumnE

• LineAmount=ColumnF

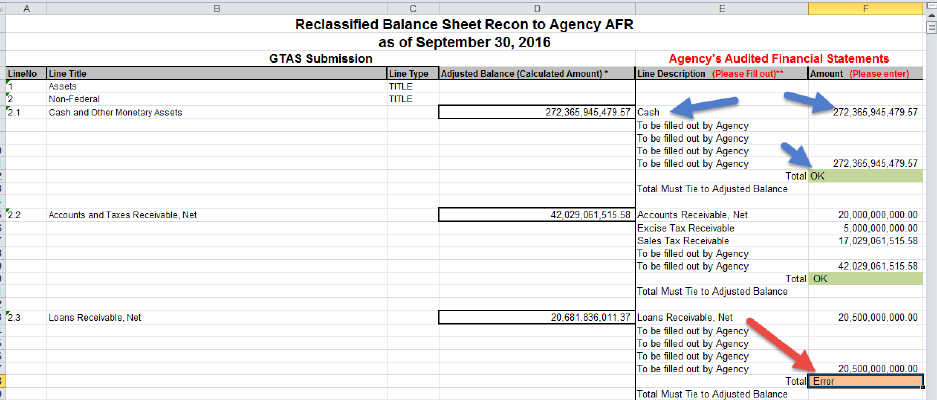

7. Totalsbetweeneachlineitemmusttie(seescreenshotbelow).Ifthetotalfielddisplays

“Error”,pleaseresearchthediscrepanciesandresolvethedifference.Belowareacouple

helpfulsuggestionsinresearchingandresolvingthediscrepancy.

ChecktomakesureeveryTreasuryAccountSymboland/orManualAdjustmentis

certifiedinGTAS.DatathatisnotcertifiedwillnotpullintotheReconciliationreport.

TheReconciliationreportcontainsbothbulkfiledataandanyapplicablemanual

adjustments.

UtilizethebulkfiledatatabsontheReconciliationreporttodetermineexactlyhow

GTASiscalculatingeachclosingpackagelineitem.

Note:WhenSplittingyourFinancialStatementlinesamongstmultiple

Reclassifiedlinespleaseusetheformatinthefollowingscreenshot.

ThingstoRemember:

FiscalServicehasprovided5textlinesforeachClosingPackageLine(thisisforinstances

wherethereisnota1to1relationshipbetweentheAuditedStatementsLineandthe

ReclassifiedClosingPackageLine).

Ifyoushouldneedmorethan5textlinesforaparticularclosingpackageline,please

emailtheGTASTeam([email protected])detailingyourneedsandwewill

modifythetemplateforyouragency.

WhensplittingamountstheLineDescriptionNames,incolumnE,needtodirectly

matchspecificLineItemsinanAgency’sAFR.Please,donotenteramountsthatdo

notdirectlymatchwiththefaceofyourAgency’sFinancialStatements.

Pleasenotethatyoudonotneedtoadjustoutyou

rCustodialActivitywhen

reconcilingtoyourGTASStatements.Pleasenotethedifferencesattributableto

CustodialactivityinthecommentssectionoftheReconciliationTemplate(Section:

4705.20A—CustodialActivity)

ThereisnoneedtoutilizeeveryclosingpackagelineprovidedintheReconciliation

templatewehaveprovided.Ifyouragencyhasnodataforthatparticularlineitem,

pleaseleaveitblank.

TreasuryFinancialManualVolumeI,Part2,Section4705.15c—FederalTrading

PartnerNotesstates:

“Federaltradingpartnersandamountsforeachfederalclosingpackagelineitem

reportedbasedonthereclassifiedfinancialstatementswillbederivedfromGTASATB

data.Amountsidentifiedasfederalshouldbenetofintradepartmentaleliminations

withthefollowingexceptions:

• ForU.S.OfficeofPersonnelManagementonly,intradepartmentalimputed

costsreportedwithatradingpartnercodeofunknown;and

• RegularexpendituretransfersfromTrustFundaccountsandFiduciaryFund

accountstoothergeneralappropriatedfunds.

Identifyingthetradingpartnerenablesanalysisandeliminationoffederal

activity/balancesbasedonreciprocalcategoriesatthegovernmentwidelevel.See

Appendix5a and 5bforacompletelistofAgencyIdentifiersandFRentities.

AllGeneralFundactivitywillbereportedtotheappropriatereclassifiedfinancial

statementlinewithinRC30–RC48activities.TheGeneralFundactivitybasedonthe

USSGLandfederal/non‐federalattributeswillbereportedtotheappropriateClosing

PackagelinewithinRC30–RC48(seeAppendices1,6,and7fortheappropriate

reclassificationofreclassifiedfinancialstatementlines)usingafederal/non‐federal

attributedomainvalueof“G.”SeeAppendix9formoredetailsontransactionswiththe

GeneralFund.”

Therefore,anyintradepartmentaldifferencesidentifiedduringtheAFRtoClosing

Packagereconciliationshouldbenotedandwillbetreatedasvalidreconcilingitems.

AdditionalInstructions

Perthe“ClosingPackageAudit”pdfdistributedtothegovernmentwidecommunity,pleasefollowthe

belowinstructionswhensubmittingtheReclassifiedReconciliationreportstoyourauditors.

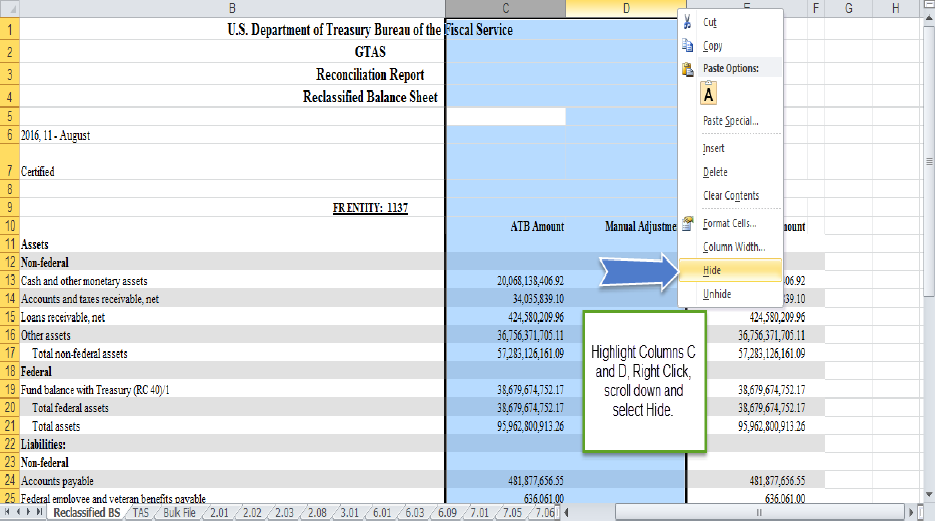

HidetheATBamountandManualAdjustmentColumns

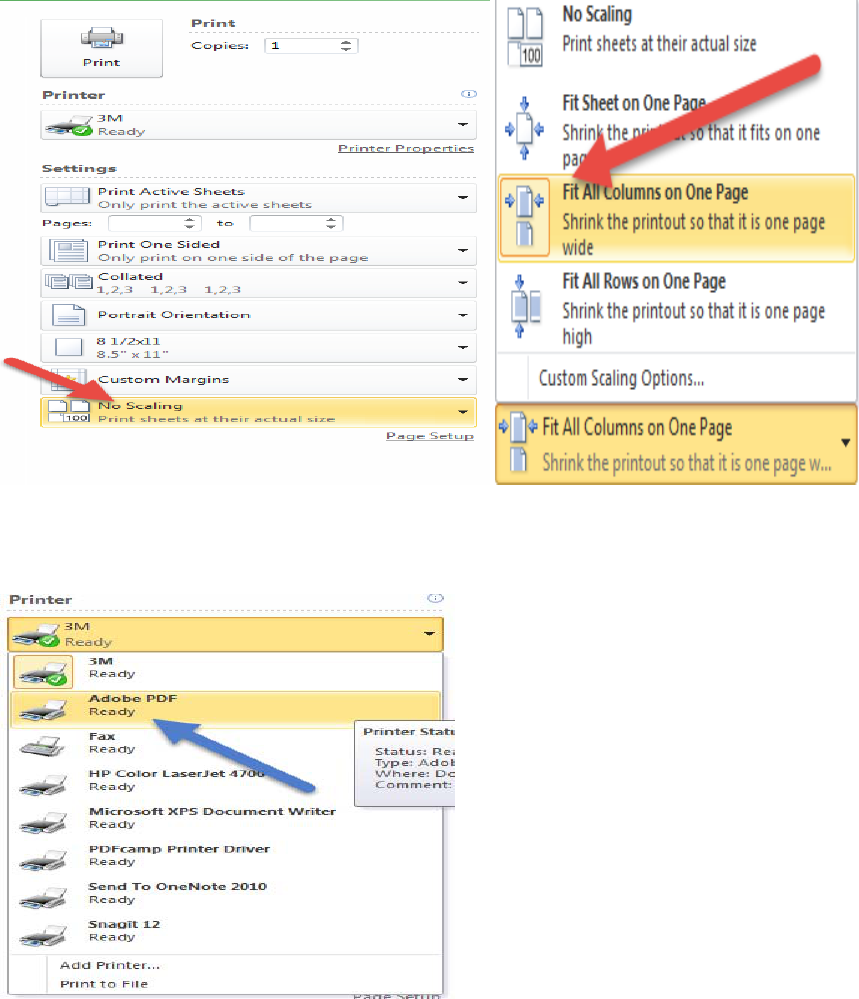

Print first Tab to PDF – to eliminate the extraneous TABS not needed for submission to the auditors.

• While on the First TAB, and after Columns C and D have been hidden, click the print icon in

the top ribbon (will vary depending on your version of Excel)

• Most likely you will need to format the report so that it is print ready, to do this you will need

to format so that all columns fit on one page – see screenshots below for example

Oncethereportisformattedproperly,ensure“PrintActiveSheets”isselectedundersettings

(thisensuresonlythefirstTABisprinted),thenselect“AdobePDF”inthedropdownmenu,

thenclickPrint‐SeeScreenshot